VEVEY, Switzerland – Nestlé posted its highest sales growth in five years on Thursday, as stuck-at-home consumers spent more on pet care, coffee and nutrition supplements during the Covid-19 pandemic, whereas out-of-home channel sales fell significantly. The Swiss giant fared better than some rivals as it kept shedding underperforming businesses and investing in growth areas like plant-based food, coffee and health science.

Full-year organic sales, which strip out currency swings, acquisitions and divestitures, grew 3.6% in 2020, ahead of Nestle’s own guidance for “around 3%” and peer Unilever’s 1.9% underlying sales growth.

Analysts in a consensus compiled by Nestle were looking for 3.5% organic sales growth for the full year.

Nestlé Health Science saw 12.2% sales growth, driven by strong demand for vitamin and wellness supplements, including the Garden of Life, Pure Encapsulations and Persona brands.

Coffee was also in demand from lockdown shoppers, with Nespresso reporting 7% sales growth — its highest level in six years

Growth in these categories helped compensate for lower sales of confectionery and bottled water, which fell by 1.5% and 7% respectively during the period.

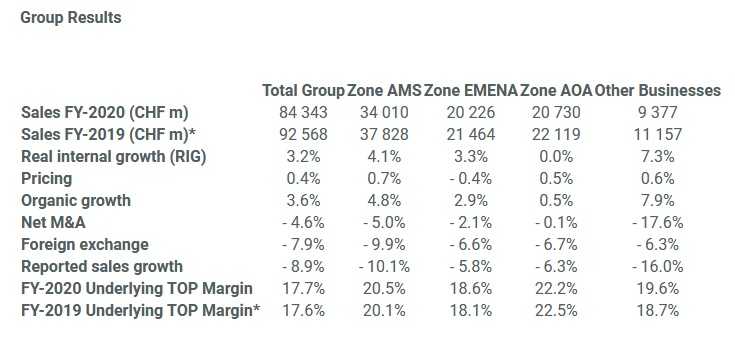

However, total reported sales decreased by 8.9% to CHF84.3 billion due to the negative impact of foreign exchange and divestitures. Net profit for 2020 fell 3% to CHF12.2 billion ($13.6 billion), just beating expectations.

The company said it wanted to continue to increase its organic sales growth towards a mid-single-digit rate this year and sustain it over the mid-term.

It said its net profit fell 3% to 12.2 billion Swiss francs ($13.58 billion), above a forecast for 11.97 billion francs. The year-ago period had benefited from a one-off gain linked to the sale of the skin health business.

Nestlé reports full-year results for 2020

- Organic growth reached 3.6%, with real internal growth (RIG) of 3.2% and pricing of 0.4%. Growth was supported by strong momentum in the Americas, Purina PetCare and Nestlé Health Science.

- Foreign exchange reduced sales by 7.9% due to the continued appreciation of the Swiss franc against most currencies. Divestitures had a negative impact of 4.6%. As a result, total reported sales decreased by 8.9% to CHF 84.3 billion (2019: CHF 92.6 billion).

- The underlying trading operating profit (UTOP) margin reached 17.7%, up 10 basis points on a reported basis and 20 basis points in constant currency. The trading operating profit (TOP) margin increased by 210 basis points to 16.9% on a reported basis.

- Underlying earnings per share increased by 3.5% in constant currency and decreased by 4.5% on a reported basis to CHF 4.21. Earnings per share stayed unchanged at CHF 4.30 on a reported basis.

- Free cash flow was CHF 10.2 billion.

- Return on invested capital increased by 240 basis points to 14.7%.

- Board proposes a dividend increase of 5 centimes to CHF 2.75 per share, marking 26 consecutive years of dividend growth. In total, CHF 14.5 billion were returned to shareholders in 2020 through a combination of dividend and share buybacks.

- Continued progress in portfolio management. Nestlé divested the Yinlu peanut milk and canned rice porridge businesses in China and agreed to sell its regional spring water brands, purified water business and beverage delivery service in the U.S. and Canada. Portfolio rotation since 2017 now amounts to around 18% of total 2017 sales.

- 2021 outlook: continued increase in organic sales growth towards a mid single-digit rate. Underlying trading operating profit margin with continued moderate improvement. Underlying earnings per share in constant currency and capital efficiency expected to increase.

- Mid-term outlook: sustained mid single-digit organic sales growth. Continued moderate underlying trading operating profit margin improvement. Continued prudent capital allocation and capital efficiency improvement.

Mark Schneider, Nestlé CEO, commented:”2020 was a year of hardship for so many, yet I am inspired by the way it has brought all of us closer together. I want to thank our employees and our partners – from farmers to retailers – who worked with us to ensure the supply of food and beverages to communities globally.

In this unprecedented environment, we achieved our third consecutive year of improvement in organic growth, profitability and return on invested capital.

The global pandemic did not slow us down. Our nutrition expertise, digital capabilities, decentralized structure and innovation engine allowed us to adapt quickly to changing consumer behaviors and trends. We advanced our portfolio transformation, continued to build Nestlé Health Science into a nutrition powerhouse and expanded our presence in direct-to-consumer businesses.

At the same time, we remained focused on sustainability and set out our path to achieve net zero greenhouse gas emissions by 2050. This journey is expected to support future growth and be earnings neutral – it will generate value for society and our shareholders.

Looking to 2021, we expect continued improvement in organic growth, profitability and capital efficiency in line with our value creation model.”

* 2019 figures restated following the decision to integrate the Nestlé Waters business into the Group’s three geographical Zones, effective January 1, 2020.

* 2019 figures restated following the decision to integrate the Nestlé Waters business into the Group’s three geographical Zones, effective January 1, 2020.

Coffee reached mid single-digit growth

Coffee reported mid single-digit growth, boosted by strong consumer demand for Starbucks products, Nespresso and Nescafé. Sales of Starbucks products reached CHF 2.7 billion, generating incremental sales of over CHF 400 million in 2020.

Nespresso sales reached CHF 5.9 billion, with organic growth accelerating to 7.0%, the highest level in the last six years. E-commerce and the Vertuo system saw strong double-digit growth, more than offsetting sales declines in out-of-home channels. Growth was also supported by innovations such as Reviving Origins, limited-edition products and the launch of Nespresso’s first organic coffee. By geography, the Americas and AOA posted double-digit growth. North America continued to see market share gains, with the United States becoming Nespresso’s largest market. In Europe, a sales decrease in the out-of-home channels was partially offset by mid single-digit growth in the at-home business.