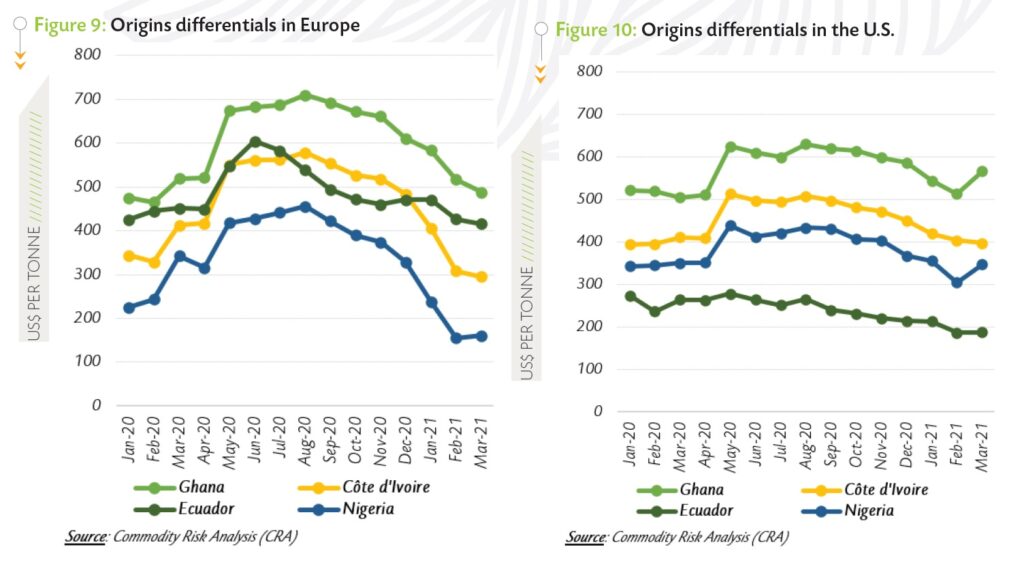

ABIDJAN, Côte d’Ivoire – This report from the International Cocoa Organization (ICCO) focuses on the evolution of prices for the March-2021 (MAR-21) and May-2021 (MAY-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during March 2021. It also describes the market conditions that prevailed at the time. Figure 1 presents price developments on the London and New York futures markets respectively at the London closing time in the course of March 2021 while Figure 2 outlines the same information for the previous year.

Both figures include the US dollar index to highlight the impact of the strength of the US dollar on the US-denominated cocoa futures prices.

Figure 1 shows that, while approaching its maturity date, the nearby contract (MAR-21) was priced higher compared to MAY-21 and remained in backwardation on both the London and New York markets. In London, the MAR-21 contract set an average premium of US$196 per tonne over the MAY-21 contract whereas in New York, the premium was established at US$110 per tonne.

Back in March 2020, the two nearest cocoa futures contracts were in contango in London whereas a backwardation was observed in New York (Figure 2). This is a recurrent feature of cocoa futures markets as the nearby contract usually trades with a premium over deferred ones. However, as contracts approach their expiry date, such a premium declines rapidly.

Back in March 2020, the two nearest cocoa futures contracts were in contango in London whereas a backwardation was observed in New York (Figure 2). This is a recurrent feature of cocoa futures markets as the nearby contract usually trades with a premium over deferred ones. However, as contracts approach their expiry date, such a premium declines rapidly.

Over the first half of the month under review, prices of the MAR-21 contract plummeted by 5% from US$2,698 to US$2,550 per tonne in London and by 8% from US$2,736 to US$2,512 per tonne in New York. During its last trading days, the nearby contract prices averaged US$2,666 per tonne in London, up by 13% compared with the average price of US$2,350 per tonne recorded during the corresponding period a year earlier.

Over the same time span in New York, the nearby cocoa contract averaged US$2,693 per tonne in March 2021; representing a 1% drop compared to US$2,667 per tonne recorded over the same period of the previous crop year.

Thereafter, from 17 March onwards, the first position contract (MAY-21) prices continued to decline over the second half of the month under review. In London, a 3% plunge to US$2,337 was recorded while in New York prices tumbled by 6% to US$2,354 per tonne.

The overall bearish stance in cocoa prices during March was driven by various factors. On the one hand, the announcement of new lockdowns in Europe in response to the third wave of the COVID-19 pandemic, which has been harmful for the global economy, was detrimental to cocoa prices.

On the other hand, production in Côte d’Ivoire and Ghana were reported at higher levels compared to the preceding season. Furthermore, the U.S. dollar appreciated by 2% and thereby exerted a downward pressure on futures prices.

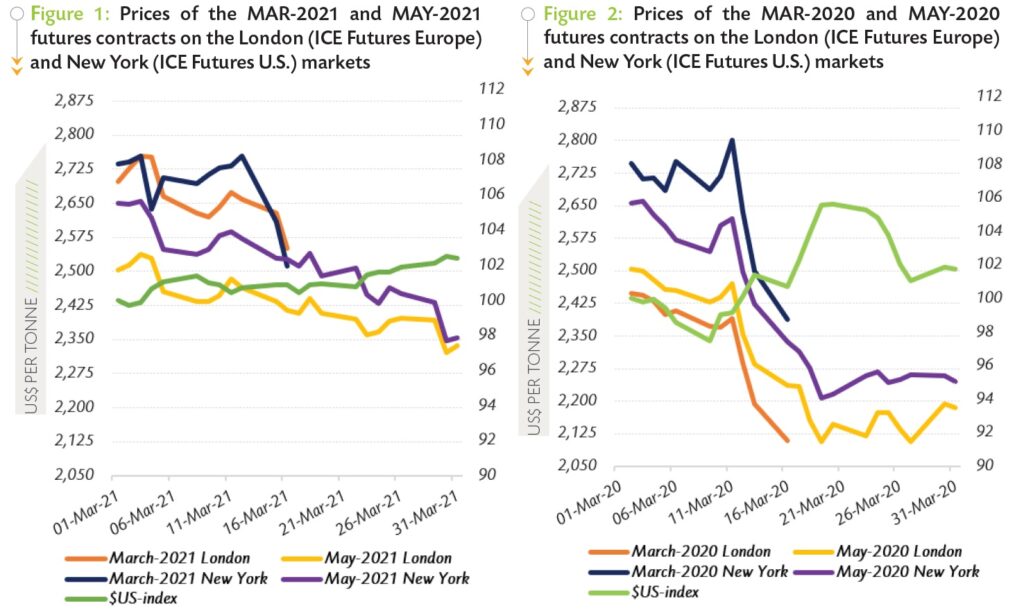

Cocoa gradings and stocks in exchange licensed warehouses

In March 2021, stocks with valid certificates in European warehouses averaged 95,321 tonnes; representing 63% of total certified stocks. As shown in Figure 3, they remained relatively modest compared to their average level of 108,991 tonnes seen in March 2020.

Compared to the average level of 154,005 tonnes seen during March 2020, European certified stocks declined by 1.7% to 151,406 tonnes in March 2021.

For the U.S., as shown in Figure 4, certified stocks moved up from an average of 5,101 tonnes in March 2020 to 41,680 in March 2021.

It is worth noting that, 52,860 tonnes of cocoa beans were tendered against the MAR-21 contract in Europe. This volume is by far higher compared with the 6,130 tonnes physically delivered against the MAR-20 contract a year ago. This is an indication that grinders prefer to source their cocoa from non-LID origins.

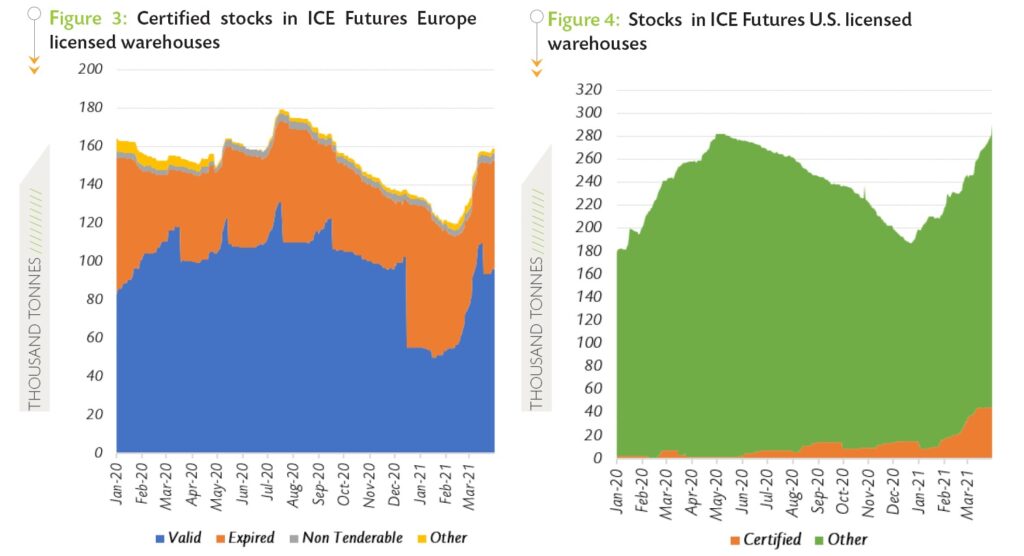

Figure 5 and Figure 6 present the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – March 2020 and October 2020 – March 2021 while Figure 7 and Figure 8 show the same information for the U.S.

Figure 5 and Figure 6 present the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – March 2020 and October 2020 – March 2021 while Figure 7 and Figure 8 show the same information for the U.S.

During the main crop of 2020/21, cocoa graded by the ICE Futures Europe reached 74,140 tonnes, up from 71,130 tonnes of cocoa graded over the same period of the previous season. Over the above-mentioned periods, the shares of Cameroonian cocoa beans at exchange gradings decreased from 68% to 35%. On the contrary, the share of Ivorian and Nigerian cocoa beans rose from 15% to 26% and 15% to 36% respectively. The gradings share of cocoa from other origins moved up from 2% to almost 4%.

Over the period October 2020 – March 2021, the ICE Futures U.S. graded 47,731 tonnes of cocoa beans, up from 10,747 tonnes graded during the same period of the preceding year. On a year-on-year basis, the share of cocoa beans from Cameroon and Ecuador in ICE Futures U.S. gradings increased from 2% to 12% and from less than 1% to 14% respectively.

In contrast, the share of Ivorian cocoa beans at exchange gradings decreased from 79% to 64% while that of Peruvian cocoa moved down from 7% to 5%. Additionally, the share of other origins in cocoa beans graded on the ICE Futures U.S. declined from 12% to 5%.

Origin differentials for cocoa prices

Origin differentials for cocoa prices

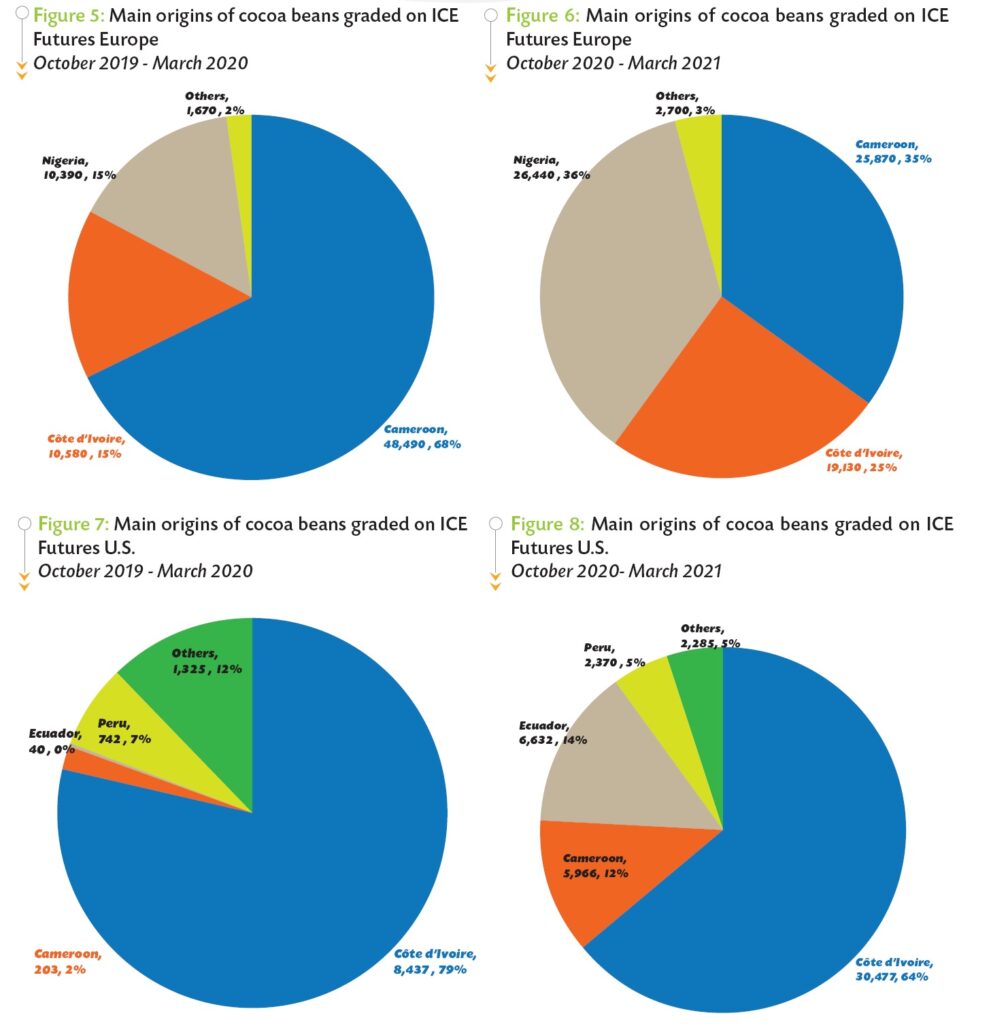

Origin differentials on prices of the six-month forward cocoa contract in Europe and the U.S. for Ghana, Côte d’Ivoire, Ecuador and Nigeria generally continued to decline in March 2021 (Figure 9 and Figure 10).

Focusing on the European market, the differential over Ghanaian cocoa stood at US$488 per tonne in March 2021, down by 27% compared to US$672 per tonne recorded in October 2020.

Similarly, the origin differential declined by 44% from US$527 to US$295 per tonne for Ivorian cocoa beans. A 59% plunge from US$390 to US$161 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential fell slightly from US$472 to US$415 per tonne.

In turn, cocoa of Ghanaian origin recorded, on the U.S. market, a differential of US$566 per tonne in March 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans plummeted by 17% from US$481 to US$398 per tonne. Premiums received for Ecuadorian beans in the U.S. dropped by 19% from US$231 to US$187 per tonne, while a 15% reduction from US$407 to US$348 was seen in the origin differential for Nigeria.

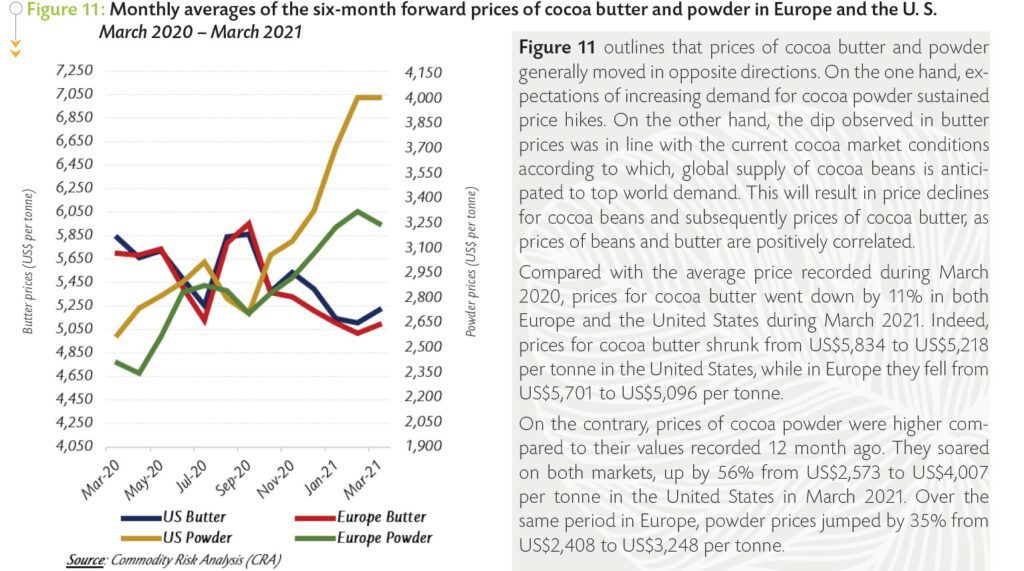

Prices of cocoa butter and powder

Production, grindings and farmgate prices

Production, grindings and farmgate prices

In Côte d’Ivoire, the 2020/21 mid-crop started in April with the Government’s decision to establish the farmgate price at XOF 750 (US$1.35) per kilogram of cocoa beans; down from XOF 1,000 (US$1.80) per kilogram announced during the main crop.

As at 11 April 2021, cumulative cocoa arrivals at Ivorian ports for the 2020/21 cocoa year were estimated at 1.718 million tonnes, up by 2.8% from the level recorded over the same period last season. The country’s exports of cocoa beans during the period October 2020-February 2021 amounted to 882,852 tonnes, down by 12% year-on-year.

Ivorian cocoa processors posted data showing that, at the end of March 2021, cocoa grindings had increased by 3.9% year-on-year from 282,000 tonnes to 293,000 tonnes. In Ghana, purchases of graded and sealed cocoa beans were reported at 748,162 tonnes, representing a 12.6% increase from 664,328 tonnes recorded a year earlier.

The country is currently maintaining its farm gate price for the 2020/21 mid-crop at the same level announced for the main crop at GH¢10,560 (US$1,837).

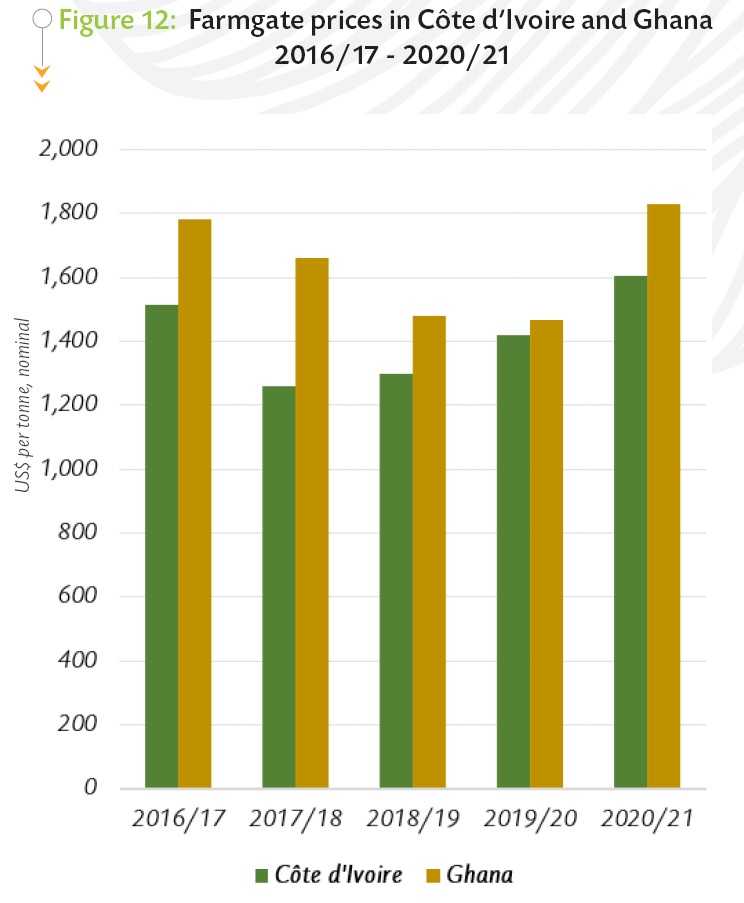

As presented in Figure 12, farm gate prices have been higher in Ghana compared to Côte d’Ivoire over the past four cocoa seasons. In Côte d’Ivoire, the price paid to farmers generally increased by 6% from US$1,513 per tonne in 2016/17 to US$1,605 per tonne in 2020/21. In a similar vein in Ghana, cocoa growers were paid US$1,829 per tonne in 2020/21, up by 3% from US$1,780 per tonne paid four year before.

As presented in Figure 12, farm gate prices have been higher in Ghana compared to Côte d’Ivoire over the past four cocoa seasons. In Côte d’Ivoire, the price paid to farmers generally increased by 6% from US$1,513 per tonne in 2016/17 to US$1,605 per tonne in 2020/21. In a similar vein in Ghana, cocoa growers were paid US$1,829 per tonne in 2020/21, up by 3% from US$1,780 per tonne paid four year before.