TORONTO, Canada – Restaurant Brands International Inc, the parent company of Tim Hortons, reported financial results for the second quarter ended June 30, 2021. The quarter saw continued improvement in global system-wide sales growth, accelerating to +4% compared to 2019. Unit growth returned to pre-pandemic levels with 378 net new restaurants opened in the 1st half. Digital sales in home markets scaled up by nearly +60% year over year and +15% sequentially. Liquidity expande to $2.8 billion, net leverage declined significantly and Board authorized $1 billion buyback program.

José E. Cil, Chief Executive Officer of Restaurant Brands International Inc. (“RBI”) commented, “We are encouraged by the momentum across our business – including sales increases driven by quality menu items, rapid adoption of our digital channels by our guests and an acceleration in new restaurant openings around the world by our franchisees who believe strongly in our brands and business model.”

Cil continued, “We also announced an increase in our share buyback authorization to $1 billion over the next two years, demonstrating our confidence in the value creation opportunity we have ahead of us with our three iconic brands, scalable business model, expanding digital strength and dedicated franchise partners. We believe we are well positioned to drive sustainable, long-term sales growth across the business and to continue enhancing shareholder returns with significant returns of capital through our industry-leading dividend and opportunistic share buybacks under our newly expanded authorization.”

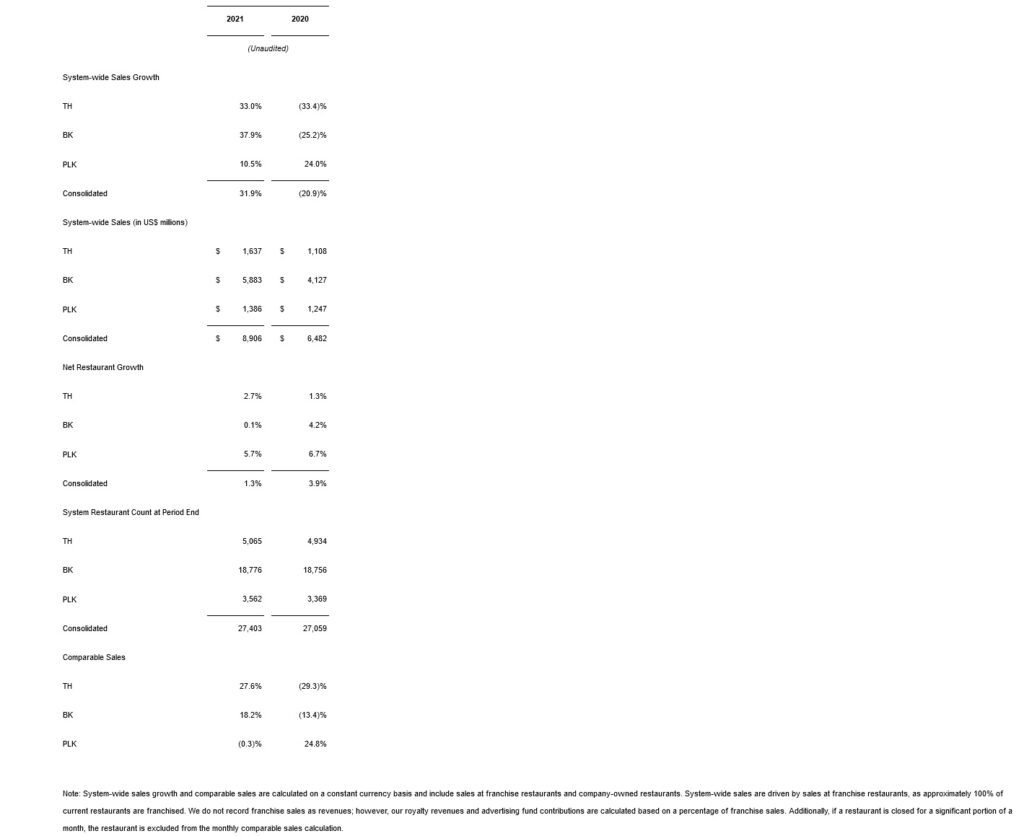

Restaurant Brands International: Consolidated Operational Highlights Three Months Ended June 30 (click to enlarge)

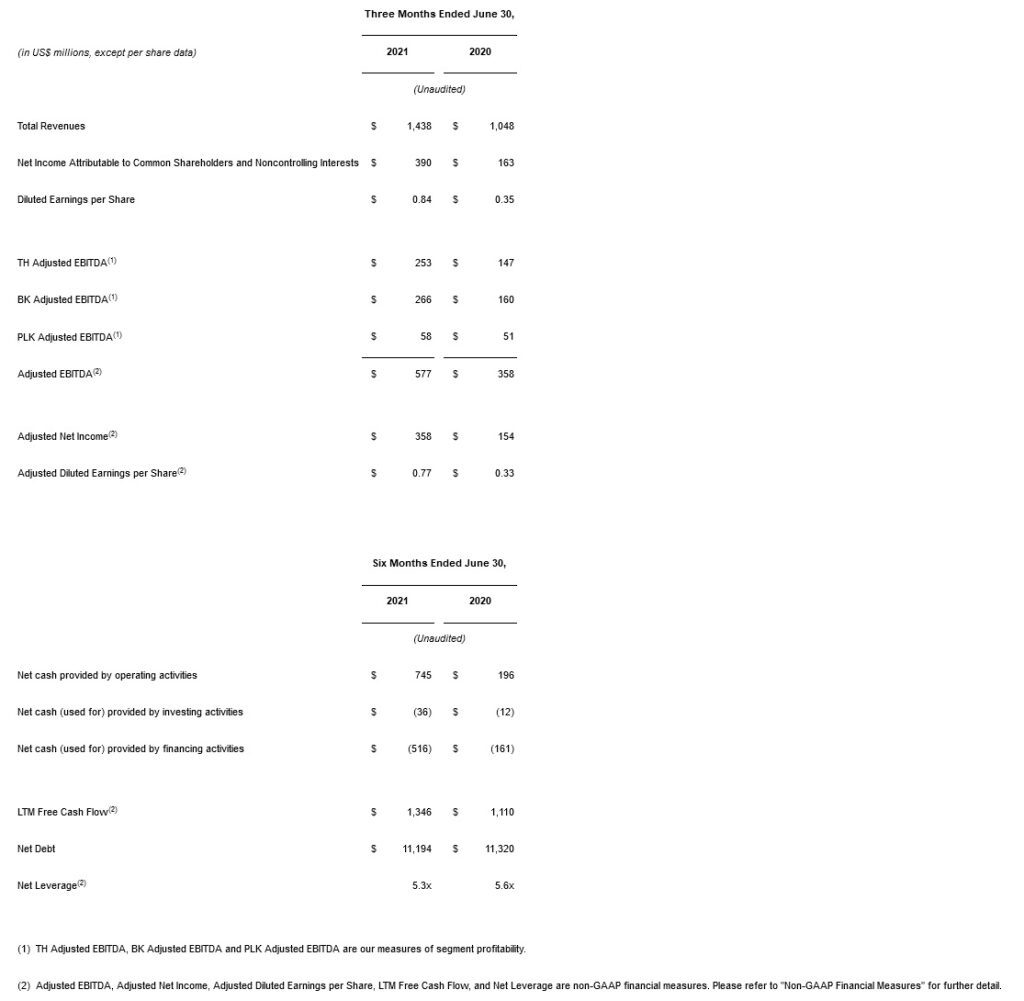

Consolidated Financial Highlights (click to enlarge)

Consolidated Financial Highlights (click to enlarge)

The year-over-year increase in Total Revenues on an as reported and on an organic basis was primarily driven by an increase in system-wide sales in all of our brands. System-wide sales were more severely impacted by COVID-19 (defined below) during the three months ended 2020 than in the same period in 2021. Favorable FX movements also contributed to the year-over-year increase in Total Revenues on an as reported basis.

The year-over-year increase in Total Revenues on an as reported and on an organic basis was primarily driven by an increase in system-wide sales in all of our brands. System-wide sales were more severely impacted by COVID-19 (defined below) during the three months ended 2020 than in the same period in 2021. Favorable FX movements also contributed to the year-over-year increase in Total Revenues on an as reported basis.

The increase in Net Income Attributable to Common Shareholders and Noncontrolling Interests for the second quarter was primarily driven by an increase in segment income in all of our segments and a favorable change in the results from other operating expenses (income), net, partially offset by a decrease in income tax benefits. Refer to “Non-GAAP Financial Measures” footnote four for further details on income tax benefits.

The year-over-year increase in Adjusted EBITDA on an as reported and on an organic basis was driven by an increase in Tim Hortons, Burger King and Popeyes Adjusted EBITDA.

The year-over-year increase in Adjusted Net Income was primarily driven by the increase in Adjusted EBITDA in all of our brands, partially offset by an increase in adjusted income tax expense. Refer to “Non-GAAP Financial Measures” footnote four and six for further details on income tax expense.