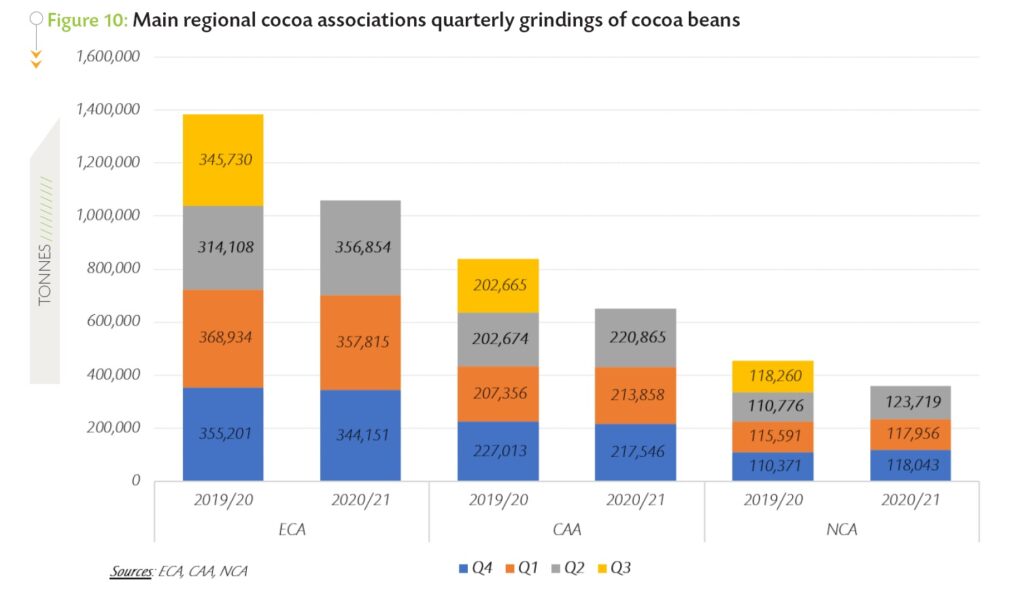

ABIDJAN, Côte d’Ivoire – The movements of cocoa futures prices for the month under review, concentrate on the July-2021 (JUL-21) and September-2021 (SEP-21) futures contracts as listed on ICE Futures Europe (London) and ICE Futures U.S. (New York). It aims to provide insights on the price developments for these two specific futures contracts.

Figure 1 shows price movements on the London and New York futures markets respectively at the London closing time in July 2021, while Figure 2 presents similar information for the previous year.

Before the JUL-21 contract reached its maturity date of 15 July, both the London and New York markets were in contango (Figure 1).

This market configuration suggests that there was no market tension existing on the physical delivery against the JUL-21 contract. Hence, the JUL-21 contract was on average US$56 per tonne cheaper compared to the SEP-21 contract in London, while in New York, the JUL-21 contract was discounted on average by US$20 per tonne compared to SEP-21.

This market configuration suggests that there was no market tension existing on the physical delivery against the JUL-21 contract. Hence, the JUL-21 contract was on average US$56 per tonne cheaper compared to the SEP-21 contract in London, while in New York, the JUL-21 contract was discounted on average by US$20 per tonne compared to SEP-21.

Back in July 2020, Figure 2 illustrates that the London market was in contango whilst the New York one was in backwardation. At the time, certified stocks with valid certificate represented 68% of total stocks held in exchange licensed warehouses in Europe. In the United States, the share of certified stocks in total stocks in exchange licensed warehouses was marginal (3%).

The nearby cocoa contract (JUL-21) prices witnessed three distinct sequences during July. Despite the initial price decline that occurred in the course of the first trading week of the reviewed month (1-8 July) on both markets, prices firmed in New York to reach a 6-week high on 12 July; settling at US$2,410 per tonne. Concurrently in London, they remain virtually flat at US$2,192 per tonne. Over this period, news agencies reported that, the US chocolate industry expanded processing by 1.8% during 2020 when the COVID-19 pandemic reached unprecedent peaks; hence boosting the optimism for demand for cocoa products.

Also, signs of slowdown in weekly arrivals of cocoa beans at Ivorian ports because of shortage of shipping containers which led to the limitation of the issuance of documents for cocoa beans shipments at Ivorian ports contributed to the overall positive trends observed in prices.

However, moving on to 13-20 July, prices plunged by 4% from US$2,211 to US$2,122 per tonne and by 5% from US$2,370 per to US$2,256 per tonne in London and New York respectively. The renewal of lockdowns in Asia and some European countries, to tackle the rapidly spreading delta variant of the COVID-19, which could be detrimental to the global economy and thereby the cocoa industry took a toll on cocoa prices.

During 21-30 July, prices halted from their descent and strengthened on both markets in reaction to the robust increases recorded in grindings in main cocoa consuming regions namely Europe, Asia and North America. In London, prices of the SEP-21 contract were reinvigorated by 5% from US$2,150 to US$2,250 per tonne while in New York, prices of the nearby cocoa contract went up by 4% from US$2,265 to US$2,365 per tonne.

Cocoa gradings and stocks in exchange licensed warehouses

Stocks of cocoa beans with valid certificates in European warehouses averaged 136,160 tonnes; representing 78% of the total stocks. As shown in Figure 3, stocks with valid certificates increased by 16% as compared to their average level of 117,453 tonnes seen in July 2020. In the United States, total stocks climbed by 42% year-on-year to reach an average of 376,494 tonnes in July 2021 (Figure 4). Over the same period, certified stocks in the United States climbed from 6,961 tonnes to 46,009 tonnes.

At its maturity, volumes of cocoa beans exchanged against the JUL-21 contract in Europe amounted to 7,960 tonnes; down from 9,280 tonnes tendered against the JUL-20 futures contract one year ago. During the month under review, Nigeria cocoa beans represented the highest share of the deliveries with 66% or 5,250 tonnes. The share of cocoa beans from Côte d’Ivoire in the deliveries that occurred in July 2021 stood at 33% or 2,610 tonnes while the remaining 1% or 100 tonnes of the deliveries came from the Democratic Republic of Congo

At its maturity, volumes of cocoa beans exchanged against the JUL-21 contract in Europe amounted to 7,960 tonnes; down from 9,280 tonnes tendered against the JUL-20 futures contract one year ago. During the month under review, Nigeria cocoa beans represented the highest share of the deliveries with 66% or 5,250 tonnes. The share of cocoa beans from Côte d’Ivoire in the deliveries that occurred in July 2021 stood at 33% or 2,610 tonnes while the remaining 1% or 100 tonnes of the deliveries came from the Democratic Republic of Congo

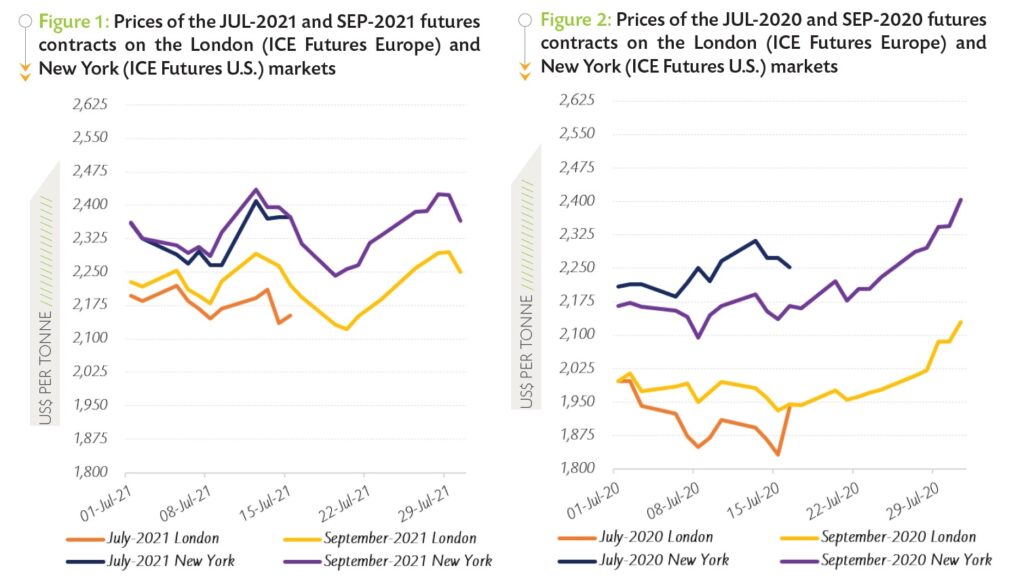

Figure 5 presents the main origins of cocoa graded on the ICE Futures Europe during the periods October 2019 – July 2020 and October 2020 – July 2021, while Figure 6 shows the same information for the cocoa graded on the U.S. Exchange.

Cocoa graded by the ICE Futures Europe, during October 2020 – July 2021, reached 136,800 tonnes, up by 14% from 119,700 tonnes of cocoa graded over the same period in the previous season. During the aforementioned periods, the volume of Cameroonian cocoa beans at exchange gradings was slashed from 55,000 tonnes to 43,200 tonnes.

Similarly, the volume of Togolese cocoa beans graded at the exchange was reduced from 4,980 tonnes to 3,240 tonnes while cocoa beans from Côte d’Ivoire slightly retreated from 33,530 tonnes to 33,180 tonnes. Other origins’ cocoa beans graded at the exchange shrunk from 3650 tonnes to 2,220 tonnes. On the contrary, cocoa beans from Nigeria outstripped the previous year from 22,540 tonnes to 54,960 tonnes.

In July the entire volume (9,989 tonnes) of cocoa graded on the ICE Futures U.S. originated from Côte d’Ivoire. Total gradings amounted to 95,487 tonnes of cocoa beans during October 2020 – July 2021, up from 16,354 tonnes graded during the same period of the preceding cocoa year. On a year-on-year basis, the volumes of cocoa beans from Côte d’Ivoire and Ecuador in ICE Futures U.S. gradings increased from 8,699 tonnes to 53,762 tonnes and from 1,169 tonnes to 15,311 tonnes respectively.

Similarly, volumes of Cameroonian and Peruvian cocoa beans at exchange gradings went up from 1,340 tonnes to 12,531 tonnes and from 1,099 tonnes to 5,112 tonnes respectively. Volumes of Nigerian cocoa beans in ICE Futures U.S. licensed warehouses increased from 954 tonnes to 4,794 tonnes. Additionally, the volumes of cocoa beans graded on the ICE Futures U.S. for other origins went up from 3,092 tonnes to 3,976 tonnes.

Origin differentials

Origin differentials

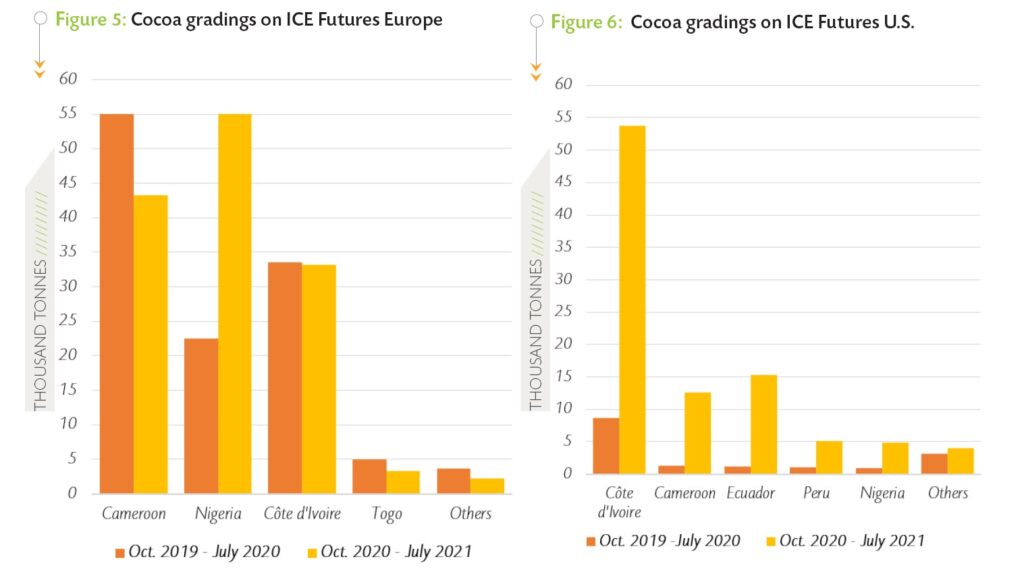

Figure 7 and Figure 8 provide evidence that origin differentials on prices of the six-month forward cocoa contract in Europe and the United States for Ghana, Côte d’Ivoire, Ecuador and Nigeria witnessed pronounced declines in July as compared to their levels recorded at the beginning of the 2020/21 cocoa year.

In Europe, the differential for Ghanaian cocoa averaged US$301 per tonne in July 2021, 55% lower compared to US$672 per tonne recorded in October 2020. Similarly, the origin differential dropped by 67% from US$527 to US$171 per tonne for Ivorian cocoa beans. A 78% reduction from US$390 to US$84 per tonne was recorded for the Nigerian cocoa country differential, while Ecuador’s differential dwindled by 30% from US$472 to US$332 per tonne.

On the U.S. market, cocoa beans from Ghana recorded a differential of US$374 per tonne in July 2021 against US$614 per tonne during October 2020. Over the same period, the premium applied to Ivorian cocoa beans plummeted by 42% from US$481 to US$278 per tonne. Premiums received for Ecuadorian beans in the U.S. sunk by 39% from US$231 to US$140 per tonne, while a 46% reduction from US$407 to US$219 per tonne was seen in the origin differential for Nigeria.

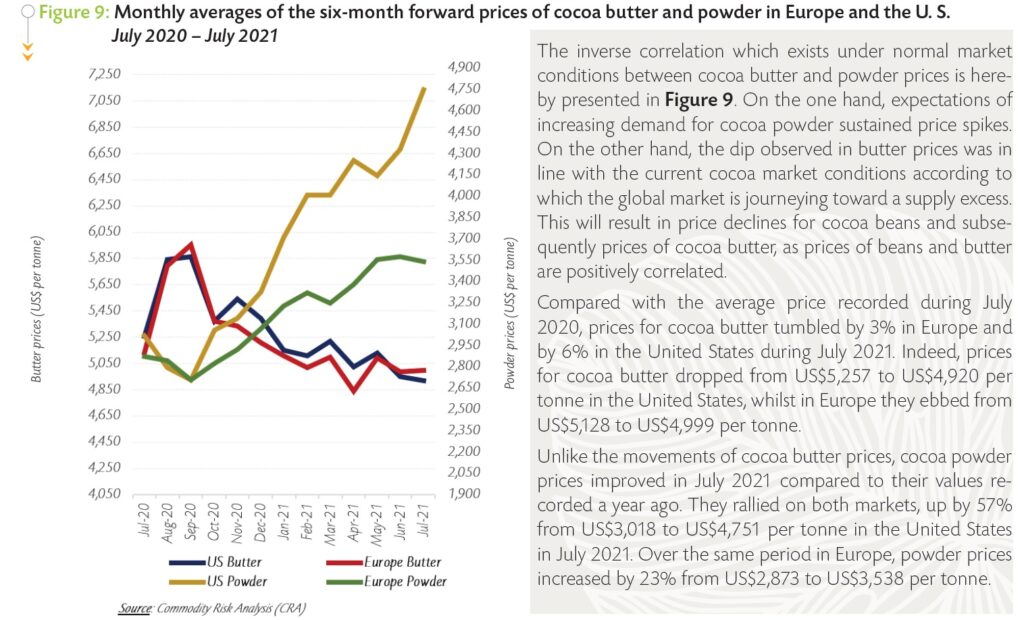

Prices of cocoa butter and powder

Prices of cocoa butter and powder

Production and Grindings

Production and Grindings

Since the start of the 2020/21 cocoa season, cumulative arrivals of cocoa beans in Côte d’Ivoire are higher year-onyear. As at 8 August 2021, cumulative arrivals at Ivorian ports were seen at 2.111 million tonnes, up by 4.8% compared to 2.014 million tonnes recorded a year earlier. In addition, the country was reported to have sold exports contracts of 1.4 million tonnes of cocoa beans for 2021/22, which represent 93% of the 1.6 million tonnes targeted to be sold by end September 2021. These contracts were sold at a discount of £150 per tonne; £50 per tonne lower compared to the discount applied to exports contracts of the 2020/21 cocoa year.

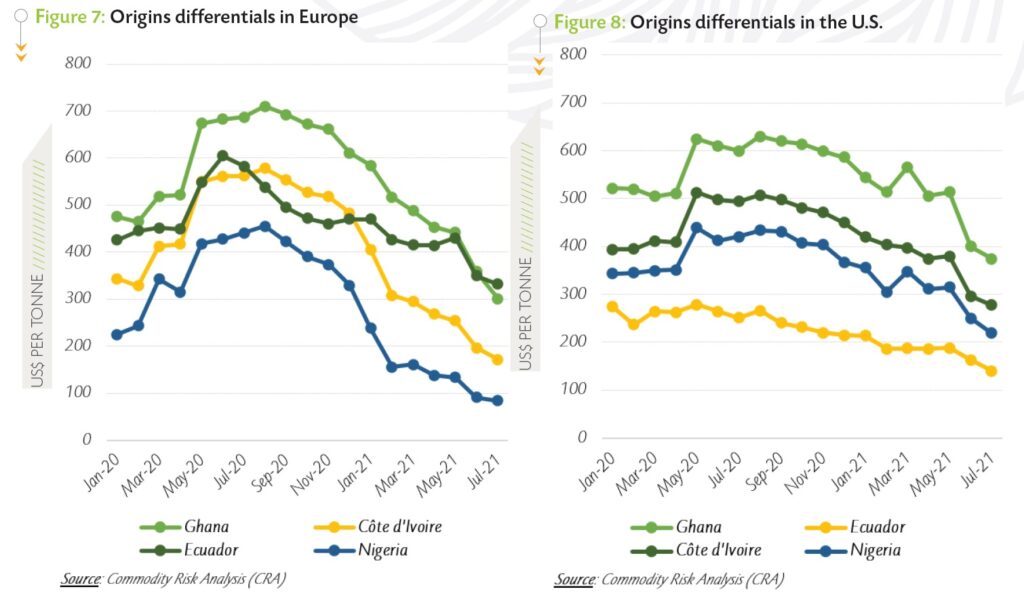

In July, data published by main regional cocoa associations for the second quarter of 2021 indicated that grindings substantially increase in Europe, South-East Asia and North America. Figure 10 shows that the European Cocoa Association (ECA) published data indicate a year-on-year soar of 13.61% from 314,108 tonnes to 356,854 tonnes in grindings.

In a similar vein, the Cocoa Association of Asia (CAA) announced a year-on-year increase of 8.98% from 202,674 tonnes to 220,865 tonnes. Further, processing activities improved in North America during the second quarter of 2021 with the National Confectioners’ Association (NCA) reporting a 11.68% increase from 110,776 tonnes to 123,719 tonnes of cocoa beans grinded.

At the end of the third quarter of the 2020/21 cocoa season, cumulative grindings of ECA members totaled 1,058,820 tonnes, up by 20,577 tonnes from the level reach at the corresponding period of the previous season. In South-East Asia, cumulative grindings increased by 2% year-on-year to 652,269 tonnes over the first three quarters of 2020/21.

Over the same period, grindings in North America grew by 7% from 336,738 tonnes to 359,718 tonnes.