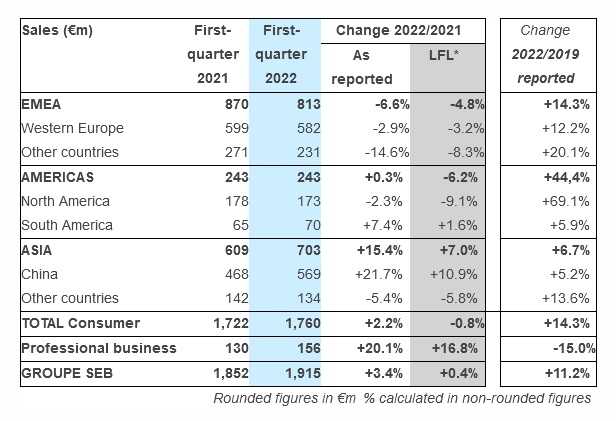

ECULLY, France – With sales of €1,915m, up 3.4% against demanding comparatives in 2021, Groupe SEB got off to a good start in 2022 in an environment marked by the conflict in Ukraine, the resurgence of COVID-19 in China and Japan, persisting supply chain issues and inflation. The 3.4% increase includes organic growth of +0.4% and a currency effect of +3.0%. The scope effect was zero.

These performances should be seen in the light of an extremely demanding comparison basis in first quarter 2021, which combined exceptional business momentum and extensive loyalty programs accounting for approximately €50m. As a result:

- organic growth in the first-quarter includes effects for ca. – 4 points stemming from Russia-Ukraine and from variations of Loyalty Programs;

- Group sales grew by 11% (as reported) vs the first quarter of 2019, the last “normal” basis of comparison.

The Group’s growth trajectory is healthy and consistent with our expectations.

The Consumer business achieved sales of €1,760m, up 2.2% and down slightly like-for-like (-0.8%) against extremely high comparatives in 2021. Sales were also up 14% (as reported) from 2019.

Business activity trended positively overall, despite persistent supply-chain disruptions, with revenue rising in most countries and a favorable price-mix effect. The Group continued to outperform the market and reinforce its positions.

In terms of products, brisk business in floor care (vacuum cleaners) was confirmed, on the strength of its broad range and product dynamic. The XÔ launch proved a major success at retailers and sell-out has been highly satisfactory. Linen care sales were back to growth as social lives returned to normal. However, cookware and electrical cooking demand was moderate relative to a very strong previous-year period including the loyalty programs mentioned above.

Professional sales totaled €156m in the first quarter for an increase of over 20%, including organic growth of 16.8%. Despite undemanding comparison with first-quarter 2021 (when most of the hospitality and catering sector was shut down), this performance confirms the recovery in core business, driven both by equipment and services.

* Like-for-like: at constant exchange rates and scope of consolidation

Professional business activity

Professional business activity

With growth of 20% as reported and of nearly 17% like-for-like, the Professional business continued its recovery in the first quarter. The performance compares with a start to the year in 2021 that was still highly impacted by lockdowns and shutdowns in the hospitality and catering sector, notably in Germany.

In Professional Coffee, accounting for over 90% of Professional sales, momentum continued to be fueled by the core business, particularly in the EMEA region. Activity is underpinned by a solid and diversified customer portfolio and by the Services business, back to standard levels since the second half of 2021.

At the same time, while not returning to the exceptional highs of 2019, the Group continued to sign major contracts. Thus, first-quarter sales were bolstered by the resumption of deliveries of Schaerer machines to Luckin Coffee in China.

The Hotel equipment business, which has a lesser impact on revenue, also achieved a significant rebound in revenue in the first quarter.

Groupe Seb: Outlook

The Group is highly cautious regarding the geopolitical and sanitary situation. It is implementing all the measures required to adapt to the evolution of the international economic climate.

In this context, Groupe SEB maintains for 2022 its ambition of growth in sales and increase in Operating Result from Activity, with the assumption of a gradually improving environment and the leveraging of our innovation dynamic and commercial strength.

Convinced of the structurally promising nature of our Consumer and Professional markets, we are confident in our capacity to continue reinforcing our positions worldwide.