LUXEMBOURG – The Board of Directors of Ivs Group S.A. (Milan: IVS.MI), convened on May 13th, 2022, and chaired by Mr. Paolo Covre, examined and approved the Interim Financial Report at 31 March 2022, as summarised below.

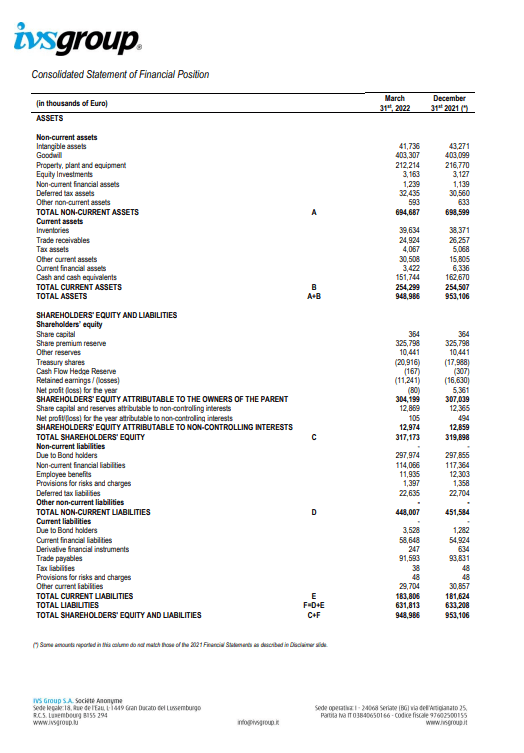

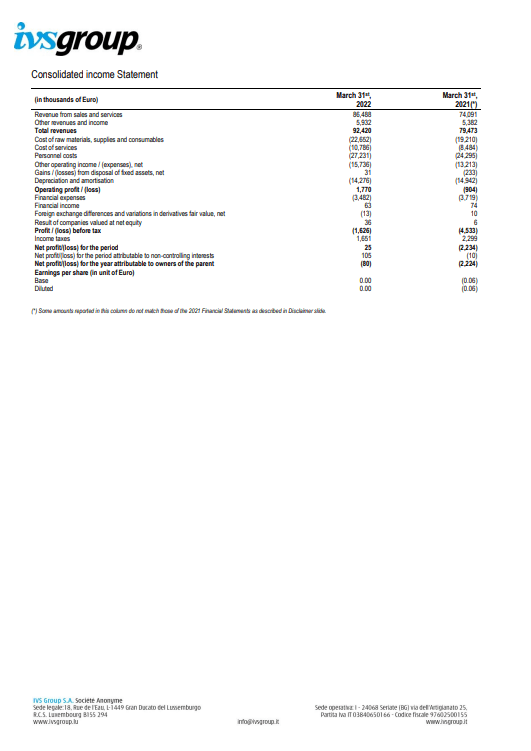

Consolidated revenues in 1Q 2022 reached Euro 92.4 million (of which 81.7 million related to the core vending business), +16.3% from Euro 79.5 million of 1Q 2021 (Euro 70.1 in vending).

Sales increased by 14.1% in Italy, by 49.2% in France, 6.6% in Switzerland and 23.0% in Coin Service division, but decreased by 3.0% in Spain.

France shows a much higher growth compared to the other markets thanks to the positive contribution of Paris Metro contract, although passenger flows are still far from expected standard levels.

Coin Service division includes the sales in the digital and payment services, that generates the largest part of sales and margins in the fourth quarter and in the first part of the year bring the group a negative contribution, whilst metal coins business margins are closer to excellent pre Covid levels.

Ivs vending sales increase

Vending sales increased progressively during 1Q 2022, accelerating since March 2022, when it was generated almost 40% of the total sales of the quarter. January and February, on the contrary, were still heavily hit by the wave of Omicron-Covid and the consequent high absences in the workplaces.

In fact, the first two months of 2022, although growing compared to the corresponding months of 2021 (+2.8% and +7.6% on volumes; +10.4 and +15.1% on sales), were approximately 15% below budget.

Along with the slow-down of pandemic effects, March 2022 showed a much higher increase (+14.4% on volumes, +23% on sales vs. March 2021). The contribution to sales pro- rata temporis of the acquisition completed in the period was almost nihil.

The total number of vends at March 2022 was equal to 166.5 million 153.2 million, +8.7% from 153.2 million at March 2021; over 39% of total 1Q volumes was made in March. IVS continues to have an acquisition rate of new clients higher than the churn rate.

Average price per vend in 1Q 2022 increased to Euro 49.09 cents, from Euro 45.73 cents of 1Q 2021 (+7.3%). That is due both to the policy of price increase and to the gradual recovery of volumes in public and travel market segments, that have higher prices compared to the corporate sector.

Margins of growth

The recovery in public locations, that still have huge margins of growth before reaching pre Covid volumes, together with the price increase policy (that requires times to be applied to all the contracts and technical interventions), supports a multi-year trend of growing selling prices, made easier also by present inflation context, with counterparts ready to accept the price increase of quite small amounts, compared to much higher price increase (+20-50 Euro cents) in other channels, as coffee at bars.

Ebitda reported is equal to Euro 16.0 million, increased by 14.3% compared to Euro 14.0 million at March 2021. Adjusted Ebitda is equal to Euro 17.0 million, +25.8% from Euro 13.6 million at March 2021, with a 18.4% Ebitda margin (20.9% if calculated net of positioning fees). As well as monthly volumes and sales, also a major part of Ebitda of 1Q 2022 was generated in March. Since the beginning of Covid pandemic, the group started and is continuing to renegotiate positioning fees.

Net Profit

Consolidated Net Profit at March 2021 is equal to Euro 0.02 million (with Euro 0.1 million net profit attributable to minorities) compared to Euro -2.2 million of 2021. The Net Profit Adjusted for the exceptional items is equal to Euro 0.8 million, from Euro -2.5 million at March 2021. The Net Result includes non-recurring costs and related tax effect for a total of around 0.7 million.

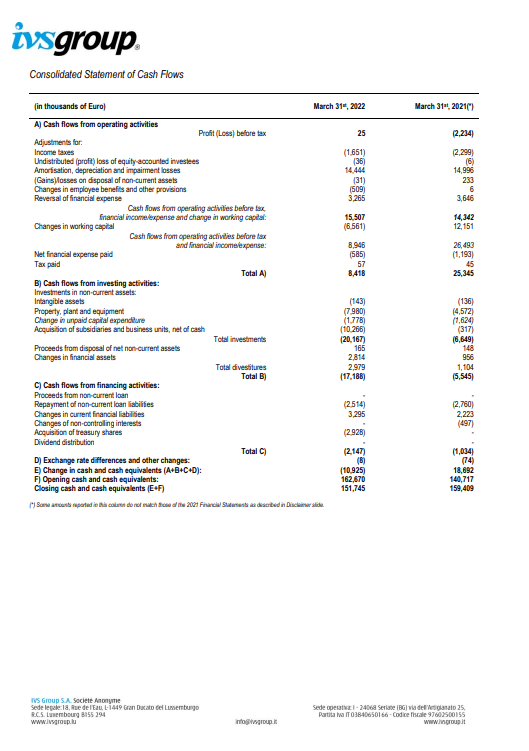

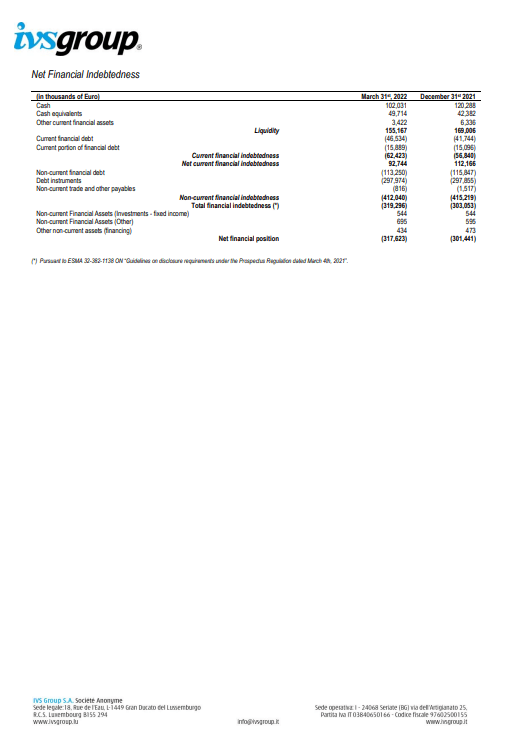

Net Financial Position (“NFP”), is equal to Euro -317.6 million (including Euro 46.4 million debt deriving from rent and leasing contracts according to the definitions of IFRS 16, from Euro 301.4 million at the end of 2021 (337.7 at 31 March 2021). During 1Q 2022 were made advance payments of Euro 10.0 million related to the Business Combination with Liomatic, that is not yet part of IVS Group.

The cash-flow from operations of 1Q 2022 was equal to Euro 15.5 million, facing net payments for Capex of Euro 9.7 million and Euro 10.3 million for M&A (including the above-mentioned Euro 10 million advance payments for Liomatic price). Net working capital and stocks slightly increased, following the expected recovery, absorbing around Euro 6.6 million.

Working capital includes VAT credits for Euro 8.0 million (not included in the NFP), that increased during 1Q 2022 by around Euro 2.8 million; no reimbursements or pro-soluto sales of VAT credit occurred in 1Q 2022. Net debt includes Euro 2.3 million of interests accrued on the bonds expiring in October 2026.

Other significant transactions and events occurred after 31 March 2022, Covid situation and prospects for the year

The present scenario, with high inflation and uncertainties due to international tension, has however much less impact on IVS Group business compared to the former years of Covid. In fact, presences in locations like schools and universities, public transport like railways stations, underground and airports, are gradually coming back to normality, as well as consumptions at the vending machines.

In the manufacturing sector, vends had returned to pre Covid levels at the end of 2021 and the slow-down at the beginning of 2022 (due again to Covid reasons), has already been recovered since March, with a growth trend which is substantially confirmed also in April, net of the different working days related to Eastern holidays, with a positive impact also from the recovery of significant tourism flows.

The combined effect of higher selling prices and of reopening and recovery of activities in public locations, multiplied by the rising volumes, supports and gives good visibility to the generation of growing sales and cash-flow.

The growth of economic results

The stronger leadership position that IVS Group will reach with Liomatic and GeSA, will further contribute to the growth of economic results, exploiting the best and most efficient commercial conditions and operational skills of each partner in the Business Combination.

An almost doubled market share will not only make Ivs Group an essential reference point on the vending channel but will also allow to extract important results from the investments made in the field of digitalisations and direct relationships with final consumers, that already reached high absolute numbers, not only for Ivs business, but also for the business of other possible strategic partners.

On May 9th, 2022 started the offering of new Ivs Group shares, for a total value of around Euro 186 million, related to the completion of the Business Combination with Liomatic and GeSA.

The reinvestment in Ivs Group of over 70% of the prices agreed by the sellers is a clear sign of Liomatic and GeSA shareholders’ confidence in the prospects of the transaction. IVS Group controlling shareholders, Ivs Partecipazioni S.p.A., informed that it has already underwritten its pro-quota of the capital increase (for an amount of around Euro 116 million).

The procedure of the capital increase is expected to be completed by the end of May / beginning of June 2022.

About Ivs Group

Ivs Group S.A. is the Italian leader and the second player in Europe in the business of automatic and semi-automatic vending machines for the supply of hot and cold drinks and snacks (vending).

The core vending business is mainly carried out in Italy (81% of sales), France, Spain and Switzerland, with around 230,000 vending machines; the group has a network of 87 branches and around 2,700 employees. Ivs Group serves more than 15,000 corporate clients and public entities, with over 650 million vends in 2021.

The Ivs Group report in detail