Share your coffee stories with us by writing to info@comunicaffe.com.

WASHINGTON, USA – The Foreign Agricultural Service (FAS) of the United States Department of Agriculture (USDA) has released the latest Coffee: World Markets and Trade report. This biannual report, published in June and December, includes data on U.S. and global trade, production, consumption and stocks, as well as analysis of developments affecting world trade in coffee.

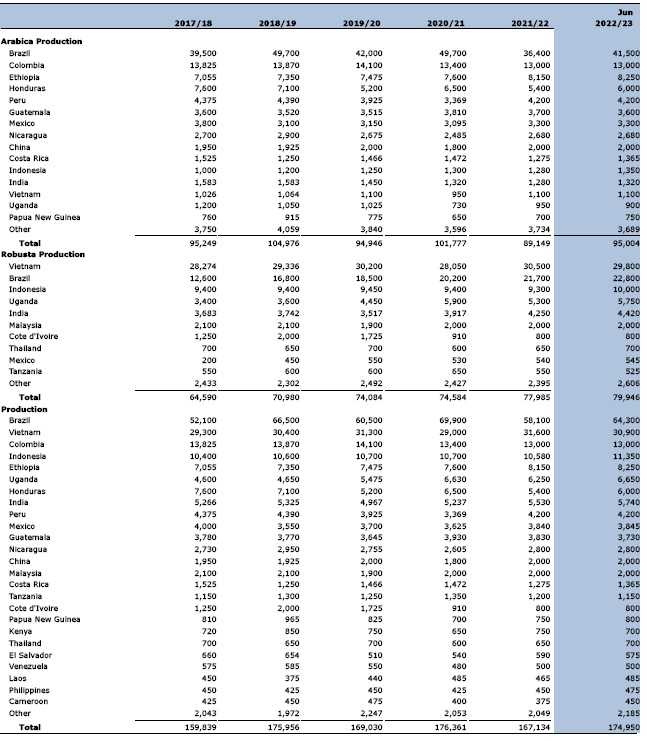

World coffee production for 2022/23 is forecast by USDA to rebound 7.8 million bags from the previous year to 175.0 million due primarily to Brazil’s Arabica crop entering the on-year of the biennial production cycle.

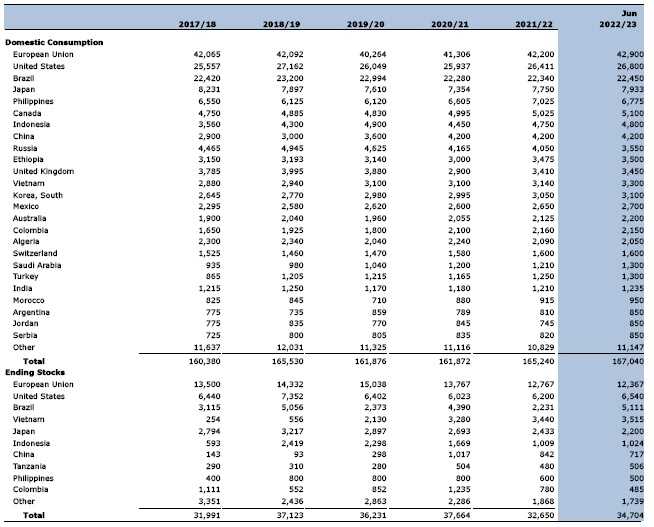

Global consumption is expected to rise 1.8 million bags to 167.0 million, with the largest gains in the European Union, the United States, Japan, and Brazil.

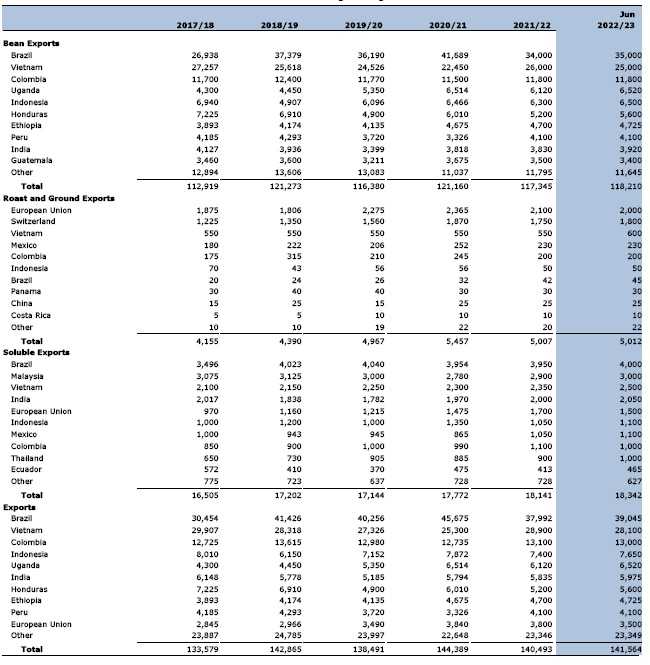

World exports are forecast modestly higher by USDA on gains in Brazil and Indonesia. Ending stocks are expected 2.1 million bags higher to 34.7 million following last year’s sharp drawdown.

Brazil Arabica output is forecast to recover 5.1 million bags to 41.5 million. The majority of producing areas are in the on-year of the biennial production cycle, resulting in higher production potential for the upcoming crop; however, this quantity is well below recent on-year crops that peaked at nearly 50 million bags.

Arabica trees in many growing regions continue to recover from severe frosts in June and July 2021 as well as high temperatures and below-average rainfall that prevailed until September 2021. Although light frosts were also observed last month in limited areas in the states of Sao Paulo, Minas Gerais, and Parana, minimal damage was reported.

The Robusta harvest is forecast to continue expanding to reach a record 22.8 million bags, up 1.1 million, as favorable weather conditions and good crop management aided fruit settings and development in the main growing region of Espirito Santo.

A marginal increase in harvested area also supports the expected gains. The combined Arabica and Robusta harvest is forecast up 6.2 million bags to 64.3 million. Output gains are expected to be nearly evenly distributed between exports and stocks.

Vietnam production is forecast at 30.9 million bags, down 700,000 from last year’s record harvest.

Cultivated area is forecast unchanged from last year, with over 95 percent of total output remaining as Robusta. The rainy season started earlier than previous years which supported good flowering and cherry development. Wetter-than-normal conditions reduced irrigation needs and costs.

However, fertilizer prices skyrocketed as much as 70 percent in the last 6 months while local coffee prices remained flat. Farmers responded by reducing fertilizer use which is expected to lower yields and output from the previous year. Bean exports are forecast to decline 1.0 million bags to 25.0 million, and ending stocks are nearly flat at 3.5 million bags.

Colombia Arabica coffee production is forecast flat at 13.0 million bags on normal growing conditions. Yields are not expected to rise because farmers have limited fertilizer use due to the recent price spike.

Colombia is highly dependent on imported fertilizer ingredients such as nitrogen, phosphorous, and potassium. The National Federation of Coffee Growers (FEDECAFE) has delivered limited quantities of fertilizer through its replanting program, but it is unlikely to meet the total fertilizer needs of its members. Bean exports, mostly to the United States and European Union, are forecast flat at 11.8 million bags.

Indonesia production is forecast to rise nearly 800,000 bags to 11.4 million. Robusta output is expected to reach 10.0 million bags on favorable growing conditions in the lowland areas of Southern Sumatra and Java where approximately 75 percent is grown. The main harvest season in southern Sumatra began on time in March and is expected to continue through July 2022. Arabica production is also seen rising slightly to 1.4 million bags. Bean exports are forecast to gain 200,000 bags to 6.5 million.

India production is forecast to gain 200,000 bags to 5.7 million as favorable weather during the flowering and fruit set period is expected to improve Arabica and Robusta yields. Bean exports are forecast up 100,000 bags to 3.9 million, while inventories remain stable.

European Union imports are forecast up 1.0 million bags to 46.0 million and account for 40 percent of the world’s coffee bean imports. Top suppliers include Brazil (40 percent), Vietnam (20 percent), Uganda (8 percent), and Honduras (7 percent). Ending stocks are expected to drop 400,000 bags to 12.4 million in order to sustain a modest increase in consumption.

The United States imports the second-largest amount of coffee beans and is forecast up 500,000 bags to 25.5 million by USDA. Top suppliers include Brazil (30 percent), Colombia (19 percent), Vietnam (10 percent), and Honduras (7 percent). Ending stocks are forecast to grow 300,000 bags to 6.5 million.

USDA revised estimate for 2021/22

World production is lowered 300,000 bags from the December 2021 estimate to 167.1 million.

- Brazil is up 1.8 million bags to 58.1 million due largely to higher Arabica yields.

- Honduras is revised 1.4 million bags lower to 5.4 million as leaf rust lowered yields more than

expected. - Colombia is 800,000 bags lower to 13.0 million due to excessive rain and cloud cover that

lowered yields. - Cote d’Ivoire is reduced 670,000 bags to 800,000 due to lower yields.

World bean exports are revised up 200,000 bags to 117.3 million.

- Brazil is up 4.0 million bags to 34.0 million as logistical bottlenecks slowed trade less than expected.

- Honduras is reduced 1.3 million bags to 5.2 million on reduced exportable supplies.

- Colombia is down 1.0 million bags to 11.8 million on reduced exportable supplies.

- Cote d’Ivoire is down 650,000 bags to 550,000 on updated trade data.

World bean imports are revised up 2.4 million bags to 112.7 million.

- European Union is raised 2.5 million bags to 45.0 million on higher consumption and build-up of stocks.

World ending stocks are revised up 2.7 million bags to 32.7 million.

- European Union is revised up 1.5 million bags to 12.8 million.

- Vietnam is raised 500,000 bags to 3.4 million.

- The United States is up 400,000 bags to 6.2 million.

The following tables show: world coffee production, exports and production