ORRVILLE, Ohio, USA – The J.M. Smucker Co. announced results for the second quarter ended October 31, 2022, of its 2023 fiscal year. Financial results for the second quarter of fiscal year 2023 reflect the divestitures of the natural beverage and grains businesses on January 31, 2022, and the private label dry pet food business on December 1, 2021. All comparisons are to the second quarter of the prior fiscal year, unless otherwise noted.

J.M. Smucker: 2Q Key figures

- Net sales increased $155.1 million, or 8 percent. Net sales excluding divestitures and foreign currency exchange increased 11 percent.

- Net income per diluted share was $1.79. Adjusted earnings per share was $2.40, a decrease of 1 percent.

- Cash provided by operations was $205.0 million, an increase of 24 percent. Free cash flow was $102.9 million, compared to $105.9 million in the prior year.

- The Company increased its full-year fiscal 2023 financial outlook for net sales and adjusted earnings per share.

Net Sales

Net sales increased 8 percent. Excluding noncomparable net sales in the prior year of $65.0 million from the divested natural beverage and grains and private label dry pet food businesses, as well as $7.0 million of unfavorable foreign currency exchange, net sales increased $227.1 million, or 11 percent.

The increase in comparable net sales was primarily driven by a 17 percentage point increase from net price realization, primarily reflecting list price increases for each of the Company’s U.S. Retail segments and for International and Away from Home, partially offset by a 6 percentage point decrease from volume/mix primarily driven by the U.S. Retail Coffee segment.

Operating Income

Gross profit decreased $10.4 million, or 1 percent. The decrease reflects a reduced contribution from volume/mix and the noncomparable impact of the divested natural beverage and grains businesses, partially offset by a favorable net impact of higher net price realization and increased commodity and ingredient, manufacturing, transportation, and packaging costs, inclusive of costs related to a voluntary recall of Jif® peanut butter products in May 2022. Operating income decreased $18.4 million, or 6 percent, primarily reflecting the decrease in gross profit and a $6.6 million increase in selling, distribution, and administrative (“SD&A”) expenses.

Adjusted gross profit increased $0.1 million. The difference between adjusted gross profit and generally accepted accounting principles (“GAAP”) results reflects the exclusion of the change in net cumulative unallocated derivative gains and losses and special project costs. Adjusted operating income, which further reflects the exclusion of amortization and other special project costs as compared to GAAP operating income, decreased $8.3 million, or 2 percent.

Interest Expense and Income Taxes

Net interest expense decreased $0.6 million, primarily due to the net favorable impact of debt repayments and issuances in the prior fiscal year.

The effective income tax rate was 24.4 percent compared to 23.4 percent in the prior year, reflecting a higher state income tax rate in the current year. The adjusted effective income tax rate was 24.4 percent, compared to 23.5 percent in the prior year.

Cash Flow and Debt

Cash provided by operating activities was $205.0 million, compared to $165.1 million in the prior year, primarily reflecting lower cash required to fund working capital. Free cash flow was $102.9 million, compared to $105.9 million in the prior year, as a $42.9 million increase in capital expenditures offset the increase in cash provided by operating activities. Net debt repayments in the quarter totaled $88.8 million.

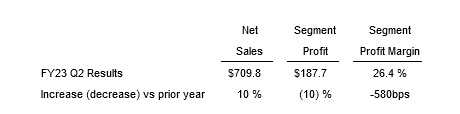

J.M. Smucker: U.S. Retail Coffee

Net sales increased $64.7 million, or 10 percent. Net price realization increased net sales by 23 percentage points, primarily reflecting list price increases across the portfolio, partially offset by a reduced contribution from volume/mix of 13 percentage points driven by the Folgers® and Dunkin’® brands.

Segment profit decreased $20.1 million, primarily reflecting the decreased contribution from volume/mix and higher marketing spend, partially offset by a favorable net impact of higher net price realization and increased commodity and manufacturing costs.

J.M. Smucker: International and Away From Home

Net sales of The J.M. Smucker Co. increased $35.8 million, or 14 percent. Excluding $1.5 million of noncomparable net sales in the prior year related to the divested natural beverage and grains businesses and $7.0 million of unfavorable foreign currency exchange, net sales increased $44.3 million, or 17 percent. Excluding the impact of the divested businesses and foreign currency exchange, net sales increased 19 percent and 15 percent for the Away from Home and International operating segments, respectively. Net price realization contributed an 18 percentage point increase to net sales for the combined businesses, primarily driven by increases for coffee products and baking mixes and ingredients, partially offset by a decreased contribution from volume/mix of 1 percentage point.

Segment profit increased $1.1 million, primarily reflecting a favorable net impact of higher net price realization and increased commodity costs, partially offset by a decreased contribution from volume/mix.