ABIDJAN, Côte d’Ivoire – Grindings data published by the main regional cocoa associations for the first quarter of the 2022/23 cocoa season indicated that cocoa processing activities decreased in the main cocoa-consuming regions namely Europe, South-East Asia, and North America, says the Cocoa Market Report of the International Cocoa Organization (ICCO) for the Month of January 2023.

The slowdown in cocoa processing activities could have been partly fuelled by high operation costs amidst a strong global inflationary context and persistently higher energy costs.

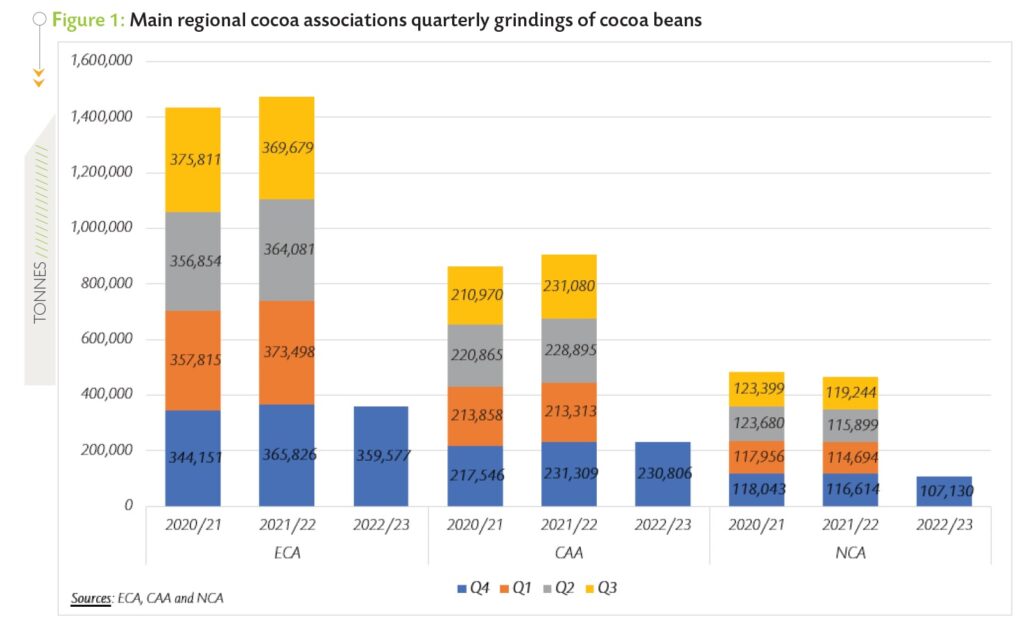

As presented in Figure 1, the European Cocoa Association (ECA) posted data indicating a year-on-year decline of 1.7% from 365,826 tonnes to 359,577 tonnes in grindings. In turn, the Cocoa Association of Asia (CAA) posted a slight year-on-year drop of 0.2% from 231,309 tonnes to 230,806 tonnes.

In a similar vein, the National Confectioners’ Association (NCA) published a reduction of 8.1% from 116,614 tonnes to 107,130 tonnes of cocoa beans ground. Grindings for each first quarter of the previous three cocoa years represented approximately one-fourth of the respective total volumes of cocoa ground at the time.

Furthermore, the declining grindings during Q4.2022 moved in tandem with the net imports of cocoa beans and cocoa semi-finished products in the European Union whereas in the United States and Canada, net imports of cocoa beans and cocoa semi-finished products were higher year-on-year.

Indeed, the latest trade statistics from Eurostat indicate that imports of cocoa beans and cocoa semi-finished products in the European Union were reduced by 13.1% year-on-year in Q4.2022 to 336,000 tonnes.

On the contrary, the combined volumes of net imports of cocoa beans and cocoa semi-finished products of Canada and the United States increased by 10% from 180,000 tonnes in Q4.2021 to 198,000 tonnes in Q4.2022 based on trade statistics from the Global Trade Atlas (GTA).

Hence, the decline in processing activities in the United States was accompanied by an increase in the net imports of cocoa beans and cocoa semi-finished products while in the European Union, the descending trend in both grindings and net imports of cocoa beans and cocoa semi-finished products during Q4.2022 suggests a plausible shrinkage in the demand for cocoa in the whole EuroZone.

As much as global inflationary pressures heighten concerns related to cocoa demand, grindings at origin are on the rise. Contrary to the overall decline in grindings in the main consuming markets, top African cocoa growers are expected to further expand their domestic cocoa processing activities.

Indeed, Côte d’Ivoire is envisioning to process nearly half of the raw cocoa beans produced in the country. The mid-crop harvest is usually processed at origin because the size and quality of the beans are respectively smaller and lower than the main crop.

Additionally, the Conseil du Café Cacao (CCC) and the Ghana Cocoa Board (COCOBOD) sell the mid-crop harvest at a discount to all processors within the respective countries.

So, to process 50% of the annual production, a share of the main crop has to be ground locally. Therefore, a question one could raise is whether a cocoa exporter is going to make more money by directly selling beans of bigger size and higher quality or processing part of the main crop at origin. Furthermore, a new cocoa processing plant is scheduled to be built in Côte d’Ivoire in the course of the year, with more plants envisaged in future.

It is worth noting that the grinding capacity of Côte d’Ivoire is currently estimated at over 700,000 tonnes.

Furthermore, the cocoa exporters’ association of Côte d’Ivoire (GEPEX) which gathers the top six cocoa processors in the country reported that grindings by its members reached 233,743 tonnes, up year-on-year by 10.8% since the start of the 2022/23 cocoa season. Concurrently, the volumes of exports of semi-finished products from Côte d’Ivoire went up by 3.2% year-on-year from 109,000 tonnes in Q4.2021 to 112,500 in tonnes in Q4.2022.

With consumers in developed countries becoming more discerning and cocoa imports in that part of the world on course to start complying with upcoming laws regarding sustainability, deforestation, child labour, traceability, etc., imports of beans for the operations of cocoa processors are likely to focus more on certain qualities other than the import volumes.

Slight setback for main crop output from Côte D’ivoire while Ghana is currently rising

Cocoa production in Côte d’Ivoire since the start of the 2022/23 cocoa year is reported to have now settled below last season’s level at 1.650 million tonnes as at 19 February 2023, merely down by 0.5% compared with 1.659 million tonnes recorded at the same period of the 2021/22 season. As the main crop is still ongoing, recent beneficial rains that occurred in main cocoa growing areas of Côte d’Ivoire bolstered optimism for the mid-crop.

In addition, the country’s exports of cocoa beans during the first quarter of 2022/23 were reported to have dropped by 15% year-over-year from 382,864 tonnes in Q4.2021 to 324,478 tonnes in Q4.2022. It is important to indicate that, the year-on-year reduction in the arrivals at Ivorian ports coincided with information about the unusual trade of cocoa beans from the country to neighbouring countries.

To shed light on these cross-border flows, it is important to have in mind the impact that rising cocoa prices, inflation, and developments on currency markets had on the fixed farm gate prices of the major cocoa producing countries, which were set in accordance with the market conditions, which prevailed last season.

Currently, the fixed farm gate prices in Côte d’Ivoire (XOF900,000 per tonne or US$1,486 per tonne) and Ghana (GH₵12,800 per tonne or US$1,147 per tonne) are estimated to be respectively US$247 per tonne and US$586 per tonne lower than the estimated farm gate prices in neighboring countries. And these margins are incentivizing cross-border flows (arbitrage).

Nevertheless, at this junction, it is not possible to estimate precisely the magnitude of these flows. It will become clearer once the trade statistics for Q4.2022 and Q1.2023 for the sub-region become available.

In Ghana, the latest available data on purchases of graded and sealed cocoa beans were higher year-on-year by 54%, from 286,000 tonnes to 440,403 tonnes as at 3 February 2023.

Futures price movements

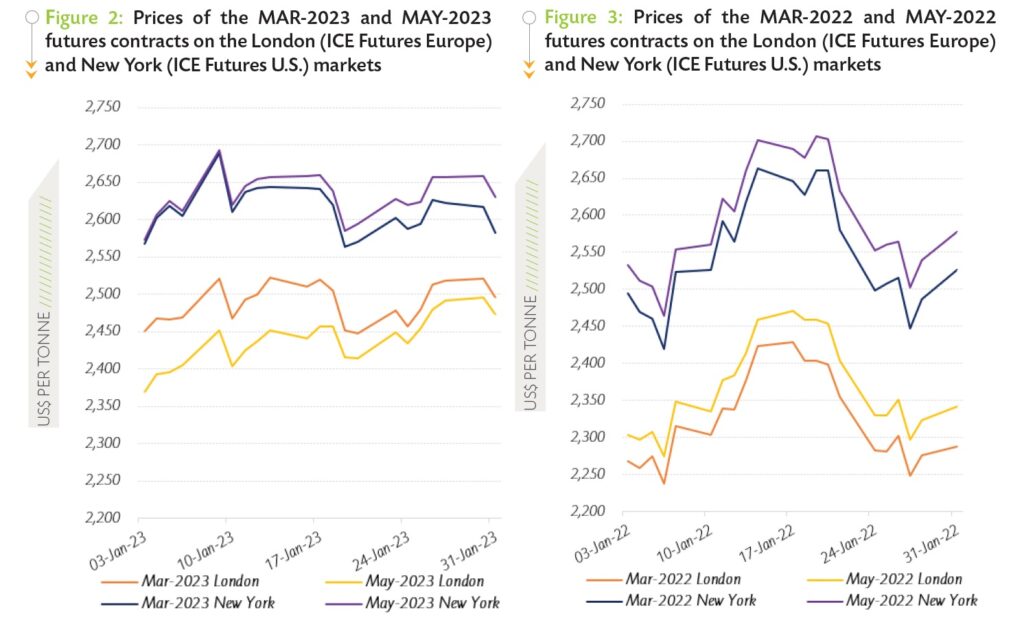

During January 2023, prices of the nearby cocoa futures contract oscillated between US$2,448 and US$2,523 per tonne in London and averaged US$2,488 per tonne, up by 7% compared to the average price of US$2,324 per tonne for the nearby contract recorded at the same period of the 2021/22 cocoa year.

In New York, the average price of the MAR-23 contract settled at US$2,614 per tonne, up by 3% from US$2,547 per tonne recorded in January 2022 and ranged between US$2,564 and US$2,689 per tonne.

Figure 2 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in January 2023, while Figure 3 presents similar information for the previous year

Figure 3 shows that the London market developed in backwardation while the New York market evolved in contango during January 2023. Indeed, the MAR-23 contract was priced with an average premium of US$50 per tonne compared to the MAY-23 contract in London. The backwardation in the London market is probably fuelled by the new rules governing cocoa gradings in ICE futures Europe which came into effect in December 2022.

The higher re-grading fees together with the price discount applied to exchange-certified stocks with older grading dates are incentivizing on the one hand the grading of new stocks and, on the other hand, the withdrawal of beans with older grading dates.

The higher re-grading fees together with the price discount applied to exchange-certified stocks with older grading dates are incentivizing on the one hand the grading of new stocks and, on the other hand, the withdrawal of beans with older grading dates.

Clearly, this turnover process has just started; and the backwardation will remain until a new stable equilibrium in the turnovers of stocks is reached. On the contrary, the New York futures market was in contango. The new grading rules concern only the London market.

During 03-09 January 2022, prices of the MAR-23 contract climbed on both sides of the Atlantic, lifted up by 3% from US$2,450 to US$2,522 per tonne and by 5% from US$2,568 to US$2,689 per tonne in London and New York respectively. At the time, drier spells were prevailing in the cocoa growing zones of Côte d’Ivoire and the country’s volume of gross exports of cocoa beans for the fourth quarter of 2022 was lower year-on-year.

Moving on to the middle of the month under review, prices halted their upward trend and remained within a range as market participants were awaiting grindings data for Q4.2022

Thereafter, upon the release of slightly lower year-on-year grindings data published by the main regional cocoa associations in Europe, South-East Asia, and North America, prices of the front-month cocoa contract plunged by 3% on both markets over three consecutive trading days 17-19 January, tumbling from US$2,520 to US$2,452 per tonne in London and from US$2,641 to US$2,564 per tonne in New York.

However, the reduction recorded in prices of the MAR-23 contract was short-lived and in the course of the latter part of January 2023, prices generally reverted from their descent. In London, prices of the nearby cocoa futures contract increased by 2% moving from US$2,448 to US$2,495 per tonne while in New York, they averaged US$2,601 per tonne and ranged between US$2,570 and US$2,627 per tonne.

This market development occurred in the midst of looming concerns of potential crop problems in Ghana due to the negative effect of the Cocoa Swollen Shoot Virus Disease (CSSVD) on the country’s cocoa production.