GRAND DUCHY OF LUXEMBOURG – The Board of Directors of IVS Group S.A. (Milan: IVS.MI), convened on May 15th, 2023, and chaired by Mr. Paolo Covre, examined and approved the Interim Financial Report at 31 March 2023, as summarised below. The Board resolved also to submit to the next GM, to be convened on June 27th, 2023, the payment of an ordinary dividend of euro 0.11 for each share (own shares excluded), for a total amount of around euro 10.0 million, to be taken from the shares premium reserve (and therefore exempt from withholding taxes for natural persons as it is not generated from profits of the current year or previous years), with ex-date 24 July, record date 25 July, and payment 26 July 2023.

The Board finally decided to co-opt a new director, in the person of Mr. Fabrizio Donegà, that will become a member of the Committee for Nominations and Remuneration and of the Committee for Control and Risks once the independence requirements have been verified.

Summary of results at 31 March 2023

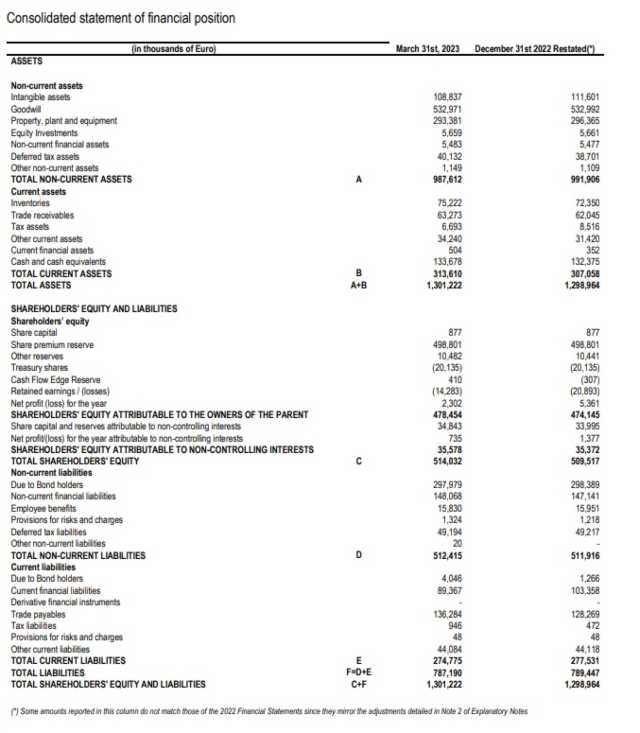

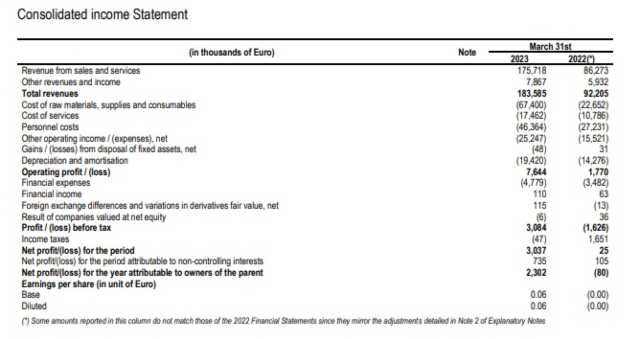

Consolidated Revenues: euro 183.6 million, +99.1%, compared to March 2022.

Ebitda reported: euro 27.1 million. Adjusted Ebitda: euro 28.1 million, +64.8% compared to 2022.

Ebit Adjusted: euro 8.7 million (+ 212.9% vs 2022)

Consolidated Net Profit: euro 3.0 million. Adjusted Net Profit: euro 3.9 million (+413.7%).

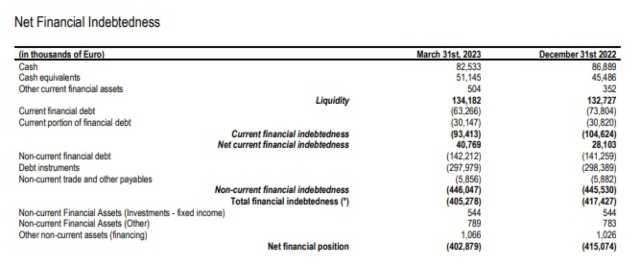

Net Financial Debt equal to euro 402.9 million, (including euro 66.3 million debt related to IFRS 16) from euro 415.1 million at the end of 2022

Operating performances

Consolidated revenues in 1st Q 2023 reached euro 183.6 million, +99.1% compared to euro 92.2 million in 1st Q 2022, that did not include the businesses entered in IVS Group since July 2022 after the business combination with Liomatic and Ge.Sa- Vendomat.

According to the new division of the Groups’ activities, the operating businesses showed the following turnover performances (before intra group elisions).

- Vending business (including four areas: Italy, France, Spain and other Europeans countries): total revenues euro 142.7 million, +61.1% compared to 6 million at 31 March 2022, and more precisely: (i) Italy (euro 118.2 million, +66%), (ii) France (euro 12.5 million, +26.6%), (iii) Spain (Euro 9.0 million, +30.7%), (iv) other Europe markets (euro 3.0 million, +379.8%). Italy includes most of Liomatic vending businesses and GeSA-Vendomat; France has the same previous IVS Group perimeter; Spain includes also some local Liomatic vending business; the other European markets include the former IVS Group businesses in Switzerland and Poland, and those of Liomatic in Germany, Portugal and San Marino.

- Resale business: total revenues euro 35.4 million, that was not present before the business combination . Through the acquired businesses, the group is now the Italian market leader also in this important market

- horeca business: total revenues euro 4.0 million. This is also a new business segment for IVS Group, and it is mostly represented by activities owned by Liomatic (in Spain), and some business started by IVS in the second half of 2022.

- Coin division business: total revenues euro 8.3 million (+41.5%), no contributions from the business combination, but including N-and Group, specialized in production and sale of touch screens, mostly destined in the vending sector, and in the improvement of digital users’ interfaces), showing a sales growth in all the most important businesses, and the ongoing increase of the payment app CoffeecApp (around 3 million registered users and around 366,000 constantly active users).

The total number of vends at March 2023 was equal to 261.3 million +56.9% from 166.5 of IVS Group only at March 2022 before the business combination. As the move of business and personnel amongst the different branches and companies of the group was already started some months ago (especially in the Italian market), the contribution to the volumes from the different areas – before and after the business combination – it is quite insignificant.

Average price per vend (net of VAT) was equal to euro 51.03 cents, from 49.09 cents (+4.0%) of IVS Group in the same period of 2022 (before thebusiness combination). The actual price increase in percentage was higher, but the new average includes the selling prices of Liomatic and GeSA.

The price increase policy will continue to deploy its effects for quite a long time on the whole client’s base.

Ebitda reported is equal to euro 27.1 million, increased by 68.7% compared to euro 16.0 million at March 2022. Adjusted Ebitda is equal to euro 28.1 million, +64.8% from euro 17.0 million at March 2022. The margins of the business areas started to reflect the positive effects expected from the business combination.

Adjusted Ebit increased by 212.9% to euro 8.7 million, from euro 2.8 million at March 2022, thanks to the Ebitda growth and despite the growth of depreciation charges, that mostly reflect the allocation to amortisable assets of some parts of the purchase price and goodwill emerging from the business combination, whilst the effect of the selectivity on industrial capex started in 2020 is confirmed.

Consolidated Net Profit at March 2022 is equal to euro 3.04 million (with euro 0.7 million net profit attributable to minorities) compared to Euro 0.03 million of 2022. The Net Profit Adjusted for the exceptional items is equal to Euro 3.9 million, from euro 0.8 million at March 2022 (with euro 0.8 million minorities).

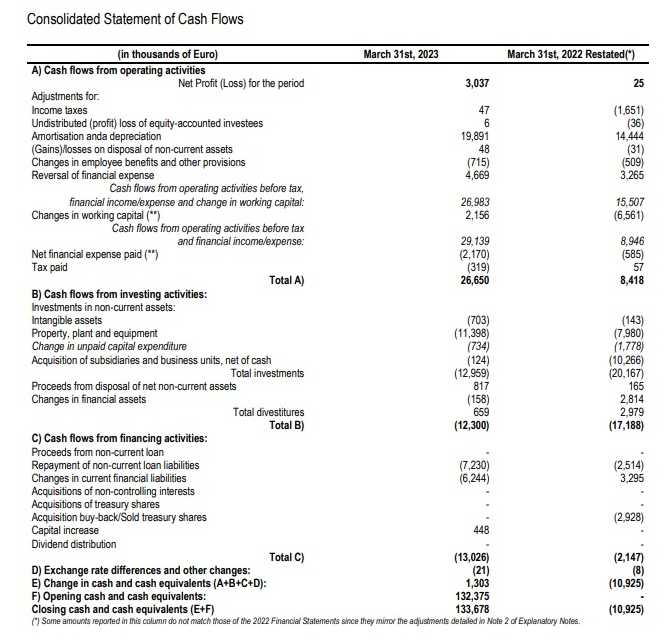

Net Financial Position (“NFP”), is equal to euro -402.9 million (including euro 66.3 million debt deriving from rent and leasing contracts according to the definitions of IFRS 16), decreased by euro 12.2 million from euro -415.1 million (of which euro 69.4 million of IFRS16 effects) at the end of 222.

During 1Q 2023 the IVS Group generated an operating cash-flow of euro 26.7 million (euro 8.4 million in 1Q22). Payments for Capex were equal to euro 13.0 million (Euro 20.2 million in 1Q22). Net working capital generated approximately euro 2.2 million. In particular, among working capital, VAT credits, currently equal to euro 16.8 million (not included in the net financial position), increased by euro 2.9 million compared to the 13.9 million at the end of 2022 (in the period no refunds or non-recourse assignments of VAT credits were received). The NFP includes the interests (approximately Euro 4.3 million) accrued from the last payment date (mid-October 2022) on the bond expiring in October 2026.

Other significant events occurred after 31 March 2023 and prospects for the year

2023 will represent for IVS Group the first full year with the new activities and organisation arising from the business combination effective on July 2022. The integration of the resources and competences from the different areas of the group, aimed at obtaining cost and revenues synergies, is proceeding according to plans, with a complete achievement of the expected benefits in a period of around two years from the transaction.

The present scenario, with high inflation, international tensions, and the consequent impact on consumptions, has only marginally affected the recovery of sales volumes to the levels before Covid expected at the beginning of 2022, but it makes even more valuable the significant possibilities of internal improvements within the group, allowed by its larger size.

From a quantitative point of view, in the core vending business a level of 1 billion vends at the end of 2023, with an increase of the margins in all the business areas are considered achievable.

About IVS Group

IVS Group S.A. is the Italian leader and the second player in Europe in the business of automatic and semi-automatic vending machines for the supply of hot and cold drinks and snacks (vending). The vending business is mainly carried out in Italy (around 83% of total sales), France, Germany, Poland, Portugal, Spain and Switzerland, with around 289,500 vending machines, a network of 132 branches and around 4,000 employees. IVS Group served more than 15,000 corporate clients and public entities, with more than 825 million vends in 2022.

The IVS results in details