LONDON, UK – World Coffee Portal’s Coffee At Home UK 2023 report shows total consumer coffee machine sales in the UK rose from £123.2m in 2019 to £157.2m in 2022. The pandemic saw a surge in UK consumers brewing coffee at home, with lockdowns catalysing already burgeoning interest in recreating café-made beverages at home with higher-quality coffee more sophisticated equipment.

Demonstrating the tremendous growth potential of the UK domestic coffee machine market, the report also shows 81% UK consumers surveyed drink at least one cup of coffee at home every day, with 57% drinking multiple cups.

76% of industry leaders surveyed by World Coffee Portal identify current trading in the UK at-home coffee market as positive.

Coffee pod systems dominate, but espresso are machines gaining ground

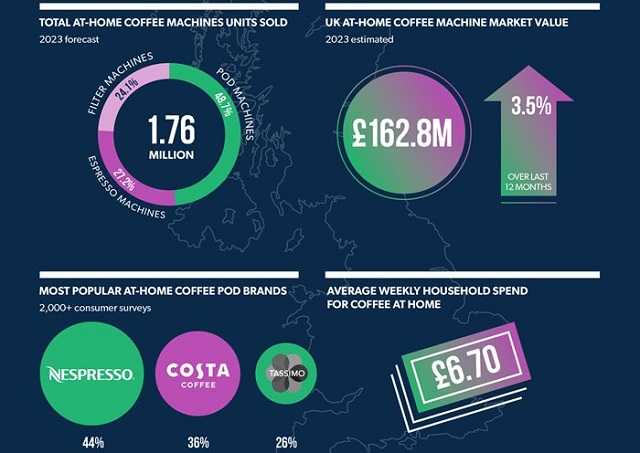

The report shows coffee pod systems are the most popular at-home machine type among UK consumers, accounting for 48.7% of all domestic coffee machine sales, with espresso machines at 27.2% and filter machines comprising 24.1%.

While pod machines are anticipated to remain the best-selling consumer coffee machine systems over the next five years, domestic espresso machine sales are also gaining significant momentum and are forecast to capture a 30% market share by 2028.

Filter coffee machines are a popular entry point into the home coffee machine market predominantly due to their typically lower price level. However, the filter machine market is expected to grow slower than pod and espresso machines over the next five years, adding £5.72m to reach £44.9m.

UK at-home coffee industry seeks to reduce packaging waste and improve energy efficiency

Sustainability has become a key coffee industry focus, with notable innovation in packaging and energy efficiency. As coffee pod waste has come under increased scrutiny, manufacturers have responded by developing compostable and recyclable capsules and packaging.

Numerous coffee machine brands have sought to reduce their manufacturing carbon footprint and reliance on plastics while improving product energy efficiency. Despite this, 51% of industry leaders feel coffee retailers are not environmentally friendly enough and 36% believe machine manufacturers could do more to reduce their impact.

Further indicating the importance of sustainability in the UK at-home coffee market 56% of consumers surveyed would be more likely to purchase coffee knowing it was environmentally friendly.

Further growth forecast as interest in coffee at-home blooms

Although the home coffee machine market achieved 3.5% sales growth over the last 12 months, the number of units sold fell 2.5% over the period. This indicates that many consumers have already made a longer-term investment in a machine and are more cautious on new purchases during the cost-of-living crisis – 66% of UK pod machine owners surveyed purchased their current model within the last three years.

Total at-home coffee machine sales in the UK are expected to grow 4.1% to reach £169.5m in 2024, rising to £183.2m by 2026, when a forecast 1.83 million units sold will surpass 2021’s peak of 1.81 million units.

Commenting on the report findings, Allegra Group CEO and Founder Jeffrey Young said:

“It is highly encouraging to see UK consumers’ growing appreciation of premium coffee in the home. This reinforces World Coffee Portal’s research that UK consumers are increasingly opting for high-quality coffee at all daily touch points and indicates buoyant domestic coffee equipment value and volume in the UK for several years to come.”