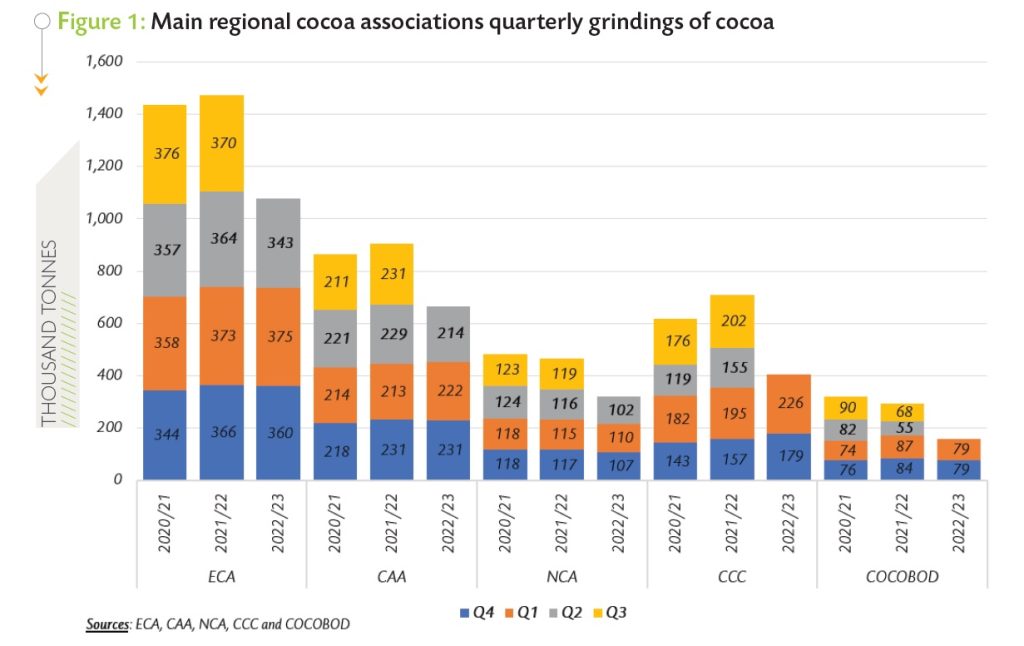

ABIDJAN, Côte d’Ivoire – Cocoa grindings data published by the main regional cocoa associations for the second quarter of 2023 indicated an overall plunge in cocoa processing activities in the traditional consuming regions, namely, Europe, North America, and Southeast Asia. Figure 1 shows the quarterly grindings of the three main cocoa associations – the European Cocoa Association (ECA), the National Confectioners’ Association (NCA), and the Cocoa Association of Asia (CAA) – and the two para-statal agencies regulating the cocoa sector in Côte d’Ivoire – Conseil du Café-Cacao (CCC) – and in Ghana – Ghana Cocoa Board (COCOBOD).

It should be noted that, based on the latest official statistics available at the time of writing,

grindings data for the CCC and COCOBOD only covered the period through the second quarter (Q1.2023) of the 2022/23 cocoa year.

On a cumulative basis, grindings data for the first three quarters of 2022/23 for ECA indicate that cocoa processing in Europe amounted to 1,078,235 tonnes, down by 2.3% year-on-year. The NCA reported a year-on-year decline of 8% in cocoa processing amounting to 319,289 tonnes against 347,207 tonnes recorded during Q4.2021 – Q2.2022.

It is worth mentioning that the extent to which grindings were reduced in North America caught market participants by surprise. For the same period, in Southeast Asia, the CAA data showed that cocoa processing activities in the region dropped year-on-year – declining by 1% from 673,517 tonnes to 666,811 tonnes.

By aggregating these cumulative data, grindings stood at 2,064,335 tonnes over the first three quarters of the 2022/23 cocoa year

representing a 2.8% reduction (minus 59,794 tonnes) compared with 2,124,129 tonnes recorded at the corresponding period of the 2021/22 cocoa year.

It should be noted that based on historical information, grindings reported by the regional cocoa associations in Europe, North America, and Southeast Asia represented nearly 56% of global grindings.

In Côte d’Ivoire, on the other hand, cumulative grindings for the first half of the 2022/23 cocoa year by the Ivorian Exporters’ Association (GEPEX) indicated that volumes of cocoa processed by its members amounted to 522,825 tonnes, up by 15% (plus 52,922 tonnes) from 470,449 tonnes year-on-year.

This increase in cocoa processing in Côte d’Ivoire absorbed a large part of the reduction (59,794 tonnes) in grindings of the three main regional cocoa associations. It is worth noting that based on recent data, Côte d’Ivoire is currently processing over 30% of its cocoa beans.

The recent opening of a cocoa processing factory in San Pedro increased the country’s processing capacity and thereby contributed to the increase in domestic grindings. This is particularly the case given that, regardless of the anticipated production shortfall in Côte d’Ivoire, processing plants must operate in order to cover various costs.

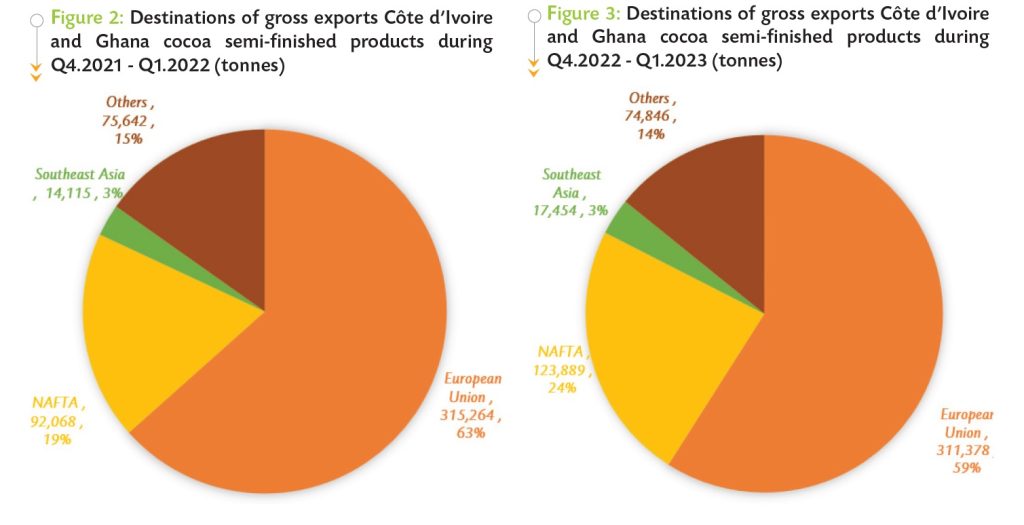

To ascertain whether the reduction in grindings in Europe, North America and South-East Asia was the result of a reduction in demand for cocoa or the decisions of the major processors to increase grindings in their Ivorian subsidiaries, we compared trade flow data over Q4.2021 – Q1.2022 and Q4.2022 – Q1.2023 as shown in Figure 2 and Figure 3, respectively.

The European Union and the NAFTA countries were the top two regional destinations for Côte d’Ivoire and Ghana’s cocoa semi-finished products, while the share of Southeast Asia remained flat at 3%.

Though the picture might be partial as the trade data covers only the first six months of these cocoa years, it emerges that increasing volumes of semi-finished products are being exported from Côte d’Ivoire and Ghana to NAFTA countries.

However, the inverse is observed for Europe where exports of semi-finished products witnessed a relatively lower reduction. When trade statistics for Q2.2023 are available, the situation could be re-assessed to figure out whether there is an ongoing squeeze in the demand for cocoa in Europe or if the reduction in European domestic cocoa processing is being compensated for by an increase in the region’s imports of cocoa semi-finished products from top origin countries.

Is cocoa production in Côte D’ivoire really going down year-on-year?

Supplies of cocoa beans from Côte d’Ivoire are lower year-on-year since the beginning of the 2022/23 cocoa year. Indeed, as at the end of July 2023, arrivals at Côte d’Ivoire ports of exports were reported to lag behind volumes recorded in the corresponding period of the previous season, and by 30 July 2023, cumulative arrivals of cocoa beans in the country were seen at 2.283 million tonnes, down by 4.2% (minus 99,000 tonnes) compared to 2.382 million tonnes seen over the same period of the previous cocoa year.

In addition, as reported by Refinitiv, Côte d’Ivoire’s exports of cocoa beans over October 2022 – June 2023 stood at 1,231,594 tonnes, down by 12% compared to 1,392,723 tonnes exported over October 2021 – June 2022.

Despite the currently low level of arrivals in Côte d’Ivoire, historical information outlined that the weekly arrivals in the country are regularly subject to revisions, and should this occur for the 2022/23 arrivals figures, production in Côte d’Ivoire for 2022/23 might end up being higher year-on-year.

In Ghana, no fresh information on purchases of graded and sealed cocoa beans was available at the time of writing, but expectations are that the volumes may not be significantly different from the previous season.

Futures price development

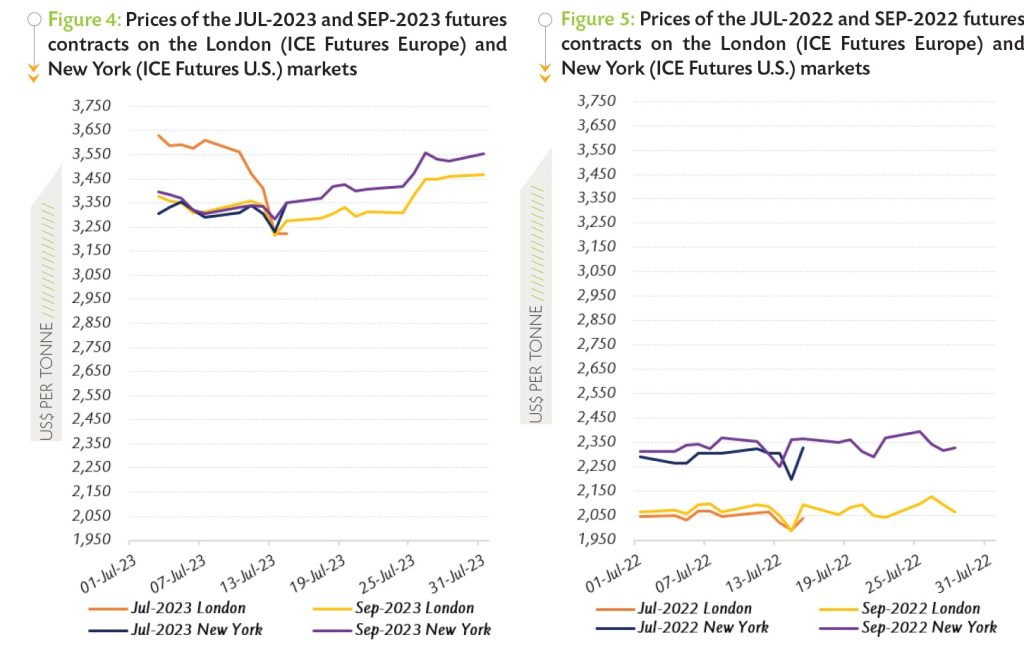

Over the month under review, prices of the front-month contract averaged US$3,425 per tonne and ranged between US$3,221 and US$3,628 per tonne in London while in New York, they averaged US$3,391 per tonne and oscillated between US$3,230 and US$3,559 per tonne.

Compared to the average prices recorded a year ago (US$2,061 per tonne in London and US$2,315 per tonne in New York), the average prices seen in July 2023 represented significant increases of 66% and 46% respectively.

Figure 4 shows price movements of the first and second positions on the London and New York futures markets respectively at the London closing time in July 2023, while Figure 5 presents similar information for the previous year. At the approach of its maturity date, the JUL-23 contract traded lower compared to the SEP-23 one in New York while in London, the inverse occurred.

Indeed, the first position of cocoa futures priced on average at US$164 per tonne more compared to the second position contract in London while in New York, prices of the nearby futures contract were discounted on average by US$28 per tonne compared to those of the SEP-23 contract. A year back in July 2022, both the London and New York markets were in a normal contango (Figure 5).

During the first half of the July 2023, the JUL-23 contract traded lower in London while in New York, it traded within a range. In London, prices of the nearby contract declined by 11% from U$3,628 to US$3,221 per tonne, while in New York they averaged US$3,314 per tonne and ranged between US$3,230 and US$3,356 per tonne.

During the first half of the July 2023, the JUL-23 contract traded lower in London while in New York, it traded within a range. In London, prices of the nearby contract declined by 11% from U$3,628 to US$3,221 per tonne, while in New York they averaged US$3,314 per tonne and ranged between US$3,230 and US$3,356 per tonne.

At the time, improving climate conditions were reported in the main cocoa growing regions in Côte d’Ivoire following the downpours that led flooding in cocoa plantations in the country.

The global cocoa market was also bracing itself for a slowdown in the demand for cocoa as mirrored by published grindings data. At the expiration of the JUL-23 contract, the first position rolled over to the SEP-23 one, which prices the latter part of the 2022/23 cocoa year.

Thereafter from mid-July 2023 onwards, prices improved by 5% on both the London and New York markets, increasing from US$3,388 to US$3,469 per tonne and from US$3,370 to US$3,555 per tonne, respectively. During this period, concerns arising from the expectation of a consecutive supply deficit for the 2023/24 season supported prices.