Share your coffee stories with us by writing to info@comunicaffe.com.

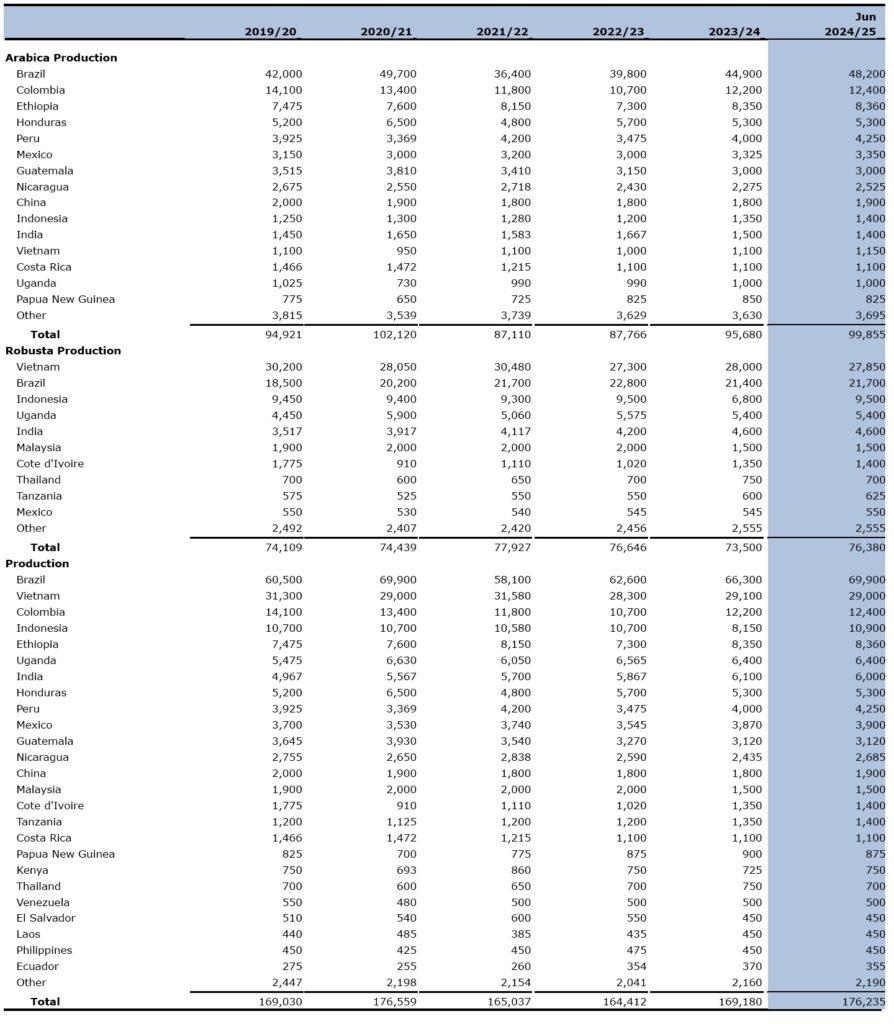

MILAN – The United States Department of Agriculture (USDA) released its first semi-annual coffee report (Coffee: World Markets and Trade) yesterday afternoon containing its official estimates on production, exports, consumption and stocks. The report forecasts world production to increase by 4.2% or 7 million bags to 176.235 million in 2024/25, just below a peak of 176.559 million reached in 2020/21.

As anticipated in the Gain Reports, Brazil’s production should be in line with that recorded in 2020/21 and total 69.9 million.

The Arabica crop will be of 48.2 million, up 3.3 million from the previous year, but still below the peaks recorded in 2018/19 and 2020/21. Robusta harvest is projected to grow marginally (+300 thousand bags), to 21.7 million.

The USDA also appears to be optimistic about Vietnam: it has raised its estimate for the current crop by 1.6 million bags to 29.1 million, and expects production in 2024/25 to be similar to that of the current year, at around 29 million bags.

Trade estimates released in recent weeks are much more pessimistic. Some predict a sharp drop in production for the next crop year.

Production in Colombia, a country to which the report devotes a focus in its introduction, is recovering slightly.

Indonesia’s production is up by more than a third (+33.7%) to 10.9 million, a strong recovery from the drop suffered this year.

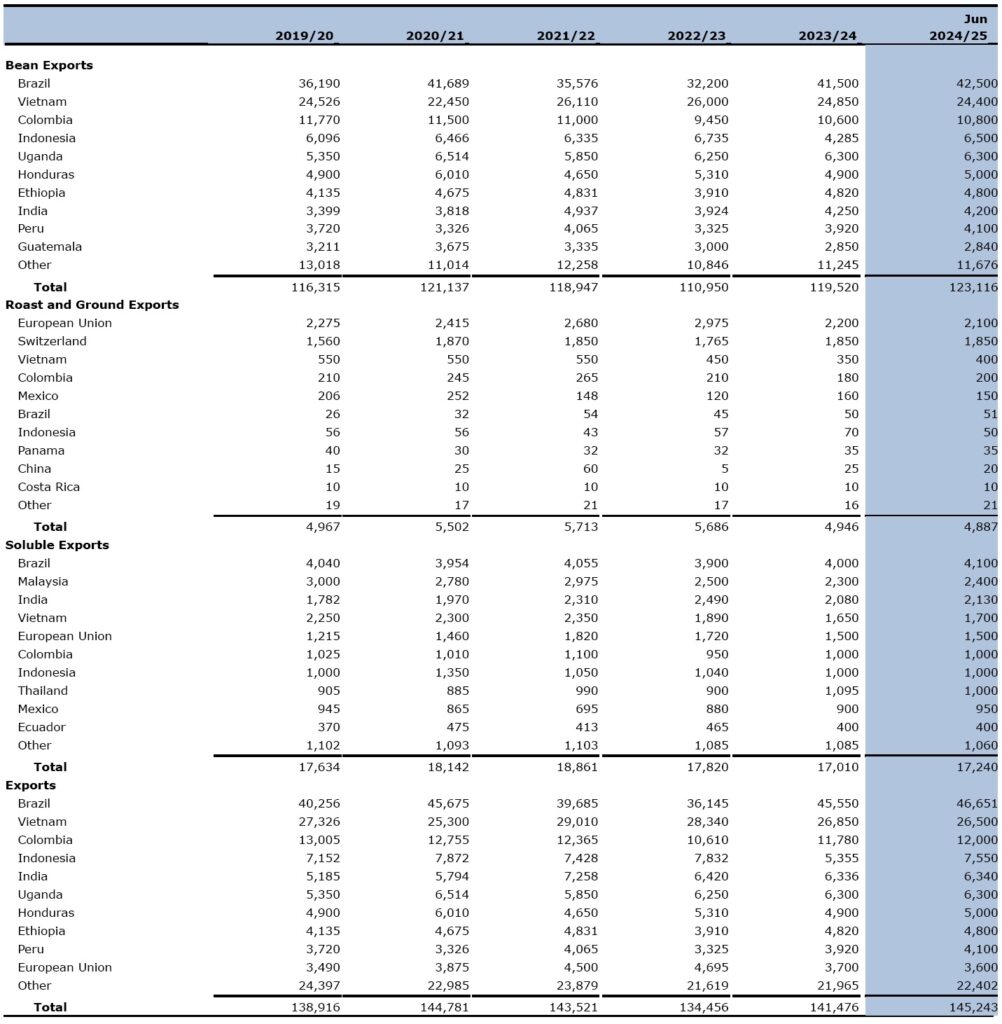

With additional supplies, global exports are expected up 3.6 million bags to 123.1 million primarily on strong shipments from Indonesia and Brazil.

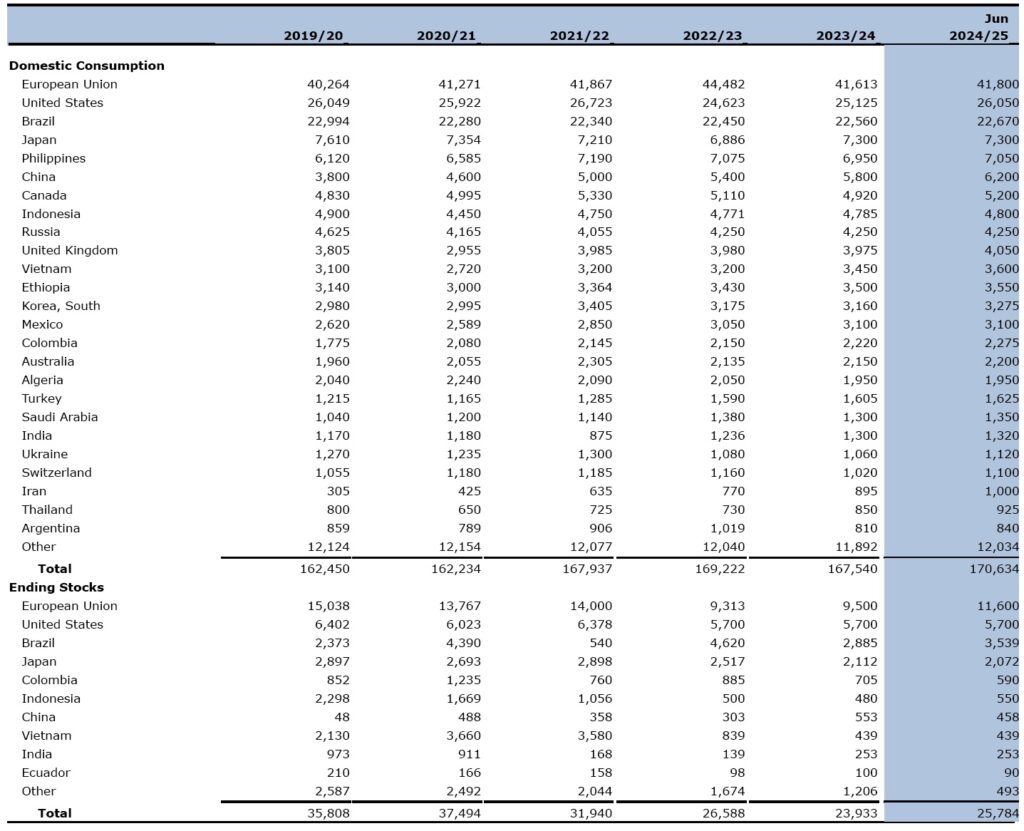

Consumption is seen by USDA 3.1 million bags higher to 170.634 million (+1.8%).

Ending stocks are expected to rise 1.9 million bags to 25.8 million following 3 years of decline.

Vietnam production is forecast nearly unchanged at 29.0 million bags, with over 95 percent of total output remaining as Robusta. The rainy season was slightly delayed and above average temperatures were recorded in many areas, adversely affecting yields.

Similar conditions lowered yields and output the previous 2 harvests. Bean exports are forecast to drop nearly 500,000 bags to 24.4 million due to reduced total supply and rising domestic consumption.

Reduced groundwater and forest cover pose long term challenges as many coffee growers in Vietnam rely on wells for irrigation and forest cover helps slow evaporation. In response, the provincial.

Department of Agriculture and Rural Development and Western Highland Agriculture and Forest Science Institute have implemented strategies to encourage sustainable coffee production.

These plans include replacing old coffee trees with new varieties, intercropping to increase shade and water retention, adopting water saving irrigation systems, and helping coffee farmers certify their farms for sustainable practices.

According to Ministry of Agriculture and Rural Development statistics, approximately 30 percent of coffee area has been certified to meet sustainability standards.

Brazil combined Arabica and Robusta harvest is forecast up 3.6 million bags to 69.9 million in 2024/25. Arabica output is forecast to improve 3.3 million bags to 48.2 million and the Robusta harvest is expected to rebound 300,000 bags to 21.7 million.

High temperatures at the end of 2023 caused some cherries to drop during the fruit-forming stage, but subsequent adequate precipitation provided ideal conditions for the final stage of fruit development and yields were boosted. With higher supplies, coffee bean exports are forecast up 1.0 million bags to 42.5 million and ending stocks are expected to rise nearly 700,000 bags to 3.5 million.

Colombia Arabica production is forecast up 200,000 bags to 12.4 million on slightly higher yields, though yields are expected below recent highs due to increased rates of coffee cherry borer insect infestations.

Bean exports, mostly to the United States and European Union, are forecast up 200,000 bags to 10.8 million on higher supplies.

Central America and Mexico production is forecast 300,000 bags higher to 16.6 million, with Arabica accounting for 95 percent of output. Nicaragua is expected nearly 300,000 bags higher to 2.7 million, while Mexico is expected to gain just 30,000 bags to 3.9 million.

Production is expected flat in Costa Rica, El Salvador, Guatemala, Honduras, and Panama. Bean exports for the region are forecast up 500,000 bags to 13.4 million, fueled by slightly higher supplies and an expected drawdown of stocks.

Indonesia combined Arabica and Robusta harvest is forecast to rebound nearly 2.8 million bags to 10.9 million. Robusta output is expected to recover 2.7 million bags to 9.5 million on favorable growing conditions in the lowland areas of Southern Sumatra and Java where approximately 75 percent is grown.

Last year’s crop suffered from excessive rain during cherry development and caused sub-optimal conditions for pollination. Arabica production is seen rising slightly to 1.4 million bags.

Elevated output is expected to translate to exports gaining 2.2 million bags to 6.5 million.

India combined Arabica and Robusta harvest is forecast down 100,000 bags to 6.0 million as Arabica output slips to 1.4 million due to poor pre-monsoon rains. Robusta production is expected unchanged at 4.6 million on normal growing conditions. Bean exports are forecast down slightly to 4.2 million bags on lower output.

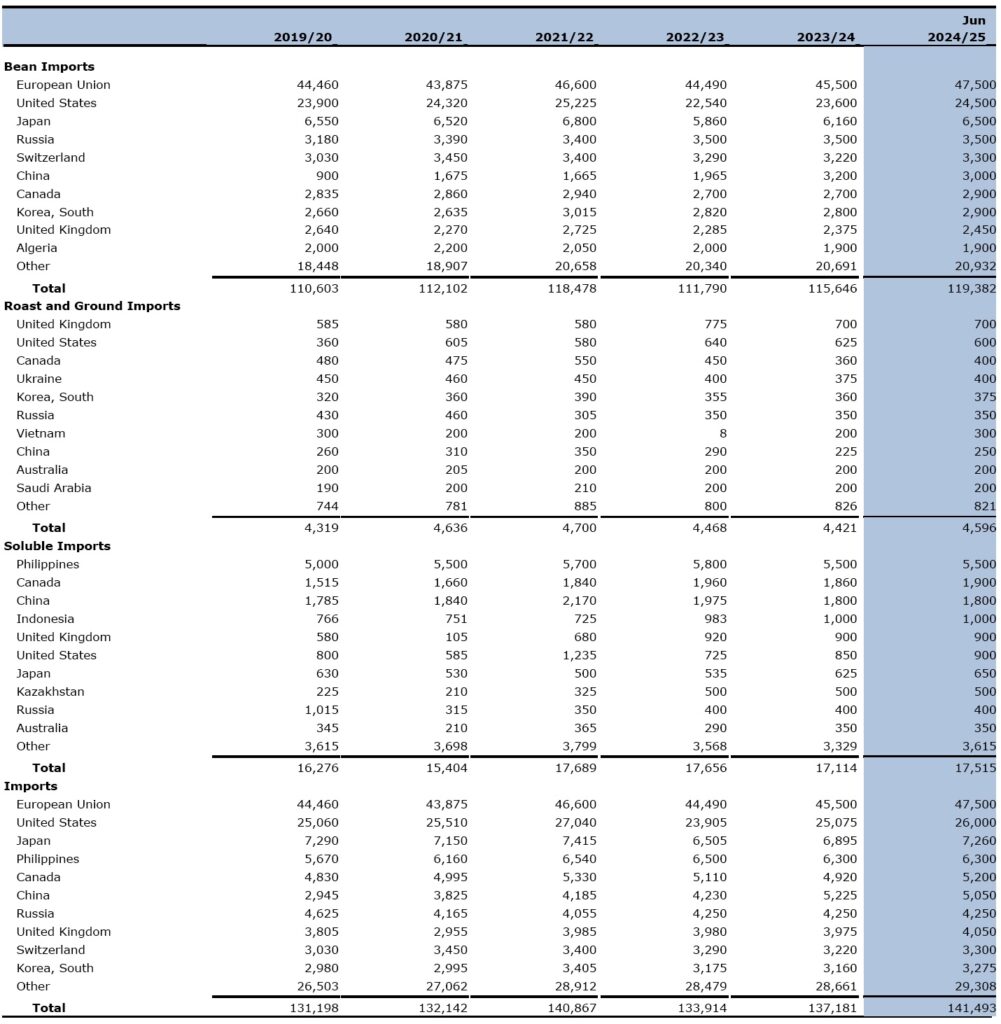

European Union imports are forecast up 2.0 million bags to 47.5 million due to higher shipments from Brazil and Indonesia. Top suppliers in calendar year 2023 included Brazil (36 percent), Vietnam (25 percent), Uganda (8 percent), and Honduras (7 percent). Ending stocks are expected to rise 2.1 million bags to 11.6 million.

The United States imports the second-largest amount of coffee beans and is forecast to gain 900,000 bags to 24.5 million on rising consumption. Top suppliers in calendar year 2023 included Brazil (27 percent), Colombia (19 percent), Vietnam (11 percent), and Guatemala (6 percent). Ending stocks are forecast unchanged at 5.7 million bags.

USDA Revisions to 2023/24 Forecasts

World production is lowered 2.2 million bags from the December 2023 estimate to 169.2 million.

- Central America and Mexico are reduced 2.5 million bags to 16.4 million due to higher-than anticipated incidents of coffee cherry borer insect infestations as well as coffee rust.

- Indonesia is revised down 1.6 million bags to 8.2 million as drought conditions in Southern Sumatra lowered Robusta yields.

- Vietnam is raised 1.6 million bags to 29.1 million as farmers improved yields through higher -than-expected irrigation to mitigate the effects of drought and high temperatures.

- Colombia is up 700,000 bags to 12.2 million as coffee cherry borer insect infestations were not as severe as anticipated.

World bean exports are lowered 400,000 bags to 119.5 million.

- Central America and Mexico are reduced 2.7 million bags to 12.9 million on reduced exportable supplies.

- Indonesia is down 700,000 bags to 4.3 million on lower output.

- Brazil is raised 2.0 million bags to 41.5 million on higher-than-anticipated stocks drawdown.

- Vietnam is revised 1.9 million bags higher to 24.9 million on higher exportable supplies.

World ending stocks are reduced 2.6 million bags to 23.9 million.

- Brazil is lowered 1.7 million bags to 2.9 million on higher shipments.

- Indonesia is reduced 800,000 bags to 500,000 on lower output.

USDA: World Coffee Production

World Coffee Exports

World Coffee imports

World Coffee Consumption and Stocks