ABIDJAN, Côte d’Ivoire – With no substantial changes to market fundamentals and the certainty of a large deficit for the 2023/24 season, cocoa futures markets continue to be in backwardation and prices remain at relatively high levels according to the Icco Market Review. In the first half of May, prices moved sideways in both New York and London, represented in Figure 1 and Figure 2 respectively, as the May contract was approaching its expiry. The London market was closed on 6 May 2024.

Icco Market Review May

Starting from the third week of May, a price rally was recorded in both New York and London as concerns about the mid- crop output indicated further supply tightness. By 15 May 2024, compared to the initial trading price for the month, prices in London were up by 9% from US$10,451 per tonne. This rally concluded at the end of May, following reports of above average rains in most major growing areas in Côte d’Ivoire which raised hopes of better crop development and harvest.

As mentioned in previous reports, not much can be expected at this time of the year as it is necessary to wait for the completion of pod-counting surveys, expected between the end of August and mid-September, to have an initial estimate of the projected market balance for the 2024/25 year.

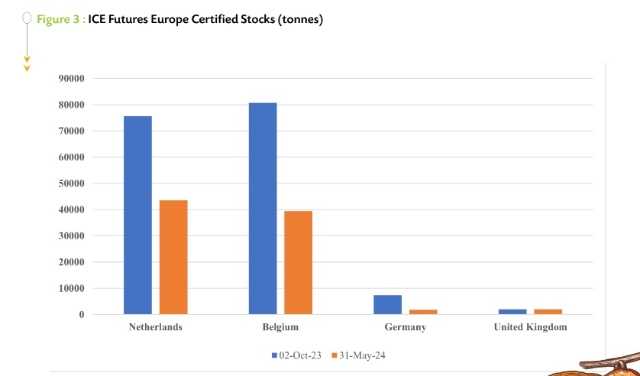

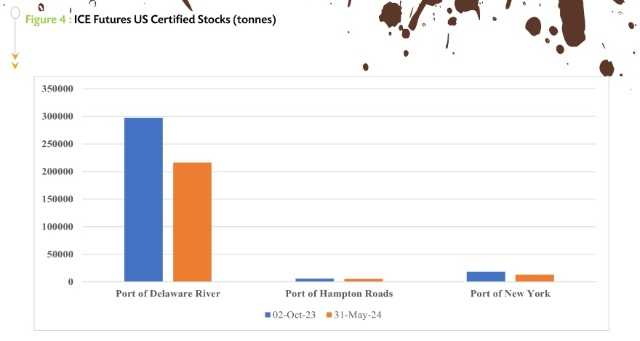

Movement of terminal market stocks

Stocks inventories of cocoa beans from the start of the season to 31 May 2024 have shown a significant reduction. This further heightens the current supply concerns and increases the premium of the contract in expiry. It could also depict that end users are relying on terminal stocks as the physical market supply is limited. In Europe, stocks from 2 October 2023 to 31 May 2024 declined by 47% from 165,690 tonnes to 86,740 tonnes (Figure 3). For the same time frame in the United States, stocks in the major ports dropped from 321,984 tonnes to 235,321 tonnes (Figure 4).