GRAND DUCHY OF LUXEMBOURG – The Board of Directors of IVS Group S.A. (Milan: IVS.MI), convened on September 5th, 2024, and chaired by Mr. Paolo Covre, examined and approved the Half-Year Financial Report at 30 June 2024, summarised below.

Summary of results at 30th June 2024

- Consolidated Revenues: Euro 371.4 million.

- Ebitda: Euro 56.6 million. Ebitda Adjusted: Euro 57.5 million.

- Ebit: Euro 16.7 million. Ebit Adjusted Euro 17.6 million.

- Consolidated Net Profit: Euro 4.9 million. Net Profit Adjusted: Euro 6.0 million.

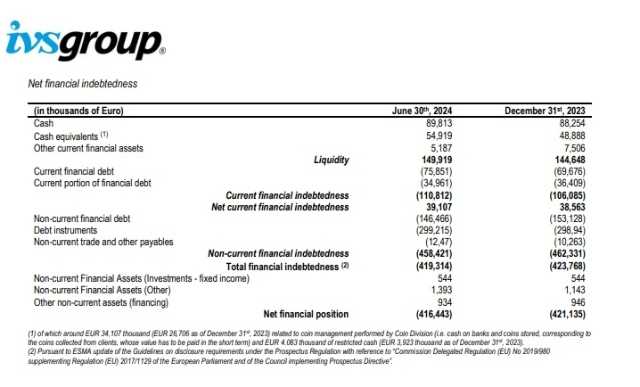

- Net Financial Debt equal to Euro 416.4 million, (including Euro 63.8 million debt related to IFRS 16) from Euro 421.1 million at the end of 2023.

Operating performances

Consolidated revenues in 1st Half 2024 reached Euro 371.4 million, +0.1% compared to Euro 370.9 million in 1st Half 2023,

According to the new division of the groups’ activities, the operating businesses showed the following turnover performances (before intra group elisions).

1) Vending business (including four areas: Italy, France, Spain and other countries): Euro 289.9 million, +2.9% compared to 281.6 million at 30 June 2023, Sales grew in all countries, especially thanks to price increases, while volumes slightly declined in Italy and Spain, and marginally increased in France and Other countries.

2) Resale business: Euro 54.6 million, -24.4% compared to Euro 72.1 million in 1st Half 2023. The decrease in principally due the drop of foreign sales (especially to Russia), that already declined since 2nd Half 2023 (change vs 2nd Half 2023 -8.2%).

3) Ho.Re.Ca. business: Euro 15.5 million, +34.6 from Euro 11.6 million in 1st Half 2023.

4) Coin division business: Euro 19.9 million, +9.4% from Euro 18.2 million of 1st Half 2023.

The total number of vends as of 30 June 2024 was equal to 505.7 million, -1.9% from 515.5 million at June 2023.

Average price per vend (net of VAT) was equal to Euro 53.80 cents, from 51.40 cents (+4.7%) in the same period of 2023.

In 1st Half 2024 were completed 8 acquisitions, in Italy and Poland, for a value of around Euro 2.6 million, contributing pro-rata temporis to sales for around Euro 0.7 million.

EBITDA is equal to Euro 56.6 million, compared to Euro 55.0 million at June 2023.

Ebitda Adjusted is equal to Euro 57.5 million, +0.2% from Euro 57.4 million at June 2023.

EBIT increased to Euro 16.7 million, from Euro 15.4 million at June 2023. EBIT Adjusted is equal to Euro 17.6 million, from Euro 17.7 million at June 2023.

Consolidated Net Profit at June 2024 is equal to Euro 4.9 million (after profit attributable to minorities) compared to Euro 4.3 million at June 2023. The Net Profit Adjusted for the exceptional items (after minorities) is equal to Euro 5.9 million, from Euro 6.1 million at June 2023.

Net Financial Position (“NFP”), is equal to Euro -416.4 million (including Euro 63.8 million debt deriving from rent and leasing contracts according to the definitions of IFRS 16), improved from Euro -421.1 million at the end of 2023 and from Euro -422.8 million on 31 March 2024. In the NFP is not included the VAT credit (Euro 13.3 million at the end of June 2024).

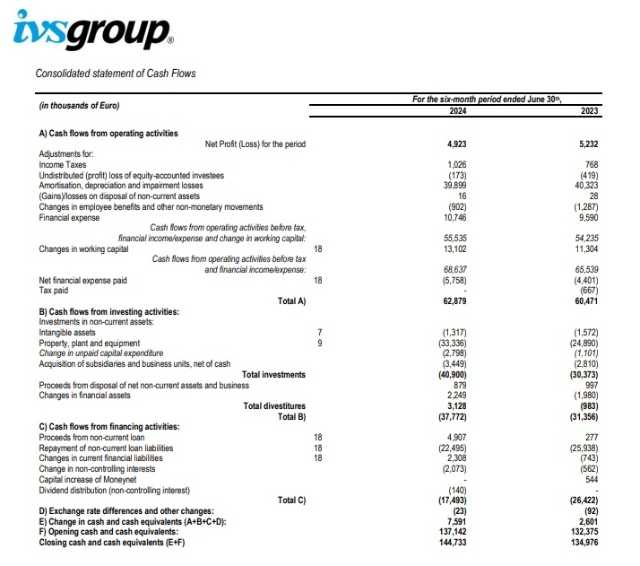

During the 1st Half 2024 IVS Group generated an operating cash-flow of Euro 62.9 million (Euro 60.5 million in the 1st Half 2023). Payments for net Capex were equal to Euro 36.6 million (Euro 26.6 million in 1st Half 2023) and Euro 3.4 million for M&A (Euro 2.8 million in 1st Half 2023).

Other significant events occurred after 30th June 2024 and prospects for the year

The present market scenario, with continuing weak levels of consumption, after the post Covid period of high inflation and strong costs increase, drove IVS Group to accelerate, also at corporate level, the integration with the activities included in the Business Combination of 2022 with Liomatic and GeSA groups.

Capex and growth strategies aimed at reinforcing the group’s leadership and its operating excellence continue, on a wider European horizon and covering also new business areas.

IVS Group balance in detail