ABIDJAN, Côte d’Ivoire – Cocoa prices have made headlines this year. On the London futures market, the price of the DEC-2024 contract increased by nearly threefold from £2,741 per tonne at market close on 2 October 2023 to £8,218 per tonne on 19 April 2024 (Figure 1).

The cocoa market review by Icco

Subsequently, after a period of great volatility, the price of this contract moved sideways within a range from £5,000 to £5,700 per tonne. While some farmers enjoyed higher revenues, those who operated in regulated markets were unable to do so, as farm gate prices were fixed for the entire season.

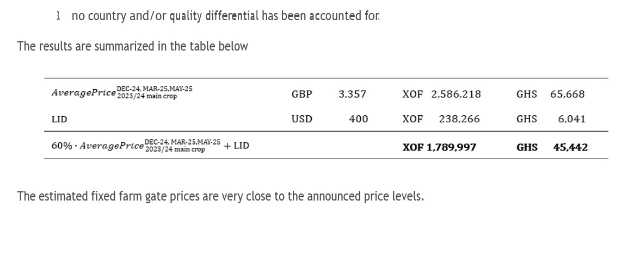

On 11 September 2024, Ghana officially opened the 2024/25 season announcing a fixed farm gate price of 48,000 cedis per tonne. Later, on 1 October, Côte d’Ivoire opened the new season setting a fixed farm gate price of 1,800,000 CFA Francs per tonne (1).

Some observers were surprised by these price levels. They probably expected them to be higher and more aligned with the current prevailing market conditions. To shed some light on why the Conseil du Café-Cacao (CCC) and the Ghana Cocoa Board (COCOBOD) set these specific prices, it is important to take a step back and remember that these institutions regulate their domestic market system with a self-financing price stabilisation policy, i.e., at no cost to the taxpayers, whose objectives are:

– to protect farmers from intra-season price volatility (i.e. establish a fixed farm gate price); and

– to give farmers a fair share of the price that buyers will pay to source beans from Côte d’Ivoire and Ghana (i.e. enforce the fixed farm gate price).

To achieve these goals, the CCC and COCOBOD sell one year in advance export licences and forward contracts, respectively, for the current season. Then, at the opening of the new season, each institution announces the fixed farm gate price. This price is made up of two components (i) about 60% of the average price paid for these export licences and forward contracts – hereafter referred to as instruments – for the upcoming season; and (ii) the Living Income Differential of $400 per tonne which was established by the Côte d’Ivoire and Ghana Cocoa Initiative.

At this point, it is important to clarify (i) what is the basis for the price negotiation of these instruments; and (ii) why these instruments are negotiated during the previous season but executed in the current one.

What is the basis for the price negotiation of these instruments? It is important to recall that futures contract prices summarise market participants’ expectations on the availability of exchange-certified beans at specific exchange-designated locations when they expire. Therefore, the prices of futures contracts maturing during the 2024/25 main season – DEC-24, MAR-25 and MAY-25 – will form the basis for negotiating the prices of these instruments.

Why are these instruments negotiated during the previous season but executed in the current one? Several factors make it impractical to negotiate and execute these instruments during the respective season. First, Côte d’Ivoire and Ghana produce just over half of the world’s production. It would therefore be a formidable challenge for the CCC and the COCOBOD to negotiate, sell and complete the due diligence process on these instruments in a very short period of time. Secondly, the industry establishes production plans well in advance to cope with peaks in consumption (i.e. Halloween, Christmas, Valentine’s Day and the Easter period).

Therefore, securing the physical supply just before the opening of the season is very risky and probably not logistically feasible, considering that the first consumption peak is expected within one month from the opening of season (Halloween) and the next peak is only two months afterwards (Christmas).

A supposition could be that the CCC and COCOBOD still decide to set the fixed farm gate price on the basis of the limited number of instruments they managed to sell just before the opening of the new season. Under these conditions, a subsequent declining price trend will reduce the value of any instruments in the process of being negotiated. So, taxpayers’ money will be needed to support the farm gate price previously established when prices were higher.

After having clarified these aspects, let us try to retrace the steps used by the CCC and the COCOBOD to determine the fixed farm gate prices for the 2024/25 season.

Caution should be exercised in the interpretation of the following steps as they are just guidelines. The training, professionalism and versatile nature of the trading team of CCC and Cocobod enable them to also apply certain technical and other marketing strategies during their sales activities. No one knows these additional strategies due to market confidentiality. Moreover, sales are very often undertaken based on the needs of the industry.