NEW YORK, USA – Bloomberg announced today the 2025 target weights and composition for the Bloomberg Commodity Index (“BCOM”). Launched in 1998, with historical information dating back to 1960, BCOM is a widely tracked benchmark for the commodities markets (estimated AUM $102B).

Composed of 24 exchange-traded contracts on physical commodities, the new BCOM target weights become effective during the 2025 January Roll Period.

As a result of this year’s reconstitution, there will be no commodity additions or deletions to BCOM. Lead (LL) will remain in the index for 2025, meeting the minimum threshold requirement for commodities currently included in the BCOM as per the BCOM Methodology.

In addition, Cocoa has successfully met the minimum threshold requirement for the first time and will be eligible for BCOM inclusion in 2026, pending a pass next year.

Brent Crude Oil saw the largest weight increase overall, rising to 8.03% to surpass Natural Gas as the highest weighted component in the Energy group.

This marks the first time since its inclusion in 2012 that Brent Crude Oil held this position. Energy will remain the highest BCOM commodity group weight in 2025, despite a small decrease to 30.01%.

Grains, Softs, and Livestock representing agriculture commodities will all increase in 2025. Industrial Metals will hold the lowest weight since the inception of BCOM, declining to 15.1%.

Gold is set to decline for the third consecutive year since its 2022 peak, contributing to the reduction in the Precious Metals group to 18.8%. Overall, BCOM will see weight increases in Softs, Livestock, and Grains, with decreases with Energy, Precious Metals, and Industrial Metals.

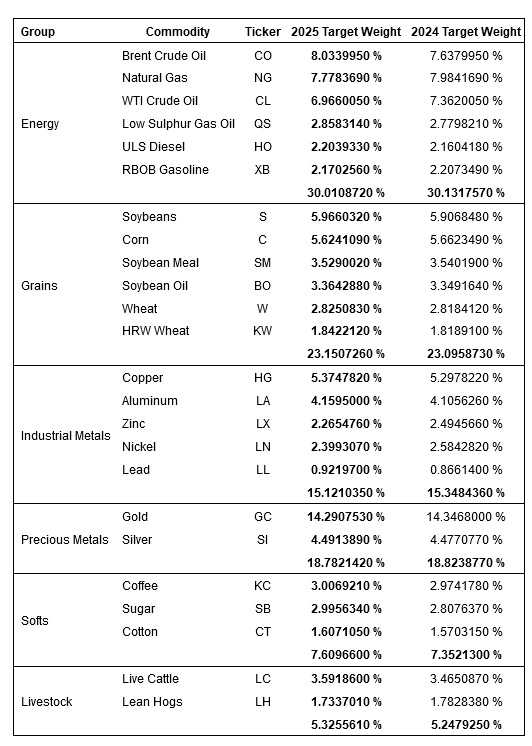

Target weights of all BCOM components and groups for 2025, as well as their comparative weights in 2024, are listed below:

Target weights are determined in accordance with the rules described in the BCOM methodology. The index rules account for liquidity and production data in a 2:1 ratio and are subject to the following requirements for diversification and minimum weights:

- No group may see its weight exceed 33%

- No single commodity, together with its derivatives, may see its weight exceed 25%

- No single commodity may see its weight exceed 15%

- No single commodity may constitute less than 2% of the Index as liquidity allows.

Bloomberg Terminal users can visit IN <GO> on the Bloomberg Terminal for index performance and analytics.