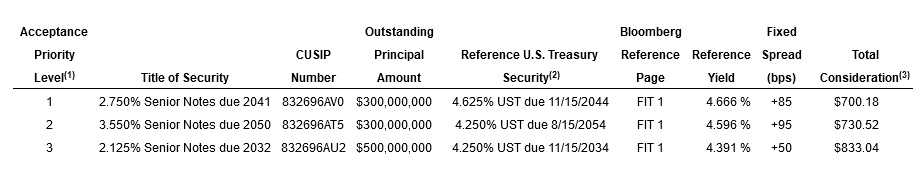

ORRVILLE, Ohio, USA – The J. M. Smucker Company (the “Company”) (NYSE: SJM) today announced the pricing terms for its previously announced cash tender offers (each, an “Offer” and collectively, the “Offers”) to purchase up to $300 million aggregate purchase price, not including accrued and unpaid interest (the “Offer Cap”), of the Company’s validly tendered (and not validly withdrawn) notes set forth below (the “Notes”) using a “waterfall” methodology under which the Company will accept the Notes in order of their respective acceptance priority levels noted in the table below (the “Acceptance Priority Levels”). The Offers are being made pursuant to an Offer to Purchase, dated December 3, 2024 (the “Offer to Purchase”), which sets forth a description of the terms of the Offers.

As of 10:00 a.m. New York City time, on December 17, 2024 (the “Price Determination Time”), the Company expects to accept for purchase pursuant to the Offers the full amount of the 2.750% Senior Notes due 2041 (which have an Acceptance Priority Level of 1), the full amount of the 3.550% Senior Notes due 2050 (which have an Acceptance Priority Level of 2) and a portion of the 2.125% Senior Notes due 2032 (which have an Acceptance Priority Level of 3) validly tendered and not validly withdrawn at or prior to the Early Tender Time (as defined below) on a prorated basis as described in the Offer to Purchase, using a proration factor of approximately 69.9%, so that the aggregate purchase price does not exceed the Offer Cap. The 4.375% Senior Notes due 2045 (which have an Acceptance Priority Level of 4) and the 5.900% Senior Notes due 2028 (which have an Acceptance Priority Level of 5) will not be accepted for purchase.

The “Total Consideration” to be paid for the Notes validly tendered (and not validly withdrawn) at or prior to 5:00 p.m., New York City time, on December 16, 2024 (the “Early Tender Time”) and accepted for purchase pursuant to the Offers, includes an early tender premium of $30 per $1,000 principal amount of Notes so tendered and accepted for purchase (the “Early Tender Premium”), which will not constitute an additional or increased payment. In addition to the applicable Total Consideration, holders who validly tender and do not validly withdraw their Notes, and whose Notes are accepted for purchase in the Offers will also be paid any applicable accrued and unpaid interest up to, but excluding, December 19, 2024 (the “Early Settlement Date”). The Total Consideration has been determined in the manner described in the Offer to Purchase by reference to a fixed spread for each of the Notes over the applicable yield to maturity of the applicable U.S. Treasury Security (the “Reference Treasury Security”), determined at the Price Determination Time as specified in the table below and on the cover page of the Offer to Purchase in the column entitled “Reference U.S. Treasury Security.”

The table below includes only the Notes validly tendered (and not validly withdrawn) at or prior to the Early Tender Time that the Company expects to accept for purchase pursuant to the Offers.

- The Company is offering to accept the maximum principal amount of validly tendered (and not validly withdrawn) Notes in the Offer for which the aggregate purchase price, not including accrued and unpaid interest, does not exceed $300 million using a “waterfall” methodology under which the Company will accept the Notes in order of their respective Acceptance Priority Levels noted in the table above.

- The Total Consideration for Notes validly tendered (and not validly withdrawn) prior to or at the Early Tender Time and accepted for purchase is calculated using the applicable fixed spread as described in the Offer to Purchase. The Early Tender Premium of $30 per $1,000 principal amount is included in the Total Consideration for each series of Notes set forth above and does not constitute an additional or increased payment. Holders of Notes will also receive accrued and unpaid interest on Notes accepted for purchase up to, but excluding, the Early Settlement Date.

- Per $1,000 principal amount of Notes. Includes the Early Tender Premium of $30 per $1,000 principal amount of Notes.

All conditions of the Offers were deemed satisfied by the Company, or timely waived by the Company. Accordingly, the Company expects to accept for purchase, and pay for, $300 million aggregate purchase price of Notes validly tendered (and not validly withdrawn) on the Early Settlement Date.

Although the Offers are scheduled to expire at 5:00 p.m., New York City time, on January 2, 2025, unless extended or terminated, because the aggregate purchase price of Notes validly tendered (and not validly withdrawn) prior to or at the Early Tender Time exceeded the Offer Cap, there will be no Final Settlement Date (as defined in the Offer to Purchase), and no Notes tendered after the Early Tender Time will be accepted for purchase. Notes tendered and not purchased on December 19, 2024 (the “Early Settlement Date”) will be returned to holders promptly after the Early Settlement Date.

This press release is neither an offer to purchase nor a solicitation of an offer to sell securities. No offer, solicitation, purchase or sale will be made in any jurisdiction in which such offer, solicitation, or sale would be unlawful. The Offers are being made solely pursuant to the terms and conditions set forth in the Offer to Purchase.