Coffee production in marketing year (MY) 2015/16 (April/March) is forecast at 4.2 million bags, increasing over 4 percent compared to the previous year, according to the latest Gain Report issued by USDA’s Global Agricultural Information Network.

The report also estimates coffee production bouncing back 28 percent in MY 2014/15, totaling 4.04 million bags.

Peru suffered a rust infestation in MY2013/2014 that affected around 30 percent of the crop. Approximately 40 percent of Peru’s total area planted has been affected by the outbreak.

Peru’s total calendar year (CY) 2014 exports reached approximately 3.03 million bags (182,720 MT); Germany and the United States were the two main coffee export destinations with 27 and 24 percent of exports respectively.

Colombia is an important buyer of Peruvian coffee as well.

Peru’s coffee sector generates 855,000 jobs in otherwise remote, impoverished areas of the country. The government, through DEVIDA, encourages coffee production as an alternative crop to coca leaf cultivation.

Coffee production in marketing year (MY) 2015/16 (April/March) is forecast at 4.2 million bags (60-kilograms per bag), increasing over 4 percent compared to the previous year.

We estimate coffee production bouncing back 28 percent in MY 2014/15, totaling 4.0 million bags.

Like other countries in the region, Peru suffered an outbreak of the fungus Hemileia vastatrix which causes coffee leaf rust disease in MY2013/2014 affecting around 30 percent of the crop.

Approximately 40 percent of Peru’s total area planted has been affected by the outbreak. Harvested area in MY 2015/16 is forecast at 350,000 hectares, remaining at the same levels as the previous year but increasing 20,000 hectares compared to MY2013/2014.

Harvesting commences in April and peaks in the June-September period; 85 percent of the crop is brought in between April and July.

Peru’s production in MY 2013/14 was affected by the north to south spread of coffee leaf rust emanating from Central America and aggravated by inadequate local controls. Along with the presence of moisture, Hemileia vastatrix requires temperatures of between 10 and 35 degree Celsius.

Reduced moisture after the fungus spore germination begins will inhibit the infection process. Under extreme conditions the disease will kill a tree.

Normally, the loss in leaf foliage diminishes the plant’s ability to photosynthesize and store energy for fruit production, resulting in vastly lower yields.

While coffee production occurs throughout the eastern slope of the Andes, production is concentrated in three main growing areas.

Coffee production is gradually shifting from Chanchamayo (i.e., one of the nine provinces of the Junín region) in Peru’s central highlands to the northern highlands of the Amazonas and San Martín regions.

Although Chanchamayo still accounts for 28 percent of overall production, Amazonas and San Martín combined now account for over 49 percent of national production.

Peru produces Arabica coffee almost exclusively. Over seventy percent of which is of the typica variety followed by caturra (20 percent), and others (10 percent).

Roughly 75 percent of Peruvian coffee cultivation occurs between 1,000 and 1,800 meters above sea level.

Most coffee is shade grown and plant density on farms averages 2,000 plants per hectare. Coffee in Peru remains largely hand-picked and sundried.

The majority of Peru’s coffee producers are small farmers. These cultivate coffee on plots of land averaging three hectares.

Small producers often form associations or cooperatives aiming to obtain better prices, improve post-harvest production handling, and cooperate on more effective marketing strategies.

Some of the larger of these associations have membership of over 2,000 producers. The more sophisticated of these associations have financial institutions that provide producer loans, which partially subsidize production costs through technical assistance aimed at improving crop quality and yields. Cooperatives will market production directly or recur to coffee traders.

Poor access to credit places constraints on many of the smaller coffee producers. Peru’s private banks refuse to accept untitled land as loan collateral; forcing most producers to obtain credit either from coffee buyers or informal lenders. The result of which is that small producers are burdened with fixed-price sales contracts and or high repayment interest rates.

Under more normal circumstances, yields can reach upwards of 2,500 kilograms per hectare (~42, 60-kg bags) on well managed plantations.

On the less well managed coffee farms, yields drop due to poor cultivation practices and limited fertilizer use. High plant replacement costs remain a concern. Sources indicate it costs $3,000 per hectare to replace old, less productive and or diseased plants.

This forces many producers to replant on average every twenty to thirty years instead of every ten years as occurs in other coffee producing countries. Annual plant maintenance costs average about $1,200 per hectare. Based on these and other factors, FAS Lima calculates the average cost of production at about $1.62 per kilogram, eighty cents of which is labor.

Consumption

Domestic consumption in MY 2015/16 is estimated at 160,000 bags, unchanged from MY 2014/15. While overall coffee consumption remains low, it has nonetheless doubled in the past five years. Peru, with a population of 30 million, has an annual per capita consumption of 600 grams.

This contrasts with neighboring Colombia where per capita consumption climbs to two kilograms or Brazil where it exceeds four kilograms.

Peruvians are primarily consumers of soluble (instant) coffee. Instant coffee accounts for 75 percent of total domestic coffee consumption.

Nonetheless consumption patterns are changing and a roasted, ground coffee drinking culture is taking root. Coffee consumption among young, urban consumers is growing; consumption levels are now reaching the one kilogram per capita threshold.

Domestic coffee consumption nevertheless still only accounts for about 10 percent of total production. Small corner stores (60 percent) and supermarkets (30 percent) account for the bulk of domestic coffee sales.

Trade

Peru’s exports of coffee in MY 2015/16 are forecast at 4.0 million bags, up 4 percent compared to our MY 2014/14 estimate of 3.8 million bags.

The report foresees export volumes increasing as the coffee leaf rust outbreak abates and planted area expands as a result of the government’s program to renew 80,000 hectares of coffee land

Peru’s total calendar year (CY) 2014 exports reached approximately 3.0 million bags (182,720 MT); Germany and the United States were the two main coffee export destinations with 27 and 24 percent of exports respectively. Colombia continues to be an important buyer of Peruvian coffee.

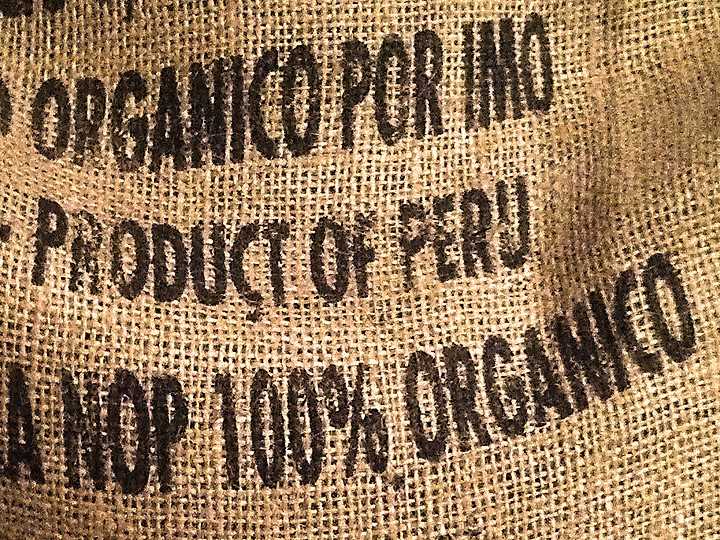

According to trade sources, Peruvian coffee is often repacked and labeled in Colombia for re-export. Export prices for Peruvian coffee averaged $4,030 per metric ton in CY 2014, 38 percent higher than CY 2013. Peru, with some 90,000 certified organic hectares, is the world’s leading exporter of organic coffee.

A significant portion of Peru’s coffee exports are organic, attributed in large part to the smaller growers’ inability to pay for costly chemical fertilizers and pesticides. Foreign demand for specialty coffee however is motivating some of the smaller growers to seek out specialized certification.

Current certifications, accessible even to smaller coffee farmers include:

• Fair Trade: Certified by Fair Trade Labeling Organizations International (FLO)

• Organic: Certified by several agencies such as USDA’s National Organic Program (NOP), Japanese Agricultural Standards (JAS), Natureland, and the Organic Crop Improvement Association (OCIA)

• Sustainable Coffee: Certified by the Rainforest Alliance

• Café Practice: Certified by Starbucks

• Other certifications include bat friendly and bird friendly

Policy

The Ministry of Agriculture and Irrigation established in 2013 a program to renew 80,000 hectares of coffee land over the next four years.

Some $70 million has been budgeted for this program; funds will be channeled through the country’s AgroBanco (i.e., agricultural development bank).

These loans are to be repaid in eight years at a ten percent interest rate. While some farmers are questioning the credit terms, these are understood to be better than what the country’s private banking sector is currently offering.

As of December 2014, some 24,000 hectares have been renewed. The Peruvian Government has made international coffee promotion a national priority.

PromoPeru (i.e., Peru’s export promotion agency) and its commercial offices overseas actively promote Peruvian coffee.

At the same time, some local government agencies and non-governmental organizations are promoting organic coffee production as a means for increasing farmers’ income.

Peru’s coffee sector generates 855,000 jobs in otherwise remote, impoverished areas of the country. The government, through DEVIDA, encourages coffee production as an alternative crop to coca leaf cultivation.