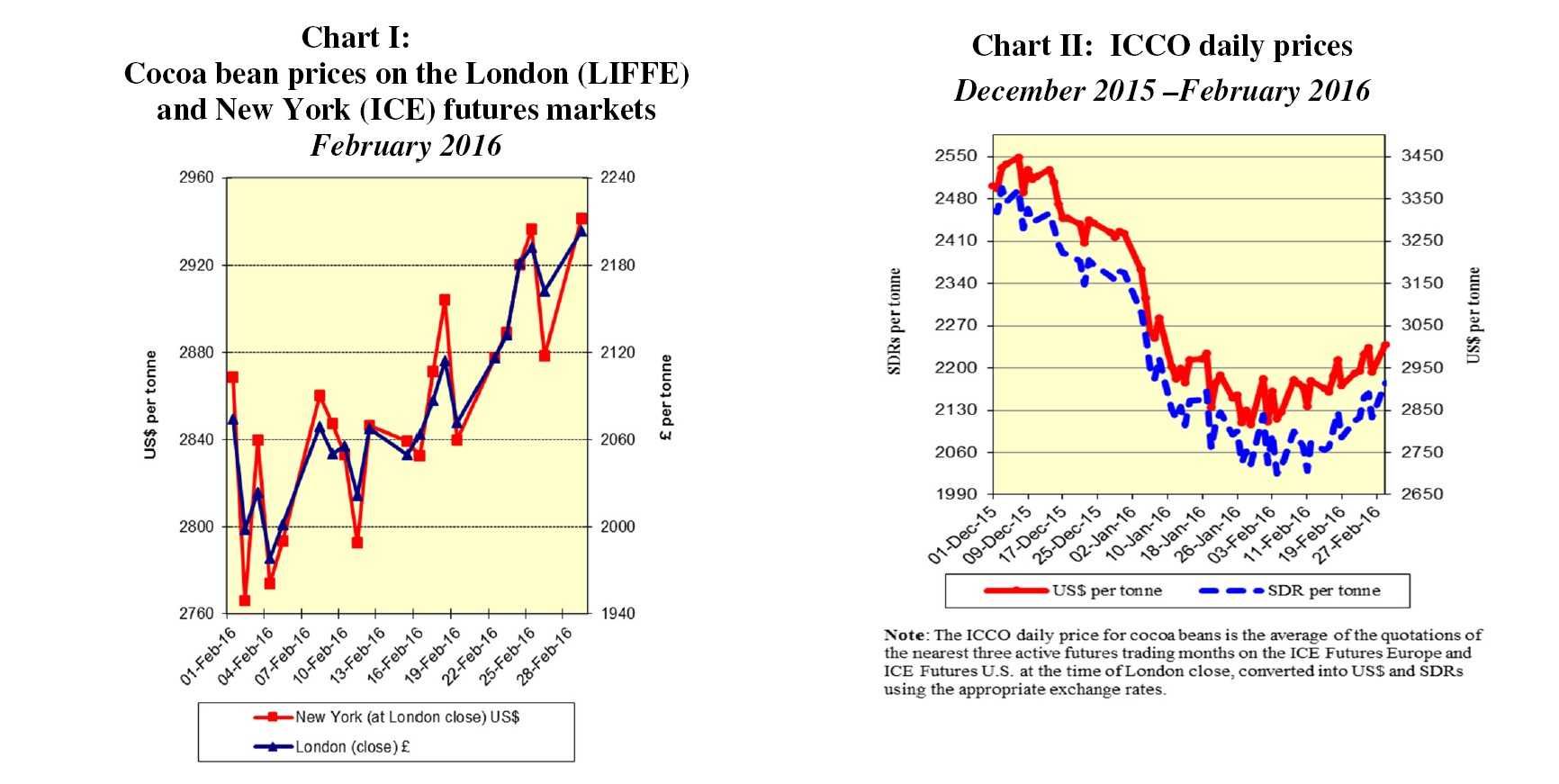

LONDON, UK – The current review reports on cocoa price movements on the international markets during February 2016. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures U.S.) markets for the month under review.

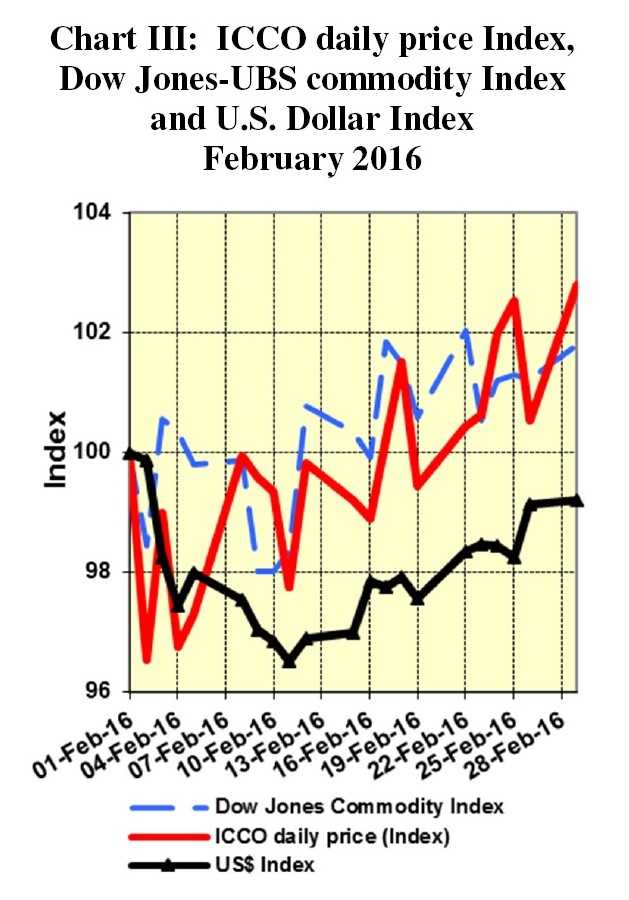

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from December 2015 to February 2016. Chart III depicts the change in the ICCO daily price Index, the Dow Jones-UBS Commodity Index and the US Dollar Index in February while Chart IV presents the prices of European cocoa products from the beginning of the current cocoa year onwards.

Price movements

In February, the ICCO daily price averaged US$2,916 per tonne, down by US$36 compared to the average price recorded in the previous month (US$2,952), and ranged between US$2,823 and US$3,006 per tonne.

During the first week of February, cocoa futures prices continued their downward trend initiated at the beginning of the calendar year and attained a nine-month low, at £1,978 per tonne in London and their lowest level for the month, at US2, 766 per tonne in New York.

As reported in the previous monthly review, this decline on both markets is the result of reports indicating expectations of stronger-than-previously-anticipated harvests in West Africa, in addition to the slowing Chinese economy and weak global demand for cocoa.

However, from the latter part of the first week onwards, cocoa futures prices changed direction due to renewed concerns in relation to the negative impact of the Harmattan on the size of the upcoming mid-crop and the quality of the on-going main crop in West Africa.

Since January in particular, a significant share of beans reaching the ports has reportedly been rejected by exporters in Côte d’Ivoire, as their size is below the official threshold set for exports.

In addition, cocoa prices in London were supported by the weakening Pound Sterling which resulted from concerns relating to the repercussions of a possible UK exit from the European Union, combined with the publication by the ICCO Secretariat at the end of the month of a cocoa supply deficit figure for the on-going crop year.

By the end of the month under review, cocoa prices had reached levels that were 10% and six per cent higher than for the previous three weeks, at £2,203 per tonne in London and at US$ 2,942 per tonne in New York.

Chart III shows that cocoa futures prices generally moved along with the broader commodity complex. However, the level of strength of the US Dollar was not a major factor influencing cocoa and other commodities prices in February. In general, commodity prices tend to rise when the US Dollar weakens and vice versa.

Supply & demand situation

Weekly cocoa arrivals have beaten market expectations in Côte d’Ivoire, the main cocoa

producing country.

The Conseil du Café-Cacao has released cumulative arrivals data for the October-January period, at 1,079,412 tonnes, 16,000 tonnes higher than previously estimated, while news agency data indicates that they reached 1,197,000 tonnes by 28 February, a figure only 7,000 tonnes lower than for the same period of the previous season.

As the main crop tails off, attention is focussed on the mid-crop, and in particular, the impact of the severe Harmattan winds on output.

The ICCO Secretariat expects the total country output to reach 1.690 million tonnes in the current 2015/2016 season, corresponding to a decline of 106,000 tonnes compared to the record crop realized in the previous season.

The expected production reduction in Côte d’Ivoire is anticipated to be offset by the rise in Ghana. The ICCO Secretariat has projected total output for the second largest producing country to reach around 840,000 tonnes in 2015/2016.

Chart IV shows that, during the month under review, the gradual decline in cocoa butter prices initiated in mid-November came to a halt. As the Easter festivities approach, increased buying activities by chocolate manufacturers have lent support to cocoa

butter prices. On the other hand, cocoa powder prices have remained relatively steady.

Conclusion

The ICCO Secretariat’s first forecasts for the current 2015/2016 cocoa year, published in the latest issue of the Quarterly Bulletin of Cocoa Statistics, envisage a supply deficit of around 113,000 tonnes.

World cocoa bean production is expected to decrease by almost two per cent to 4.154 million tonnes.

However grindings are forecast to increase by 1.9% to 4.225 million tonnes.

If realized this would decrease the total statistical stocks of cocoa beans as at the end of the 2015/2016 cocoa year from 1.607 million tonnes in the previous season to 1.494 million tonnes, equivalent to 35% of projected annual grindings for the current season