The United States Department of Agriculture (USDA) – Foreign Agricultural Service has released its Annual Gain Report on the coffee sector in India. Production for marketing year 2016/17 (Oct/Sep) is forecast at 5.17 million 60 kg bags (310,180 metric tons).

The 2016/17 crop is expected to be lower than the 2015/16 production estimate on account of poor post-blossom and backing showers (Mar-Apr) that affected yields as well as a reduction in harvested acreage and number of bearing trees.

Backing showers are a must for fruit set and the lack of rains during February and March coupled with limited access to irrigation effected fruit setting and retention in both Arabica and Robusta crop.

The coffee production estimate for MY 2015/16 remains unchanged at 5.3 million 60 kg bags. This is below the Coffee Board post-monsoon estimate of 5.83 million 60 kg bags (350,000 metric tons).

The Coffee Board revised the MY 2015/16 production estimate downward from 5.9 million 60 kg bags to 5.83 million 60 kg bags in December 2015. During the Northeast Monsoon (Oct-Dec), the southern coffee growing states received above normal rainfall; especially, in December which led to incidence of berry droppings, the emergence of pests and disease, and slight yield loss.

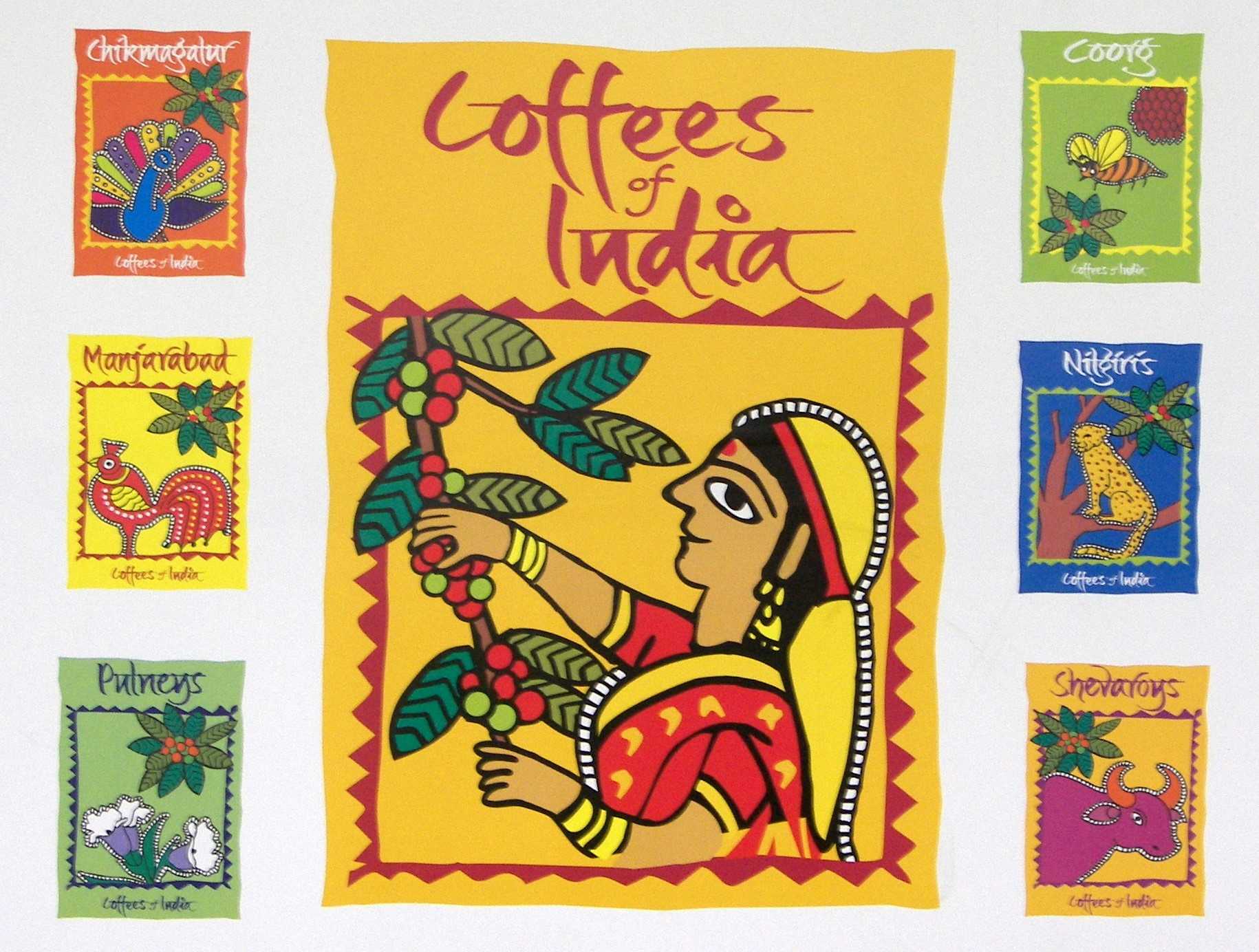

According to the Indian Meteorological Department, the period from March 1, 2016 to April 27, 2016, the coffee growing district in Chikmagalur (southern Karnataka) received 17.6 millimeters (mm) of rainfall which is 72 percent below the normal rainfall.

During the same time period, the Kodagu district of Karnataka received only 32.3 mm rainfall (67 percent below normal) and the Hassan district of Karnataka received 36.1 mm of rain (38 percent below normal).

Similarly, with other major coffee growing states, Kerala was 57 percent below normal rainfall. Trade sources indicate that growers in certain coffee growing districts in Karnataka have been issued notices by local authorities restricting the usage of water for irrigation purposes.

In December 2015, the Coffee Board of India published the final production estimate for MY 2014/15 at 5.45 million 60 kg bags. Accordingly, FAS Mumbai revised the production estimate to reflect official data.

MY 2016/17 exports are forecast at 5 million 60 kg bags as the industry’s focus on exports, a bigger

crop, and continued demand from European buyers should raise volumes over the previous year.

Current MY 2015/16 exports are estimated at 5 million 60 kg bags (303,000 metric tons), based on trade estimates and steady demand from major European buyers. Export data in green bean equivalent from October, 2015 to January, 2016 shows a 15 percent increase in shipments compared to the same period last year.

Even though prices are much lower since the beginning of the marketing year, the depreciation in rupee continues to provide support to exporters.

The export data for MY 2014/15 has been revised based on DGFT data. Accordingly FAS Mumbai raised the export estimate to reflect available data. Indian Robusta has a good reputation among international buyers and European countries continue to be the major buyers of Indian coffee.

Italy, Germany, and Russia are the top export destinations for Indian coffee. India exports an estimated 90 percent of its production.

Actual exports are virtually equivalent to production, but include 1.0 million bags of coffee that are imported duty free for processing and re-export under a special re-export program.

Globally, the average ICO indicator prices for Arabica have fallen by 22 percent between January and November while Robusta prices have fallen by 17 percent.

In India, the raw coffee prices in the largest coffee growing state of Karnataka as of April 27, 2016 for Arabica parchment and cherry have fallen by 8 and 3 percent respectively since beginning of marketing year (Oct/Sep), but Robusta parchment prices have risen by 19 percent.

The rise in Robusta prices is on account of lower arrivals in the market and expectation of a lower crop harvested in MY 2015/16. But large carryover stocks are expected to keep prices low.

Domestic prices are largely driven by international prices and trade sources indicate that global supplies of Robusta are keeping prices at lower levels. Robusta prices are expected to remain firm until the onset of the next harvest as strong foreign demand pressures Indian supplies.

As per coffee board trade data, the major shipment ports for coffee in India are Mangalore (Karnataka) and Cochin (Kerala) followed by Chennai (Tamil Nadu). Traditionally, January is when coffee exports begin.