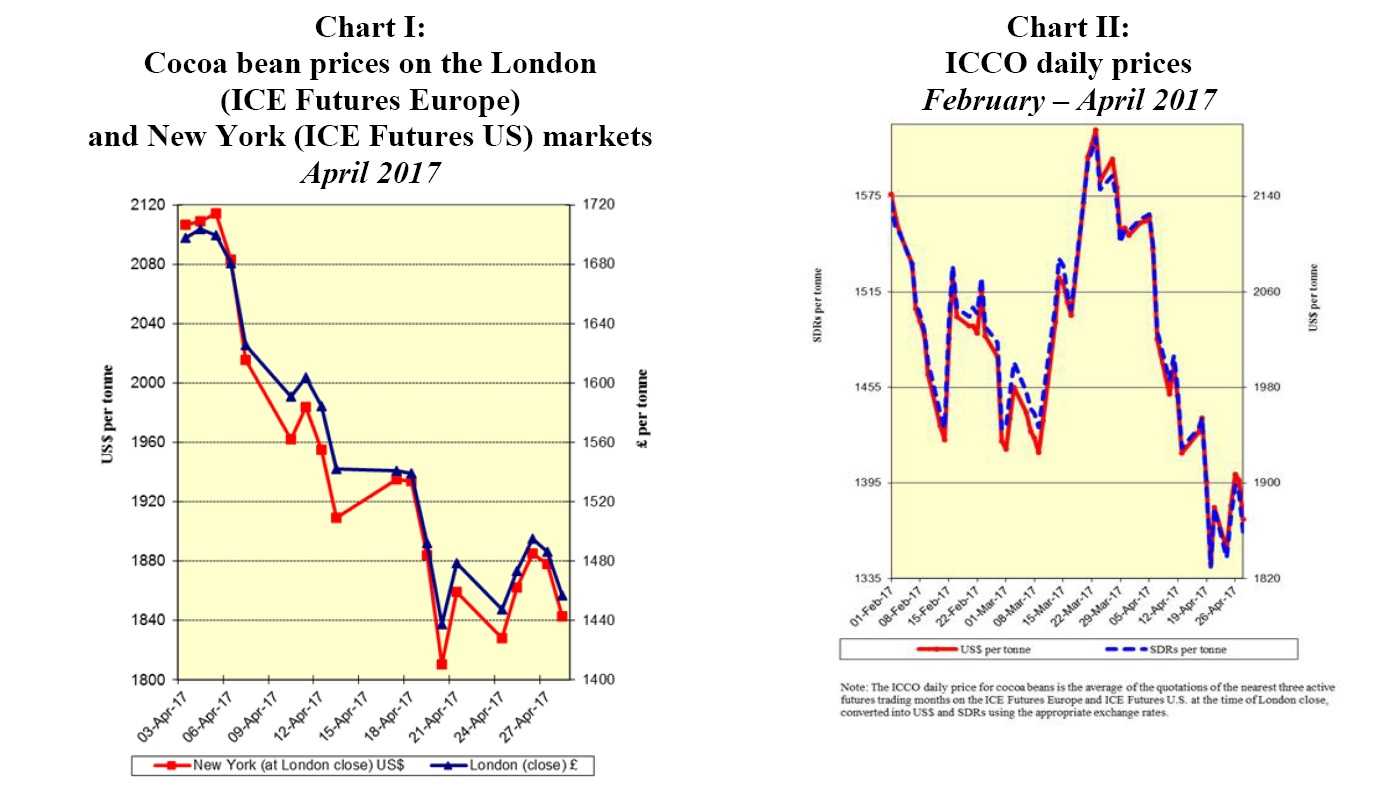

ABIDJAN – The current review of the cocoa market situation reports on price movements on the international markets during the month of April 2017. Chart I illustrates price movements on the London (ICE Futures Europe) and New York (ICE Futures US) markets in April.

Chart II shows the evolution of the ICCO daily price, quoted in US dollars and in SDRs, from February to April 2017.

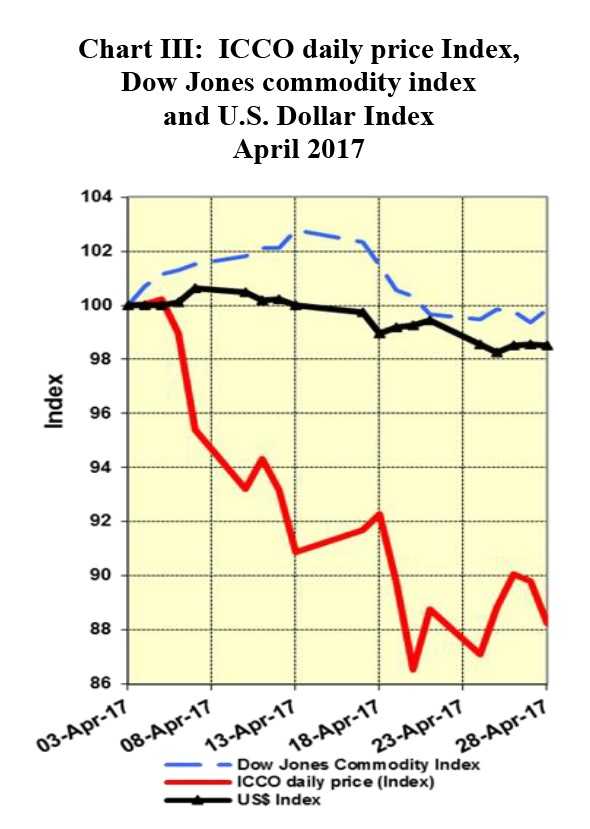

Chart III depicts the change in the ICCO daily price Index, the Dow Jones Commodity Index and the US Dollar Index during the month under review.

Price movements

Price movements

In April, the ICCO daily price averaged US$1961 per tonne, down by US$97 compared to the average price recorded in the previous month (US$2,058) and ranged between US$1,833 and US$2,123 per tonne.

At the beginning of April, cocoa futures prices continued the sustained downward trend initiated from the latter part of the previous month, amid renewed selling activities from the investors, against the backdrop of reports of excessive cocoa supply for the on-going crop season, on both London and New York cocoa futures markets.

Thus, by the end of the third week, cocoa prices fell to a four year-low at £1,438 per tonne in London and at a more than nine-year low at US$1,810 per tonne in New York; as a result, losing respectively 15% and 14% of the value of their quotations attained during the very first trading session of the month under review.

During that same period of the month under review, the strengthening of the Pound Sterling, amid the announcement by Mrs Theresa May, the British Prime Minister, of an early general election on June 8th, mainly influenced cocoa prices on the London market.

Thereafter, as seen in Chart I, cocoa prices changed course and moved sideways for the rest of the month, as the release of regional grindings data, roughly in line with market expectations, coupled with an emergency meeting at the end of the month of the ICCO producer country members with the intention of aligning production strategies, could not provide both markets with a clear direction.

As reflected in Chart III, for the majority of the month under review, the general commodity complex outperformed cocoa prices, mainly under the influence of the ongoing general sell-off sentiment which started at the beginning of the calendar year, while the strength in the US dollar somehow slightly decreased.

Supply and demand situation

According to data published by news agencies, cocoa arrivals from the start of the 2016/2017 crop season up to 7 May reached 1,523,000 tonnes in Côte d’Ivoire, compared with 1,276,000 tonnes for the same period of the previous season; thus, indicating a 16% increase in port arrivals, in line with market expectations of a record surplus for the ongoing 2016/17 cocoa season.

Weekly arrivals picked up sharply in the later part of the month under review, and the prospects remained good for the ongoing mid-crop.

Due to the persistent price decrease in cocoa futures over the last months, the Conseil du Café Cacao was forced to lower the farm gate price for the mid-crop season to 700 Fcfa ($1.14), down by 36%.

In Ghana, cocoa purchases declared to the Ghana Cocoa Board were at 757,506 tonnes as at 20 April 2017, indicating a 13% increase over the previous year, with the regulator projecting 850,000 tonnes for the current 2016/2017 season.

Despite the fall in international prices, the government insists that the farm gate price will not change during the mid-crop season; the price will be maintained at 7,600 cedis ($1,914) per tonne.

On the demand side, for the first quarter of 2017, market expectations were broadly met. Indeed, European grindings increased as expected, by 1.1% from the corresponding quarter to 339,485 tonnes.

North American grindings also showed an increase, of 1.15% year-on-year, to 120,152 tonnes, in line with expectations from market participants.

Overall, despite the almost 6% decrease of North American grindings as compared to the fourth quarter of 2016, the grindings picture worldwide for the first quarter of the current cocoa season reflected a considerable increase, with Asian grindings data showing a 19.2% year-on-year increase to 177,450 tonnes.

At the end of May 2017, the ICCO Secretariat will release its revised crop and grindings forecasts for the current cocoa year in its Quarterly Bulletin of Cocoa Statistics.