TORONTO, Canada and TAMPA, FL, U.S. – Cott Corporation today announced that it has entered into a definitive agreement to sell its traditional beverage manufacturing business (“Cott Beverages”) to Refresco for USD $1.25 billion.

The transaction includes Cott’s North America, U.K., and Mexico businesses (excluding the RCI International division and its associated concentrate facility as well as the Aimia Foods division).

For over 60 years Cott Beverages has been a leading manufacturer of a diverse mix of beverages for the retail trade and branded manufacturers and is one of the world’s largest producers of beverages on behalf of retailers, brand owners and distributors, producing multiple types of beverages in a variety of packaging formats and sizes, including carbonated soft drinks, 100% shelf stable juice and juice-based products, energy drinks, clear, still and sparkling flavored waters, sports drinks, new age beverages, ready-to-drink teas, freezables and ready-to-drink alcoholic beverages.

Cott Beverages has been known for its excellent customer service and superb quality standards as demonstrated by the many retail and product performance awards received over the years, and has consistently offered its customers a strong value-added proposition of low cost, high quality products while generating strong free cash flows.

“After a thorough strategic review in 2013, we developed an accelerated diversification and acquisition strategy in order to transform our company and create a business weighted towards better for you products in categories with topline growth, a more diverse channel and customer base, higher margins, and strong free cash flow generation.

This transaction is very much in line with this strategy, and enables our traditional business to become an integral part of a larger global beverage manufacturing company that pursues the same high customer service and quality standards Cott has been known for throughout its history”, commented Jerry Fowden Cott’s Chief Executive Officer.

Cott Beverages generates approximately $1.7 billion in revenues and has a strong and experienced management team with longstanding customer relationships in North America and the United Kingdom. Subsequent to the closing of the transaction, Cott Beverages’ leadership team will report to the Executive Board of Refresco.

“We are excited to welcome Cott Beverages to the Refresco family. We have been focused on growing our platform in both North America and Europe and this transaction is a significant enhancement to our buy and build strategy which will provide Refresco with enlarged scale, synergies, and savings alongside Refresco’s manufacturing footprint, geographic diversity, product range and customer service,” commented Hans Roelofs, Refresco’s Chief Executive Officer.

“We will now have a well-balanced portfolio with exposure to all categories for retailers in North America and Europe in addition to a scale contract manufacturing footprint throughout these geographies from which to continue to grow both organically and by pursuing our buy and build strategy,” continued Mr. Roelofs.

Strategic Rationale

“The sale of Cott’s traditional business substantially accelerates our ability to deleverage the business and positions us well to grow our water, coffee, tea and filtration businesses both organically and through value accretive tuck-in acquisitions while also giving us the optionality to expand our platforms through larger scale acquisitions if and when the right value enhancing opportunities present themselves,” continued Mr. Fowden.

The transaction is expected to:

- Improve top-line growth and stability

- Enhance overall gross profit and EBITDA margins

- Significantly reduce net leverage

- Reduce customer concentration

- Reduce commodity exposure

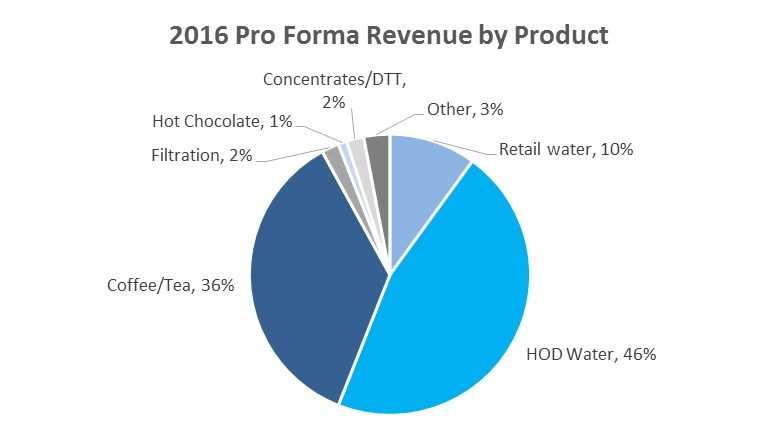

Shift Cott’s core focus to the growing categories of water, coffee, tea and filtration

The transaction is expected to reduce Cott’s leverage to below 3.5x net debt to 2017 pro forma adjusted EBITDA (excluding Cott Beverages) after sale proceeds are used for the redemption of the remaining $250 million of our 10% DS senior secured notes, $525 million of our 5.375% notes, and paying off our asset-based lending facility.

As a result of the redemption of our 5.375% notes, we expect to commence asset sale proceed offers on or about the closing date of the transaction pursuant to the indentures governing our then remaining unsecured notes, pursuant to which we will offer to repurchase such notes at 100% of the principal amount thereof.

The acquisition, which is expected to close in the second half of 2017, is subject to certain closing conditions including regulatory approval, Refresco shareholder approval, and working capital adjustments.

Barclays acted as financial advisor to Cott while Drinker Biddle & Reath LLP acted as legal advisor. In addition, Cott turned to CMS for advice on Dutch law matters relating to the transaction.

Transaction Conference Call

Cott Corporation will host a conference call today, July 25, 2017, at 8 a.m. EST, to discuss the sale, which can be accessed as follows:

North America: (888) 231-8191

United Kingdom: 0-800-051-7107

International: (647) 427-7450

Conference ID: 58688747

A copy of the slide presentation that will be used on the call will be available through Cott’s website at www.cott.com. The conference call will be a live audio webcast available via the above referenced link and it will be recorded and archived for playback for a period of two weeks following the call.