DEERFIELD, Ill. – Mondelez International, Inc. yesterday announced the pricing for its previously announced cash tender offer (the “Tender Offer”).

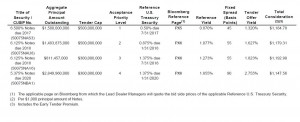

The offer is for its 6.500% Notes due 2017 (the “Priority 1 Notes”), 6.125% Notes due 2018 (the “Priority 2 Notes”), 6.125% Notes due 2018 (the “Priority 3 Notes”) and 5.375% Notes due 2020 (the “Priority 4 Notes” and, together with the Priority 1 Notes, the Priority 2 Notes and the Priority 3 Notes, the “Notes”).

The Tender Offer is being made pursuant to an Offer to Purchase, dated November 19, 2013 (the “Offer to Purchase”) and related Letter of Transmittal, also dated November 19, 2013 (the “Letter of Transmittal”), which set forth a description of the terms and conditions of the Tender Offer.

The consideration to be paid in the Tender Offer for each series of Notes has been determined in the manner described in the Offer to Purchase by reference to a fixed spread over the yield to maturity of the applicable Reference U.S. Treasury Security specified in the table below and in the Offer to Purchase (the “Tender Offer Yield”).

Holders who validly tender and do not validly withdraw Notes at or prior to the Early Tender Deadline (as defined below) that are accepted for purchase will receive the applicable “Total Consideration” listed in the table below, which includes an early tender payment of $30.00 per $1,000 principal amount of Notes accepted for purchase (the “Early Tender Premium”).

Holders who validly tender after the Early Tender Deadline but at or prior to the Expiration Time (as defined below) that are accepted for purchase will receive the Total Consideration listed in the table below minus the Early Tender Premium.

In addition, holders whose Notes are accepted for purchase pursuant to the Tender Offer will also receive accrued and unpaid interest on their purchased Notes from the last interest payment date for such Notes to, but excluding, the applicable settlement date.

The Tender Offer will expire at 11:59 p.m., Eastern time, on December 17, 2013, unless extended (such date and time, as the same may be extended, the “Expiration Time”).

Holders of Notes must validly tender and not validly withdraw their Notes on or before 5:00 p.m., Eastern time, on December 3, 2013, unless extended (such date and time, as the same may be extended, the “Early Tender Deadline”) to be eligible to receive the applicable Total Consideration for their tendered Notes.

After such time, the Notes may not be withdrawn except in certain limited circumstances where additional withdrawal rights are required by law.

Assuming the Tender Offer is not extended and the conditions to the Tender Offer are satisfied or waived, the company expects that settlement for Notes validly tendered and not validly withdrawn on or before the Early Tender Deadline will be on December 11, 2013 (the “Initial Settlement Date”), and that settlement for Notes validly tendered and not validly withdrawn after the Early Tender Deadline will be on December 18, 2013.

The Tender Offer is not conditioned upon any minimum amount of Notes being tendered, and the Tender Offer may be amended, extended, terminated or withdrawn in whole or with respect to one or more series of Notes.

The amounts of each series of Notes that are purchased on any settlement date will be determined in accordance with the acceptance priority levels and proration procedures described in the Offer to Purchase.

Subject to applicable law, the Tender Offer may be amended, extended, terminated or withdrawn with respect to one or more series of Notes. If the Tender Offer is terminated with respect to any series of Notes without Notes of such series being accepted for purchase, Notes of such series tendered pursuant to the Tender Offer will promptly be returned to the tendering holders.

Notes tendered pursuant to the Tender Offer and not purchased due to the priority acceptance procedures or due to proration will be returned to the tendering holders promptly following the Expiration Time or, if the Tender Offer is fully subscribed as of the Early Tender Deadline, promptly following the Early Tender Deadline.

Prior to the Initial Settlement Date, the company intends to offer and sell new debt securities. The net proceeds of the offering will be used to finance the purchase of the Notes validly tendered and accepted for purchase pursuant to the Tender Offer, and to pay all fees and expenses in connection with the Tender Offer.