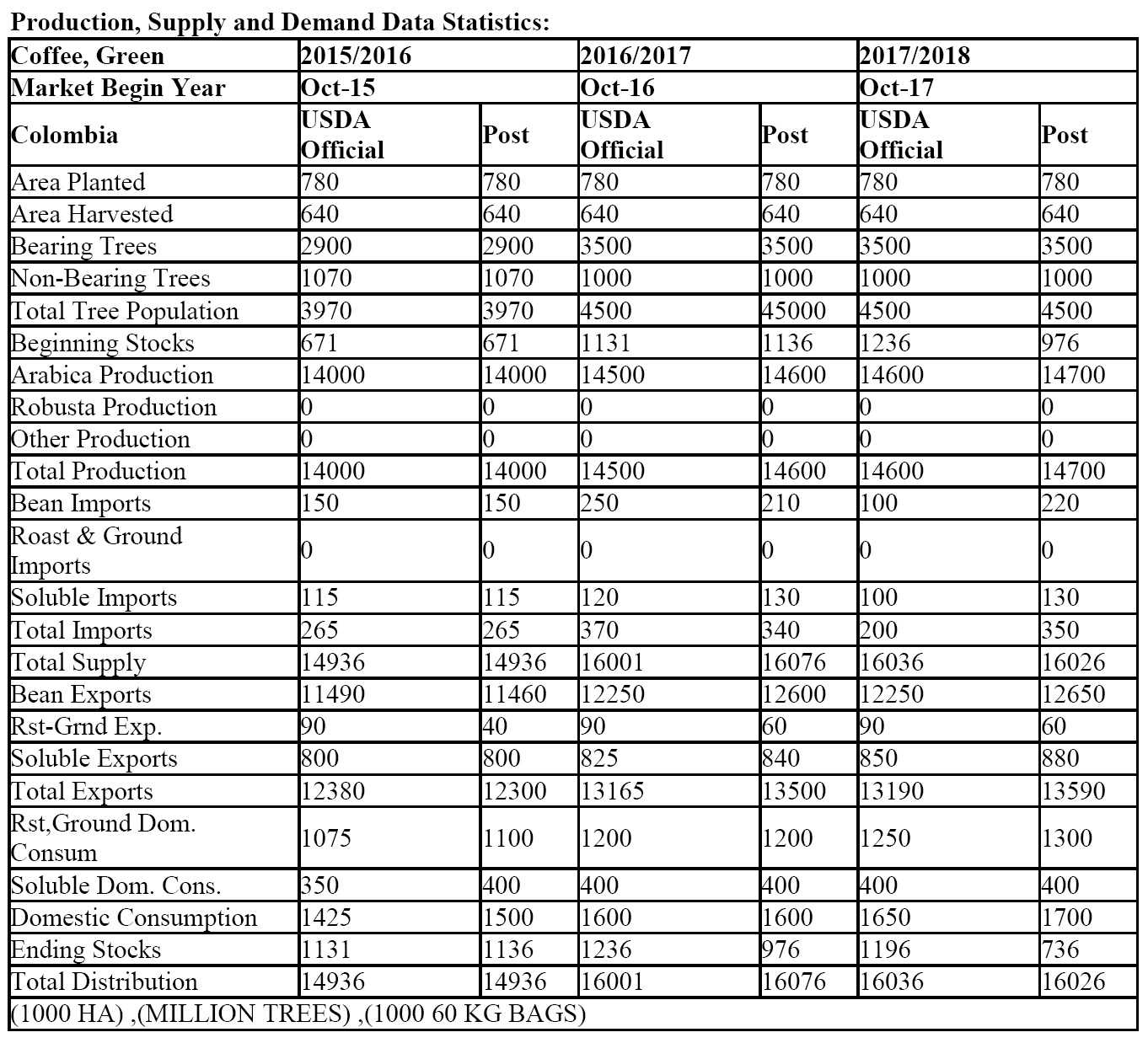

As a result of renovated plantations and favorable weather conditions, Colombian coffee production reached historical high levels of 14.6 million 60-kg bags green bean equivalent (GBE) in marketing year (MY) 2016/2017, says USDA’s FAS in its semi-annual report on Colombia.

If weather conditions remain favorable, production is forecast to marginally increase in MY 2017/2018 to 14.7 million bags GBE. Paralleling the increase in production, exports are expected to reach 13.6 million bags GBE in MY 2017/2018.

Production

Post increased the estimate for Colombian coffee production to 14.6 million bags GBE in MY 2016/2017, higher than the previous estimate of 14.5 million bags GBE. Production remains strong due to favorable weather conditions and productive maturity of renovated coffee trees. Post forecasts production to increase to 14.7 million bags GBE in MY 2017/2018 as the production recovery stabilizes and weather patterns remain normal.

The Colombian Institute of Meteorology (IDEAM) estimates a 65 percent chance of La Niña weather phenomena developing during the last part of 2017 and beginning of 2018. However if it occurs, it will be a low intensity weather event.

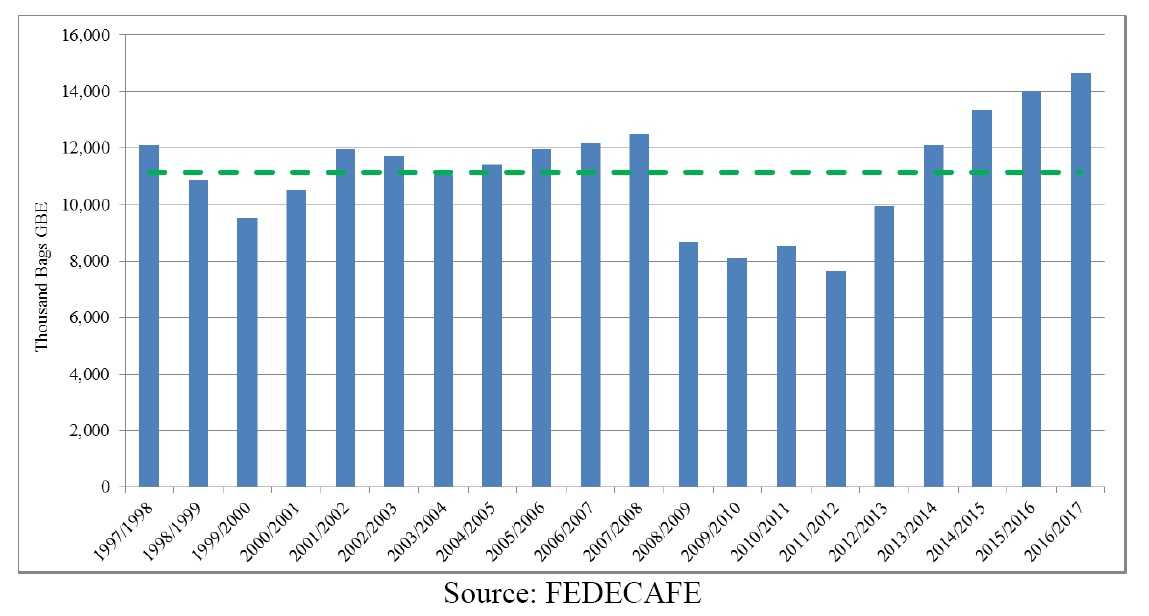

Colombia coffee production is at record levels not seen since the early 1990’s given the highly successful replanting program of coffee rust resistant varieties and good weather conditions.  The National Federation of Coffee Growers of Colombia (FEDECAFE) estimates that average coffee productivity has increased to 18.2 bags GBE per hectare, 32 percent higher than the last decade (13.8 bags GBE).

The National Federation of Coffee Growers of Colombia (FEDECAFE) estimates that average coffee productivity has increased to 18.2 bags GBE per hectare, 32 percent higher than the last decade (13.8 bags GBE).

From the beginning of the replanting program in 2012 up to date, more than 420,000 hectares have been renovated, which corresponds to 45 percent of total Colombian coffee production area. On average, 84,000 hectares are annually renovated, but FEDECAFE and the Colombian government plan to increase this number to at least 90,000 hectares per year to reach the production goal of 18 million bags GBE in the coming years.

The graph below illustrates production from the last twenty years, highlighting the turnaround in MY 2012/2013. As a reference, the average annual production is illustrated by the green dotted line. The average size of the Colombian coffee farm is 4.5 hectares of land. FEDECAFE estimates there are 560,000 coffee growing families, where small farmers with less than 5 hectares of land are responsible for approximately 69 percent of coffee production in Colombia. There are 940,000 hectares of coffee planted in Colombia but only 780,000 correspond to technified crops which mean they are partially planted with improved coffee varieties, such as rust resistant trees, dense plantations and are younger than 12 years. FEDECAFE indicates that about 80 percent of coffee area is planted with rust resistant varieties, compared to 35 percent in 2010, when weather conditions had devastating effects on coffee production.

The average size of the Colombian coffee farm is 4.5 hectares of land. FEDECAFE estimates there are 560,000 coffee growing families, where small farmers with less than 5 hectares of land are responsible for approximately 69 percent of coffee production in Colombia. There are 940,000 hectares of coffee planted in Colombia but only 780,000 correspond to technified crops which mean they are partially planted with improved coffee varieties, such as rust resistant trees, dense plantations and are younger than 12 years. FEDECAFE indicates that about 80 percent of coffee area is planted with rust resistant varieties, compared to 35 percent in 2010, when weather conditions had devastating effects on coffee production.

According to FEDECAFE’s last sanitary survey, on average, borer infestation and rust levels are below two percent. Medium and large scale growers have faced higher production costs due to a shortage of agricultural labor during harvesting season; however, since 2016, Venezuelan seasonal workers have supported labor in the main producing regions.

In addition, the flowering period for the MY 2017/2018 first harvest has been more dispersed than previous years. This will result in lower concentration of labor needs, and thus, less pressure for higher wages. FEDECAFE estimates that average production cost per 125 kilogram bag is 600,000 Colombian Pesos (COP) (USD 200).

In December 2016, internal coffee prices reached high historical levels; however, during 2017 prices have shown a downward trend given the recovery of the Colombian peso and lower international prices. From January to October 2017, the monthly average internal price of coffee reached COP 827,530 (USD 276) per 125 kilogram bag, a 2.3 percent increase from the same time period a year before.

Consumption

Colombian coffee consumption has grown by 30 percent within the past five years. In MY 2016/2017, domestic consumption is estimated to reach 1.6 million bags GBE, compared to 1.2 million bags GBE in 2012/2013.

The increase is mainly driven by a growing number of coffee shops and the creation of new coffee products to satisfy the increasing demand of young well-travelled professionals and foreign visitors. Domestic consumption is forecast to marginally increase in MY 2017/2018 to 1.7 million bags GBE.

The major players in the Colombian coffee stores market are: Juan Valdez, leading with 22.6 percent market share, followed by OMA (12.5%) and McCafé (4.6%). Other companies with a presence in this market include Illy, Segafredo, Café Tostao, and the mega-coffee retailer, Starbucks, which started operations in Colombia in 2014.

Trade

Paralleling larger production, exports reached 13.5 million bags GBE in MY 2016/17. In MY 2017/18, Post estimates Colombian coffee exports will marginally increase at 13.6 million bags GBE. Colombian coffee exports have been expanding significantly since 2013, reflecting the recovery in coffee production.

The United States is the major single destination for Colombian coffee, importing approximately 44% of the value of all Colombian coffee exports, followed by the European Union (25%), Japan (10%), and Canada (7%).

As part of a quality differentiation and improvement policy, Colombia continues increasing high quality coffee exports that meet cupping and grading certifications and capture more value added. Value added, specialty coffee now comprises close to 40 percent of Colombia’s total coffee exports.

Colombian specialty coffee is booming with certified and organic coffees receiving significant price premiums. Coffee denomination of origin labels from specific regions of Colombia, such as the southern growing regions of Huila, Cauca and Nariño, are gaining more international recognition for the cupping quality.

Colombian specialty coffee growers produce coffee under numerous international programs that provide fair trade and organic certifications such as USDA Organic, UTZ Certified, 4C, and Rainforest Alliance.

Protocols vary, depending on the certification they are trying to meet, between growers and intermediaries, including FEDECAFE, to maintain the levels of quality that will meet certification standards and buyer/consumer expectations abroad. In an effort to promote direct trading and increase small-scale producer income, FEDECAFE launched an initiative to allow registered exporters to ship coffee in small quantities. Shipments of up to 60 kilograms of green coffee, roasted coffee, instant coffee and coffee extract, are occurring with authorized private shipping companies.

Despite the fact that Colombia has prided itself on exporting only the finest beans, in May 2016, FEDECAFE modified exports standards to help growers sell lower-quality beans affected by the El Niño drought and align Colombia to international standards.

In addition, as a result of the increase in the quantity of grains of inferior quality, coffee soluble exports increased. To satisfy the increasing domestic demand, imports are forecast to increase in MY 2016/2017 to 340,000 bags GBE, increasing further to 350,000 bags in MY 2017/2018. The Colombian coffee bean imports are mainly from Peru, Ecuador and Brazil. Imports are primarily used to meet the lower end of the domestic market.

Stocks

There exists no government or FEDECAFE policy to support large scale carry-over stocks of coffee. Post estimates for MY 2016/2017 beginning stocks totaled 1.1 million bags GBE considering enlarged production and stored bags due to the trucker’s strike which reduced the availability of transportation from the coffee regions.

In MY 2017/2018 beginning stocks will decrease to 976,000 bags GBE. In MY 2017/18 ending stocks will fall to 736,000 bags GBE given that there is no policy incentive or infrastructure to maintain long term stocks.

Policy

Most coffee growers are members of FEDECAFE and take advantage of the organization’s educational programs, technical training, and sales support. FEDECAFE provides technical support to coffee producers through the extension service that assists growers on good practices for planting, harvest and post-harvest, as well as productive phases that have an impact on the final quality of coffee.

In addition, FEDECAFE manages low interest loan programs for the costs of replanting; however, loans are only offered for planting the rust resistant variety. FEDECAFE purchases coffee from its members at an internal price which parallels the international commodity markets less some administrative and internal transport expenses. FEDECAFE’s price acts as a floor price should farmers not procure higher price premiums for specialty coffee through other buyers and intermediaries.

Most of the policies and programs for the coffee sector are sponsored by the National Coffee Fund which is a parafiscal account whose contributions are made exclusively by Colombian coffee growers. The Fund’s resources are managed by FEDECAFE.

The Colombian government also offers financial assistance through the Rural Funding Incentive program (ICR), which provides loans with discounted payback terms. Additionally, a special loan category supported by the government Financing Fund for Agricultural Sector (FINAGRO), was established for supporting small growers in replanting their coffee fields. The Ministry of Agriculture is also supporting specific projects focused on improving post-harvest process and coffee quality. Since the second part of 2014, the Protection for the Income of Farmers (PIC) subsidy program has been suspended as prices have peaked above the PIC trigger price (Production cost).