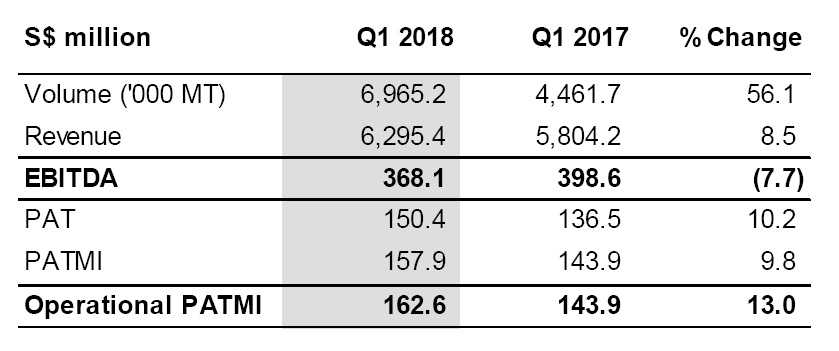

SINGAPORE – Olam International has released on May 14, 2018 its Q1 2018 results showing a strong financial performance. PATMI is up 9.8% to S$157.9 million; Operational PAT MI is up 13.0% to S$162.6 million. EBITDA stands at S$368.1 million against a strong Q1 2017 of S$398.6 million.

The company reported a significant improvement in net gearing (Mar 31, 2018: 1.49x; Mar 31, 2017: 1.98x).

Investments in prioritised platforms, completion of planned divestments and continued working capital optimisation were also highlighted in the report.

Management Comments:

Co-Founder & Group CEO, Sunny Verghese said:

“We continued to deliver earnings growth and position ourselves for the future, including the recent launch of AtSource, which enables us to turn sustainability into a key business driver for transforming agricultural supply chains.

“Even as we successfully execute on our 2016-2018 Strategic Plan, we will be embarking on our next Strategic Plan exercise which will see us evolve all the elements of Olam 2.0 and lead the industry’s digital disruption and transformation.”

Executive Director and Group COO, A. Shekhar said:

“We are pleased with our ability to deliver year-on-year profit growth against a strong performance in Q1 2017. We executed on our planned investments and divestments, reduced financing costs and diversified our funding mix with ground-breaking initiatives, including Asiaʼs first sustainability-linked club loan.

“Our gearing has improved significantly from a year ago, giving us additional growth headroom. We will continue to pursue profitable growth while improving our cost efficiency and capital productivity.”

Financial Results

Q1 2018

- PATMI (Profit After Tax and Minority Interest) increased 9.8% year-on-year (YoY) to S$157.9 million (Q1 2017: S$143.9 million) on reduced net finance costs and lower taxation.

- Operational PATMI, which excludes exceptional items, grew 13.0% YoY to S$162.6 million (Q1 2017: S$143.9 million).

- EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) was down 7.7%at S$368.1 million (Q1 2017: S$398.6 million) against a strong Q1 2017.

Cash flow and gearing

- Net gearing as at March 31, 2018 was lower at 1.49 times compared to 1.98 times as at March 31, 2017 due to lower net debt from the reduction in working capital, lower gross capital expenditure, divestments and the conversion of warrants into equity.

- Free Cash Flow to Equity (FCFE) for Q1 2018 was negative S$409.2 million (Q1 2017: negative S$41.5 million) due to higher working capital usage during this quarter, partly offset by reduced capital spending, divestments and lower interest paid.

Q1 2018 Segmental Performance

- Edible Nuts, Spices & Vegetable Ingredients

- Revenue was lower by 4.0% at S$874.5 million, mainly on reduced volumes YoY in peanuts.

- EBITDA came down marginally by 1.6% to S$135.8 million, as compared with a strong set of results for Q1 2017.

Confectionery & Beverage Ingredients

- Revenue decreased 10.5% to S$1.9 billion on lower volumes and lower prices.

- EBITDA declined 18.4% to S$61.2 million due to significantly lower contribution from Coffee in Q1 2018, as compared with an excellent performance in Q1 2017. Cocoa however delivered an improved performance.

Food Staples & Packaged Foods

- Revenue increased 34.0% to S$2.6 billion, mainly on higher trading volumes in Grains.

- EBITDA declined by 15.1% to S$100.4 million when compared with a very strong Q1 2017.

Industrial Raw Materials, Ag Logistics & Infrastructure

- Revenue was up 9.1% to S$903.4 million on higher Cotton volumes and prices.

- EBITDA improved 6.4% to S$66.2 million on higher contribution from Cotton and GSEZ.

Commodity Financial Services

- The segment reported an EBITDA of S$4.5 million compared to S$5.1 million in Q1 2017.

Outlook

While global markets continue to experience political and economic uncertainties, Olam believes its diversified and well-balanced portfolio provides a resilient platform to navigate the challenges in both the global economy and commodity markets.

Olam will continue to execute on its 2016-2018 Strategic Plan in 2018 and pursue growth in its prioritised platforms while putting sustainability at the heart of its business. It remains focused on turning around underperforming businesses, ensuring gestating businesses reach full potential and delivering positive free cash flow.