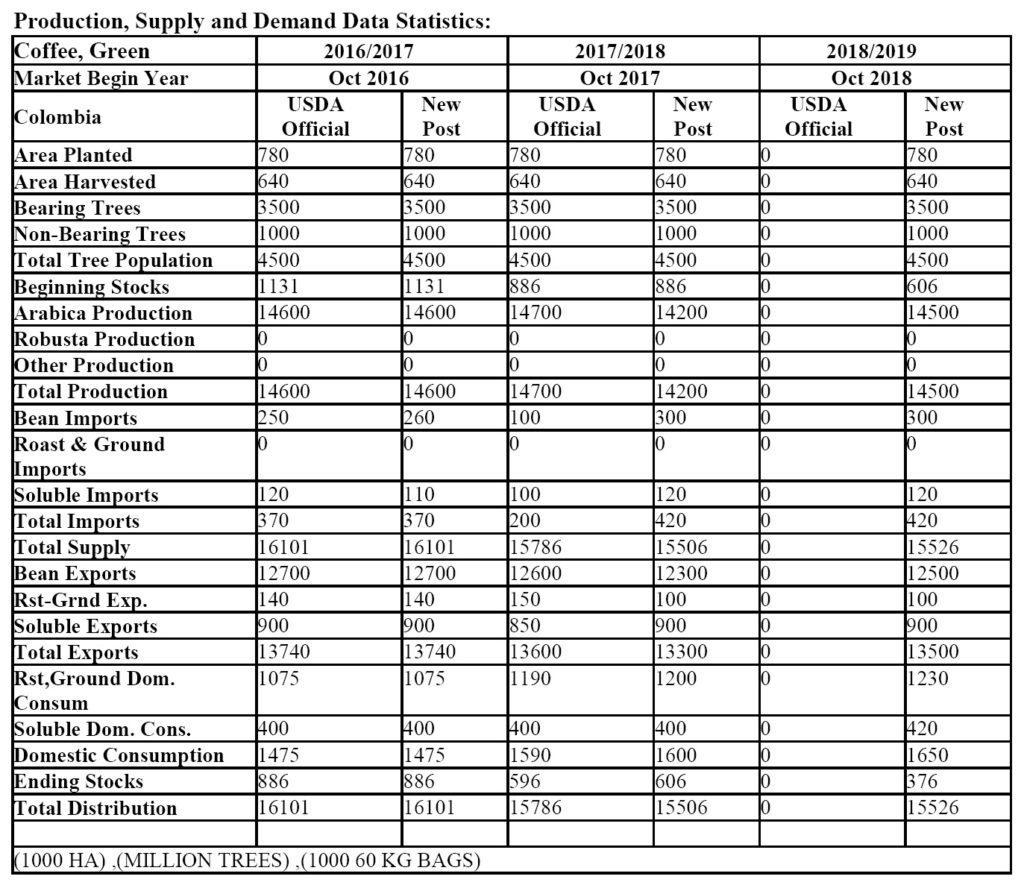

Heavy rains and cloudiness reported at the beginning of 2018 in the coffee regions reduced prospects for Colombian production, says USDA’s Gain Report – Colombia, Coffee Annual. Colombian coffee production is estimated to decrease to 14.2 million bags GBE in MY 2017/18 (October through September), down from the previous estimate of 14.7 million bags GBE.

Production is forecast to increase to 14.5 million bags GBE in MY 2018/19 due to projected better weather conditions and more plants reaching their productive peak.

The production recovery during the past years has been a direct result of the successful replanting program, which reduced the average age of coffee trees from 15 to 7 years and increased productivity and plant density.

The National Federation of Coffee Growers of Colombia (FEDECAFE) and the Colombian government plan to increase the number of hectares annually renovated to at least 90,000 in order to reach the production goal of 18 million bags GBE in the near future, however, in 2017 only 72,000 hectares were renovated.

In MY 2017/18, Post revised export estimates to 13.3 million bags GBE following the decrease in production. Exports are forecast to marginally increase to 13.5 million bags GBE for MY 2018/19.

Production

Post decreased the estimate for Colombian coffee production to 14.2 million bags GBE in MY 2017/18, lower than previous estimate of 14.7 million bags GBE. Production has been affected by rising cloudiness and rainfall due to a low intensity La Niña weather phenomenon.

Despite this decrease, Colombian coffee production remains strong compared to the average production from past years.

If weather conditions are neutral, as it is expected, and production recovery stabilizes, Post forecasts production to increase to 14.5 million bags GBE in MY 2018/19.

Colombian coffee production is at record levels not seen since the early 1990’s given the highly successful replanting program of coffee rust resistant varieties and good weather conditions.

FEDECAFE estimates that average coffee productivity has increased to 18.2 bags GBE per hectare, 32 percent higher than the last decade (13.8 bags GBE). From the beginning of the replanting program in 2012 up to now, more than 420,000 hectares have been renovated, which corresponds to 45 percent of the total Colombian coffee production area.

On average, 84,000 hectares are annually renovated, but FEDECAFE and the Colombian government plan to increase this number to at least 90,000 hectares per year to reach the production goal of 18 million bags GBE in the coming years.

In 2017, only 72,000 hectares were renovated as the government support was available to farmers later in the year. The renovation cost per hectare is estimated between 8 to 12 million Colombian pesos ($2,860-$4,285).

The average size of the Colombian coffee farm is 4.5 hectares of land. FEDECAFE estimates there are 560,000 coffee growing families, where small farmers with less than 5 hectares of land are responsible for approximately 69 percent of coffee production in Colombia.

There are 940,000 hectares of coffee planted in Colombia but only 780,000 correspond to technified crops which mean they are partially planted with improved coffee varieties, such as rust resistant trees, dense plantations and are younger than 12 years.

FEDECAFE indicates that about 80 percent of coffee area is planted with rust resistant varieties, compared to 35 percent in 2010, when weather conditions had devastating effects on coffee production.

According to FEDECAFE’s last sanitary survey, on average, borer infestation and rust levels are below two percent.

Since 2017, domestic prices have shown a downward trend given the recovery of the Colombian peso and lower international prices. From January to April 2018, the monthly average internal price of coffee reached COP 738,529 (USD 264) per 125 kilogram bag, a 13 percent decrease from the same time period a year before.

This dramatic reduction in domestic prices has motivated coffee growers to claim support from the government. According to FEDECAFE, about 35 to 40 percent of total coffee production receives significant price premiums given characteristics of specialty coffee.

Consumption

Colombian coffee consumption keeps growing driven by an increasing number of coffee shops and the creation of new coffee products to satisfy the rising demand of young professionals and foreign visitors.

In MY 2017/18, domestic consumption is estimated to reach 1.6 million bags GBE, compared to 1.2 million bags GBE in 2012/13, an increase of 33 percent. Domestic consumption is forecast to marginally increase in MY 2018/19 to 1.65 million bags GBE.

The major players in the Colombian coffee stores market are: Juan Valdez, leading with 22.6 percent market share, followed by OMA (12.5%) and McCafé (4.6%).

Other companies with a presence in this market include Illy, Segafredo, Café Tostao, and the mega-coffee retailer, Starbucks, which started operations in Colombia in 2014. Café Tostao presence has dramatically grown in the last two years to have about 300 small coffee stores in Bogota and Medellin.

Trade

The decline in coffee exports is given by lower production in MY 2017/18. Post estimates Colombian coffee exports will decrease by 3.2 percent at 13.3 million bags GBE. However, Colombian coffee exports have been expanding significantly since 2013, reflecting the recovery in coffee production. In MY 2018/19, coffee exports are forecast to increase to 13.5 million bags as production recovers.

The United States is the major single destination for Colombian coffee, importing approximately 44% of the value of all Colombian coffee exports, followed by the European Union (25%), Japan (10%), and Canada (7%).

Traditionally FEDECAFE purchases coffee from its members, but in an effort to promote direct trading and increase small-scale producer income, FEDECAFE launched an initiative to allow registered exporters to ship coffee in small quantities. Shipments of up to 60 kilograms of green coffee, roasted coffee, instant coffee and coffee extract, are occurring with authorized private shipping companies.

This initiative has resulted in a larger number of private exporters. FEDECAFE’s market share of total exports decreased from 22.6 percent in 2016 to 18.3 percent in 2017, while private exporters increased their share from 77.4 percent in 2016 to 81.7 percent in 2017.

Despite the fact that Colombia has prided itself on exporting only the finest beans, in May 2016, FEDECAFE modified exports standards to help growers sell lower-quality beans affected by the El Niño drought and align Colombia to international standards.

Although the Green Coffee Association of New York’s standards catalog Colombian beans that pass through a screen of 14/64 and have a 5% tolerance as Excelso Colombian coffee, Colombia had traditionally self-imposed a 1.5% maximum tolerance, which prevented the export of a significant amount of high quality beans (FEDECAFE, 2016).

To satisfy the increasing domestic demand, imports are estimated to increase in MY 2017/18 to 420,000 bags GBE, with no significant changes in MY 2018/19. The Colombian coffee bean imports are mainly from Peru, Ecuador and Brazil. Imports are primarily used to meet the lower end of the domestic market.

Stocks

There exists no government or FEDECAFE policy to support large scale carry-over stocks of coffee. In MY 2017/18 beginning stocks are estimated at 886,000 bags GBE given historical large production the year before. In MY 2018/19 ending stocks will fall to 376,000 bags GBE as a result of reduced production and recover of exports, in addition, there is no policy incentive or infrastructure to maintain long term stocks.

Policy

The decrease in domestic prices due to the peso strength against the dollar and the reduction on international prices fueled coffee growers to claim for government support through the Protection for the Income of Farmers (PIC) subsidy program.

This government program has been suspended since the second part of 2014 as prices have peaked above the PIC trigger price (production cost) (see graph 3). The Colombian government has not restated the PIC program but it is offering financial assistance through the Rural Funding Incentive program (ICR), which provides loans with discounted payback terms.

Additionally, a special loan category supported by the government Financing Fund for Agricultural Sector (FINAGRO), was established for supporting small growers in replanting their coffee fields.

The Ministry of Agriculture is also supporting specific projects focused on improving post-harvest process and coffee quality. The funds allocated in 2018 by the Colombian government and FEDECAFE’s fund are estimated at COP 45,000 million (USD 16 million), mainly to support the replanting program.

Most coffee growers are members of FEDECAFE and take advantage of the organization’s educational programs, technical training, and sales support. FEDECAFE provides technical support to coffee producers through the extension service that assists growers on good practices for planting, harvest and post-harvest, as well as processing that have an impact on the final quality of coffee.

In addition, FEDECAFE manages low interest loan programs for the costs of replanting; however, loans are only offered for planting rust resistant varieties.