BOLOGNA, Italy — The annual general meeting of the Shareholders of IMA S.p.A., world leader in the production of automatic packaging machines, met today under the chairmanship of Alberto Vacchi and approved the financial statements at 31 December 2018.

The Shareholders’ Meeting approved the distribution of a dividend of 2.0 euros per share, an increase over the previous year (a dividend of 1.70 euros per share approved by the Shareholders’ Meeting of 27 April 2018), due for payment from 22 May 2019 (ex-coupon no. 26 on 20 May 2019).

Proof of title, pursuant to art. 83-terdecies of the Consolidated Finance Act, to receive payment of the dividend will be based on the intermediary’s records referred to in art. 83-quater, paragraph 3 of the Consolidated Finance Act, at the end of 21 May 2019 which will be the record date. Shareholders will be able to collect their dividends, gross or net of withholding tax depending on the tax regime applicable to them, exclusively from their respective intermediaries.

IMA Group results at 31 December 2018

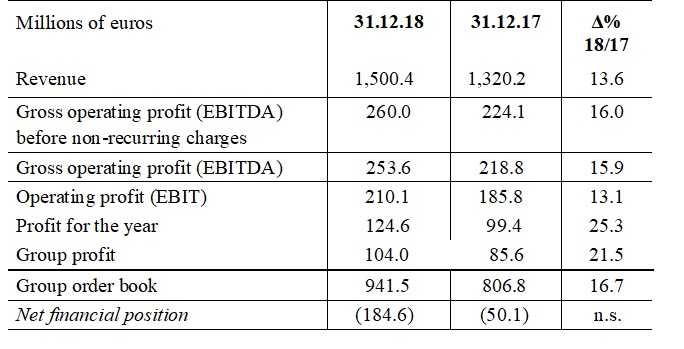

The IMA Group has closed 2018 with net revenue of 1,500.4 million euros, an increase of 13.6% compared with 1,320.2 million at 31 December 2017. Exports accounted for about 90%, with growth in all the world, especially in European Countries, North America, and in other non European countries.

The IMA Group has closed 2018 with net revenue of 1,500.4 million euros, an increase of 13.6% compared with 1,320.2 million at 31 December 2017. Exports accounted for about 90%, with growth in all the world, especially in European Countries, North America, and in other non European countries.

Gross operating profit (EBITDA) before non-recurring charges shows a significant increase to 260 million euros (+16% compared with 224.1 million at 31 December 2017), gross operating profit (EBITDA) rises to 253.6 million euros (+15.9% compared with 218.8 million at 31 December 2017) and operating profit (EBIT) comes to 210.1 million euros (+13.1% compared with 185.8 million at 31 December 2017). There has been significant growth in profit for the year, which rose to 124.6 million euros (+25.3% compared with 99.4 million in 2017) as well as in the Group profit which reached 104.0 million euros (+21.5% compared with 85.6 million in 2017).

The consolidated order book rose to 941.5 million euros (+16.7% compared with 806.8 million at 31 December 2017).

The IMA Group closed 2018 with better results than the previous year, thanks to the positive trend in sales of automatic machines and complete lines to the sectors of reference and the contribution of the newly acquired companies Petroncini, TMC and Ciemme, consolidated respectively from April, May and July 2018.

In the period April-December 2018, Petroncini, TMC and Ciemme generated total revenue of 64.7 million euros and EBITDA before non-recurring charges of 7.8 million euros. At 31 December 2018, they had net financial debt of 9.6 million euros and an order book of 41.9 million euros.

Net financial indebtedness of the IMA Group at 31 December 2018, was 184.6 million euro (50.1 million euros at 31 December 2017) and takes into account the total outlay of 97.7 million euros for the acquisitions of TMC, Petroncini and Ciemme. This figure includes the positive effect of 26.8 million euros from the sale of the majority interest in IMA Dairy & Food Holding GmbH and 8.5 million euros for the purchase of treasury shares by IMA and GIMA TT, in accordance with the authorisations approved by their respective Shareholders’ Meetings.

IMA Group forecasts for the whole of 2019

The high level of the order book at 31 December 2018 and the positive trend in new orders during the first three months of the current year enable us to confirm our forecasts of further growth on last year. For 2019, if current conditions are confirmed in the coming months, the IMA Group estimates revenue of approximately 1.58 billion euros and a gross operating profit (EBITDA) of about 260 million euros, with a considerable increase in net profit.

Note that the forecasts do not take into account the effects of IFRS 16, which came into force on 1 January 2019. Disclosures on application of this standard have been provided in the Annual Financial Report.

In commenting on the Group’s performance at 31 December 2018, Alberto Vacchi, IMA’s Chairman and CEO, declared:

“The year closed with brilliant results in the various business lines, confirming the Group’s leadership in the pharmaceutical field and its ability to expand in sectors with good development prospects, such as coffee, tissue and health & personal care. We are very satisfied with the results achieved in 2018: in fact we have reached 1.5 billion of revenue and increased profits, while paying maximum attention to the needs of our customers and investors.

These excellent results are also due to our strong commitment to digitisation and the excellence of our technology which we export all over the world. We are looking forward to the current year with confidence – continued Alberto Vacchi – thanks to an order book that at the end of 2018 is +16.7% on last year and a good performance in the first three months of 2019. The 2019 forecast, which will see a considerable increase in net profit, reflects a lower contribution by the tobacco business compared with the year just ended, but that does not change the enormous trust that we have in this highly profitable business, which has great prospects for future growth.

Our growth objective will also be pursued through acquisitions: we have in fact recently acquired 70% of Spreafico Automation and 61.45% of the Argentinean company Tecmar, thereby completing the range of machines that we can offer in the coffee sector. The significant amount of cash flow generated in 2018 allowed us to make both routine and strategic investments, increasing the value of the Group, and to reward those that had confidence in our sustainable growth potential” – concluded the Chairman of IMA.

New plan to buy and sell treasury shares approved

The Shareholders’ Meeting renewed the authorisation to buy and sell treasury shares up to the maximum limit permitted by law. The proposed purchase price is equal to the average stock price during the previous five days (+/-10%), while the proposed selling price will be at least the average purchase cost of the shares. As of today, IMA owns 107,000 treasury shares.

Appointment of the Board of Statutory Auditors and its Chairman for the period 2019-2021

The Shareholders’ Meeting has appointed the members of the Board of Statutory Auditors, until approval of the financial statements as of 31 December 2021, Francesco Schiavone Panni (Chairman – taken from the list presented by a group of asset management companies), Riccardo Andriolo and Roberta De Simone (taken from the list presented by the majority shareholder SO.FI.M.A. S.p.A.) as Standing Auditors, Chiara Molon (taken from the list presented by a group of asset management companies), Giovanna Bolognese and Federico Ferracini (taken from the list presented by the majority shareholder SO.FI.M.A. S.p.A.) as Alternate Auditors.

The CVs of the new Statutory Auditors are available in the Investor Relations section (Shareholders Meetings) of the Company’s website www.ima.it.

The Shareholders’ Meeting voted to grant the Board of Statutory Auditors for the period 2019-2021 an annual gross fee of 30,000 euros for each Acting Auditor and 50,000 euros for the Chairman.

Remuneration Report

The Shareholders’ Meeting also voted in an advisory capacity to approve the first section of the Remuneration Report prepared in accordance with art. 123-ter, para. 6 of the Legislative Decree 58/1998.

The manager responsible for the preparation of the Company’s accounting documents, Sergio Marzo, declares in accordance with article 154 bis paragraph 2 of the Consolidated Finance Act that the accounting information contained in this press release agrees with the books of account, the accounting entries and supporting documentation.

About Ima

Established in 1961, IMA is world leader in the design and manufacture of automatic machines for the processing and packaging of pharmaceuticals, cosmetics, food, tea and coffee. The Group has about 5,500 employees, about 2,300 of whom overseas, and can count on 41 production plants in Italy, Germany, Switzerland, the United Kingdom, the United States, India, Malaysia, China and Argentina. IMA has an extensive sales network comprising 29 branches which provide sales and service in Italy, France, Switzerland, the United Kingdom, Germany, Austria, Spain, Poland, Israel, Russia, the United States, India, China, Malaysia, Thailand and Brazil, representative offices in Central and East European countries and over 50 agencies covering a total of about 80 countries. IMA S.p.A. has been listed on the Milan Stock Exchange since 1995 and in 2001 joined the STAR segment.

The following manufacturing companies are part of the IMA Group: Benhil GmbH, Ciemme S.r.l., Co.ma.di.s. S.p.A., Corazza S.p.A., Delta Systems & Automation Inc., Eurosicma S.p.A., Eurotekna S.r.l., Gima S.p.A., Gima TT S.p.A., G.S. Coating Technologies S.r.l., Hassia Packaging Pvt. Ltd., Ilapak International SA, Ilapak Italia S.p.A., Ilapak (Beijing) Packaging Machinery Co. Ltd., IMA Automation Malaysia Sdn. Bhd., IMA Automation USA Inc., IMA Life North America Inc., IMA Life (Beijing) Pharmaceutical Systems Co. Ltd., IMA MAI S.A., IMA Medtech Switzerland S.A., IMA North America Inc., IMA-PG India Pvt. Ltd., IMA Swiftpack Ltd., Mapster S.r.l., Petroncini Impianti S.p.A., PharmaSiena Service S.r.l., Revisioni Industriali S.r.l., Shanghai Tianyan Pharmaceutical Machinery Co. Ltd., Spreafico Automation S.r.l., Tecmar S.A., Teknoweb Converting S.r.l., Telerobot S.p.A., Tissue Machinery Company S.p.A., Valley Tissue Packaging Inc.