MILAN – The Board of Directors of Italmobiliare S.p.A. – an investment holding company listed on the Milan Stock Exchange owner of a majority stake in Caffè Borbone, one of the top names on the national market and a leading supplier of capsules and pads – approved on Thursday the additional quarterly financial disclosure as at and for the three months to March 31, 2019.

At the end of 2019 first quarter, overall Net Asset Value, excluding treasury shares held in portfolio, was 1,487.1 million euro. The rise of 65.7 million euro from the end of 2018 (1,421.4 million euro) was mainly due to the increase in the market value of the listed equity investments HeidelbergCement (+43,2 million euro) and Mediobanca (+17,6 million euro, including the change in value of shares sold in the first quarter).

During the first quarter, Italmobiliare sold Mediobanca shares for a total amount of 24.3 million euro.

Moreover, in January Italmobiliare finalized the acquisition of 26.9% of Autogas Nord share capital for 60 million euro. –Autogas Nord is one of the leading in the Italian LPG market. This transaction led to an increase in the value of the portfolio companies and a reduction in cash and cash equivalents, with a neutral effect in terms of NAV.

Italmobiliare S.p.A. had a positive net financial position of 310.5 million euro as of March 31, 2019 (344.9 million euro at the end of 2018).

During the first quarter, Group consolidated revenue (130.8 million euro) rose by approximately 44% yoy, mainly thanks to the contribution of Caffè Borbone. In the first quarter of the current year, Caffè Borbone and Tecnica Group confirmed their strong performance both in terms of sales and operating profit, as already reported at the end of 2018.

Significant events in the quarter

In January, Italmobiliare S.p.A. finalized the agreement announced on November 15, 2018, for the purchase of a stake of approximately 27%, subject to post closing adjustment, of Autogas Nord S.p.A. share capital, one of the leading LPG players in Italy. Italmobiliare invested 60 million euro, becoming a minority shareholder of a group with a turnover of approximately 500 million euro.

As proposed by the Board of Directors on March 6, 2019, Italmobiliare S.p.A. shareholders’ meeting held on April 17, 2019 approved the cancellation, without reduction of the share capital, of 5,133,800 treasury shares, out of a total of 5,685,870 shares currently held by the company, representing 11.9% of the share capital. After the cancellation, the number of issued shares will be reduced from 47,633,800 to 42,500,000 and Italmobiliare will hold 552,070 treasury shares, representing approximately 1.3% of its share capital.

The shareholders also renewed the authorization for the purchase and disposal of treasury shares for the next 18 months. The authorization proposal refers to a maximum of 2,200,000 shares (equivalent to 4.619% of the shares currently representing the share capital, i.e., before the share cancellation illustrated above) for a maximum amount of 60 million euro.

Net Asset Value

Italmobiliare Net Asset Value as of March 31, 2019 was 1,487.1 million euro (excluding treasury shares) with an increase of 65.7 million euro from December 31, 2018 (1,421.4 million euro).

The main changes in NAV resulted from an increase in the market value of the listed equity investments HeidelbergCement (+43.2 million euro) and Mediobanca (+17.6 million euro, including the change in value of the shares sold in the first quarter).

During the first three months, Italmobiliare sold Mediobanca shares totaling 24.3 million euro.

Furthermore, the abovementioned acquisition of 26.9% of Autogas Nord share capital led to an increase in the value of the portfolio companies and a reduction in cash and cash equivalents, with a neutral effect in terms of NAV.

NAV as of March 31, 2019 was calculated by applying the specific procedure and, where necessary, on the basis of the valuations of independent experts, considering:

- the market price as of March 31, 2019 of the equity investments in listed companies;

- the value of non-listed companies, determined through commonly used valuation methods (DCF and/or market multiples) or, when such information is not available, on the basis of their equity value as reflected in the most recent approved financial statements, prepared and presented in accordance with the IAS/IFRS standards or with local accounting principles;

- the reported NAV of the Private equity funds as per their most recent financial reports;

- the market value of real estate assets;

- any deferred tax effects.

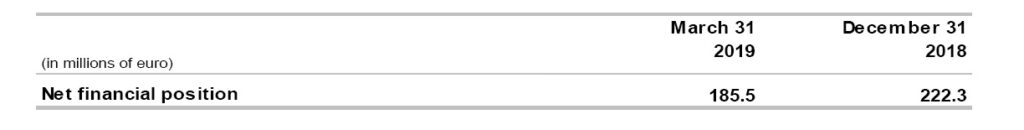

Net financial position

The positive consolidated net financial position of 185.5 million euro showed a decrease of 36.8 million euro from December 31, 2018, largely as a result of the acquisition of Autogas Nord S.p.A. (-60.1 million euro), counterbalanced in part by the sale of Mediobanca shares (+24.3 million euro) and the improvement of Caffè Borbone net debt (+11.4 million euro).

The positive consolidated net financial position of 185.5 million euro showed a decrease of 36.8 million euro from December 31, 2018, largely as a result of the acquisition of Autogas Nord S.p.A. (-60.1 million euro), counterbalanced in part by the sale of Mediobanca shares (+24.3 million euro) and the improvement of Caffè Borbone net debt (+11.4 million euro).

The application of the new IFRS 16 reporting standard had a negative impact of 14.5 million euro on the Group net financial position.

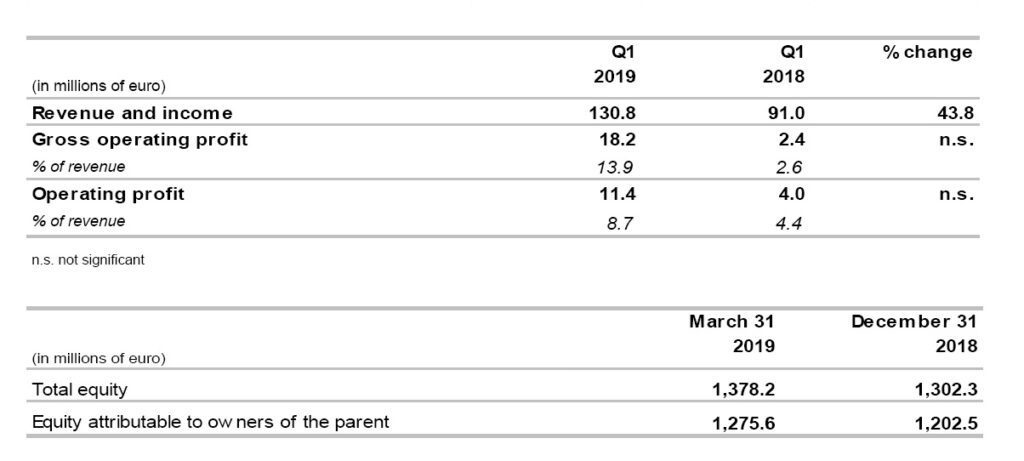

Key consolidated figures as of March 31, 2019

First quarter

The slowdown in the world economic cycle continues: the significant deceleration in the manufacturing sector is mitigated in part by the stability of the services sector. While developed countries present a general weakness (notably the Eurozone manufacturing sector), the emerging economies are showing signs of stabilization (China) similarly to the trend in the international trade. The more visible risk for the economic cycle is still the global political uncertainty: mainly tensions over US-China and US-Europe trade tariffs, Brexit and elections for the European Parliament.

The slowdown in the world economic cycle continues: the significant deceleration in the manufacturing sector is mitigated in part by the stability of the services sector. While developed countries present a general weakness (notably the Eurozone manufacturing sector), the emerging economies are showing signs of stabilization (China) similarly to the trend in the international trade. The more visible risk for the economic cycle is still the global political uncertainty: mainly tensions over US-China and US-Europe trade tariffs, Brexit and elections for the European Parliament.

In Italy, uncertainty over fiscal policy coupled with a situation of economic stagnation reflect on the sustainability of the evolution of the public debt.

Italmobiliare Group consolidated revenue and other income in the first quarter of 2019 increased by 39.8 million euro (+43.8%) compared to the same period in 2018 . The consolidation of Caffè Borbone was the main driver in the revenue increase. The improvement in both gross operating profit (+15.8 million euro) and operating profit (+7.4 million euro) was also mainly a result of the consolidation of Caffè Borbone. The application of the new IFRS 16 reporting standard had a positive impact of 1.1 million euro on gross operating profit.

Consolidated equity as ofMarch 31, 2019, was 1,378.2 million euro, up by 75.9 million euro from December 31, 2018 (1,302.3 million euro).

The overall change arose largely from:

- the change in the fair value reserve on assets classified at fair value through other comprehensive income (FVOCI) (+65.6 million euro), mainly coming from the increase in HeidelbergCement and Mediobanca share prices;

- the profit for the period (+6.3 million euro);

- the exchange-rate effect (+1.0 million euro).

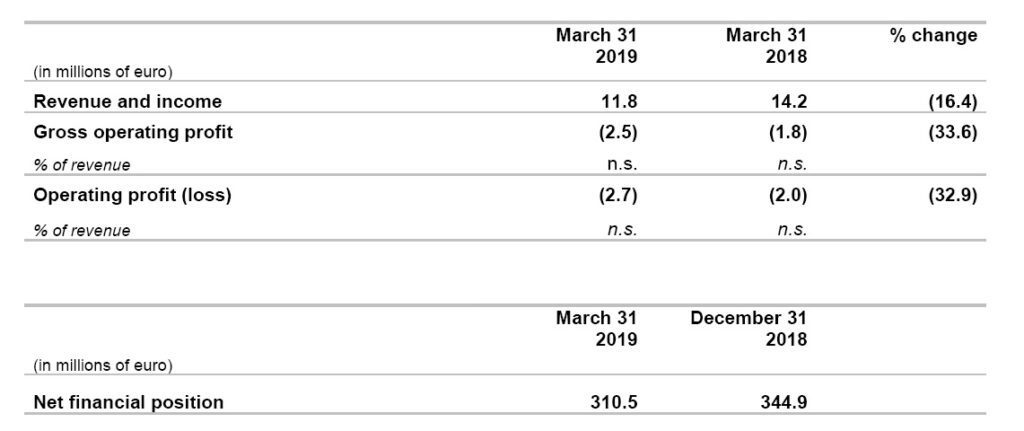

Italmobiliare S.p.A.

Italmobiliare S.p.A. revenue and other income in the first quarter 2019 was affected, as in previous years, by the cash in of dividends, which are typically executed by most of the portfolio companies in the second quarter of the year.

Italmobiliare S.p.A. revenue and other income in the first quarter 2019 was affected, as in previous years, by the cash in of dividends, which are typically executed by most of the portfolio companies in the second quarter of the year.

First quarter revenue amounted to 11.8 million euro, with a reduction of 2.4 million euro from the first quarter of 2018, coming mainly from:

- interest and financial income of 4.1 million euro (9.4 million euro in the first quarter 2018), essentially as a result of the 8.7 million euro increase in the fair value of options on equities;

- no dividend distributed by subsidiaries (1.0 million euro in the year-earlier period);

- capital gains on trading securities totaling 7.7 million euro, a significant increase from the first quarter of 2018 (+3.6 million euro), largely arising from capital gains on mutual funds.

With regard to negative income components, amounting to 14.4 million euro (16.0 million euro in the year-earlier period), the improvement is attributable to financial costs, which decreased by 1.8 million euro mainly due to lower impairment losses on trading securities (2.3 million euro), partially offset by higher costs on derivatives (-1.1 million euro). The holding’s operating expenses amounted to 6.1 million euro, in line with the previous year.

Equity as ofMarch 31, 2019 was 1,297.8 million euro, an increase of 67.7 million euro from December 31, 2018. The overall change arose from an increase in the OCI reserve (+65.9 million euro) and from the gains realized on the sale of FVTOCI equity investments (+3.8 million euro), counterbalanced in part by the loss for the first quarter.

As of March 31, 2019, Italmobiliare S.p.A. held 5,685,870 treasury shares representing 11.94% of the share capital.

The net financial position of Italmobiliare S.p.A. showed a decrease of 34.4 million euro, from 344.9 million euro as of December 31, 2018 to 310.5 million euro at the end of March 2019. The main cash flows referred to the acquisition of Autogas Nord S.p.A. (-60.1 million euro), counterbalanced in part by the sale of Mediobanca shares (+24.3 million euro).

Caffè Borbone

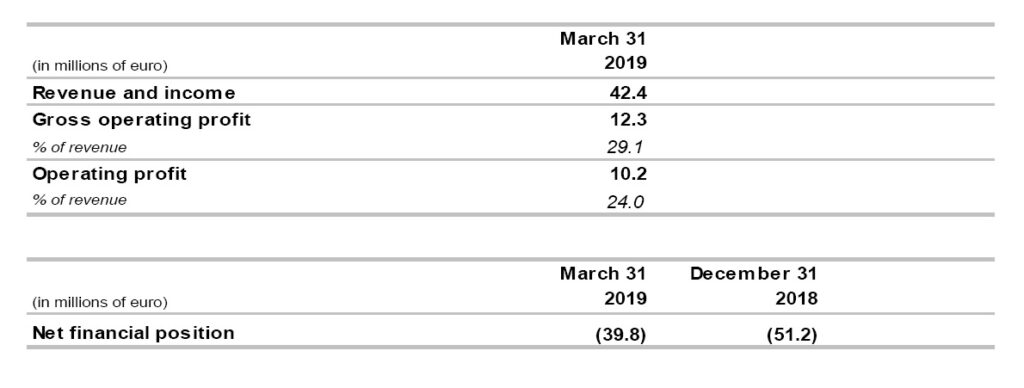

Caffè Borbone closed the first quarter 2019 with revenue and other income of 42.4 million euro, an increase of 28.6% from the previous year (management figure). Gross operating profit was 12.3 million euro, margin on revenue over 29%, and operating profit was 10.2 million euro.

Caffè Borbone closed the first quarter 2019 with revenue and other income of 42.4 million euro, an increase of 28.6% from the previous year (management figure). Gross operating profit was 12.3 million euro, margin on revenue over 29%, and operating profit was 10.2 million euro.

The strong growth trend reported in 2018 continued in the first quarter across all the main sales channels (specialist retailers, mass merchandising, web) and the entire product range (pods and capsules compatible with the main single-serve coffee machines), and was boosted by the launch of the line of capsules compatible with the “Dolce Gusto” system.

The continued development of the mass merchandising channel, which began in 2018, and expansion in the northern regions of Italy, where distribution has historically been less widespread, were particularly successful.

Growth was also supported by an effective marketing strategy, headed by the launch of a new advertising campaign with a celebrity support by Gerry Scotti.

The consolidated net financial position as of March 31, 2019 reflected debt of 39.8 million euro, an improvement of 11.4 million euro from the position as of December 31, 2018 (-51.2 million euro) mainly due to the sound generation of operating cash flows.