VILLORBA, Italy – The Board of Directors of Massimo Zanetti Beverage Group S.p.A., one of the leading brands worldwide in the production, processing and marketing of roasted coffee, listed on the Milan Stock Exchange (MZB.MI), approved today the Consolidated Results as of September 30, 2019.

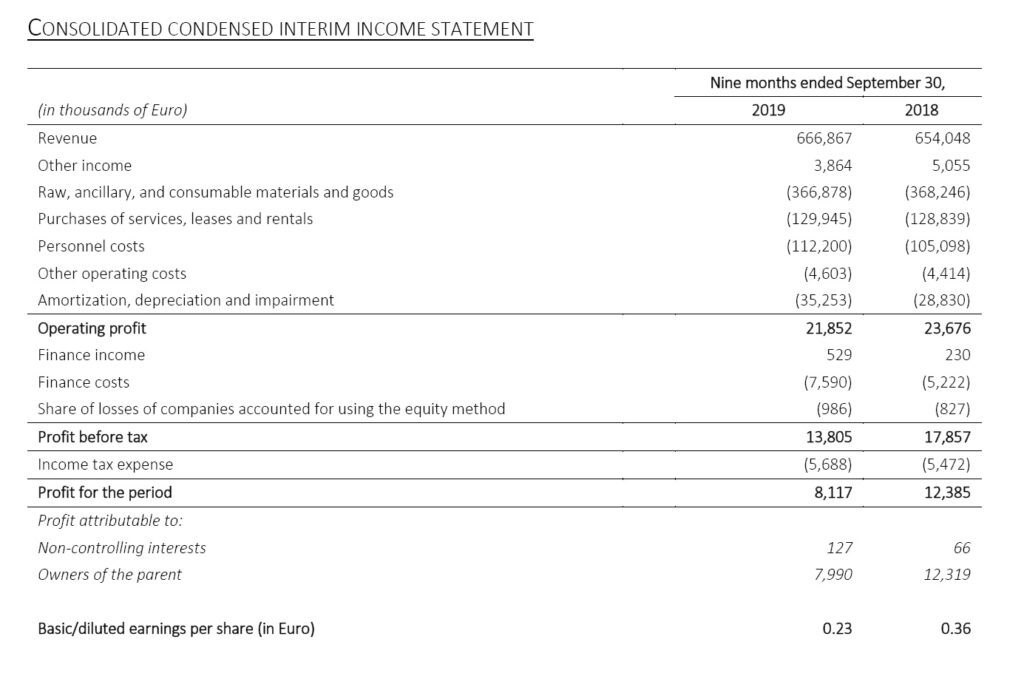

Key Figures

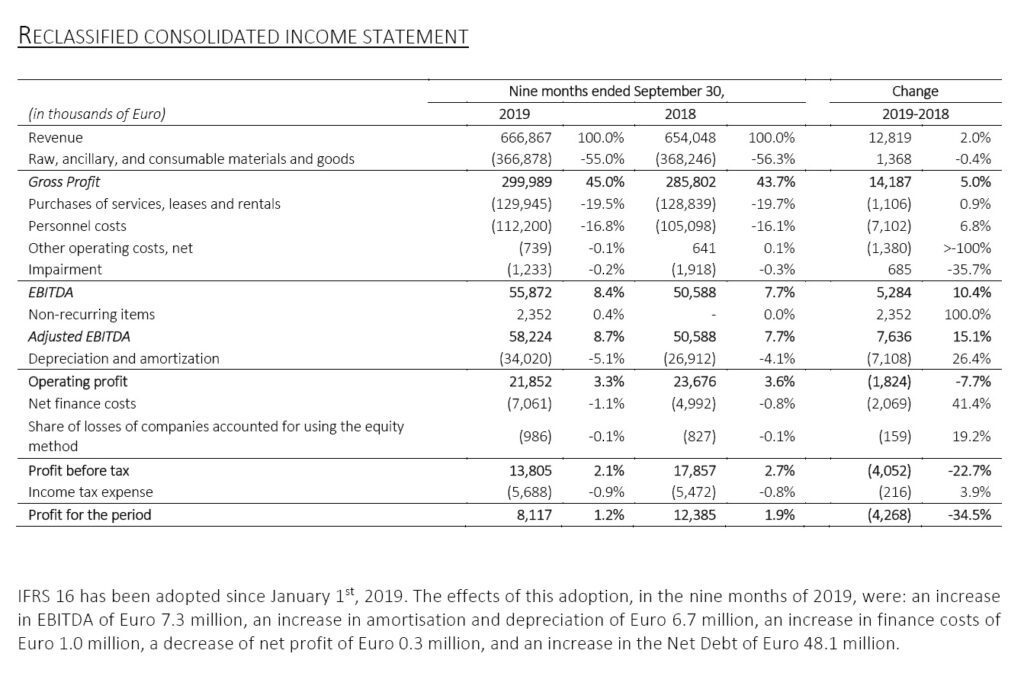

- Revenues: Euro 666.9 million compared to Euro 654.0 million in the nine months of 2018; +2.0% at current exchange rates, -0.8% at constant exchange rates. Volumes: +0.6%

- Gross Profit: Euro 300.0 million, +5.0% compared to Euro 285.8 million in the nine months of 2018 with the margin on revenues of 45.0% compared to 43.7% (+130 basis points)

- Ebitda Adjusted and excluding ifrs 16 effects *: Euro 50.9 million, +0.7% compared to Euro 50.6 million in the nine months of 2018

- Ebitda: euro 55.9 million, +10.4% compared to Euro 50.6 million in the nine months of 2018

- Net profit adjusted and excluding IFRS 16 effects *: Euro 10.2 million, -18.0% compared to Euro 12.4 million in the nine months of 2018

(*) before non-recurring items of Euro 2.4 million and excluding the effects of the adoption of IFRS 16 accounting standard. For additional information, please refer to the annex of this press release.

Massimo Zanetti, the Group’s Chairman and Chief Executive Officer, said:

“‘In the first nine months of 2019, the Group reported a growth in revenue of 2% at current forex, highlighting a progressively improving trend over the recent months. In particular, the Food Service channel recorded a solid growth in the third quarter, +7% at current forex, thanks to the positive performance in all the markets. Also the Mass Market channel reported a satisfactory performance, with the third quarter growing by 3% at current forex, driven by the positive performance of the sales mix, confirming the good results of the new products, which drove the expansion of the gross margin in a highly competitive context. This increase in the gross margin partially offset the investments in marketing and the strengthening of the commercial structures in APAC and in Europe. Looking at the rest of the year, our prospects remain essentially unchanged and we are confident that we will achieve a positive performance on the main growth indicators for the year”.

Volumes

In the nine months of 2019, the roasted coffee sales volumes of Massimo Zanetti Beverage Group S.p.A. were equal to 94.0 thousand tons, +0.6% compared with the same period of 2018. This is a result of a positive impact from Northern Europe (+0.9 thousand tons) mainly in the Mass Market channels and from the Asia-Pacific (+0.9 thousand tons) in the Private Label and food service channels. Americas was stable (+0.2 thousand tons) and the Southern Europe decreased (-1.4 thousand tons) mainly in the Mass Market channel, linked to the timing of the introduction of new Segafredo products in Italy.

Consolidated Revenues

The Group’s consolidated revenues amounted to Euro 666.9 million in the nine months of 2019 showing an increase of Euro 12.8 million (+2.0%) compared to the nine months of 2018. This increase is a result of:

- the foreign exchange rates (mainly Euro against the US dollars) had a positive impact of +2.7%

- the roasted coffee sales volumes, +0.6% compared with the same period last year

- the decrease of roasted coffee sales price (-1.3%) as a consequence of the decrease of the cost of raw material (green coffee).

Revenue for the nine months 2019 includes, for Euro 9.2 million, the impact deriving from the acquisition, done in February 2019, of the business and asset of a group of companies in Australia known as “The Bean Alliance” (“BAG”).

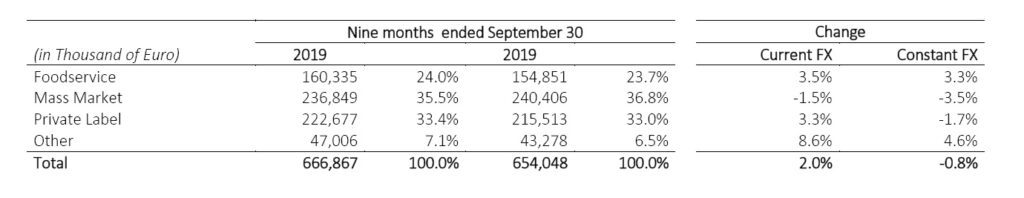

Revenues by channel

The revenues from the Food Service channel, were up 3.5% at current exchange rates, +3.3% at constant exchange rates, compared with the nine months of 2018, thanks to the performance in the Americas and in APAC and with a third quarter growing by 6.7% at current forex, increasing in all the geographical areas.

Mass Market declined 1.5% at current forex, 3.5% at constant forex, compared with the nine months of 2018. The channel showed a progressive improvement in all the geographical areas in the last quarter (+3.0% compared to the third quarter of 2018), after a first half negatively affected by the weakness of the Americas and the timing effect of the introduction of the renewed Segafredo product range in Italy. The Private Label revenues are explained by the slight decrease of roasted coffee sales price as a consequence of the reduction of the cost of green coffee.

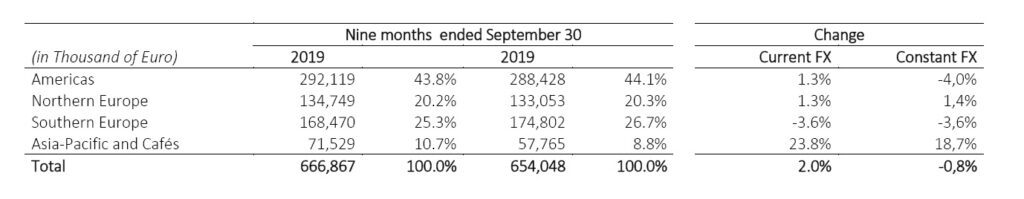

Revenues By Region

Revenue in the Americas, at Euro 292.1 million in the nine months of 2019 was down 4.0% at constant exchange rates compared with the nine months of 2018, attributable to the Mass Market channel, mainly due to the decline in the market in the cans category, the slight decline of Private Label channel, due to the slight decrease of roasted coffee sales price, partially compensated by the solid growth achieved in the Food Service channel. Revenue generated in Northern Europe, increased 1.4% at constant exchange rates compared to the nine months of 2018, showing a positive performance in all channels.

Revenue in Southern Europe decreased by 3.6% compared with the nine months of 2018, due to the sales prices adjustment in the Private Label and the timing of the introduction of new Segafredo products in the Italian Mass Market.

Asia-Pacific and Cafés, which also includes the revenue generated by the international network of cafés, posted revenue of Euro 71.5 million, with a growth of 18.7% at constant exchange rates compared with the nine months of 2018, also reflecting the recent acquisition of the Australian BAG.

Gross Profit

Gross Profit at Euro 300.0 million shows an increase of Euro 14.2 million compared with the nine months of 2018 (+5.0%). This increase is explained by the favourable impact of exchange rates (Euro 5.5 million compared with the nine months of 2018) and by the increase in Gross Profit resulting from the sales of roasted coffee and other products.

The increase in Gross Profit from the sale of roasted coffee is mainly due to the positive impact of the trends in sales and purchase prices respectively of roasted and green coffee and to the different mix in the sales channels. In percent of revenues the Gross Profit increased 130 basis points (from 43.7% of revenues to 45.0%).

Gross Profit for the nine months ended September 30, 2019 includes Euro 5.2 million deriving from the acquisition of BAG.

Ebitda Adjusted

EBITDA adjusted amounts to Euro 58.2 million compared to Euro 50.6 million in the nine months of 2018. This result was attributable to:

- the increase in Gross Profit, as mentioned above

- the increase in operating costs (of Euro 9.1 million) mainly driven by the personnel costs and costs for services, also impacted from the acquisition of BAG for Euro 3.9 million

- the positive impact of exchange rate fluctuations (Euro 0.7 million)

- and the positive impact of the adoption of the new accounting standard IFRS 16, applicable since January 1st, 2019 (amounting to Euro 7.3 million) as a result of lower costs for leased assets.

EBITDA adjusted of the nine months of 2019 excludes non-recurring costs of Euro 2.4 million, mainly related to reorganization plans launched at the subsidiaries as well as the re-launch of the Segafredo Zanetti brand in the Mass Market channel in Italy.

Operating Income (Ebit)

Operating income (EBIT) is equal to Euro 21.9 million, a decrease of 1.8 million compared to the nine months of 2018. In addition to that disclosed about EBITDA, the decrease is mainly attributable to the increase in amortization and depreciation, equal to Euro 7.1 million. This is mainly a result of the first application of IFRS 16, from January 1, 2019, that raised amortization and depreciation by Euro 6.7 million due to the new accounting of lease contracts.

Net Profit

The net profit is equal to Euro 8.1 million, a decrease of Euro 4.3 million compared to the nine months ended September 30, 2018. In addition to what was previously described for the operating profit, this increase is also due to the combined effect of:

- the increase in net finance costs Euro 2.1 million, mainly due to: i) the impact deriving from the first application of IFRS 16 for Euro 1.0 million; ii) increase in net finance costs due to the fair value on derivatives for Euro 0.5 million; iii) increase on interests expenses for Euro 0.7 million;

- the increase in the shares of losses of companies accounted for using the equity method, amounting to Euro 0.2 million;

- the increase in income taxes amounting to Euro 0.2 million.

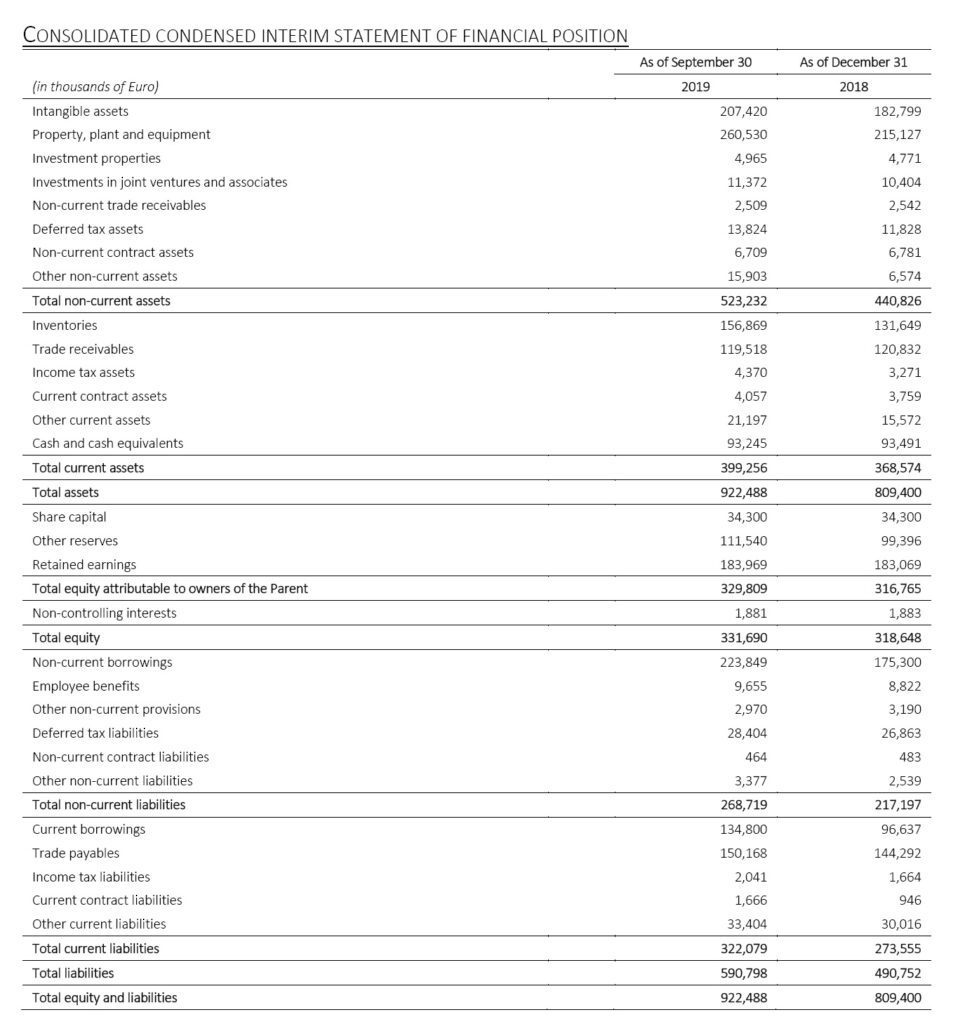

Net Debt

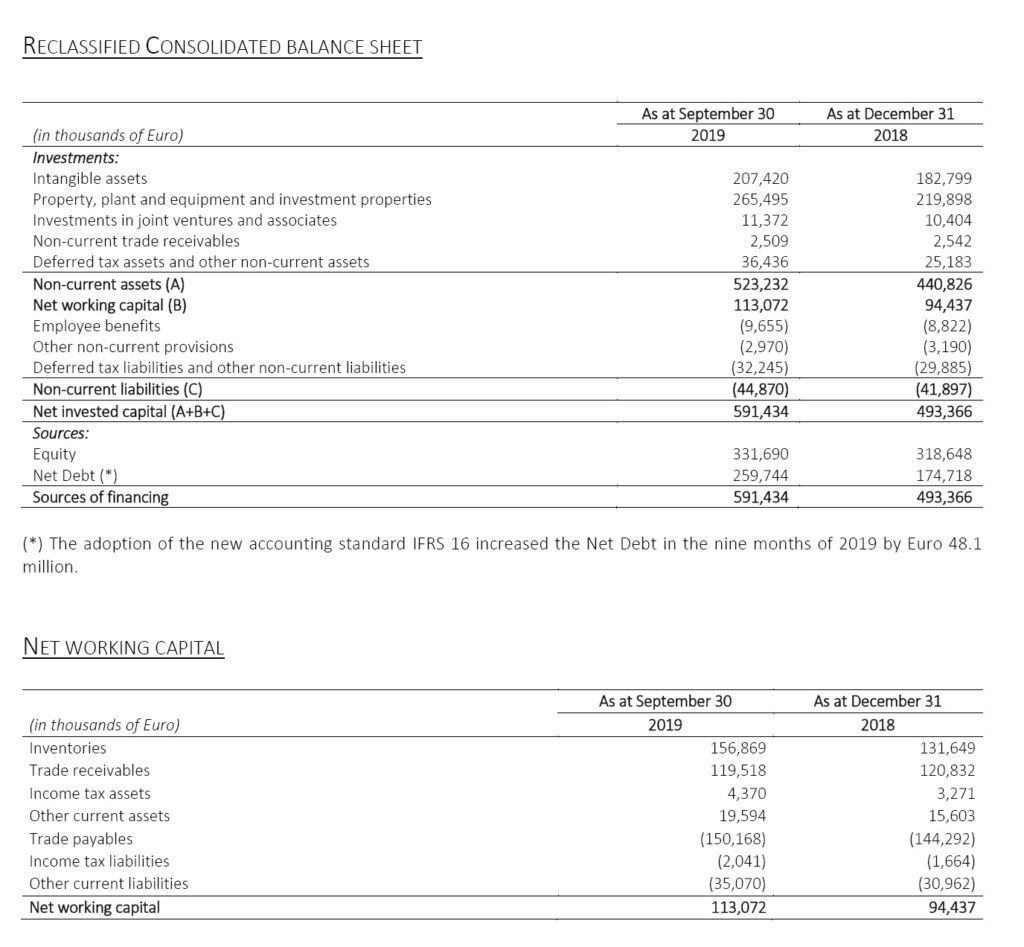

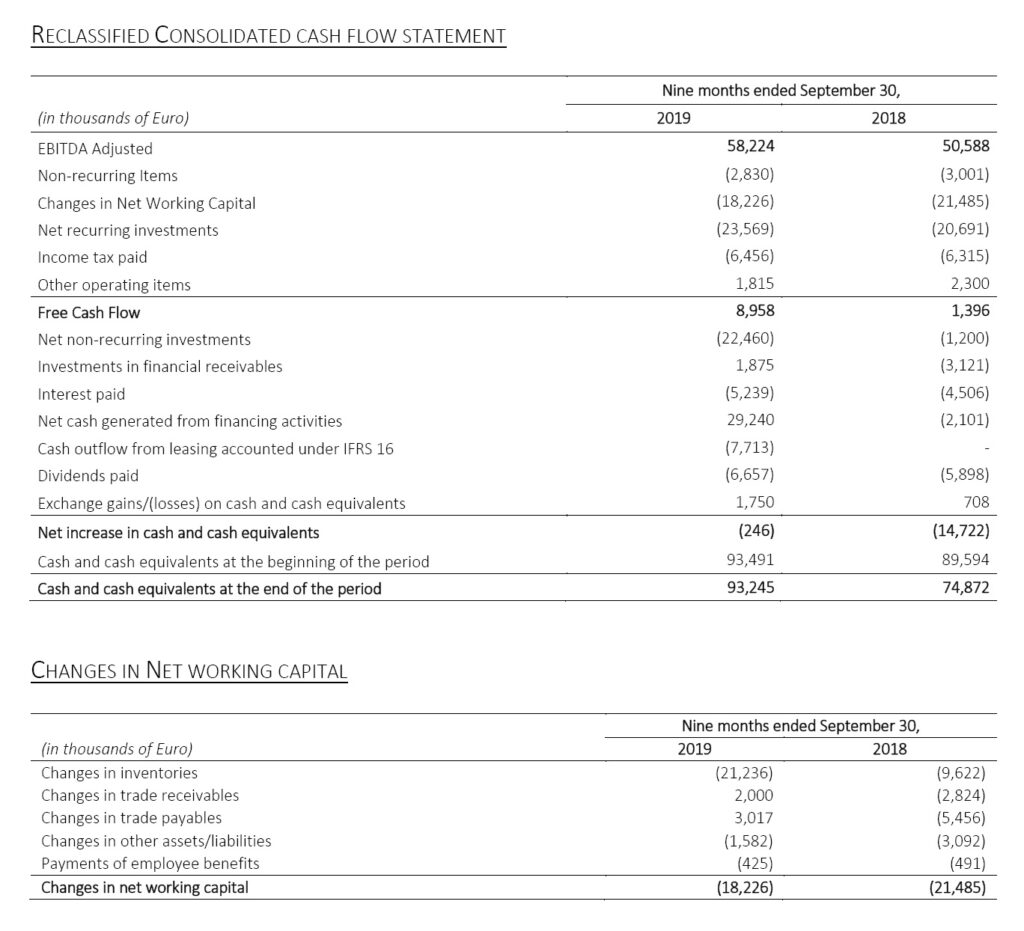

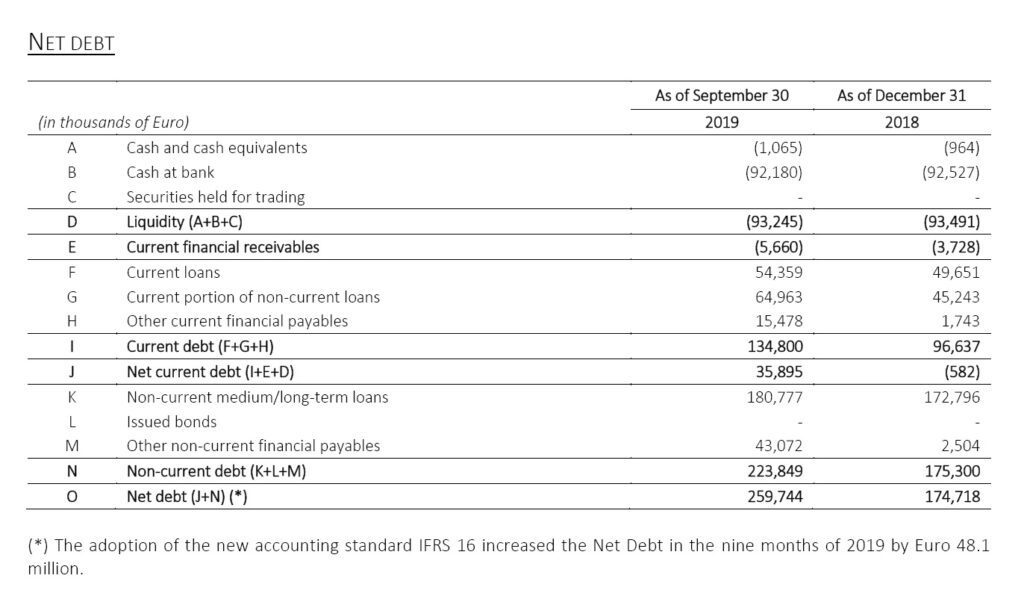

Net debt, excluding the effect of the IFRS 16 adoption, is equal to Euro 211.7 million compared to 174.7 million at December 31, 2018. This increase is mainly due to the following:

- Free Cash Flow with a positive impact of Euro 9.0 million in the nine months ended September 30, 2019;

- dividends paid amounting to Euro 6.7 million;

- interest paid of Euro 5.2 million for the nine months ended September 30, 2019;

- non-recurring investments of Euro 22.5 million in the nine months ended September 30, 2019 (these investments includes acquisitions of BAG and of the Portuguese companies Cafés Nandi SA and Multicafès Industria de Cafè) and the discounted value of potential earn-out deriving from the Australian acquisition (Euro 6.0 million).

Lastly, the adoption of the new accounting standard IFRS 16 increased the Net Debt by Euro 48.1 million. As a result, the Net Debt as of September 30, 2019, after the adoption of IFRS 16, amounted to Euro 259.7 million.

Forecast for operations and significant subsequent events

In view of the results achieved in the nine months of 2019 and considering current trends, the expectations relating to the performance of the Group for 2019, assuming the absence of extraordinary transactions, excluding those already announced in the first quarter of 2019, are as follows:

- slight increase in revenues driven by:

- the improvement in product and channel mix

- growth in volumes in line with market trends

- increase in EBITDA adjusted of approximately +1%

- net debt is expected to be around Euro 195 million.

These forecasts are assumed at constant exchange rates and exclude the impact of the application of IFRS 16.