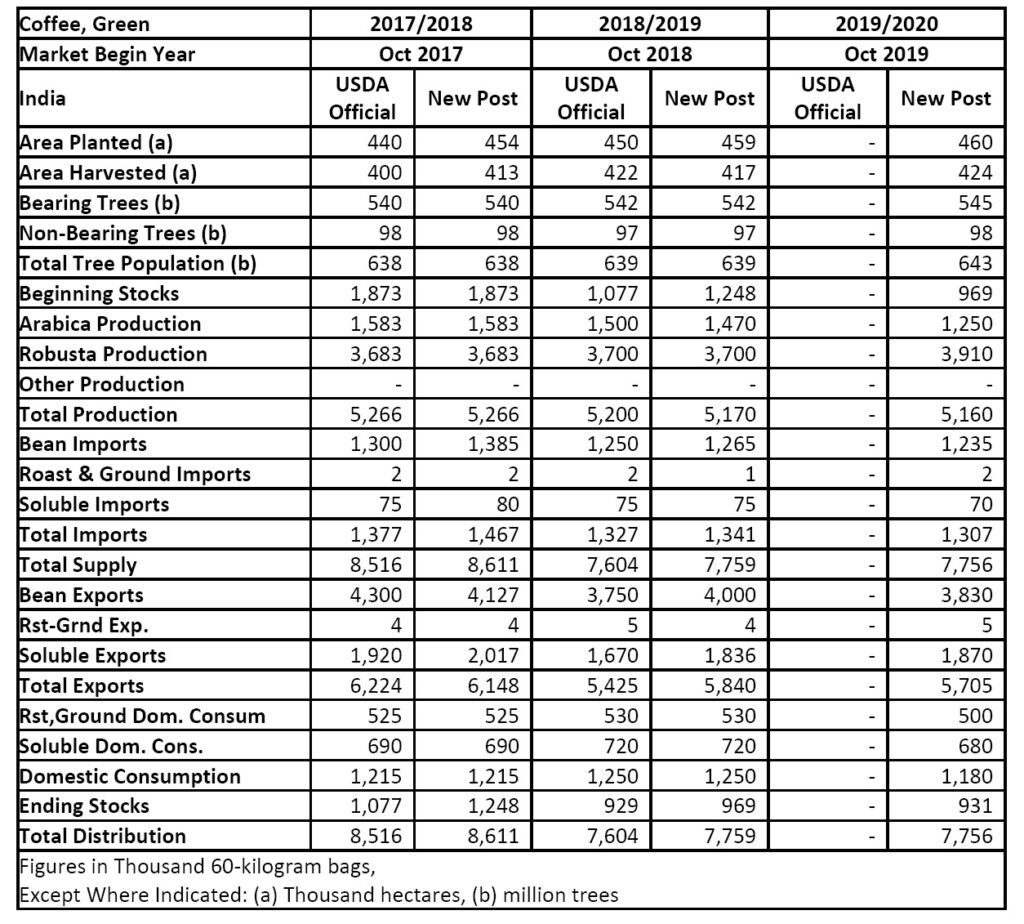

MUMBAI, India – In its semi annual report, FAS Mumbai revises its coffee production forecast for India slightly down to 5.16 million 60-kilogram (kg) bags for marketing year 2018/19 (October–September). The excessive rains during the southwest monsoon followed by additional rains during the northeast monsoon have led to low yield expectations for the Arabica crop.

Post’s export forecast is revised down by 2 percent to 5.71 million 60 kg bags as Indian bean prices are significantly higher than other competitors on the world market.

Area

FAS Mumbai revises marketing year (MY) 2019/20 planted area slightly up to 460,000 hectares with the bearing area to increase to around 424,000 hectares. The Coffee Board of India (The Board) published the planted area for MY 2018/19 at 459,895 hectares, and the bearing area was 416,741 hectares.

The area harvested and plant inventory estimates are higher compared to last year as older trees were replaced with newer trees that have since started bearing fruit.

With coffee estates in close proximity to protected forest reserves, there is limited opportunity for further area expansion.

Growers are gradually shifting towards replanting to replace their aging plantations at an annual rate of 1-2 percent per year, which leaves a difference of approximately 40,000 ha between harvested and planted area.

Generally, the first fruit is expected after the third year. According to Coffee Board of India data, the increase in coffee area is primarily occurring in the non-traditional areas of Andhra Pradesh and Northeastern Region.

Production

FAS Mumbai revises MY 2019/20 coffee crop (Oct/Sep) slightly down to 5.16 million 60- kilogram bags (309,600 metric tons or MT). Post estimates Arabica production at 1.25 million 60- kilogram bags (75,000 MT) and Robusta production at 3.91 million 60- kilogram bags (234,600 MT).

According to the Indian Meteorological Department (IMD), the coffee growing regions in south interior Karnataka and Kerala received excessive rains during southwest monsoon, followed by heavy rains in October during the northeast monsoon.

There are reports that excessive moisture has led to the emergence of rot disease in addition to berry droppings which will likely lead to yield losses, especially for the Arabica crop. Trade sources indicate rains in October caused significant damage to the coffee crop which could reduce production between 20-30 percent. In addition, other crops such as black pepper, which have become a major source of income for farmers (which helps support coffee production) are also facing record low prices, adding to the financial struggles of producers and limiting any additional investments in maintaining estates.

Inputs

Recent increases in farm input costs, along with the elimination of fertilizer and diesel subsidies have increased production costs for growers. The coffee sector provides direct employment to 664,505 workers via plantations and indirect employment to 1.3 million workers in coffee processing and other related activities.

With increasing off-farm employment opportunities, coffee planters have started experiencing shortages of skilled labor. Labor costs, which account for more than 50 percent of the cost of cultivation, continue to escalate. According to the Board’s statistics, the general daily wage rate in the state of Karnataka rose to Rs. 314 (US$ 4.44), per day. As per the Plantations Labour Act (PLA), 1951, estate owners are required to provide housing, medical facilities, insurance, and other benefits to the permanent and resident labor working at the plantations.

Policy

The coffee sector has been reliant on the Merchandise Export Incentive Scheme (MEIS) Scheme since 2015.

Exporters in India avail between two percent and seven percent of the free-on-board (FOB) value of covered exports in the form of MEIS duty credit scrip.

The scrip was transferred or used for payment of a number of duties/taxes including the customs / excise duty / service tax.

The existing scheme will continue till December 31, 2019 and will subsequently be replaced by a Scheme for Remission of Duties or Taxes on Export Product (RoDTEP) from January 1, 2020 onwards which is expected to offer better rewards than the existing MEIS scheme.

Consumption in India

The MY 2019/20 consumption forecast is 1.18 million 60-kg bags. Industry estimates coffee consumption somewhere between 1.16 million 60-kg bags and 1.25 million 60-kg bags (70,000–75,000 MT). Post’s estimate of consumption is nearly 6 percent lower than last year. This is largely driven by the slowdown in sales experienced by the largest café chain retailer in India.

This chain is under heavy financial debt and its assets will likely be sold off. Higher Robusta farm gate prices coupled with the low capacity utilization by roasters has led to limited buying in the market. Larger players are holding higher than normal stocks due to the slowdown in the market.

The Board has not published any consumption data since 2011. FAS Mumbai consumption estimates are based on industry analysis and discussions with industry stakeholders.

Stocks

There are no government-held stocks. Stocks are privately held by either producers or traders. According to the coffee board data, the domestic coffee bean farm gate prices have remained much higher than last year.

While farmers hold stocks in anticipation of expected higher prices, there is limited incentive to carry over higher stocks as production in other major coffee producing regions will likely drive international prices downwards which will directly impact the domestic prices which are aligned with international prices.

Trade

FAS Mumbai revises down MY 2019/20 exports by 2 percent to 5.71 million 60-kilogram bags. Overall, bean exports are forecast to be lower by four percent than last year, partially offset by a two percent increase in exports of soluble coffee.

Indian bean prices are currently trading at a high differential as compared to other origins. Trade sources indicate that Vietnam and Uganda are two major competitors that are attractive substitutes for international buyers.

As coffee is an export-oriented commodity, domestic coffee prices are dependent and aligned to international prices. Approximately 75 percent of Indian coffee production is exported. While Italy, Germany, Russia and Belgium remain the traditional export markets, exporters are increasingly exploring new markets for their shipments. Mangalore port remains the biggest port for coffee shipments by volume, followed by Cochin and Chennai.

FAS Mumbai estimates MY 2019/20 imports at 1.3 million 60-kilogram bags. Most of the imported coffee is destined for processing and re-export due to duty exemptions and lower overall prices. In MY 2018/19, imports of green coffee to India were dominated by Vietnam, Uganda, and Kenya.