Share your coffee stories with us by writing to info@comunicaffe.com.

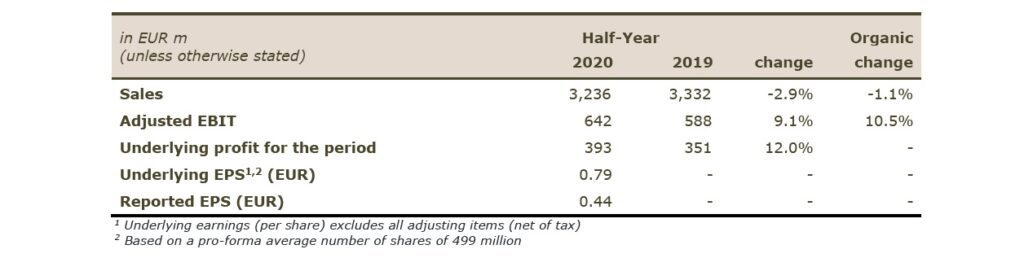

MILAN – JDE Peet’s, the world’s largest coffee and tea group by revenue, reported Tuesday half-year 2020 results that were heavily impacted by Covid-19. The owner of coffee brand Douwe Egberts and tea brand Pickwick saw its half-year sales drop by 2.9 % to 3.2 billion euros. The company said it would return to sales growth in the second half, having already seen signs in June that its out-of-home markets are starting to recover from lockdowns.

For the full year, JDE Peet’s forecast turnover growth and a 5 to 8 % profit growth.

Despite the lower turnover, the company was still able to deliver a strong performance reflecting resilience of the business and the brands.

The home segment grew by 3.7 % in Europe, JDE Peet’s most important market, and the Dutch company achieved record sales in the Old Continent.

JDE Peet’s – Key facts:

- Record in-home (CPG) sales growth driven by developed markets

- CPG performance largely offsets away-from-home

- Good recovery in away-from-home starting in June

- Adjusted EBIT organic growth of 10.5% to EUR 642 million

- Underlying profit increased by 12.0%; underlying EPS of EUR 0.79¹

- Leverage improved to 3.4x, from 4.2x at end of FY 19

- Successful completion of IPO

“JDE Peet’s delivered strong performance in the first half of 2020, demonstrating the resilience of our business and brands despite the unprecedented economic and social disruption of COVID-19” said Casey Keller, CEO of JDE Peet’s.

“Our balanced coffee and tea portfolio allowed us to quickly adapt to rapidly changing consumer habits, following the dynamic shift of cups from the away-from-home to the in-home environment. Early in the crisis, our team took proactive steps to ensure the health and safety of employees worldwide, and protect our business operations, enabling us to continue serving customers and consumers without supply disruption. Despite a volatile environment, we delivered very strong adjusted EBIT growth, reflecting our pure-play focus as well as a disciplined approach to cost management. In addition, we are well on track to meet our deleveraging goal. Starting in June, we’ve seen a good recovery in our away-from-home businesses as local markets begin to recover from lockdowns. Given our strong portfolio of products and channels, we are uniquely positioned to continue to gain market share as we pivot to meet the needs and opportunities of our customers and consumers around the world.”

JDE Peet’s – Outlook

In the first half of 2020, JDE Peet’s was affected by the outbreak of the COVID-19 pandemic, which led to unprecedented circumstances for our company, employees, customers and suppliers. “Throughout the crisis, our primary focus remained the same: the assurance of employees’ health and safety and maintaining business continuity” says the company in a statement.

“Our company and the wider coffee and tea category continued to show strong resilience during the height of the COVID-19 crisis, despite global economic uncertainty. Our global manufacturing and supply network, combined with a large portfolio of trusted brands and our strong, diversified go-to-market approach, means we are well-placed to withstand future economic uncertainties.

While uncertainty remains on the future implications COVID-19 may have on global markets, we have seen positive signs of improvement starting in June as markets began to reopen. Assuming this trend continues, we expect positive organic sales growth for FY 20. We also expect that our adjusted EBIT growth for FY 20 will be within our medium to long-term range of 5-8% with increased marketing and promotions in H2. We are well on track to reduce our leverage to below 3x net debt to adjusted EBITDA by the end of H1 21.”

1 Underlying profit (per share) excludes all adjusting items (net of tax). More information can be found in the Interim Financial Statements. Per share data are based on a pro-forma average number of shares of 499 million.

Financial Review Half-Year 2020

“In H1 20, total sales decreased by 1.1% on an organic basis. CPG sales continued to grow across segments, largely offsetting the impact COVID-19 has had on our away-from-home businesses, which represents ~25% of total sales. The organic sales growth reflects a volume/mix of -0.9% and -0.2% in price. Net acquisitions increased sales by 0.1% while foreign exchange had a negative impact of 1.8%. Total reported sales decreased by 2.9% to EUR 3,236 million.

“In H1 20, total sales decreased by 1.1% on an organic basis. CPG sales continued to grow across segments, largely offsetting the impact COVID-19 has had on our away-from-home businesses, which represents ~25% of total sales. The organic sales growth reflects a volume/mix of -0.9% and -0.2% in price. Net acquisitions increased sales by 0.1% while foreign exchange had a negative impact of 1.8%. Total reported sales decreased by 2.9% to EUR 3,236 million.

Adjusted EBIT increased organically by 10.5% to EUR 642 million driven by double-digit growth in all three CPG segments and Peet’s, offset by a decline in the Out-of-Home segment. Including the effects of foreign exchange and scope changes, adjusted EBIT increased by 9.1%.

Underlying profit – excluding non-recurring items – increased by 12.0% to EUR 393 million, due to a higher operating profit, which was partly offset by higher tax charges. Free cash flow of EUR 402 million included costs related to the IPO and higher levels of inventory required to maintain supply continuity during the COVID-19 crisis.

Net leverage improved to 3.4x net debt to adjusted EBITDA from 4.2x at the end of FY 19. We continue to make significant progress on our deleveraging priority and we are well on track to reduce our leverage below 3.0x by the end of H1 21.

Our liquidity position remains strong, with total liquidity of EUR 1,222 million consisting of a cash position of EUR 504 million and available committed RCF facilities of EUR 718 million.”

Financial Review Half-Year 2020 – By Segment

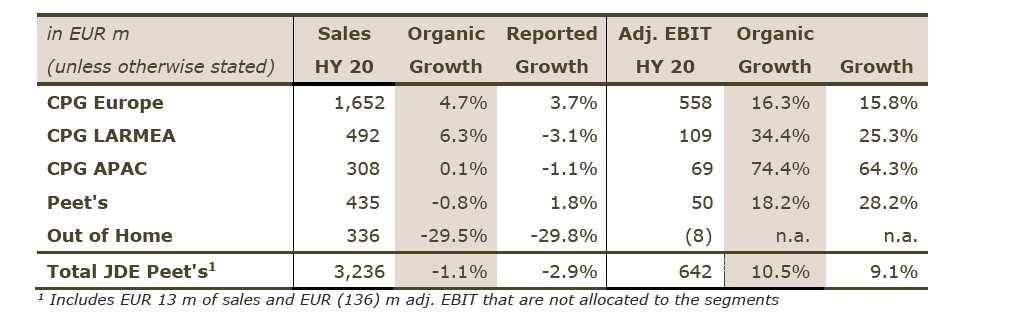

CPG – Europe

CPG – Europe

“Organic growth consisted of 5.2% volume/mix growth which was partly offset by a price effect of -0.5%. This positive volume/mix effect was largely driven by the continued success of our Beans and Single Serve offerings, as well as increased in-home consumption because of changing consumer behaviour during the COVID-19 lockdowns. Reported sales increased by 3.7% to EUR 1,652 million, including a foreign exchange impact of -1.0% mainly due to the depreciation of the Norwegian krone and the Polish zloty. Adjusted EBIT increased organically by 16.3% to EUR 558 million in H1 20, driven by higher sales and lower expenses during the COVID-19 crisis.

CPG – LARMEA

Organic growth was driven by volume/mix growth of 7.0%, which was slightly offset by a price effect of -0.8%. The volume/mix effect was driven by continued strong growth in the Single Serve and Freeze-dried instants offerings. Reported sales decreased by 3.1% to EUR 492 million, including a foreign exchange impact of -9.4% driven by the depreciation of the Brazilian real, the Russian ruble, the Turkish lira and the South African rand. Adjusted EBIT increased organically by 34.4% to EUR 109 million in H1 20, mainly driven by higher sales and lower expenses.

CPG – APAC

Organic growth consisted of a volume/mix effect of -0.2%, offset by a positive price effect of 0.3%. Australia, New Zealand and China experienced strong in-home growth during the COVID-19 crisis. The away-from-home businesses were challenged during the COVID-19 lockdowns. Reported sales decreased by 1.1% to EUR 308 million, which included a foreign exchange impact of -1.2% related to depreciation of the Australian dollar, New Zealand dollar and Singapore dollar. Adjusted EBIT increased organically by 74.4% to EUR 69 million in H1 20 largely reflecting lower operating expenses and a soft comparable basis.

Peet’s

Organic growth consisted of a volume/mix effect of -4.1% and a price effect of 3.4%. Peet’s CPG business delivered strong double-digit organic sales growth, driven by the shift to in-home consumption and the popularity of Peet’s premium Beans, Ground and Single Serve offerings. Sales in the coffee stores and away-from-home business were significantly impacted by the COVID-19 lockdowns. By the end of June, most coffee stores were open with pick-up, delivery and limited inside service. Adjusted EBIT increased organically by 18.2% to EUR 50 million in H1 20, largely driven by the growth in CPG and the transition of the ready-to-drink coffee business to a licensing partnership with Keurig Dr. Pepper.

Out-of-Home

The organic sales decline was driven by volume/mix of -27.3% and a price effect of -2.1%. The Out-of-Home segment was significantly impacted by the COVID-19. Many customer channels were closed – including offices, education, BaReCa (Bars, Restaurants, Cafes), travel and tourism. Limited service was maintained where possible in our coffee stores with pick-up and delivery. Across the business, April and May were most severely impacted by the lockdown restrictions. However, starting in June when restrictions were gradually lifted across markets, we saw good recovery. Reported sales decreased by 29.8% to EUR 336 million, including a foreign exchange impact of -1.0% and 0.7% related to scope changes. Adjusted EBIT decreased from EUR 89 million in H1 19 to EUR (8) million in H1 20 due to declining sales. We implemented furloughs and temporary lay-offs to reduce labour and operating costs. Savings in operating expenses were offset by bad debt provisions.”