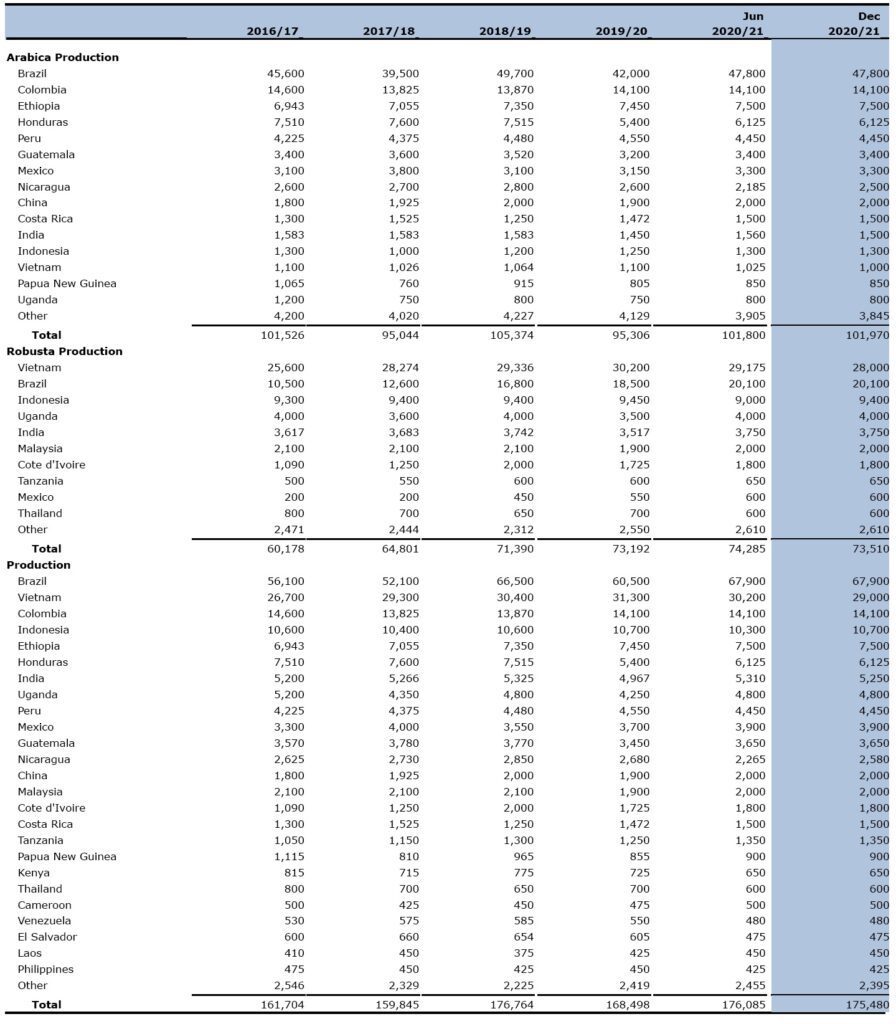

MILAN – The Foreign Agricultural Service of the United States Department of Agriculture (Usda) has issued its biannual report “Coffee: World Markets and Trade” including data on global trade, production, consumption and stocks, as well as analysis of developments affecting world trade in coffee. World coffee production for 2020/21 is forecast 7.0 million bags (60 kilograms) higher than the previous year to 175.5 million. Brazil is forecast to account for most of the gain as its Arabica crop enters the on‐year of the biennial production cycle and Robusta reaches record output.

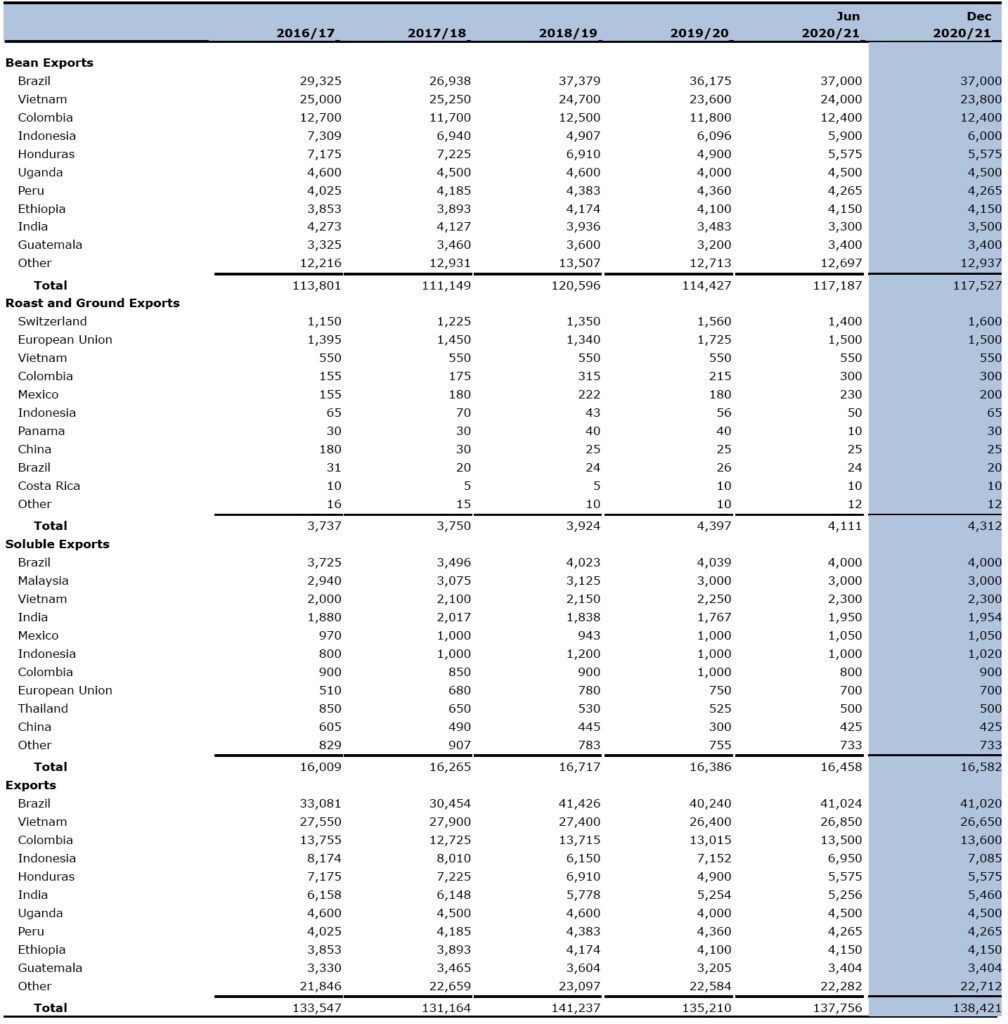

World exports are forecast higher on strong gains in Brazil, Honduras, and Colombia. Global ending stocks are expected to jump to a 6‐year high as production outpaces consumption.

Coffee prices, as measured by the International Coffee Organization (ICO) monthly composite price index, averaged $1.10 per pound in November 2020, down from the recent high of $1.16 in September 2020.

Brazil Arabica output is forecast 5.8 million bags above the previous season to 47.8 million. Good weather conditions prevailed in most coffee regions, supporting fruit setting and development and filling, thus resulting in higher yields. In addition, the majority of producing areas are in the on‐year of the biennial production cycle. Robusta production is forecast 1.6 million bags higher to a record 20.1 million.

Brazil Arabica output is forecast 5.8 million bags above the previous season to 47.8 million. Good weather conditions prevailed in most coffee regions, supporting fruit setting and development and filling, thus resulting in higher yields. In addition, the majority of producing areas are in the on‐year of the biennial production cycle. Robusta production is forecast 1.6 million bags higher to a record 20.1 million.

Abundant rainfall boosted yields in the three major producing states of Espirito Santo, Rondonia, and Bahia. Also, expansion of clonal seedlings and improved crop management techniques aided this year’s gain. Coffee traders report that both Arabica and Robusta bean size and cup quality are above historical average due to uniform blossoming followed by dry weather during the harvest.

The combined Arabica and Robusta harvest is forecast up 7.4 million bags to a record 67.9 million. Bean exports are expected to rise 825,000 bags to 37.0 million, while ending stocks are forecast to nearly triple to 5.3 million bags.

Vietnam production is forecast at 29.0 million bags, down 2.3 million from last year’s record harvest. Cultivated area is forecast unchanged from last year, with over 95 percent of total output remaining as Robusta. The beginning of the rainy season got off to a dry start, followed by below‐average precipitation in many of the major growing areas. February to May are normally dry months and coffee requires irrigation during this period to ensure proper blossom and cherry setting.

However, low coffee prices were a disincentive to incur irrigation costs, reducing yields for some growers. Vietnam’s Ministry of Agriculture and Rural Development indicated that it will direct policies to reduce coffee area by approximately 20,000 hectares to 600,000 and encourage farmers to switch to other crops where conditions are not favorable for coffee cultivation. Over the last few years, some farmers have begun to plant durian, mango, avocado, and passion fruit trees in their coffee orchards.

And with black pepper prices falling over the last 5 years, farmers are no longer replacing coffee trees with pepper. Bean exports are forecast nearly unchanged at 23.8 million bags, while inventories are expected to remain above 4 million bags for a second consecutive year.

Colombia Arabica production is forecast unchanged at 14.1 million bags on favorable growing conditions and higher yields. Bean exports, mostly to the United States and European Union, are forecast up 600,000 bags to 12.4 million. With consumption also rising, ending stocks are expected slightly lower.

Indonesia output is forecast unchanged at 10.7 million bags as lower Robusta output is offset by higher Arabica production. Delayed rains in Southern Sumatra and Java, where approximately 75 percent of the Robusta crop is grown, lowered production 50,000 bags to 9.4 million. Arabica production, situated in Northern Sumatra, had favorable growing conditions and is expected to boost output 50,000 bags to 1.3 million. Ending stocks are expected to remain elevated at 2.4 million bags as recent prices have offered little incentive to draw inventories lower. Bean exports are forecast 100,000 bags lower to 6.0 million.

India production is forecast to gain 300,000 bags to 5.3 million as favorable weather during the flowering and fruit set period is expected to improve Arabica and Robusta yields. Bean exports as well as inventories are forecast unchanged at 3.5 million bags and 900,000 bags, respectively.

Total output for Central America and Mexico is forecast up 900,000 bags to 18.3 million bags. Coffee rust remains in the region and continues to impact output. Honduras is expected to account for nearly all the region’s growth, rebounding 700,000 bags to 6.1 million on favourable growing conditions coupled with increased application of fertilizers to boost yields. Honduras accounts for about one‐third of the region’s output. Mexico and Guatemala each account for about 20 percent of the region’s output and they continue to implement programs to replace trees with rust‐resistant varieties.

Nicaragua’s production is forecast to drop a third consecutive year on lower yields due to coffee rust. Following higher production, the combined bean exports for Central America and Mexico are forecast 900,000 bags higher to 14.8 million.

Over 45 percent of the region’s exports are destined for the European Union, followed by about one third to the United States.

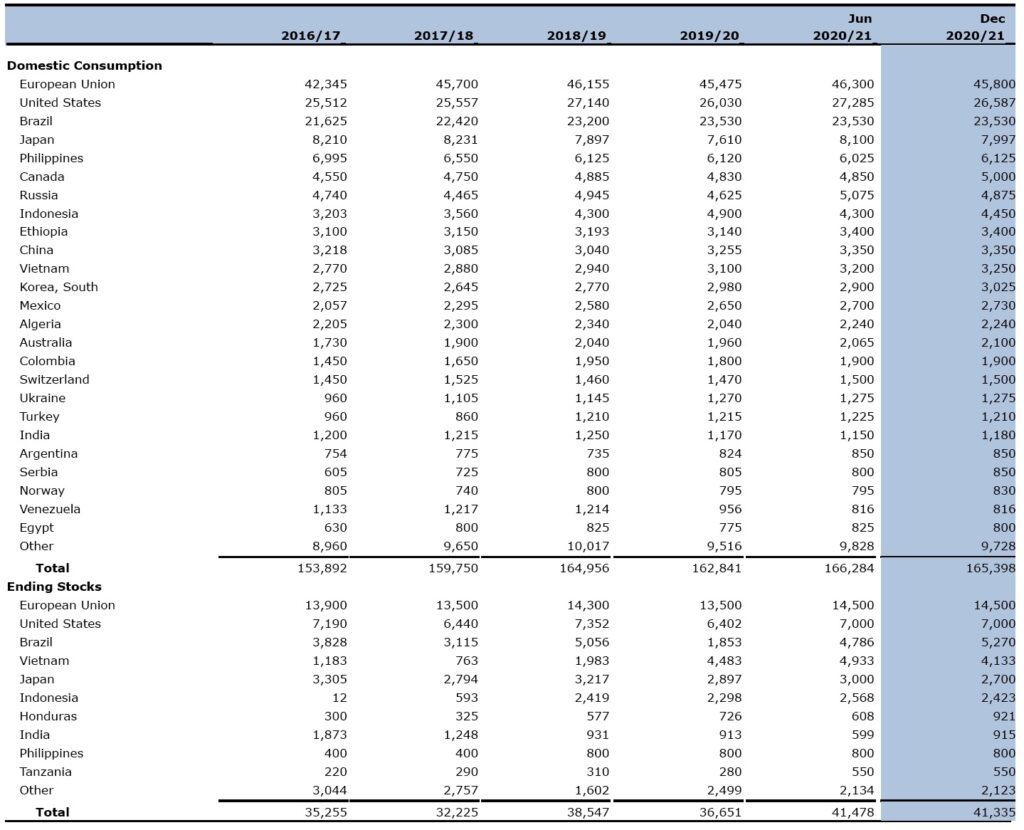

European Union imports are forecast up 1.9 million bags to 49.0 million and account for nearly 45 percent of the world’s coffee bean imports. Top suppliers include Brazil (29 percent), Vietnam (22 percent), Colombia (7 percent), and Honduras (6 percent). Ending stocks are expected to rise 1.0 million bags to 14.5 million.

European Union imports are forecast up 1.9 million bags to 49.0 million and account for nearly 45 percent of the world’s coffee bean imports. Top suppliers include Brazil (29 percent), Vietnam (22 percent), Colombia (7 percent), and Honduras (6 percent). Ending stocks are expected to rise 1.0 million bags to 14.5 million.

The United States imports the second largest amount of coffee beans and is forecast up 2.1 million bags to 26.0 million. Top suppliers include Brazil (25 percent), Colombia (22 percent), Vietnam (15 percent), and Honduras (6 percent). Ending stocks are forecast to grow 600,000 bags to 7.0 million.

World production is raised 1.6 million bags from the June 2020 estimate to 168.5 million.

- Brazil is up 1.2 million bags to 60.5 million, largely due to updated data for Arabica output.

- Colombia is 300,000 bags higher to 14.1 million on higher yields.

World bean exports are up 2.4 million bags to 114.4 million.

- Brazil is raised 3.5 million bags to 36.2 million on updated trade data.

- Honduras is down 600,000 bags to 4.9 million on reduced exportable supplies.

- Vietnam is lowered 400,000 bags to 23.6 million as farmers added to stocks.

World bean imports are lowered 1.0 million bags to 108.7 million.

- The United States is down 1.1 million bags to 23.9 million on lower consumption.