Share your coffee stories with us by writing to info@comunicaffe.com.

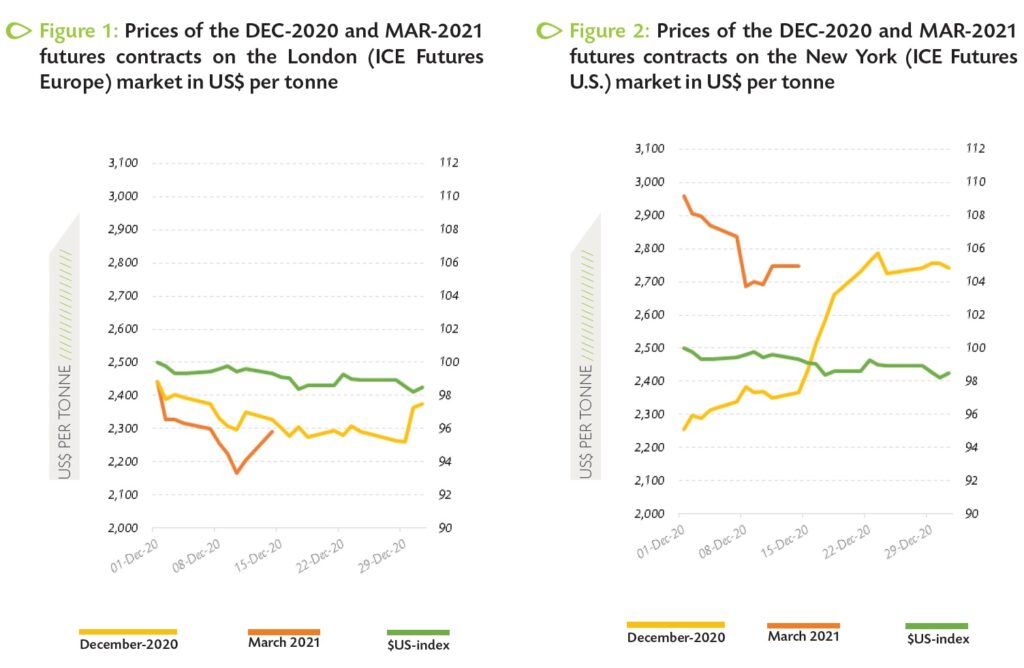

ABIDJAN, Côte d’ivoire – This review of the cocoa market situation provides a brief on the December-2020 (DEC-20) and March-2021 (MAR-21) futures contracts prices listed on ICE Futures Europe (London) and ICE Futures U.S. (New York) during the month of December 2020. It aims to highlight key insights on expected market developments and the effect of the exchange rate on the US-denominated prices of the said contracts. Figure 1 and Figure 2 show the price developments respectively on the London and New York futures market at the London closing time.

Both figures include the evolution of the US dollar index to highlight the impact of the strength of US$ dollar on the US$-denominated cocoa futures prices.

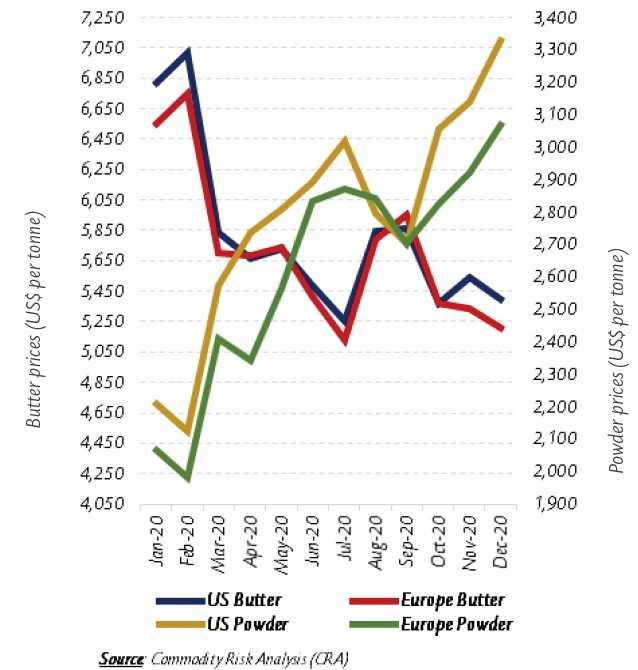

Finally, Figure 3 presents monthly averages of the six-month forward prices for cocoa butter and powder in Europe and the United States since the beginning of 2020.

During the month of December, the DEC-20 contract was in contango in London (Figure 1), whereas the same contract was trading in backwardation in New York (Figure 2). In the latter market, the premium was an incentive to increase the volumes of certified stocks, which had declined from an average of 20,909 tonnes during the first two weeks of December 2019 to 14,814 tonnes a year later.

During the month of December, the DEC-20 contract was in contango in London (Figure 1), whereas the same contract was trading in backwardation in New York (Figure 2). In the latter market, the premium was an incentive to increase the volumes of certified stocks, which had declined from an average of 20,909 tonnes during the first two weeks of December 2019 to 14,814 tonnes a year later.

Furthermore, the share of Ivorian cocoa beans in the ICE U.S. licensed warehouses dwindled year-on-year by 62% from an average of 15,649 tonnes to 6,007 tonnes over the same period.

In terms of price developments, futures markets were bearish during the period 1-14 December. This downward trend was fueled by persisting worries on the demand for cocoa products in Europe and North America.

Thereby, the DEC-20 contract prices weakened on both sides of the Atlantic, declining by 6% from US$2,441 to US$2,291 per tonne in London and by 7% from US$2,960 to US$2,747 per tonne in New York.

Moving on to the last two trading weeks, the prices of the MAR-21 contract ranged between US$2,261 and US$2,374 per tonne, with an average of US$2,299 per tonne in London, while in New York, they improved by 13% from US$2,433 to US$2,743 per tonne.

Over the same time frame, cumulative arrivals of cocoa beans were lower year-over-year in Côte d’Ivoire on 27 December by 3.3% from 1.098 million tonnes to 1.062 million tonnes and below-average rainfall were recorded in West Africa’s cocoa producing regions.

At the end of 2020, the annual average price of the front-month contract in London had merely decreased by 0.2% compared to the previous calendar year as seen in Table 1. During the same period in New York, the average of the nearby contract prices strengthened by 6% year-on-year.

The annual average US-denominated ICCO daily price was US$2,367 per tonne, up by 1% compared to the level reached the previous year. The average of the ICCO daily price denominated in Euro decreased by 1%, settling at US$2,077 per tonne over the same period.

Movements of cocoa futures and cocoa butter prices are generally positively correlated, whereas the inverse occurs with cocoa powder prices. Figure 3 below shows that, compared with the average prices recorded at the start of the year 2020, prices for cocoa butter were down by 20% in Europe and by 21% in the United States during December.

Movements of cocoa futures and cocoa butter prices are generally positively correlated, whereas the inverse occurs with cocoa powder prices. Figure 3 below shows that, compared with the average prices recorded at the start of the year 2020, prices for cocoa butter were down by 20% in Europe and by 21% in the United States during December.

Indeed, prices for cocoa butter dropped from US$6,824 to US$5,395 per tonne in the United States, while in Europe they deteriorated from US$6,549 to US$5,209 per tonne.

Indeed, prices for cocoa butter dropped from US$6,824 to US$5,395 per tonne in the United States, while in Europe they deteriorated from US$6,549 to US$5,209 per tonne.

On the contrary, compared to the levels reached in January 2020, cocoa powder prices hiked on both markets, up by 51% from US$2,207 to US$3,327 per tonne in the United States. Over the same period in Europe, powder prices increased by 48% from US$2,067 to US$3,068 per tonne.

The decline in processing activities as a result of the COVID-19 pandemic continued to sustain the downward trend in cocoa beans and butter prices.

Furthermore, compared to their average values recorded during January 2020, the nearby cocoa futures contract prices were discounted by 9% from US$2,516 to US$2,293 in London at the end of December 2020.

In New York, prices of the cocoa contract first position marginally decreased by 0.1% from US$2,675 to US$2,672 per tonne over the same period.