Share your coffee stories with us by writing to info@comunicaffe.com.

MILAN, Italy – SCA Sustainability Director, Andrés Montenegro, writes an “after action review”[1] on the SCA’s Equitable Value Distribution Survey tool, offering insights into its process, highlighting key elements from its results, and providing early insights into how these results will impact the SCA’s Sustainable Coffee Agenda. Below we report Montenegro’s analysis published for the SCA magazine 25.

The SCA’s Equitable Value Distribution Survey tool

“When we launched a Specialty Coffee Association (SCA) survey on equitable value distribution in April 2023, our goal was simple: what do we know—or think we know—about this key concept that could help us address the root cause of sustainability challenges faced by the global specialty coffee sector?

We also wanted the survey to supplement the prevalent technical approaches used in value distribution research, which focus mostly on monetary/economic analysis, with a methodology that focused on “sense-making.” A sense-making methodology is a practical tool for informing collective perceptions towards a shared understanding, and it also generates action(s) that can more effectively address the corresponding topic. The results of this initial survey serve as a “baseline,” allowing us to measure change over time, but also function as a lightning rod to focus and direct the industry’s ongoing dialogue.”

What’s the strategy?

“After concluding its year-long Price Crisis Response Initiative (PCR) in December of 2019, the association published a Summary of Work[2] that proposed the SCA was best placed to support the sustainability of the industry by focusing on equitable value distribution across six different leverage points. In 2023, these were synthesized into a single Sustainable Coffee Agenda theory of change,[3] which focuses the SCA’s activities on shaping mindsets and business behaviors in order to foster equitable value distribution as a sustainability tool.

This “theory of change” framing gives us an opportunity to measure and track whether we are successful in this goal. Before we could begin, however, we needed a baseline that would help us understand the dominant mindset of the industry. Therefore, we designed and launched the first iteration of a survey tool that will help measure perceptions of value distribution in the present and track them over time. This has two outcomes. First, the results of the survey will help us to track shifts and changes to these mindsets over time. Second—and perhaps more importantly—the survey itself, as well as the conversations it provokes throughout the process, could serve to expand our collective understanding of what “equitable value distribution” means to different stakeholders in the specialty sector. Having a pulse on these perceptions will ensure that the conversations and actions that the association proposes to the industry are relevant to the value chain participants who are faced with (and ultimately make) choices every day about what kind of business and relationships to build.”

How did it work?

From inception, the SCA focused on building a survey mechanism that was balanced and salient. In other words, we prioritized an unbiased and fair survey process that would yield relevant results to coffee sector actors. For the tool to provide comprehensive and trustworthy information gathered from our diverse and large coffee system, especially on an ongoing basis, the survey itself needed to be simple and reliable.

Based on sense-making theory, the survey was designed to help us understand and articulate the gap that exists between our ability to strategize solutions and implement them, sometimes referred to as the “knowing– doing gap.” (Much has been written about this gap in the realm of sustainability particularly, like Theory U[4] and The Responsible Business.[5])

We expected there to be a gap between perceptions of how coffee value is versus how it should be distributed, but we didn’t know how big that gap might be (if our hypothesis was correct) or what other insights could emerge as part of the analysis.

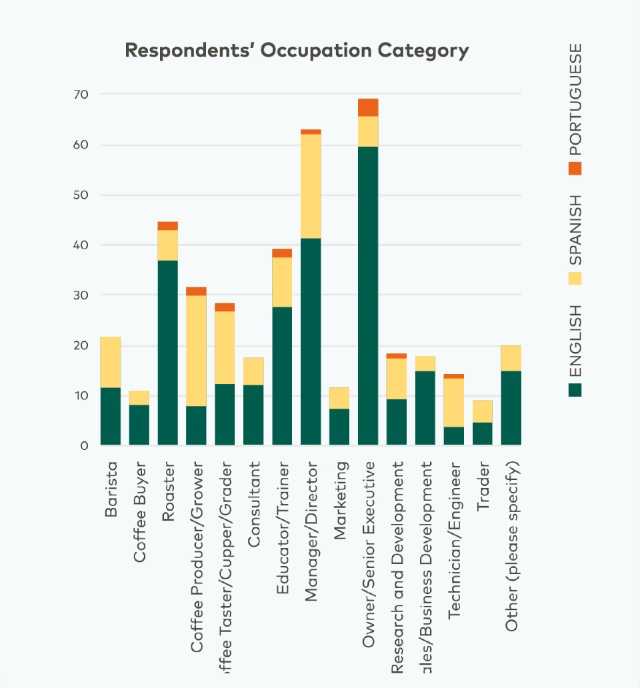

A total of 406 responses were received in English, Spanish, and Portuguese. However, attrition occurred in all languages (i.e., not all participants answered all questions). Respondents represented a total of 58 countries and had an average of 12.5 years of professional experience.

The primary occupations were in activities involving roasting and brewing, followed by traders (exporting and importing), and production (farming and processing), but every role in the supply chain that was included as an option in the survey was selected.

Across its four sections,[6] the survey used questions to help participants understand and articulate their experience of highly complex or uncertain situations. Survey responses were collected between April 21 and June 30, 2023. With the support of ANACAFÉ, we supplemented the survey with a focus group comprising 16 coffee producers in Guatemala during the 2023 Congreso de la Caficultura in July. This provided additional insight from producers on value distribution and complemented the results of the broader online survey.

What did we learn?

“One of the first questions the survey asked respondents was to self-assess their own familiarity with the concept of equitable value distribution, with most respondents (76%) reporting moderate to significant familiarity. This could be seen as a surprising result: if we understand equitable value distribution so well, what is hindering us from implementing that knowledge?

One potential explanation, which comes from social development studies, is based on the difficulties of scaling solutions from the individual to the collective. Referred to as the “internal vs. combined capabilities challenge” by Professor Martha Nussbaum,[7] this possible explanation suggests that making decisions or choosing options to solve the problem are more difficult at a collective level when the conditions for alignment or agreement are more complex.

In other words, individual understanding does not automatically translate to collective action. If this is the case, it suggests that we should find ways to leverage or adapt existing collective platforms or structures to turn this knowledge into action. An alternative explanation could simply be that we are overreporting our familiarity with a complex subject (i.e., we don’t know what we don’t know).

Beyond speculation, the comparatively small number of responses to the survey may be relevant. (A similarly disseminated survey by the SCA on the cupping form and protocol in 2020[8] garnered over 1500 responses, compared to this survey’s 400 responses.) This small response rate, combined with the attrition rate across some questions, strongly suggests that the topic is still on the fringe of mainstream sustainability conversations, even though these industry actors express great confidence in their knowledge of value distribution.

We did indeed find a gap between perceptions of how coffee’s value is currently distributed compared to how it should be distributed by asking respondents to respond to both statements using a sliding point scale, with 0 representing “totally inequitable” and 100 representing “totally equitable.” On average, respondents reported a gap of more than 54 points, with a median (middle data point of all the gaps) of 64 points.

Later, respondents were also asked to rate their level of agreement with the statement that “coffee value need[s] to be more equitably distributed in the coffee sector” on a scale from 0 points (“totally disagree”) to 100 points (“totally agree”). The average response was 89.4 points (totally agree). Although it’s possible to interpret this in a negative sense—we know so much, yet we do so little!—this is actually a sign of hope. As a sector, we have already established an implicit and collective perception that our “business as usual” does not reflect our higher aspirations of what a truly sustainable and distributive coffee sector could and should be.

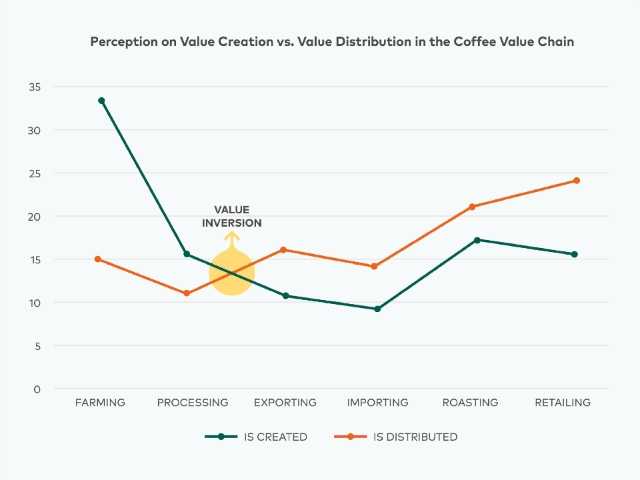

In the survey report, we used Robert Fritz’s creative tension model[9] to understand how the gaps between the current reality and an aspirational vision can take shape in a system: the higher the gap, the higher the level of tension. Applying this approach, responses to the survey indicate that tension between value creation and distribution in the coffee system increases at both “ends” of the value chain, with an inversion in the gap occurring at the exporting stage (see Figure 3). In simple terms, respondents believe that more value is created by actors upstream (closer to and including producers), while more value is distributed to actors downstream.

In the focus group activity conducted with ANACAFE in Guatemala, however, participants—coffee producers—generally reported that consumers were more likely to care about equitable value distribution than were exporters or roasters.

These examples of the gap between our perceptions of how our sector currently operates and our aspirations for how it will operate suggest that more actionable opportunities, models, and incentives to apply this concept to businesses are needed.

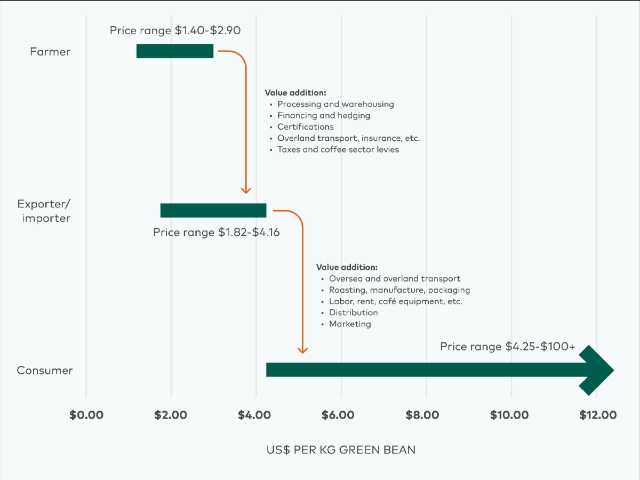

For example, in the focus group activity, participants identified four key opportunities for more equitable distribution of value to producers: (a) market diversification and local consumption; (b) farm profitability and value creation (on and off farm); (c) access to information about coffee quality and market trends; and (d) risk sharing and supply chain transparency. This likely also requires evolving the ways we interact both within our organizations and collaboratively within the sector. Such an evolution would enable an ecosystem that nurtures new ways of conducting green coffee trading and businesses, but also a clearer articulation of the role of each actor in the coffee value chain and the value they create.

What Comes Next?

Over the coming year, we’ll use these survey results to frame conversations about equitable value distribution, industry perceptions, and ways in which the concept could be better integrated into activities and business models. Through these conversations, our hope is to supplement this year’s results with additional focus group activities and to understand what changes we may want to make to the next iteration of the survey, which will take place in 2025.

In particular, we intend to expand the focus group activity we developed jointly with ANACAFE in Guatemala to involve producers and their experiences (usually underrepresented in and excluded from conversations about value) to additional actors. We are particularly interested in understanding if all groups perceive themselves as caring the most about equitable value distribution—including consumers—and whether or not they feel more closely aligned with actors who are further or closer to them in the chain.

We will also incorporate the four key opportunities identified by the focus group into the SCA’s sustainability agenda activities, particularly “access to information about coffee quality and market trends.” Sharing information is not only important for building trust—it can also add to the value of the coffee being sold.

The role of intangible assets in the modern economy[10] represents another area of potential opportunity, and the Extrinsic Assessment section of the SCA’s Coffee Value Assessment is one tool that can be used to begin to catalogue those “intangible” attributes that, along with flavor attributes, differentiate specialty coffee from commodity coffee.

Although more research is needed to quantify the value of different types of extrinsic attributes like certifications and post-harvest processing techniques, the idea that this information is part of what makes a coffee (or coffee experience) worth more has been repeatedly proven to be true by studies of preferences like the one conducted every year since 1950 by the National Coffee Association of the USA.[11]

This suggests that there is untapped potential both for additional value creation and for consumers to recognize and reward producers for the intangible assets that contribute to the value of the (tangible) coffee product. This is especially so if information about consuming markets is accessible to and actionable for producers. We will remain committed to providing a deeper and actionable understanding of value distribution and measurement, and jointly with the Coffee Science Foundation we will continue to seek funding and research partners to design a learning agenda that informs the specialty coffee community on pathways to better understand and innovate in this area.[12]

Understanding the current thinking of the specialty coffee industry is a necessary first step to evolving business models and trading systems in an inclusive way. In this global, diverse industry, it’s more dangerous than ever to make assumptions that everyone agrees about something without first asking for their input: complex sustainability problems require complex solutions.

Sustainability in the coffee sector should be thought of in terms of a trajectory rather than an absolute state: its scope may be vast and daunting, but the rules and systems we live by were created by people. Once we accept this, we can find courage to contemplate how we, the specialty coffee industry of the present, can change them.”[13]

References

[1] An “After Action Review,” or AAR, is a recognized learning process developed to help teams learn quickly from emerging experiences by actively discussing four questions: (1) What did you intend to accomplish? (2) What did you accomplish? (3) How—and why—are these things different? (4) What adaptations or changes are required?

[2] Specialty Coffee Association (SCA), Price Crisis Response Initiative: Summary of Work (December 2019), available digitally at https://bit.ly/pcrsummary. Learn more at https://sca.coffee/pricecrisis

[3] Andres Montenegro, “Our Sustainability Agenda: Making Coffee Better, for All,” 25, Issue 19 (SCA: London, April 2023), available digitally at https://sca.coffee/sca-news/

[4] C. Otto Scharmer, Theory U: Leading from the Future as It Emerges, 2nd edition (Oakland, CA: Berrett-Koehler Publishers, 2016).

[5] Carol Sanford, The Responsible Business: Reimagining Sustainability and Success, 2nd edition (Edmonds, WA: InterOctave, 2020).

[6] Introduction, definitions, and demographics; perception of value distribution (general); perception of value distribution (specific activities); quantitative and qualitative benchmarking.

[7] Martha C. Nussbaum, Creating Capabilities: The Human Development Approach (Cambridge, MA: Harvard University Press, 2011).

[8] SCA, Understanding and Evolving the SCA Coffee Value Assessment System: Results of the 2020–2021 Cupping Protocol User Perception Study and Proposed Evolution (August 2022).

[9] Robert Fritz, The Path of Least Resistance: Learning to Become the Creative Force in Your Own Life (Wordzworth Publishing, 2023).

[10] Luis F. Samper, Daniele Giovanucci, and Luciana Marques Vieira, “The powerful role of intangibles in the coffee value chain,” Economic Research Working Paper No. 19, World Intellectual Property Organization-WIPO (November, 2017).

[11] National Coffee Association, National Data Trends Study, https://www.ncausa.org/

[12] The CSF is currently seeking funding to underwrite a foundational research project that will address how we can measure value and its distribution along the supply chain as well as how value that is generated relates to costs and investments made at each node of the supply chain. Learn more: https://coffeescience.

[13] Adam Grant, Originals: How Non-Conformists Move the World (New York, NY: Penguin Books, an imprint of Penguin Random House LLC, 2017).