LONDON, UK – The coffee market in June was characterised by high volatility ultimately resulting in a sideways move of coffee prices. While the monthly average of the ICO composite indicator prices was down 2.4% to 122.39 US cents/lb, the difference in price between the opening and the end of the month was minimal.

In the first two weeks of June, the daily price of the composite indicator remained in a relatively narrow band of 122.11 to 124.55 US cents/lb.

Subsequently prices dropped significantly, with the indicator price reaching its low of 116.51 US cent/lb on 22 June.

The price recovered, making up for virtually all the losses and recorded 123.83 US cents/lb on 30 June, marginally higher than at the beginning of the month.

The breakdown by group indicators reveals that an increase in Robusta prices, especially in the second half of June, buffered a drop in prices of the Arabica Groups, preventing the composite indicator price from turning even more negative.

Robustas recorded a strong increase, up by 3.6% compared to the previous month and returning above the 100 US cents/lb mark, following reports about thinning exports from Vietnam.

All three Arabica groups in turn registered significant drops as the average prices for Colombian Milds, Other Milds and Brazilian Naturals were down 3.5%, 4.5% and 5.7%, respectively.

As a result of the opposing trends in Arabica and Robusta quotations, the arbitrage, as measured on the New York and London futures markets, decreased significantly by 22.2% to 35.07 US cents/lb, the narrowest level since April 2008.

Meanwhile intra-day volatility of the ICO composite indicator price has remained unchanged at 6.9%.

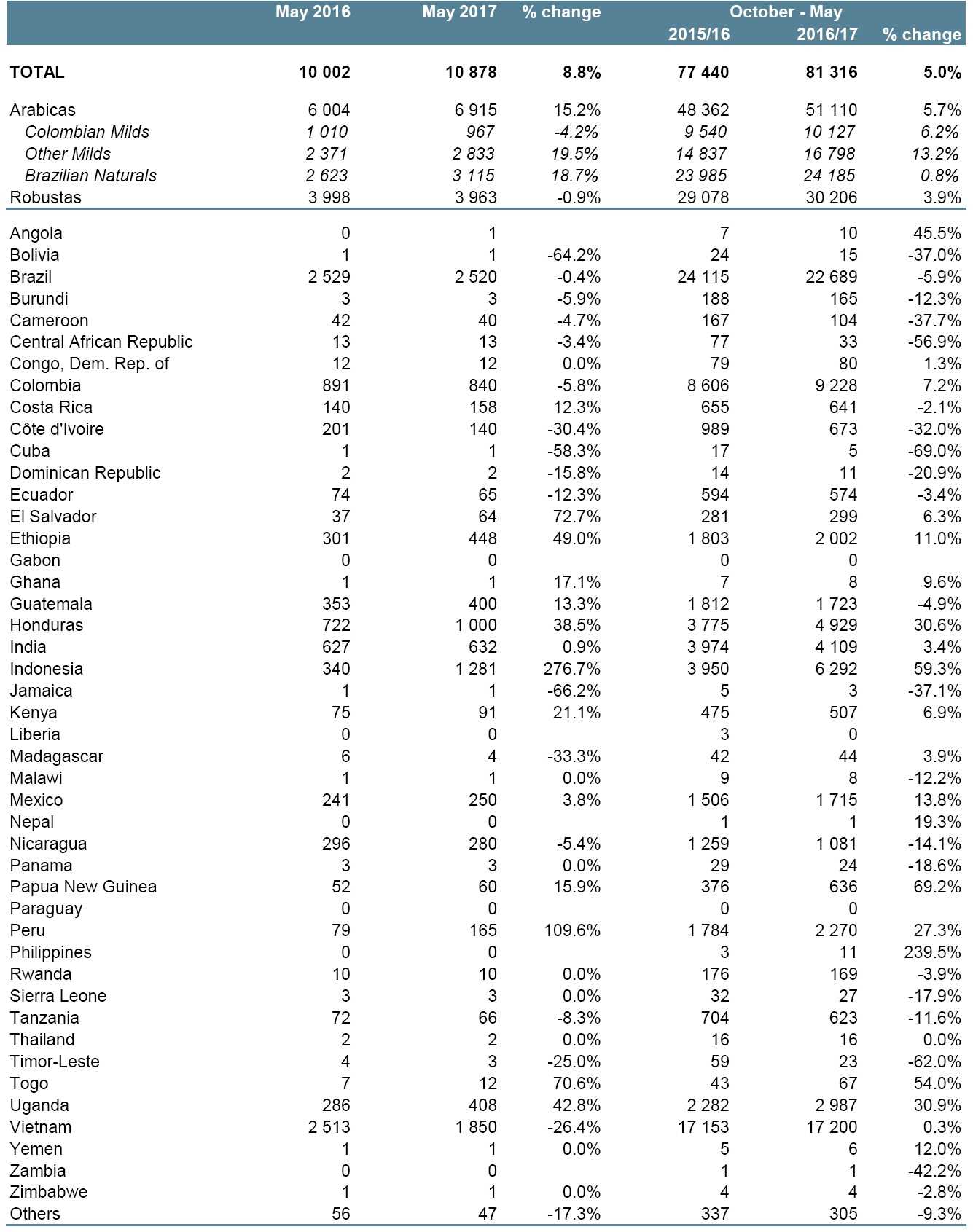

Total exports in May came to 10.9 million bags, 8.8% higher than May 2016. During the first eight months of coffee year 2016/17 total exports are 3.9 million bags higher than last year, when shipments amounted to 77.4 million bags.

Exports by Brazil have declined for two consecutive years and are 22.7 million bags in 2016/17, down 5.9% compared to the previous year.

However, the decrease was lower than expected despite the relatively poor harvest, as exporters drew heavily on existing stocks.

Furthermore, the reduced Brazilian export volume could be compensated by shipments from other origins. Notably, Colombia, Ethiopia, Honduras, Indonesia, Peru and Uganda are positioned to potential supply gap.

As the national authorities’ renovation programmes continue to bear fruit, Colombia has increased exports up to 9.2 million bags, 7.2 % more than in the October-May period last year. Indonesia recorded an impressive 2.3 million bag increase (+60%) compared to the previous year, while Honduras’ exports were 30% higher than in 2015/16.

Shipments from Vietnam are estimated to have decreased by more than a quarter from 2.5 million bags in April 2017 to 1.9 million bags in May.

Reports suggest that coffee exporters now see their local supply increasingly squeezed due to the previous small crop.

Nevertheless, the October-May exports are estimated at slightly above 17 million bags, similar to the previous year.

As a result of high export volumes so far during this coffee year and the build-up of large inventories in importing countries, the market remains well supplied.

As a result of high export volumes so far during this coffee year and the build-up of large inventories in importing countries, the market remains well supplied.

The sudden drop in prices during the third week of June seems to have been triggered by co-movement of coffee and other soft commodities, as some reports about technical selling suggest.

However, moving into the month of July, there is still a residual risk of frost in Brazil potentially affecting the outlook for the next crop.

Similarly, possible outbreaks of coffee leaf rust in countries such as Honduras may raise supply concerns in the market.

Download the full report at this link.