MILAN, Italy – The Board of Directors of Autogrill S.p.A., which convened yesterday (March 10), has reviewed and approved the consolidated results at 31 December 2021, including the consolidated Non Financial Information Declaration 2021 and the annual report in ESEF format.

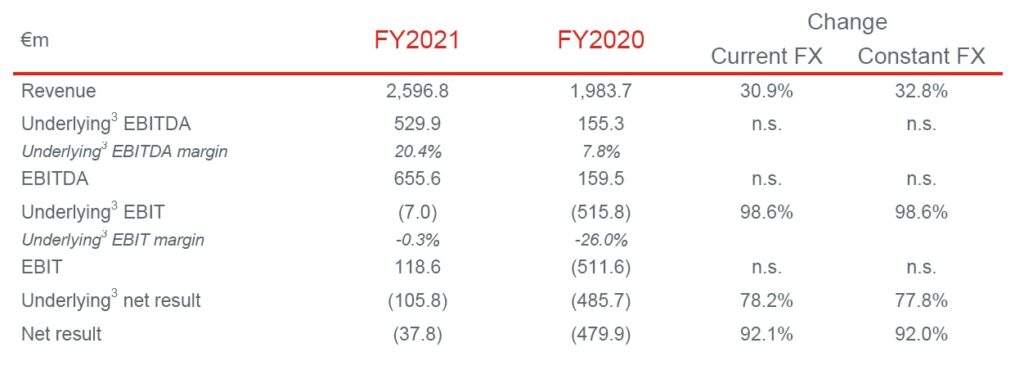

The Group reported a revenue of €2.6bn, up 32.8% at constant1 exchange rate (+30.9% at current exchange rate) and like for like2 performance of +39.0% in FY2021, with continuous improvement during the year

The underlying3 EBIT was -€7.0m in FY2021 (-€515.8m in FY2020) benefitting from initiatives implemented over the year, including better product mix, higher operating efficiency and rent renegotiation.

The Group also reported:

- Net result of -€37.8m in FY20214 (-€479.9m in FY2020)

- Free cash flow5 of €117.0m in FY2021 (-€500.9m in FY2020) excluding the impact of non-recurring transactions in North America, well above initial expectations thanks to continued cost efficiency, capex reduction and positive net working capital evolution

- Net financial indebtedness excluding lease receivables and liabilities of €197.4m as of 31 December 2021 (€1,082.7m as of 31 December 2020)

- Liquidity: approximately €1.0bn in cash and available credit facilities at the end of the year

- New wins and renewals: approximately €4.3bn6, mainly related to the extension of existing contracts

- Trading update: revenue increase of about 100% YoY at constant exchange rates at the end of February YTD; about -30% compared with the first two months of 20197

Autogrill: FY2022 guidance

Given the unfolding geopolitical events and related economic uncertainty, Autogrill temporarily

refrains from providing guidance for FY2022. FY2024 targets remain unchanged

2021 Results

Trading update at the end of February 2022 7

Group:

- Revenue increase of about 100% YoY at constant exchange rates at the end February YTD; about -30% compared with the first two months of 2019

- YoY performance mainly driven by North America, thanks to the resilience of domestic airport traffic despite Omicron impact, and Europe, benefitting from the continued solid performance on motorways

North America:

- Revenue increase of over 150% YoY at constant exchange rates at the end February YTD; about -25% compared with the first two months of 2019. The performance vs. 2019 is consistent with the airport traffic trends in the region International:

- Revenue increase of over 120% YoY at constant exchange rates at the end February YTD; about -50% compared with the first two months of 2019. The performance vs. 2019 reflects the continued lack of international traffic

Europe:

- Revenue increase of circa 50% YoY at constant exchange rates at the end February YTD; about -25% compared with the first two months of 2019, of which around -15% on motorways, reflecting the resilience of this channel to the pandemic

Autogrill: FY2022 priorities and guidance

- The priorities for Autogrill in FY2022 are:

- Protecting health and safety of employees and customers

- Enhancing the core business and the leadership position

- Building on the recovery

- Continue focusing on cash conversion

- Executing on the ESG strategy

- Given the unfolding geopolitical events and related economic uncertainty, Autogrill temporarily refrains from providing guidance for FY2022

- Despite its negligible exposure to Russia, Autogrill is closely monitoring the evolution of the conflict in Ukraine, and will promptly adapt its business strategy and risk assessment to evolving circumstances

FY2024 targets9 remain unchanged

- Revenue: €4.5bn

- Underlying3 EBIT margin: around 6%, about 140bps more compared to FY2019

- Capex as a percentage of revenue: between 4.8% and 5.4%

- FCF5: between €130m and €160m

Make It Happen – Autogrill takes to the next level its ESG strategy and reveals future targets

- Strategic framework building on 3 key pillars:

- We nurture People

- We offer sustainable Food Experiences

- We care for the Planet

- Clear commitment through 3 main target identified, one for each pillar:

- 40-50% women representation in leadership roles8 by the end of 2030

- 98% sustainable coffee sourced for proprietary brands by the end of 2025

- 20-30% reduction of GHG emissions from electricity consumption along motorways business by the end of 2030

- Autogrill is strongly committed to continually reviewing and developing approaches and targets, knowing that ESG is a journey and not a destination

Gianmario Tondato Da Ruos, Group CEO, said: “2021 has been a year of fundamental importance in our history. We significantly improved our operating efficiency and our cash generation capability exceeded the same expectations we had at the beginning of the year. Thanks also to the strengthening of the capital structure, obtained through the equity raising and the disposal of the motorway business in the US, we are now in the best conditions to grow by taking advantage of all the opportunities that market recovery will offer us”.

1 At constant exchange rates. Average €/$ FX rates:

- FY2021: 1.1827

- FY2020: 1.1422

2 The change in like for like revenue is calculated by excluding from revenue at constant exchange rates the impact of new openings, closings, acquisitions, disposals and calendar effect. Please refer to “Definitions” for the detailed calculation 3 Underlying: an alternative performance measure calculated by excluding certain revenue or cost items in order to improve the interpretation of the Group’s normalized profitability for the period. Please refer to “Definitions” for the detailed calculation

4 The change in net result is mainly relating to the following items: stock option plans of -€3.1m (+€0.5m in FY2020), capital gains net of transaction costs of €129.5m in FY2021 (€19.2m in FY2020), make-whole net of derivatives of -€17.7m in FY2021 (nil. in FY2020), efficiency costs for -€0.7m in FY2021 (-€15.5m in FY2020), and a tax effect of -€40.0m in FY2021 (+€1.6m in FY2020)

5 FCF = free cash flow is the cash from the normal business operations after subtracting any money spent on capex, and excluding the cash flows relating to extraordinary operations (e.g. acquisitions, disposals, equity raisings, debt refinancing). Free cash flow is calculated as follows: EBITDA +/- change in net working capital +/- non-cash costs and revenues already included in the EBITDA –MAG paid +/- financial income and charges (excluding costs paid in connection with early repayment of debt) +/- net tax – capital expenditures.

6 Overall value of the contracts calculated as the sum of expected sales of each contract for its entire duration, converted to € at 2021 current exchange rates. Contracts signed by subsidiaries consolidated using the equity methods are included.

7 Managerial data. The comparison excludes the impact of the disposal of motorways business in North America, concession business in Spain and Czech Republic

8 Definition of “Leadership roles” under review