ZURICH/Switzerland – Antoine de Saint-Affrique, CEO of the Barry Callebaut Group, said: “The good growth momentum from the fourth quarter 2014/15 continued and we had a strong start to our new fiscal year with broad-based sales volume growth and positive contributions from all key growth drivers.

Our focus on ‘smart growth’, i.e. a balance between volume growth and enhanced profitability as well as cash flow generation, is gradually being implemented, and our transformation projects are well on track.”

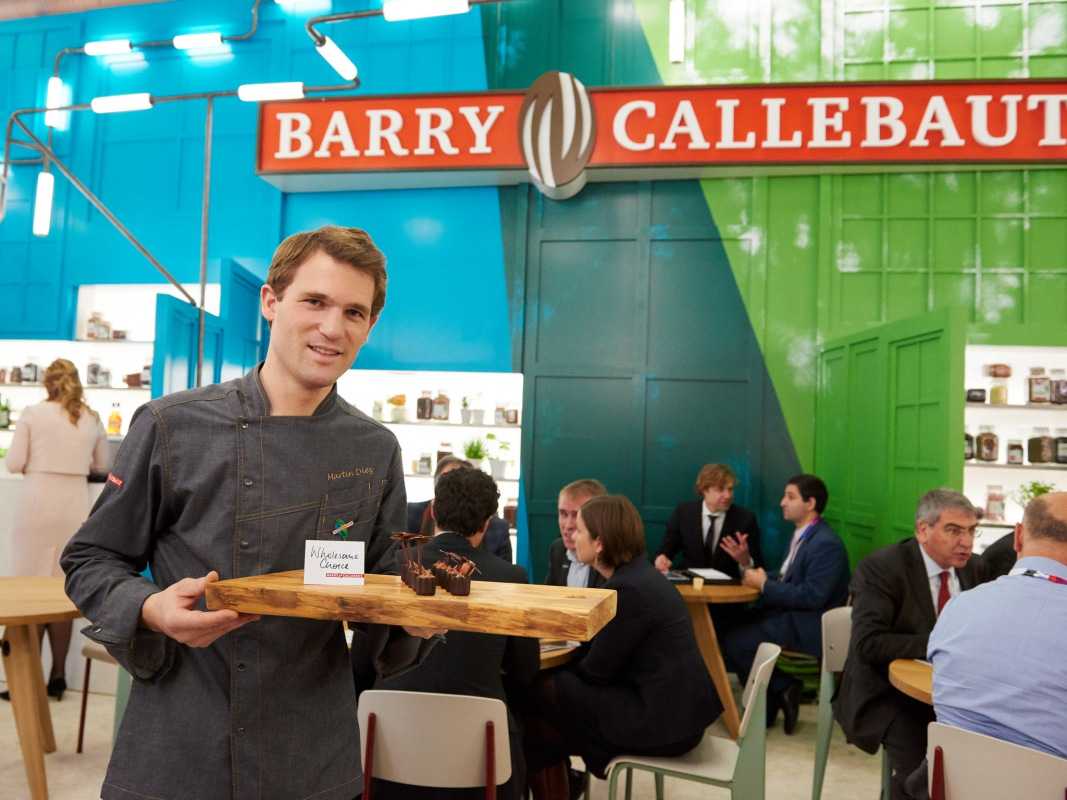

The Barry Callebaut Group, the world’s leading manufacturer of high-quality chocolate and cocoa products, grew its sales volume by 6.4% to 494,873 tonnes during the first 3 months of fiscal year 2015/16 (ended on November 30, 2015).

Top-line growth was broad-based and fueled by the three key growth drivers Outsourcing & Partnerships, Emerging Markets and Gourmet & Specialties.

This contrasts with a 3.7% decline1 of the global chocolate confectionery market in the period under review.

Sales revenue for Barry Callebaut increased by 13.3% in local currencies (+3.8% in CHF) and amounted to CHF 1,809.3 million, driven by higher cocoa bean prices.

Outlook – Good volume growth, challenging fiscal year in terms of profitability in the cocoa business

Looking ahead, CEO Antoine de Saint-Affrique said: “While the cocoa products market remains challenging this fiscal year in terms of profitability, our business model is proving robust with a broad-based and strongly performing chocolate and compound business. Together with our focus on ‘smart growth’, we are confident that we are able to continue to consistently outperform the market.”

Strategic milestones in the first 3 months of fiscal year 2015/16:

• As part of the ongoing “Expansion”, Barry Callebaut signed a contract to acquire the commercial beverages vending activities of FrieslandCampina Kievit in order to further expand its value-added Specialties business in Europe, becoming a leading supplier of vending powder mixes.

• “Innovation”: Barry Callebaut signed a licensing agreement with leading food supplement producer Naturex. Naturex will bring Barry Callebaut’s approved EFSA health claim on cocoa extracts to the food supplement market, thereby commercializing one of Barry Callebaut’s key innovation projects of recent years.

• In November, Barry Callebaut announced the streamlining of its cocoa manufacturing footprint in Asia (Thailand and Malaysia) as part of the Cocoa Leadership project in order to further strengthen its “Cost Leadership” position.

• “Sustainable Cocoa”: Barry Callebaut launched its range of HORIZONS sustainable cocoa and chocolate products and published the “Cocoa Chronicles”, an innovative set of stories told from a consumer’s perspective available to customers of the HORIZONS products, in order to drive consumer demand for sustainable cocoa and chocolate. It also acquired Nyonkopa, a Licensed Buying Company in Ghana authorized to buy cocoa directly from farmers, to cover growing customer need for sustainable and traceable cocoa from Ghana.

Global Cocoa – Focus on implementing Cocoa Leadership project

In the segment Global Cocoa, sales volume was -2.0% compared to the same prior year period and amounted to 122,731 tonnes, which reflects the current challenging cocoa market environment. After a temporary recovery at the end of September, the combined ratio again took a downturn in recent weeks.

Sales revenue grew by 20.0% in local currencies (6.1% in CHF) to CHF 549.0 million, mainly due to higher cocoa products prices.

In the Cocoa Leadership project, a key strategic initiative to strengthen the Group’s profitability, good progress has been achieved in the different streams; the announced optimization of the manufacturing footprint in Asia and the global product flows optimization are in the implementation phase and the centralized combined ratio management system is in place.

Price developments on most important raw material spot markets

During the first 3 months of the current fiscal year, cocoa terminal market prices increased from GBP 2,126 to GBP 2,281 on November 30, 2015, a 12.0% increase versus prior year. The upward move was driven by the expectation of a deficit in 2015/16 mostly due to lower Ivorian and Indonesian crops.

The world sugar market has strongly recovered and the price has increased since the end of September on the basis of an expected deficit for the 2015/16 campaign.

On the European side, prices kept moving up, driven by stocks expected to drop below 1 million tonnes towards September 2016.

Market prices for dairy products continued to drop as a result of the continued strong global milk production; milk powder prices almost hit a 5-year low. Lower demand from China and Russia’s ban on European products resulted in a high market surplus leading prices to remain weak.