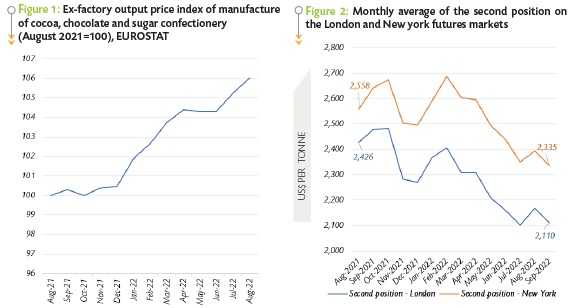

ABIDJAN, Côte d’Ivoire – According to the monthly Cocoa Market Report from the International Cocoa Organization, ex-factory chocolate prices have increased rapidly in the European Union during the past year. Prices have increased by about nearly 6% from August 2021 to August 2022, according to EUROSTAT (Figure 1).

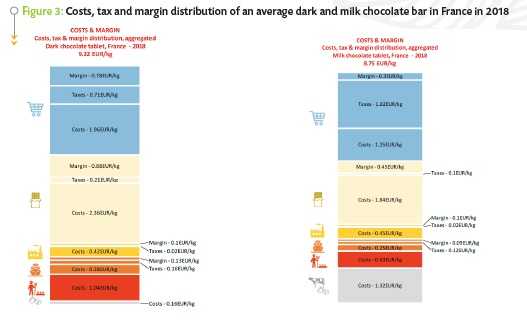

By the same token, cocoa futures prices have declined by 13% and 9% respectively on the London (ICE Futures Europe) and New York (ICE Futures US) markets (Figure 2).

Should cocoa prices not drive production costs in the cocoa and chocolate industry ?

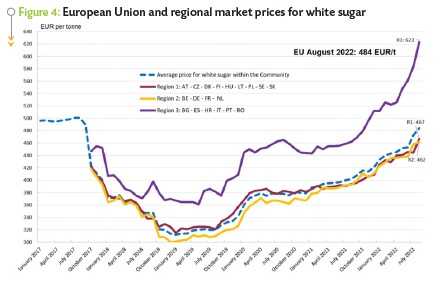

To make sense of this apparent contradiction, the starting point of our analysis is the distribution of costs, margins and taxes for an average bar of dark and milk chocolate bar sold in France in 2018¹.  In Figure 3, the staked histograms – ‘boxes’ – represent the costs, margins and taxes accrued by the various actors of the supply chain; the average dark chocolate bar is on the left, whereas the average milk chocolate bar is on the right.

In Figure 3, the staked histograms – ‘boxes’ – represent the costs, margins and taxes accrued by the various actors of the supply chain; the average dark chocolate bar is on the left, whereas the average milk chocolate bar is on the right.

Going from the top to bottom, the ‘boxes’ in blue refer to the retail sector’s costs, margins and taxes; light yellow to those of the manufacturing sector; dark yellow to the grinding sector; orange to the maritime industry; red to the cocoa farm sector; and grey to other food ingredients (sugar and milk).

In 2018, cocoa beans represented only 11% and 7% of the ex-factory price of dark and milk chocolate bars, respectively²; sugar and milk butter accounted for 15% of the price in the case of an average milk chocolate bar.

If we further consider that grindings and processing costs accounted for 57% and 55% of the ex-factory price of dark and milk chocolate bars, one can clearly deduce cocoa prices alone cannot explain the dynamics showed in Figure 1 because they account only for a fraction of the costs.

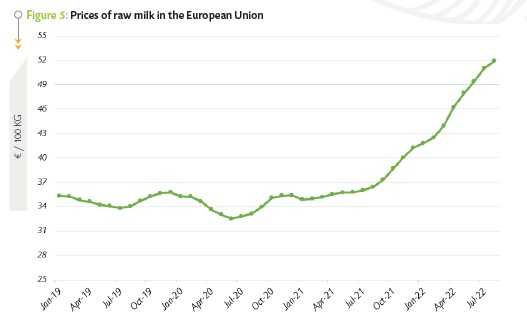

Now, a lot happened in the sugar, milk and energy markets in the EU from August 2021 to August 2022. The average EU price for white sugar increased by 22.5% from just over €400 per tonne to nearly €490 per tonne (Figure 4); the price of raw milk witnessed robust increase by 43% from €36.41 per 100 kg to €51.89 per 100 kg (Figure 5); electricity prices quadrupled (Figure 6); and the cost of credit has sharply risen since the start of the 2022 calendar year (Figure 7).

Clearly, the rising costs of production factors having an higher impact on the cocoa processing and chocolate manufacturing process have by far outweighed the reduction in cocoa prices. Moreover, as a result of this inflationary pressure, the weights of energy, capital, sugar and butter milk prices on production costs have become even bigger than those estimated in 2018 (Figure 1)

FUTURES PRICES DEVELOPMENTS

Down the road from the previous months of the 2021/22 season, cocoa prices further continued their decline in September. In the absence of an immediate supply tightness, over the first half of September, prices lacked support and posted losses on both markets. During this period, the average total stocks of cocoa beans held in the Exchange licensed warehouses increased year-on-year in both Europe and the United States.

In Europe, the average total stocks of cocoa beans reached 187,832 tonnes, up by 14% from 165,275 tonnes seen over the same period during the 2020/21 season.

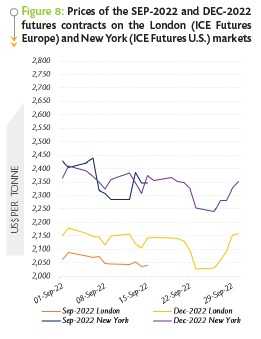

Concurrently, in the United States, the average total stocks of cocoa indicated a year-on-year increase of 4% moving from 357,500 tonnes during the first half of September 2021 to 371,756 tonnes a year later. At the time, prices of the front month contract (SEPT-22) dropped by 1% from US$2,062 to US$2,040 per tonne whereas in New York, they tumbled by 3% from US$2,427 to US$2,347 per tonne (Figure 8).

As the month progressed, the global inflationary pressures were anticipated to negatively affect demand as consumers continued to be faced with reduced purchasing power. As cited by the European Cocoa Association (ECA), grindings data for Q3.2022 dropped by 1.6% from a year earlier to 369,679 tonnes. In line with the downward trend in Europe, compared to the previous year, Germany’s cocoa grindings fell by 4.7% to 100,149 tonnes.

With energy prices pushing other costs higher and the possible rationing of energy in Europe this coming winter, this could take a toll on the operations of cocoa processors. Regarding supply, there were prospects for an abundant start of the 2022/23 crop in Côte d’Ivoire.

As the nearby contract rolled over to the DEC-22 contract (Figure 8), from 16-23 September, prices of the DEC-22 contract continued to decline on both the London and New York markets. In London, it dropped by 5% from US$2,145 to US$2,027 per tonne and by 4% in New York from US$2,355 to US$2,240 per tonne.

However, prices reverted from their slide from 26 September onwards in response to concerns that the heavy rains recorded in Côte d’Ivoire’s cocoa-producing regions could result in the outbreak of black pod disease, which could in turn cause losses for the 2022/23 season. As a result, prices of the DEC-22 contract moved up by 6% from US$2,030 to US$2,160 per tonne in London and by 5% from US$2,240 to US$2,352 per tonne in New York.

FARMGATE PRICES IN CÔTE D’IVOIRE AND GHANA

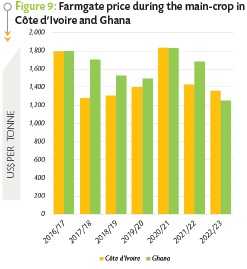

The producer price of cocoa beans for the main crop of the Côte d’Ivoire and Ghana 2022/23 season in Côte d’Ivoire was announced at 900 XOF/kg, which is equivalent to US$1,364 per tonne while in Ghana, cocoa farmers are expected to receive 12,800 Ghana cedis per tonne, or US$1,251 per tonne for their cocoa beans. From 03-05 October 2022, the average exchange rate was US$1 = XOF660 in Côte d’Ivoire and US$1 = GHS10.23 in Ghana.

As presented in Figure 9, over the main crops of the past six seasons, farmgate prices in US$ terms have been higher in Ghana compared to Côte d’Ivoire.

However, as depicted in Figure 9, the situation was reversed during the main crop of the 2022/23 season mainly due to the sharp depreciation of the Ghanaian Cedis vis-àvis the US dollar.

1 https://lebasic.com/wp-content/uploads/2020/07/BASIC-DEVCO-FAO_Cocoa-Value-Chain-Research-report_Advance-Copy_June-2020.pdf

2 Here, our focus is only on the costs, margins and taxes of manufacturers, grinders, maritime industry and farm sector