MILAN – Brazil shipped 35.626 million 60-kg bags of coffee in crop year 2022/23 (July-June), a 10.2% decrease over the previous year, according to new figures release yesterday by the country’s Council of coffee exporters (Cecafé). Exports earnings were flat at $8.1 billion reflecting a higher average export price per bag.

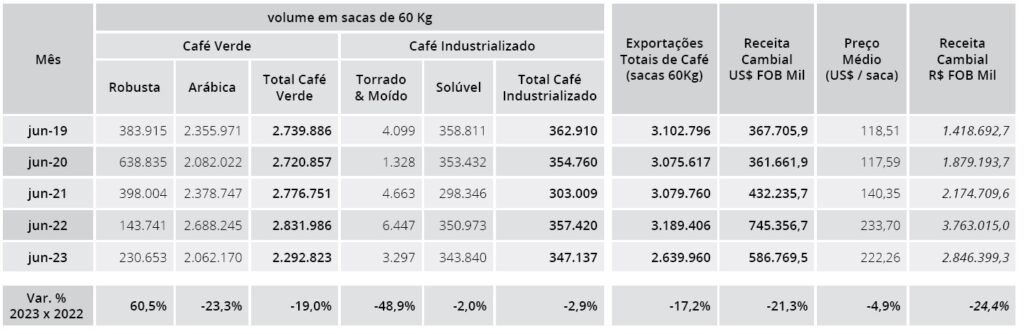

Exports of all forms of coffee fell 17.2% to 2,639,960 bags. Green coffee exports were 19% down to 2,292,823 bags, of which 2,062,170 of Arabica and 230,653 of Robusta, down 23.3% and up 60.5% respectively.

Sales abroad of processed coffee (mostly soluble) were 2.9% down to 347,137 bags.

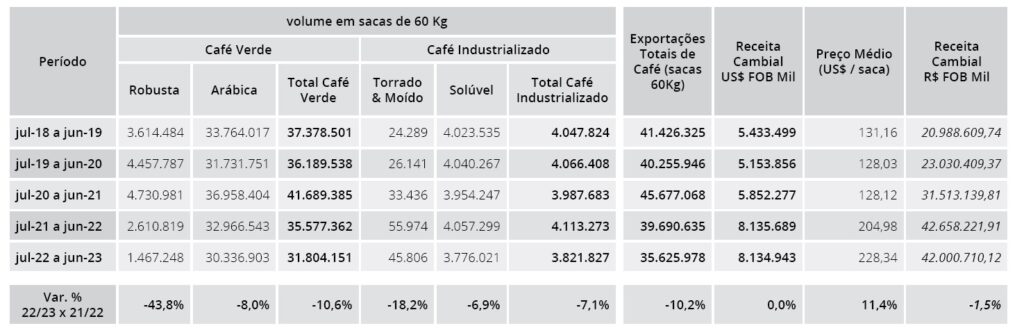

During the July-June period, exports dropped 10.2% to 35,625,978 bags from 39,690,635 in the previous equivalent period.

During the July-June period, exports dropped 10.2% to 35,625,978 bags from 39,690,635 in the previous equivalent period.

This is also 10 million bags less from an all-time high of 45,677 million bags recorded in 2020/21. Exports of green coffee amounted to 31,804,151 bags, a 10.6% decrease year-on-year.

Volumes of Arabica and Robusta fell by 8% and 43.8% respectively to 30,336,903 and 1,467,248 bags. Sales of processed coffee were 7.1% down to 3,821,827 bags.

The U.S. were once again the main destination for Brazil’ exports, with a total volume of 6,857 bags, down 13.8% from the previous crop season.

They were followed by Germany, with 5.165 million bags (-20.3%), Italy, with 2.986 million (-4.8%), and Belgium with 1.828 million (-42.6%). Cecafé also emphasized the 89% increase in sales to China in the season to 604,269 bags.

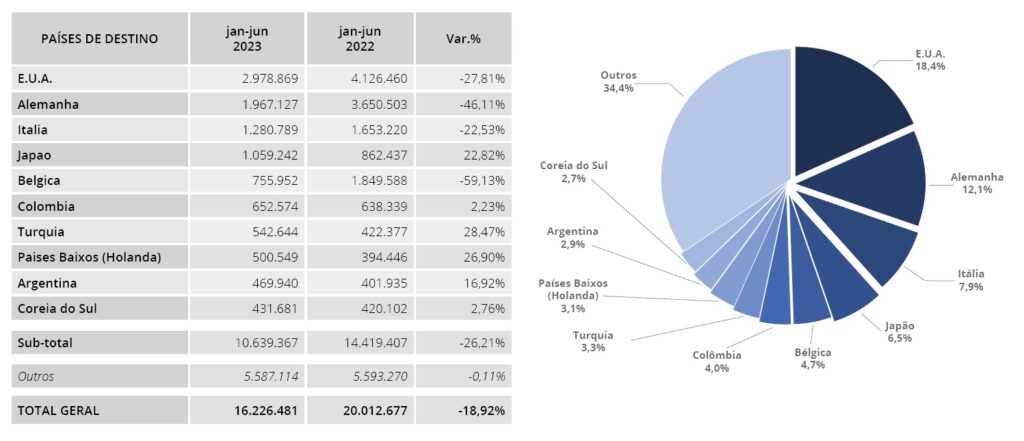

During the first semester of calendar year 2023, exports were down by 18.9% to 16,226,481 bags.

During the first semester of calendar year 2023, exports were down by 18.9% to 16,226,481 bags.

Shipments the US, Germany, Italy and Belgium fell by 27.81%, 46.11%, 22.53%, and 59.13% respectively. Only Japan bucked the trend, with a 22.82% increase.

Shipments the US, Germany, Italy and Belgium fell by 27.81%, 46.11%, 22.53%, and 59.13% respectively. Only Japan bucked the trend, with a 22.82% increase.

Cecafe’s President Marcio Ferreira said it is a good moment for Brazilian Robusta growers to sell that coffee for export, before the harvest in Vietnam, starts around November, which will bring some price pressures.

Cecafe’s President Marcio Ferreira said it is a good moment for Brazilian Robusta growers to sell that coffee for export, before the harvest in Vietnam, starts around November, which will bring some price pressures.

Ferreira also said that relatively lower prices for Arabica coffee in the local market, as the harvest progresses quickly, are leading local processors to change their blends, using more Arabica and less Robusta.