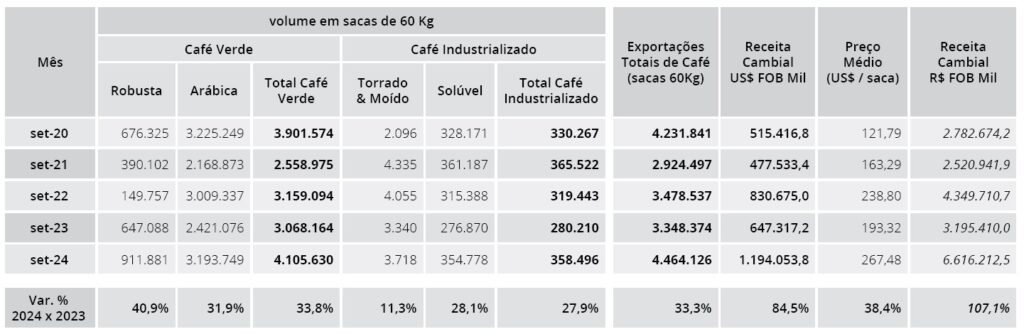

MILAN – Brazil ‘s coffee exports surged to new records last month, despite still facing considerable logistical difficulties: according to new data released by Cecafé, the Brazilian exports of all forms of coffee grew by a third (+33.3%) in September, reaching a volume of 4,464,126 bags, an all-time high for this month of the year. All export categories performed well.

Green coffee shipments registered a 33.8% increase to 4,105,630 bags. Arabica volumes amounted to 3,193,749 bags, up 31.9% and not far off 2020 levels.

Robusta exports jumped to 911,881 bags: 40.9% more than a year ago. Exports of processed coffee (mostly soluble) also did well, at 358,496 bags (+27.9%).

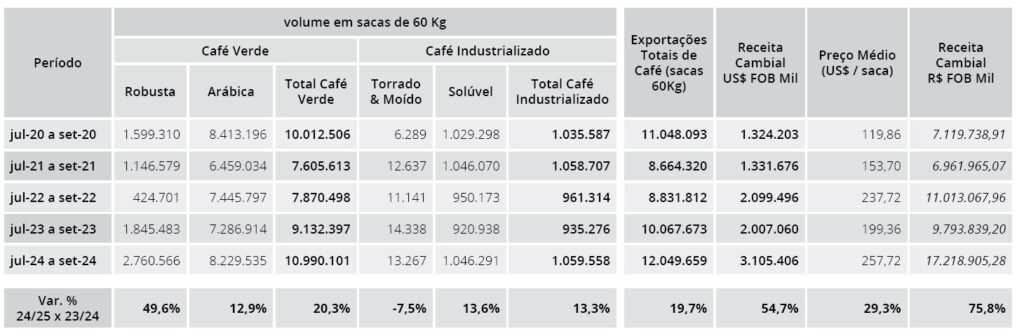

This brings total exports for the first 3 months of the 2024/24 crop year to 12,049,659 bags, up 19.7% on-year.

Exports of green coffee were up by 20.3% to just under 11 million bags, of which 8,229,535 bags (+12.9%) were Arabica and 2,760,566 bags (+49.6%) were Robusta. Foreign sales of processed coffee amounted to 1,059,558 bags (+13.3%).

In the first 9 months of the calendar year 2024, exports of all form of coffee from Brazil skyrocketed 36,428,348 bags, up 38.7% compared to the same period in 2023. Green coffee shipments soared to 33,433,737 bags, up 42.6%, of which 26,396,545 bags (26.6%) were Arabica.

There was an impressive increase in Robusta exports, which exceeded 7 million bags, compared with 2.6 million last year (+170.4%).

Finally, exports of processed coffee reached almost 3 million bags, an increase of 6.5%.

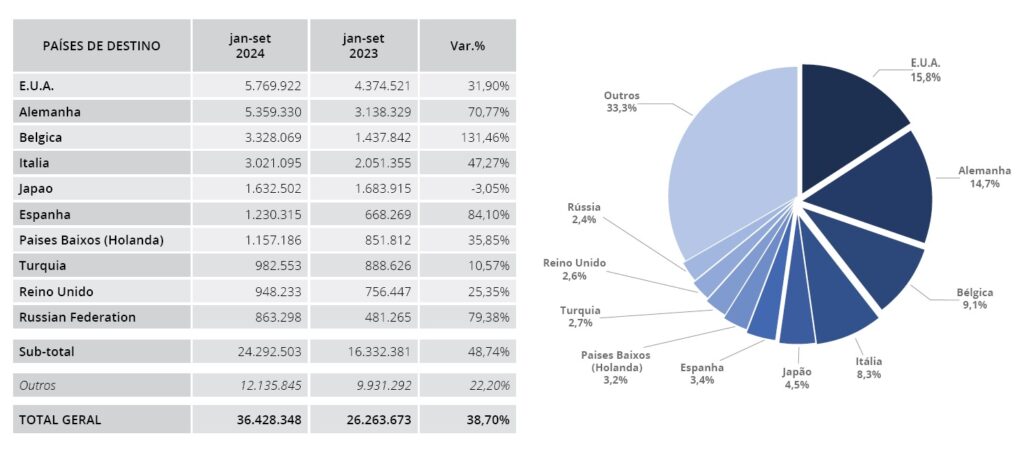

Exports grew strongly to all major destination countries, with the sole exception of Japan. Of particular note is the surge in shipments to Belgium (+131.46%).

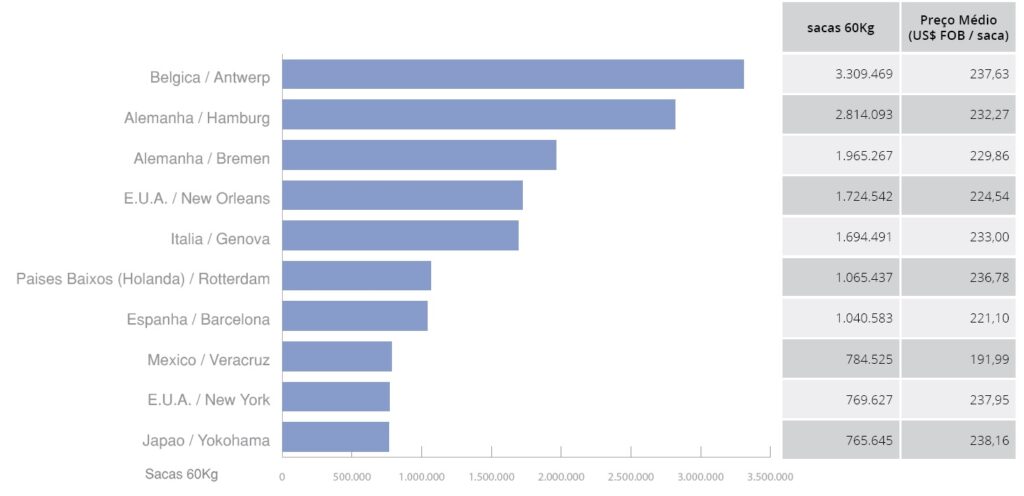

This trend is reflected in the ranking of the ports of destination, which sees the Belgian port of Antwerp, the most important port of delivery for the Ice Arabica, in first place, followed by the German ports of Hamburg and Bremen.

Despite the significant volumes recorded, the president of Cecafé, Márcio Ferreira, said Brazil continues to face critical problems in logistics, which intensified in the second half of the year, with a lack of structure and space in Brazilian ports and a greater demand for containers for shipments, mainly of coffee, sugar and cotton.

“Unfortunately, there has been no change in the logistics scenario and we continue to face major and constant delays in export ships, gate openings with limited time, overcrowded port yards and cargo arriving from the field that cannot be dispatched, generating high extra costs for exporters,” he said in a statement.