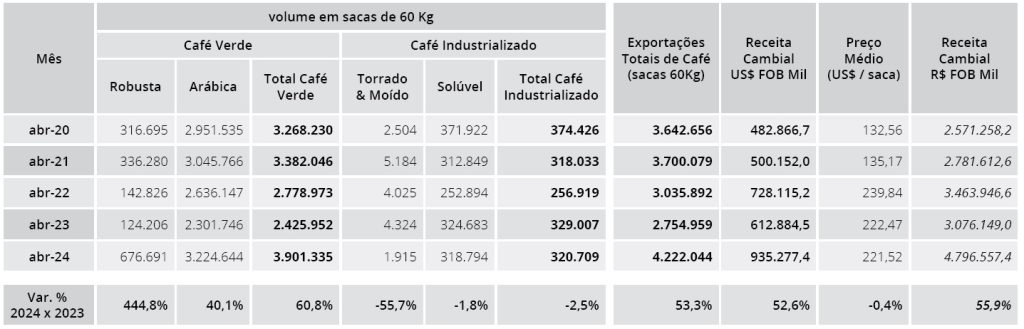

MILAN – Brazil exported a record volume of 4.2 million 60-kg bags of coffee in April 2024, dwarfing a previous record of 3.7 million bags established in the same month of 2021. Earning also reached an all-time high of US$ 935.3 million, despite a slight decrease in the average price per bag.

According to the monthly statistical report of the Brazilian Coffee Exporters Council (Cecafé), the world’s largest coffee producer and exporter shipped last month 4,222,044 bags of all forms of coffee, a 53,3% increase over April 2023.

Green coffee exports soared by 60.8% to 3,901,335 bags of which 3,224,644 bags (40.1%) of Arabica and 676,691 bags (+444.8%) of Robusta.

The only category to show a year-on-year decline was processed coffee, down 2.5% to 320,709 bags, mostly of soluble coffee.

The only category to show a year-on-year decline was processed coffee, down 2.5% to 320,709 bags, mostly of soluble coffee.

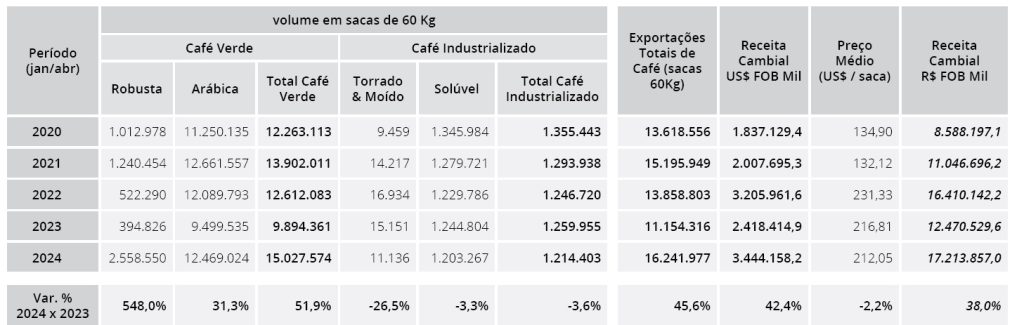

Exports of all forms of coffee in the first four months of calendar year 2024 also rose by 45.6% to a record high of 16,241,977 bags.

Green coffee exports surged to 15,027,574 million bags, up 51.9% from the same period of 2023. Arabica saw a 31.3% increase to 12,469,024 bags. Robusta exports reached an unprecedented volume of 2,558,550 bags, up 548% on-year. Processed coffee exports were down by 3.6% to 1,214,403 bags.

Green coffee exports surged to 15,027,574 million bags, up 51.9% from the same period of 2023. Arabica saw a 31.3% increase to 12,469,024 bags. Robusta exports reached an unprecedented volume of 2,558,550 bags, up 548% on-year. Processed coffee exports were down by 3.6% to 1,214,403 bags.

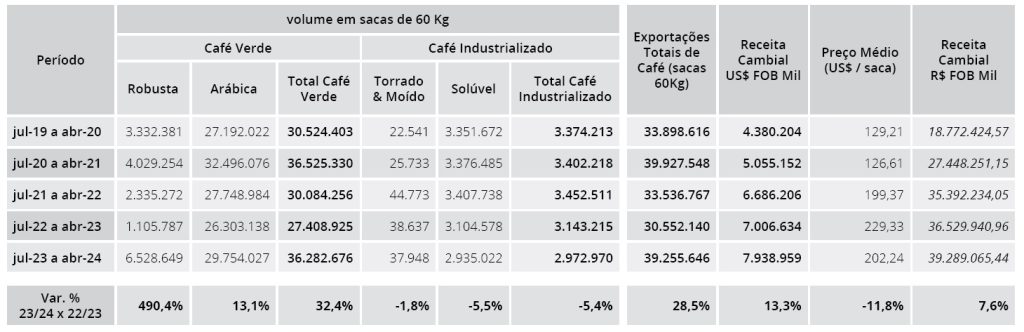

Export of all forms of coffee in the first 10 months of crop year 2023/24 reached 39,255,646 bags, 28.5% higher on-year, but still below an all-time high of 39.9 million bags set in 2020/21.

Green coffee exports amounted to 36,282,676 bags, a 32.4% increase over 2022/23.

Arabica shipments were of 29,754,027, up 13.1% on-year. Robusta exports reached an unprecedented level of 6,528,649 bags, up 490.4% on-year.

Arabica shipments were of 29,754,027, up 13.1% on-year. Robusta exports reached an unprecedented level of 6,528,649 bags, up 490.4% on-year.

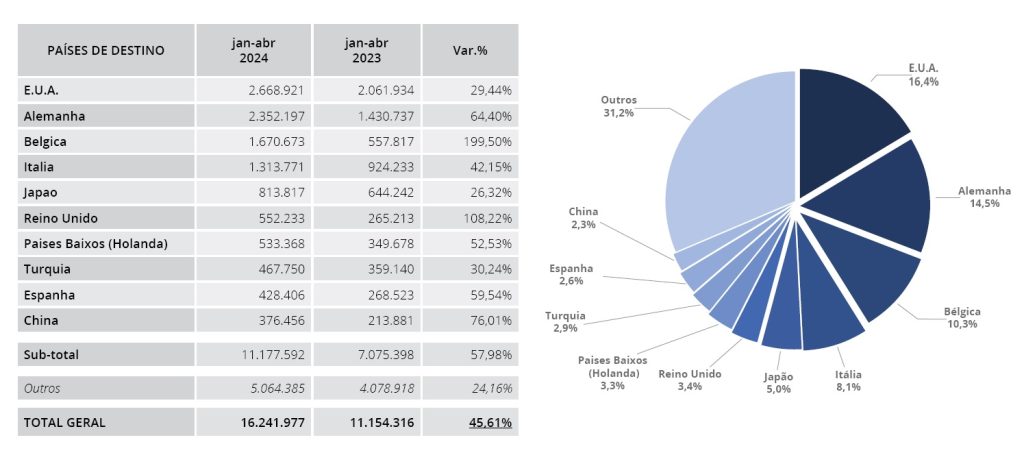

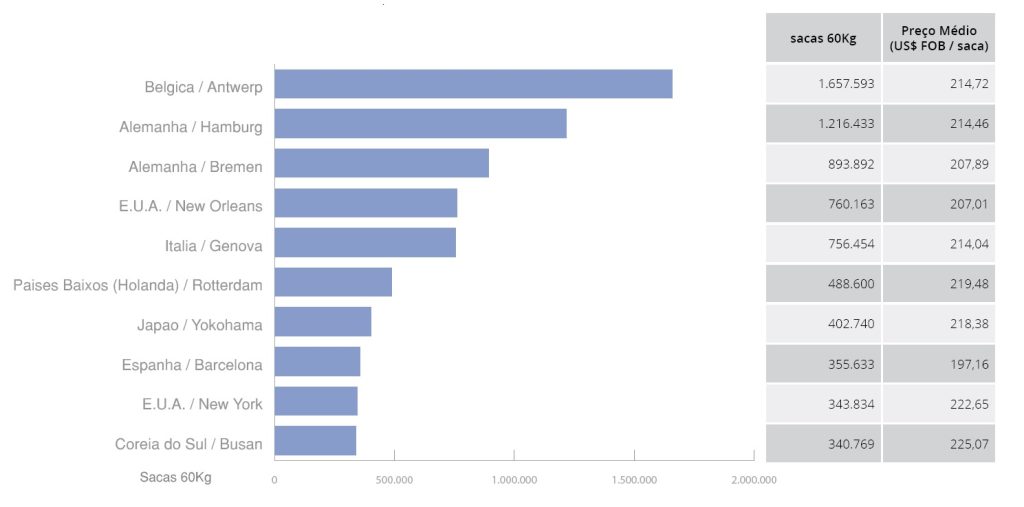

Exports to all major destinations for Brazilian coffee are booming. Shipments to the US and Germany, the two main markets for Brazilian coffee, grew by 29.4% and 64.4% to 2,668,921 and 2,352,197 bags respectively.

Exports to Belgium almost tripled (+199.5%) to 1,670,673 bags. Shipments to Italy, another major market for Brazil, reached 1,313,771 bags, or a 42.15% increase over year.

Exports to Belgium almost tripled (+199.5%) to 1,670,673 bags. Shipments to Italy, another major market for Brazil, reached 1,313,771 bags, or a 42.15% increase over year.

The Belgian port of Antwerp tops the list of main ports of destination ahead of Hamburg, Bremen, New Orleans and Genoa.

“Other producing countries have also been importing Brazilian coffees to fulfil their consumption and re-export commitments, such as Mexico, Colombia, Vietnam, and Indonesia,” said the president of Cecafé, Márcio Ferreira in the report.

“Other producing countries have also been importing Brazilian coffees to fulfil their consumption and re-export commitments, such as Mexico, Colombia, Vietnam, and Indonesia,” said the president of Cecafé, Márcio Ferreira in the report.

“Mexico, for example, has further increased its imports of green coffee, mainly of Canephora, to be used as raw material in its soluble plants, confirming the quality of our coffees as a base for industrialised products”.

Commenting on the record foreign exchange earnings generated by exports in the first four months of the year, Ferreira explained that the international market scenario was once again the driving factor.

“International stock markets soared in April, boosting the value of shipments in general and, of course, of those from Brazil. This has been important in mitigating the high cost of operations for Brazilian exporters, who continue to work in an exemplary manner to meet their commitments despite the constant logistical bottlenecks,” Ferreira concluded.