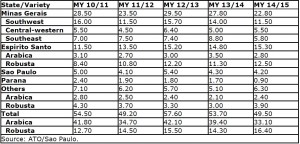

SAO PAULO – In its annual Gain Report on Brazil, the US Agricultural Trade Office in Sao Paulo (ATO/Sao Paulo) forecasts coffee production for marketing year (MY) 2014/15 (July-June), at 49.5 million bags (60 kilograms per bag), green equivalent, an 8 percent decrease from revised figure for MY 2013/14 (53.7 million 60-kg bags).

In spite of the good Arabica coffee production potential for the upcoming crop given that the majority of the trees would be in the on-year of the biennial production cycle, the prolonged drought and high temperatures during January and February, especially in the states of Minas Gerais and Sao Paulo, significantly affected the filling and development of the beans.

In addition, post contacts report significant tree eradication in the state of Parana as a consequence of last year’s frost and low prices in 2013, thus reducing the production potential for that state.

At this moment, it is unclear to predict to what extent the aforementioned problems will affect the final size of the crop.

A more precise number will be available only after the harvest when it will be possible to learn about the quality and weight of the beans. Post initial assessment projects Arabica trees production projected at 33.1 million bags, down 6.3 million 60-kg bags compared to revised figure for the previous year (39.4 million 60-kg bags). Arabica coffee harvest should begin in May/June.

Robusta production is projected at 16.4 million 60-kg bags, a 2.1 million bags increase compared to revised production for MY 2013/14 (14.3 million bags), primarily due to the good production potential in Espirito Santo, Rondonia and Bahia. The robusta harvest began in March/April.

Post revised upward both the MY 2012/13 and MY 2013/14 coffee production estimates to 57.6 and 53.7 million bags, respectively, based on updated information from post contacts and revised supply and demand figures showing higher stock numbers than initially estimated for MY 2013/14. According to post contacts, roughly 90 percent of the Brazilian 2013/14 crop has already been marketed to date. Traders report that growers have taken advantage of the high prices in the last three months and have sold high volumes in the market.

Yields

ATO/Sao Paulo projects the Brazilian coffee yield for MY 2014/15 at 23.68 bags/hectare, down 6 percent from MY 2013/14, due to adverse weather condition in the Arabica regions of Sao Paulo and Minas Gerais. The graph below shows the Brazilian average yield from MY 2004/05 through MY 2014/15

Exports

ATO/Sao Paulo projects total Brazilian coffee exports for MY 2014/15 at 32.38 million bags, down 1 million bags from previous season, due to lower expected supply of the product. Green bean exports are likely to account for 29 million bags, while soluble coffee exports are forecast at 3.35 million bags.

Coffee exports for MY 2013/14 were revised upward to 33.38 million 60-kg bags, green beans, up 9 percent from previous estimate, based on year-to-date export volumes and anticipated May-June loadings.

Coffee growers have taken advantage of the high market prices since January/February 2014 as a consequence of the prolonged drought in several coffee regions in Brazil and have steadily sold their products since then. Green bean (arabica and robusta) exports are estimated at 30 million bags, whereas soluble coffee exports are estimated at 3.35 million bags.

Stocks

Total ending stocks for MY 2014/15 are projected at 6.32 million bags, down 2.98 million bags from revised figure for MY 2013/14 (9.29 million bags), due to lower expected production. CONAB coffee stocks on November 31, 2013 are reported at 1.61 million bags.

Consumption

ATO/Sao Paulo forecasts the Brazilian coffee domestic consumption for MY 2014/15 stable at 20.1 million coffee bags (19 million bags of roast/ground and 1.1 million bags of soluble coffee, respectively). The likely increase of roasted/ground coffee prices at retail should prevent an increase in total Brazilian consumption.

Source: USDA