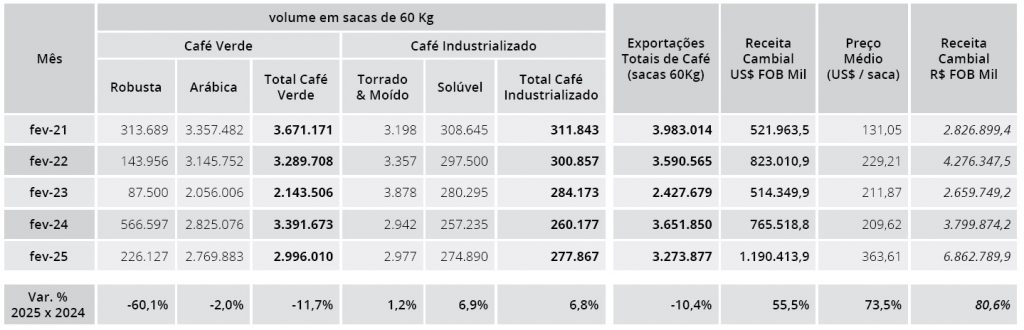

MILAN – Brazilian coffee exports fell for the third consecutive month: according to data released by Cecafé yesterday (Thursday 13 March 2025), Brazil exported 3,273,877 bags of all forms of coffee in February, a 10.4% drop compared to the same month last year. Despite the lower volume, earnings grew by 55.5% to near a whopping $ 1.2 billion. Exports of green coffee were down by 11.7% to 2,996,010 bags.

Arabica exports fell slightly (-2%) to 2,769,883 bags. Robusta shipments were heavily down (-60.1%) to 226,127 bags.

On the other hand, sales abroad of processed coffee (mostly soluble) were up by 6.8% to 277,867 bags.

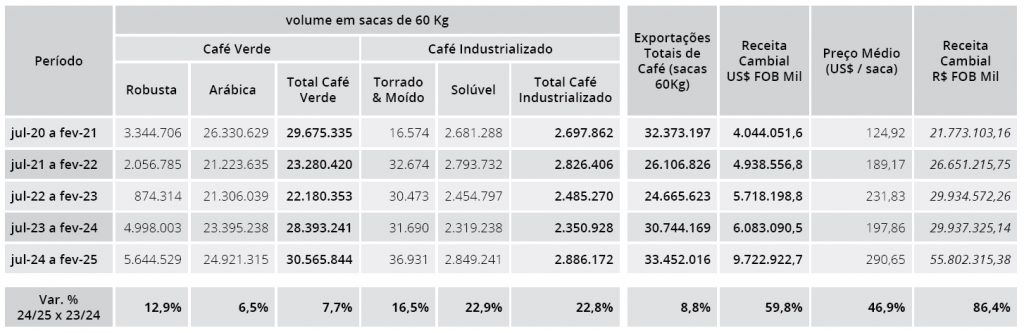

The trend in the first eight months of the current harvest year remains positive.

Between July 2024 and February 2025, exports of all form of coffee reached a record high of 33,452,016 bags, an 8.8% increase compared to the same period last year.

All export items showed positive changes. Green coffee exports amounted to 30,565,844 bags (+7.7%). Arabica shipments totalled 24,921,315 bags (+6.5%), still short of the record figure of over 26.3 million bags recorded in 2020/21.

Robusta exports reached an unprecedented volume of 5,644,529 bags (+12.9%). Sales of processed coffee also rose sharply (+22.8%), to 2,886,172 bags.

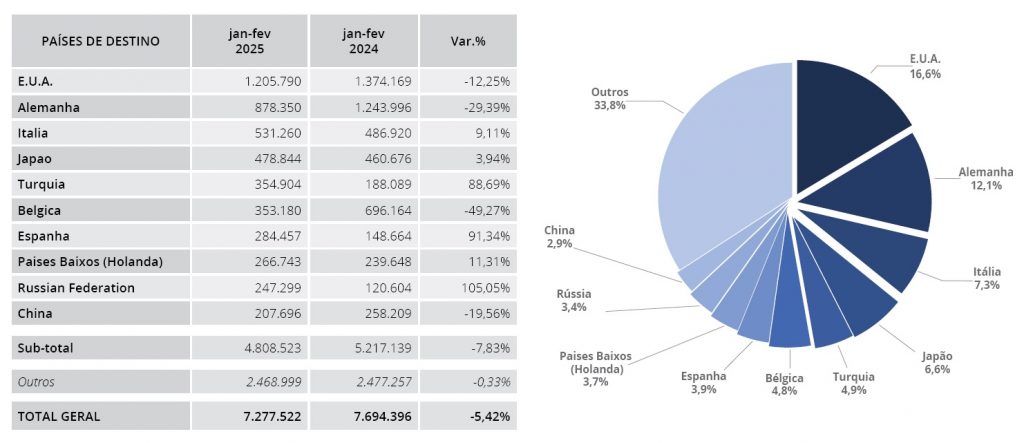

In the first two months of calendar year 2025, Brazilian exports of all forms of coffee reached 7.278 million, down 5.4% compared to the same period in 2024

Arabica exports totalled 6.069 million (-0.7%); Robusta exports fell to 559,928 bags (-45.5%).

Sales of soluble coffee amounted to 640,996 bags (+16.5%); those of roasted coffee amounted to 7,993 bags (+63.9%).

Exports to the two main markets, the USA (-12.25%) and Germany (-29.39%), declined. Italy bucked the trend (+9.11%), as well as Japan (+3.94%), Turkey (+88.69%), Spain (+91.34%), the Netherlands and the Russian Federation, while exports to Belgium (-49.27%) and China (-19.56%) fell sharply.

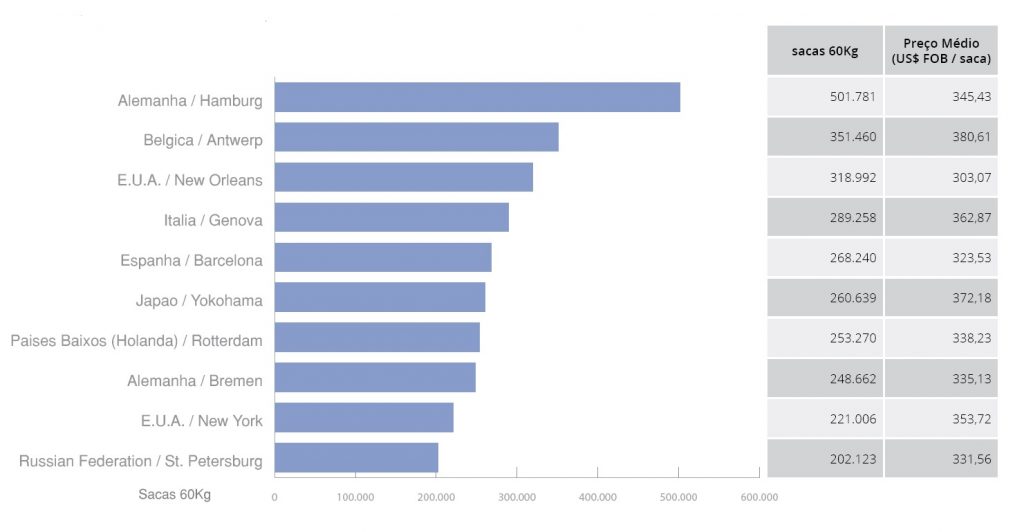

Hamburg was once again the first port of destination, followed by Antwerp, New Orleans and Genoa.

In the report, Márcio Ferreira, president of Cecafé, mentions the further price hikes recorded at the beginning of the year and their potential impact on global consumption, and expresses concern about the financial difficulties experienced by some major players in the market.

Ferreira said global coffee traded prices, which recently reached near record highs due to supply concerns, have not yet been fully passed on to consumers.

He did not rule out retail price increases, which would impact inflation and reduce demand.

The head of Cecafe said Brazilian 2025/26 coffee exports should fall after reporting a record last year, with a much lower Arabica crop, but higher for Robusta. In 2026/27, however, the Brazilian harvest could rebound if climate conditions are favourable, he added.