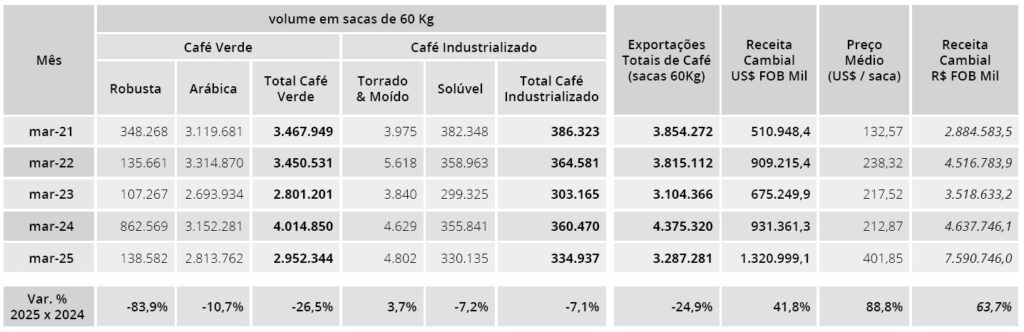

MILAN – A new setback for Brazilian coffee exports in March: according to data released yesterday, Wednesday 9 April, by Cecafé, Brazil’s exports of all forms of coffee fell by almost a quarter (-24.9%) compared to the same month last year to 3,287,281 bags.

Green coffee exports dropped to 2,952,344 (-26.5%), of which 2,813,762 (-10.7%) were Arabicas and 138,582 (-83.9%) Robustas.

The drop in sales of processed coffee (mainly soluble) was less marked (-7.1%), at 334,937 bags.

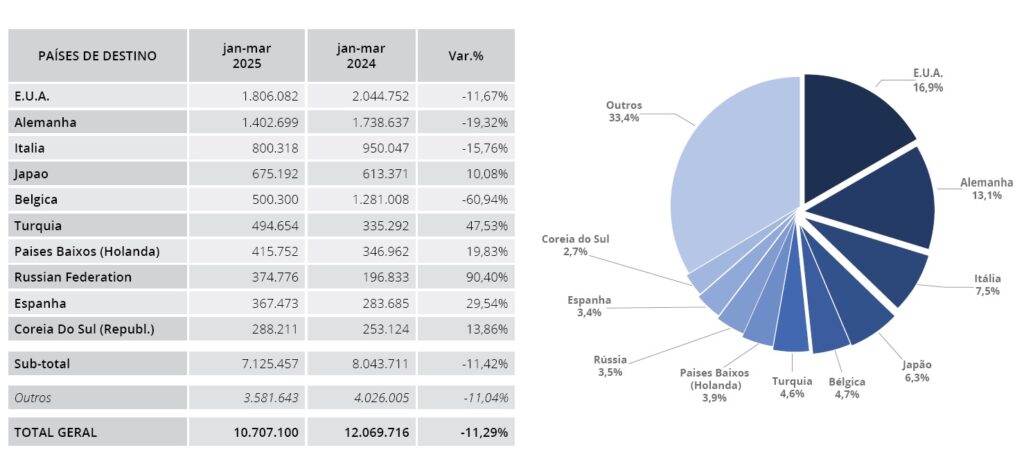

Exports of all forms of coffee also fell in the first quarter of 2025, by 11.3%, to 10,707,100 bags.

Exports of green coffee totalled 9,715,601 bags (-12.9%). A slight decrease (-2.7%) was recorded for Arabicas, whose shipments amounted to 9,012,433 bags. Robusta exports, on the other hand, fell sharply (-62.8%) to 703,168 bags.

Sales of processed coffee rose (+8.3%) to 991,499 bags.

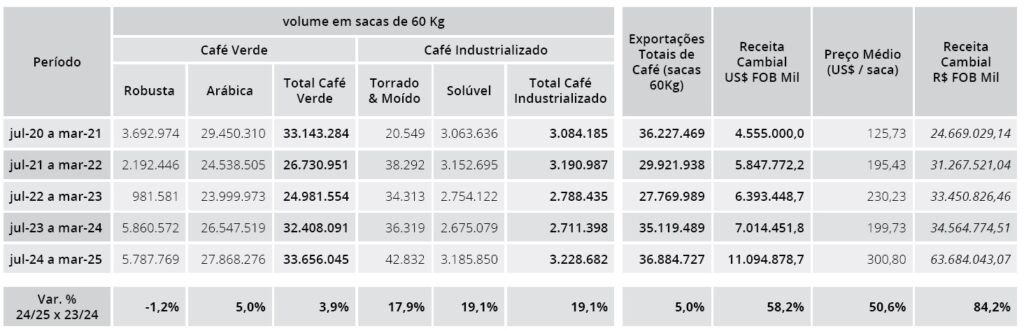

The export trend for the first 9 months of the 2024/25 crop year (July 2024-March 2025) remains positive. Exports of all forms of coffee rose to 36,884,727 bags (+5%).

Shipments of green coffee increased by 3.9% to 33,656,045 bags, of which 27,868,276 bags were Arabica (+5%) and 5,787,769 bags were Robusta coffee (-1.2%). Exports of processed coffee rose sharply (+19.1%) to 3,228,682 bags.

Brazilian coffee exports to the main destination countries were down across the board in Q1, with the sole exception of Japan.

Exports to the USA and Germany were down by 11.7% and 19.3% respectively. Exports to Italy amounted to 800 318 bags, down 15.8% compared to Q1 2024. . Shipments to Japan recovered (+10.1%), while those to Belgium fell sharply (-60.1%).

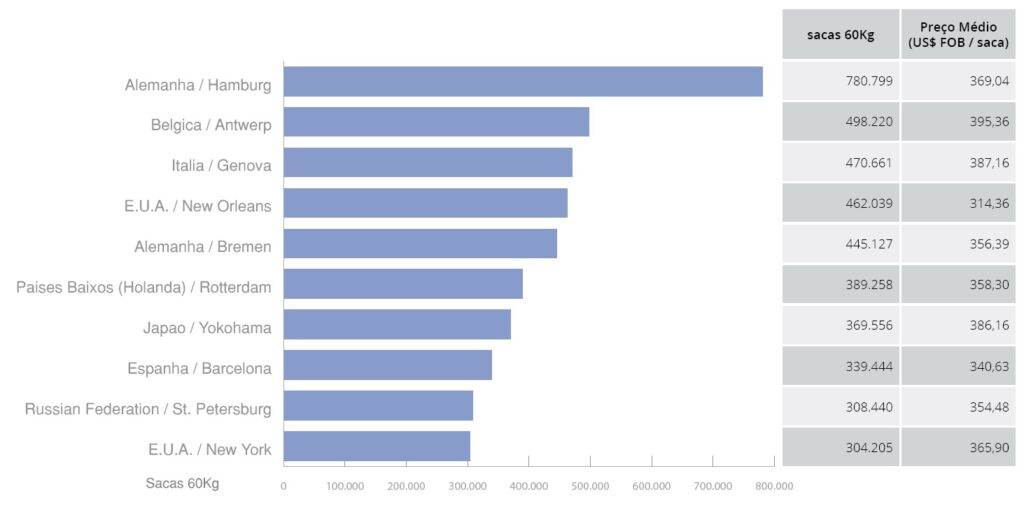

Hamburg remains by far the main port of destination followed by Antwerp and Genoa.

In other news, the Brazilian government announced the elimination of import taxes on several key food products, including coffee. The decision is aimed at reducing food prices and easing the cost-of-living crisis.

The list includes meat (current import tariff is 10.8%), coffee (9%), sugar (14%), corn (7.2%), olive oil (9%), sunflower oil (9%), sardines (32%), biscuits (16.2%), and pasta (14.4%).

Economists and market analysts express skepticism about the measure’s effectiveness. Many note that this will have a limited impact on the Brazilian market, since coffee imports make up a very small part of consumption.

Critics also highlight that Brazil’s role as the world’s largest coffee exporter complicates the scenario, suggesting that the domestic market dynamics are influenced by global trade flows and pricing mechanisms.

Consumer prices for coffee in the Brazilian domestic market have risen sharply between last year and this year, triggering consumer reaction and protests.