Italmobiliare’s Board of Directors has reviewed and approved the quarterly financial results for the nine months ending September 30, 2022. Italmobiliare S.p.A. is an investment holding company listed on the Milan Stock Exchange owner of a majority stake in Caffè Borbone, one of the top names on the national market and a leading supplier of single serve coffee.

Caffè Borbone

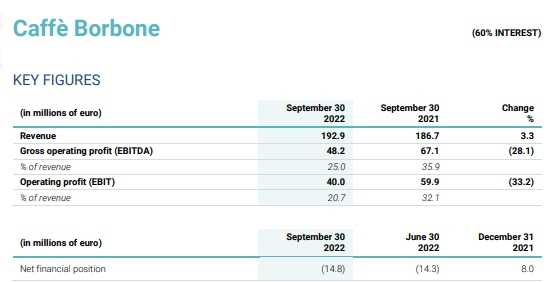

Caffè Borbone closed the first nine months of 2022 with revenue of 192.9 million euro, up by 3.3% compared with the same period 2021, which benefited from the higher domestic consumption of coffee as a result of the lockdown.

At channel level, Large-Scale Retail is increasingly significant, closing the period at +46% and confirming above-average growth rates in a single-dose market that achieved +9% (source: Nielsen).

By virtue of these excellent results, in September Caffè Borbone rose to second place in the ranking of single-dose coffee sales in the large-scale retail channel, overtaking Nestlé for the first time. The foreign market, which is increasingly strategic for the company’s future prospects, also performed extremely well, growing by 40% compared with the same period last year.

Gross operating profit was 48.2 million euro, with a margin of 25% on revenue. The decrease compared with the same period of the previous year is mainly attributable to the increase in the cost of raw materials that the company only partially passed on to the end customer by increasing the list prices of its main products in the range.

Margins were also affected by the increase in the price of fuel (with a consequent increase in transport costs for 2.5 million euro) and by the increase in energy prices (+3.4 million euro).

The net financial position at September 30, 2022 was negative for 14.8 million euro, already net of the distribution of dividends for 30 million euro in the second quarter. Cash generation before dividends in the first nine months of the year was positive for 7.6 million euro, despite a 15.3 million euro increase in working capital.

About Italmobiliare

During the first nine months of the year, the Portfolio Companies’ consolidated revenue amounted to 1,308.4 million euro, up by 22.5% on the first nine months of last year, whereas EBITDA has fallen by 15.5% to 167.9 million euro, mainly due to contingent factors, as explained in greater detail below.

Looking just at the third quarter, EBITDA is up slightly to 74.1 million euro, demonstrating the resilience of the equity portfolio even in a difficult macroeconomic context like the current one.

With particular reference to the Industrial Portfolio Companies, revenue in the period amounted to 1,285.4 million euro (+21.8%).

In the first nine months of 2022, EBITDA, in decline to 160.9 million euro from 198.2 million euro the previous year, was influenced by the macroeconomic context, namely a contraction of the economy, and in particular by the general increase in the price of raw materials and its effect on costs, which are rising.

Contingent factors also affected the performance of certain companies: Italgen’s hydroelectric output was affected by the ongoing drought; AGN Energia compares with a 2021 that benefited from the positive impact of the hedges made on the purchase cost of LPG; Tecnica Group’s accounts do not yet reflect its excellent order backlog, which is showing significant growth compared with the previous year.

Industrial Portfolio Companies

If we neutralise these three contingent factors relating to Italgen, AGN Energia and Tecnica Group, the decline in EBITDA of the Industrial Portfolio Companies compared with the same period of 2021 comes to 5.4% (-10.3 million euro), which is mainly attributable to pressure on margins due to higher raw material costs. Taking only the third quarter into consideration, EBITDA of the Industrial Portfolio Companies is more or less stable at 71.6 million euro.

Comparing the trend of the Industrial Portfolio Companies with the same period in 2021, both the revenue (+28.6%) and EBITDA (+24%) of Casa della Salute have increased significantly, thanks to better productivity of the individual centres and the new openings made at the end of 2021 and in 2022.

In the food sector, Caffè Borbone and Capitelli turned in higher revenues (+3.3% and +13.7% respectively), with a contraction in EBITDA due to the impact of higher raw material costs on industrial margins. In the energy sector, AGN Energia’s revenue is up (+35.3%) following the substantial increase in raw material costs in almost all businesses, with a good defence of margins in a very complex energy context; Italgen’s revenue, on the other hand, rose due to pass-through revenues (which do not bring additional margins), while the drought that characterised the period is reflected in the lower level of EBITDA, which fell to 3 million euro. Revenue up by 20.7% and EBITDA stable at 50.4 million euro for Tecnica Group, which has not yet fully benefited from the order backlog, which is showing excellent potential for the rest of the year.

Iseo’s revenue has increased (+7.4%), supported by increases in selling prices, while EBITDA has fallen to 14.6 million euro, partially due to the impact of fixed costs needed for the company’s business plan. Higher turnover (+55.6%), mainly thanks to the direct retail results, and higher EBITDA (+2.8%) for Officina Profumo-Farmaceutica di Santa Maria Novella. Revenue is down by 5.6% for Callmewine, but in 2021 it had benefited from the greater domestic consumption induced by Covid restrictions; EBITDA is negative, mainly due to higher fixed costs to support the company’s future growth.

The Net Asset Value of Italmobiliare

Clessidra Holding, a non-industrial portfolio company, developed as a multi-asset portfolio in the management of alternative investments, posted revenue of 23 million euro and EBITDA of 7.1 million euro.

At September 30, 2022 the Net Asset Value of Italmobiliare S.p.A. amounted to 1,962.8 million euro, substantially in line with June 30, 2022 (1,975.1 million euro) and down on December 31, 2021 (2,082.1 million euro), after paying 59.2 million euro of dividends and 33.2 million euro of taxes and operating costs. At September 30, 2022, the NAV per share (excluding treasury shares) was 46.4 euro and, considering the distribution of dividends of 1.40 euro per share, it has decreased by around 3% compared with the figure at December 31, 2021.

The net financial position of Italmobiliare S.p.A. is down from 337.5 million euro at December 31, 2021 to 209.6 million euro at the end of September 2022, allocated 51.4% to the Vontobel Fund with a conservative risk profile in line with the Company’s investment policies.

The main flows include loans net of repayments in private equity funds (-11.3 million euro), the investment as co-investor of the Clessidra Capital Partners 4 fund in the capital of Archimede S.p.A. (parent company of Formula Impresoft) with a stake of 22.99% (-12 million euro), the investment in Bene Assicurazioni S.p.A. with a stake of 19.996% (-40 million euro) and in other equity investments (-32 million euro), as well as the payment of taxes (-21 million euro). Payment of the ordinary and extraordinary dividend was more than offset by the dividends received from subsidiaries and associates.

On October 25, Italmobiliare finalised the agreement – based on an enterprise value of 66 million euro, plus 20 million euro in net cash held by the company – for the acquisition of 100% of SIDI Sport, an iconic Italian brand that specialises in the production and sale of cycling and motorcycling footwear.

Italmobiliare results in the details

Revenue for the period amounted to 145.2 million euro, a rise of 47.8 million euro compared with September 30, 2021 (97.4 million euro); this revenue was mainly generated by:

Dividends approved by subsidiaries, associates and other equity investments for 115.1 million euro (30.9 million euro in the same period of 2021). Note that this change is mainly attributable to the subsidiaries Sirap Gema and Caffè Borbone, which approved the distribution of dividends for 60 million euro and for 30 million euro respectively;

Interest and finance income of 23.7 million euro (10.6 million euro in the same period of 2021), mainly relating to exchange gains on the private equity funds;

Capital gains and revaluations of 5.5 million euro, down compared with the figure of 55.1 million euro in the same period of 2021, mainly because of lower performances by the mutual funds and private equity funds.

Operatings costs

As regards the negative components of income, which amounted to 56.1 million euro (26.5 in the same period of 2021), the following should be noted:

Operating costs of 21.2 million euro are substantially in line with the previous period;

Finance costs, equal to approximately 34.9 million euro (5.3 million euro in the same period of 2021), increased overall by approximately 29.6 million euro, mainly due to negative changes in the fair value of trading securities, mutual funds and private equity funds.

Equity at September 30, 2022 amounted to 1,288.4 million euro, 32.4 million euro down compared to December 31, 2021 (1,320.8 million euro). The overall change was mainly due to the negative change in the OCI reserve (19.8 million euro) and dividends paid (59,2 million euro), partially offset by the positive result of the period.

At September 30, 2022 Italmobiliare S.p.A. holds 217,070 treasury shares, equal to 0.51% of the share capital.

At September 30, 2022 the net financial position of Italmobiliare S.p.A. recorded a decrease of 127.9 million euro, going from 337.5 million euro at December 31, 2021 to 209.6 million euro at the end of September 2022, allocated 51.4% to the Vontobel Fund with a conservative risk profile in line with the Company’s investment policies.

The main flows include loans net of repayments in private equity funds (-11.3 million euro), the investment as co-investor of the Clessidra Capital Partners 4 fund in the capital of Archimede S.p.A. (parent company of Formula Impresoft) with an interest of 22.99% (-12 million euro), the investment in Bene Assicurazioni S.p.A. with an interest of 19.996% (-40 million euro), other investments (-32 million euro), and tax payments (-21 million euro). Payment of the ordinary and extraordinary dividend was more than offset by the dividends received from subsidiaries and associates.

Officina Profumo-Farmaceutica di Santa Maria Novella

The revenue of the Group in the first nine months 2022 amounted to 31.3 million euro, up 56% compared with the same period of 2021, mainly due to the excellent performances by direct retail. In particular, Italian shops are picking up after the pandemic period, including the flagship store in Via della Scala in Florence, which recorded a significant growth compared with the same period 2021, mainly due to the return of tourist flows to Florence. Sales up also in the stores abroad – in the United States, the United Kingdom and France. Double-digit growth in the e-commerce channel, supported by the investments in the digital sector, and the wholesale channel, mainly driven by the APAC market, which offers attractive growth prospects.

Gross operating profit was 7.1 million euro, up 3% on September 30, 2021. The industrial margin was stable, with an increase in fixed costs to enhance the company’s ambitious multi-year growth plan. In particular, personnel and marketing costs increased to support the numerous growth initiatives and the strengthening of brand awareness.

At September 30, 2022 the net financial position was positive for 19.9 million euro. If we neutralise the effects of non-recurring transactions of approximately 10 million euro, which include the sale of 5% of the shares, the payment for the acquisition of the UK company, and the effects of the impact of applying IFRS 16 (0.3 million euro) for rental contracts, cash flow2 for the nine months was negative for 2.2 million euro. This result was strongly affected by a growth in working capital, equal to 5.3 million euro, due to an increase in inventories to support the strong growth of the business. Lastly, during 2022 the company distributed 8 million euro in dividends to the parent company FT2 S.r.l. in line with the good results of 2021.

Italgen

In July, Italgen and Verdenergia S.r.l. (a company controlled by Quiris S.a.p.a., the majority shareholder of AGN Energia) completed their acquisition of 51% and 49% respectively of Rovale S.r.l., which controls a 0.5 MW hydroelectric power plant in Val Divedro, province of Verbania.

The first nine months of 2022 were characterised by a period of extreme drought. The hydroelectric output of the Italgen Group decreased of 50% to 121.6 GWh, which was the lowest level achieved in the last 70 years.

During the period, Italgen posted revenue of 36.7 million euro, an increase due to pass-through revenue of 13.7 million euro caused by having to buy energy and transport services needed to fulfil its commitments under current contracts, offsetting the low level of production during the period. Neutralising the effect of the increase in pass-through revenue, the company’s revenue is down by 6.9 million euro compared with the same period of 2021 due to the above-mentioned period of extreme drought.

Gross operating profit was 3 million euro, down by 12.3 million euro compared with the first nine months of 2021. In addition to the decline in “normalised” revenues mentioned previously, the contraction in gross operating profit is explained by the negative impact of the energy buy-backs that the company had to carry out (3.4 million euro), by the effect of the Sostegni ter Decree (1.6 million euro), and by the increase in free energy due to the Regions (0.8 million euro). These negative effects were only partially offset by a decrease in fixed costs for 0.4 million euro.

The net financial position of the Italgen Group at September 30, 2022 was negative for 31.5 million euro. Neutralising the distribution of dividends for 8.0 million euro in the second quarter, cash generation2 in the first nine months of the year was negative for 3.4 million euro, partially explained by the investments made in the period for 4.5 million euro.

Casa della Salute

At September 30, 2022 Casa della Salute posted revenue of 23.7 million euro, an increase of 28.6% compared with the same period of the previous year. The numbers are even more brilliant if we exclude the activities linked to Covid (swabs, serological tests and vaccine hubs management), which decreased in the first nine months of the current year thanks to the pandemic easing. Excluding these “spot” and non-core business results, the overall growth is 39%. Excluding the new openings in 2021 and 2022 and neutralising non-recurring revenues, the like-for-like figure is an increase of 7%, a very positive figure considering that some of the new openings are located in the same area.

Gross operating profit increased to 2.9 million euro, 24% up on the same period 2021. Neutralising non- recurring costs for 0.5 million euro mainly due to the new openings, gross operating profit was equal to 3.5 million euro, with a margin of 15% on revenue.

The net financial position at September 30, 2022 was negative for 36.7 million euro. Neutralising the increase in capital of 5 million euro in the second quarter and the one-off negative impact of 0.4 million euro of the rent of the Gestdent business unit, cash flow2 during the period was negative for 7.7 million euro, more than explained by the 8.3 million euro cash outlay for investments during the first nine months of the year.

Capitelli

Capitelli’s first nine months posted revenue of 14.1 million euro, showing an increase of 13.7% on the same period 2021, mainly due to the increase in volumes. At channel level, large-scale retail trade showed a positive trend growing at above average rates. The increase in the Ho.Re.Ca. channel (hotels, restaurants and bars) was even more significant, with growth of 24% compared with the first nine months of 2021, which had been negatively affected by the lockdown.

Gross operating profit was 2 million euro. Compared with the first nine months of 2021, the decrease is mainly due to the reduction in the industrial margin (-9 p.p.), impacted by the significant increase in the cost of raw material (meat), which is today at an all-time high. The company implemented two list price increases during the first nine months, partially offsetting this impact.

The net financial position at September 30, 2022 showed a negative balance of 1.9 million euro. Before the distribution of 5 million euro of dividends during the first quarter, cash generation1 was positive for 1 million euro, despite working capital absorption in the nine months of -0.6 million euro (albeit an improvement compared with June 30).

Callmewine

Callmewine closed the period with revenue of 10.8 million euro, 5.6% down on the same period last year; however, it should be remembered that the 2021 result was positively influenced by the increase in domestic wine consumption induced by Covid restrictions. On the other hand, looking just at the third quarter, the 2022 revenue trend is in line with 2021. Encouraging signs come from abroad (France and Germany) that grow by 53% compared with the same period 2021.

Gross operating profit was negative for 1.2 million euro, down on the same period 2021, mainly due to the increase in fixed costs in support of the company’s ambitious growth plan. On the other hand, product margins were slightly higher than in 2021, despite the inflationary pressure on wine and transport costs.

Note that during the third quarter the company collected 0.1 million euro as partial insurance reimbursement (total reimbursement 0.2 million euro) for a theft that took place in the company’s warehouse in 2021. Without this, the gross operating profit for the first nine months was -1.3 million euro in 2022 and -0.1 in 2021. The company expects to recover the remaining insurance reimbursement by the end of 2022.

The net financial position at September 30, 2022 was positive for 0.2 million euro, with a negative cash generation2 for the period of 3.3 million euro attributable to the negative result for the period and the growth in working capital for 1.8 million euro, due to the seasonality of the business.

Tecnica Group

Tecnica Group closed the third quarter with revenue up 21% compared with the same period last year. The growth was driven by the excellent results of the winter sports brands (Nordica, Blizzard-Tecnica and Moon Boot), with an increase of 93% and revenues almost doubling.

As already anticipated in the previous financial reports, analysis of current trading (the sum of revenue and order backlog) for 2022 also shows significant growth compared with 2021.

Gross operating profit amounted to 50.4 million euro, a slight improvement compared with the same period last year, with a decrease in margins on revenue mainly due to higher industrial costs, namely energy and raw material costs, and fixed costs, due to the expiry of the 2021 Covid incentives related to personnel expenses, and the increase in marketing expenses. The result for the first nine months of the year does not fully reflect the excellent current trading, especially for the winter sports brands.

The operating result came to 35.5 million euro, approximately 4% up on last year.

The net financial position was negative for 214.9 million euro, with a negative cash flow2 of approximately 79 million euro, gross of dividends for 8 million euro, attributable to the trend in working capital, which was up for 96 million euro and due to business growth and seasonality.

As already highlighted in previous reports, Tecnica Group has located part of its production for winter sports brands in Ukraine and owns a factory in Chop – a town on the border with Slovakia and Hungary. To date, the situation remains stable and production is running regularly.

AGN Energia

In the first nine months of 2022 the AGN Energia Group’s revenue was equal to 492.3 million euro, an increase on the same period of the previous year linked to the significant rise in the cost of raw materials in almost all of the Group’s businesses, which was reflected in terms of revenue but had no impact on the company’s profitability.

Looking at the individual businesses, LPG volumes decreased by 5% compared with the first nine months of 2021, also due to higher-than-average temperatures which led to a reduction in consumption; electricity and natural gas volumes also fell (by -14% and -13% respectively) due to the company’s decision to limit the commercial development of B2B customers given the delicate market context.

The Group recorded value added2 of 92.6 million euro, down by 1.5 million euro compared with the first nine months of 2021; overall, the businesses other than LPG achieved overall growth of 4.1 million euro, driven by the higher energy efficiency that is now bringing about the development launched by the company in recent years. The drop in LPG is more than explained by the positive impact on 2021 of hedging the purchase cost of LPG. If we neutralise this effect, the value added of the LPG business is growing thanks to excellent unit margins despite the extremely complex context caused by the increase in the price of the raw material.

Gross operating profit came to 33.9 million euro, which was up on the first nine months of the last year if we neutralise the impact of hedging.

At September 30, 2022 the net financial position was negative for 98.4 million euro; gross of the payment of dividends for 8.0 million euro and non-recurring transactions for 1.4 million euro, cash flow3 for the period was positive for 16.7 million euro, despite a continued absorption of working capital due to the increase in energy costs.

Iseo Serrature

In the first nine months of 2022 the Iseo Group posted revenue of 120 million euro, an increase of 7.4% compared with the same period of 2021, mainly attributable to the increase in list prices against the strong increase in raw material costs.

Gross operating profit for the period came to 14.6 million euro, down by 3.1 million euro compared with the excellent result made in the first nine months of the last year. This contraction was affected by a reduction in industrial margins (-3 percentage points despite the increase in list prices) and by the increase in fixed costs (2.9 million euro) to support the company’s business plan.

At September 30, 2022 the net financial position was negative for 43.3 million euro, net of dividends for 10 million euro paid in the second quarter. During the first nine months of the year, cash generation2 was negative for 14.4 million euro, more than explained by the increase of 21 million euro in net working capital compared with December 31, 2021, attributable to the seasonality of the business and to the growth in inventory due to increased raw material costs.

Clessidra Group

S.p.A. as the group holding company, Clessidra Private Equity SGR S.p.A. (100%), Clessidra Capital Credit SGR S.p.A. (100%), Clessidra Factoring S.p.A. (100%) and Clessidra CRF G.P. S.S. (simple partnership held 49% by Clessidra Capital Credit).

As regards the Clessidra Group’s results at September 30, 2022 the first nine months of 2022 closed with a positive brokerage margin of 20.9 million euro (11.7 million euro at September 30, 2021). The increase is mainly represented by higher management fees of the funds for 4.3 million euro and interest and commissions deriving from the factoring business for 3.6 million euro.

Administrative expenses for the period amounted to 18.2 million euro (15.3 million euro at September 30, 2021), mainly due to personnel expense of 10.2 million euro (7 million euro at September 30, 2021), as well as consulting and operating costs. After the positive balance of other operating income and charges for 2.2 million euro, operating profit was equal to 4.9 million euro (-0.3 million euro at September 30, 2021).