MILAN, Italy – The Board of Directors of Italmobiliare S.p.A., the parent company of Caffè Borbone, approved on November 9, 2021, the quarterly financial results for the nine months ending on September 30, 2021. Italmobiliare S.p.A. is an investment holding company listed on the Milan Stock Exchange owner of a majority stake in Caffè Borbone, one of the top names on the national market and a leading supplier of single serve coffee.

During the first nine months of the year, also in light of a positive overall trend in the third quarter, the investment portfolio, which has been built up in recent years to enhance the excellences of Made in Italy, confirms the positive trend already reported in the first half of the year.

Helped also by the management and governance know-how contributed by Italmobiliare to the various portfolio companies, the first nine months of the year recorded an overall improvement in profitability and revenue higher than in the same period of 2020 and in the pre-Covid period.

In particular, Caffè Borbone’s performance was again very positive, with revenue in the third quarter up by 20% compared with 2020 and a further improvement in margins (+28%). Italgen also did very well in the energy sector (EBITDA +64% vs 2020), with output above average and energy prices constantly on the rise.

Overall – again on the basis of aggregate management figures for the 9 months – the portfolio companies showed a 30.2% increase in EBITDA to over 198 million euro.

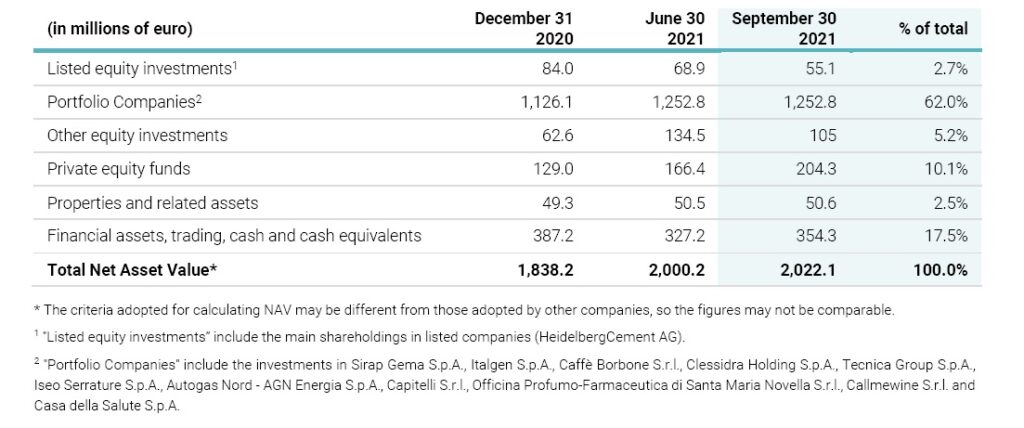

At September 30, 2021 the Net Asset Value of Italmobiliare was equal to 2,022.1 million euro, stable compared with June 30, 2021 (2,000.2 million euro). The NAV per share of Italmobiliare S.p.A., excluding treasury shares, amounted to 47.8 euro, an increase of 9.8% compared with the figure at December 31, 2020.

At September 30, 2021 the net financial position of Italmobiliare S.p.A. was positive for 354.4 million euro, 32.8 million euro lower than at December 31, 2020, with 61% allocated to the Vontobel Fund with a conservative risk profile in line with the Company’s investment policies.

At September 30, 2021 the net financial position of Italmobiliare S.p.A. was positive for 354.4 million euro, 32.8 million euro lower than at December 31, 2020, with 61% allocated to the Vontobel Fund with a conservative risk profile in line with the Company’s investment policies.

The main flows include the investment as co-investor of the Clessidra Capital Partners 3 (“CCP3”) fund in the acquisition of Casa Vinicola Botter Carlo & C. S.p.A., through a vehicle company called Bacco (-43.6 million euro) and the subsequent sales of shares (+31.7 million euro), the investment in private equity funds (-34.9 million euro) and other investments (-19.5 million euro), partially offset by the sale of HeidelbergCement AG shares (+36.8 million euro).

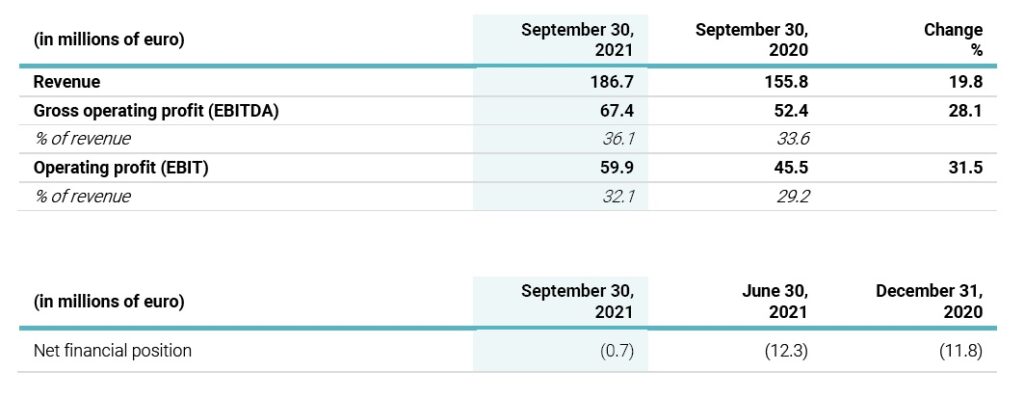

Caffè Borbone’s revenue for the first nine months of 2021 amounts to 186.7 million euro, 19.8% higher than in the same period of 2020; growth in the third quarter came to 11.2% compared with the previous year, a physiological slowdown due in part to normalisation of the Covid-19 pandemic’s effect on domestic coffee consumption.

At channel level, specialist stores and large-scale distribution confirm above-average growth rates with Caffè Borbone gaining share in a mono-portion market that turned in a +7%1; there are encouraging signs from foreign markets, though still residual as a percentage of total sales.

At channel level, specialist stores and large-scale distribution confirm above-average growth rates with Caffè Borbone gaining share in a mono-portion market that turned in a +7%1; there are encouraging signs from foreign markets, though still residual as a percentage of total sales.

Gross operating profit comes to 67.4 million euro, giving a margin on sales of 36.1%, which is 2.5 percentage points higher than the previous period; looking at the absolute figures, the gross operating margin has gone up by 28% compared with the same period of 2020 (an increase of 15.0 million euro).

The net financial position at September 30, 2021 is negative for 0.7 million euro, already net of the distribution of dividends for 30 million euro in the second quarter of 2021; cash generation before dividends in the first nine months of 2021 was positive for 41.1 million euro.