The Kingdom’s once-promising home-grown coffee industry has been laid low by adverse weather and fierce global competition, with the total area under coffee cultivation cut in half over the last three years as desperate farmers switch to other crops, a senior official at the Ministry of Agriculture said yesterday.

“Our coffee-growing industry represents just a tiny proportion of total plantations in the agricultural sector, but has seen its size decrease by 50 to 60 per cent [in three years,]” said Khan Samban, director of the ministry’s department of industrial crops.

According to ministry data, coffee plantations covered 121 hectares in 2015, down from 232 hectares in 2012.

Samban attributed the contraction to the impact of recent droughts and the volatility of global coffee prices, as well as a flood of cheap imported coffee into the market.

“The price of coffee market is not stable, it is always fluctuating, and there is also the impact of [successive droughts], so most of our farmers gave up on this crop,” he said.

“The farmers changed from coffee cultivation to growing pepper or cassava, because these crops allow farmers to collect profits faster.”

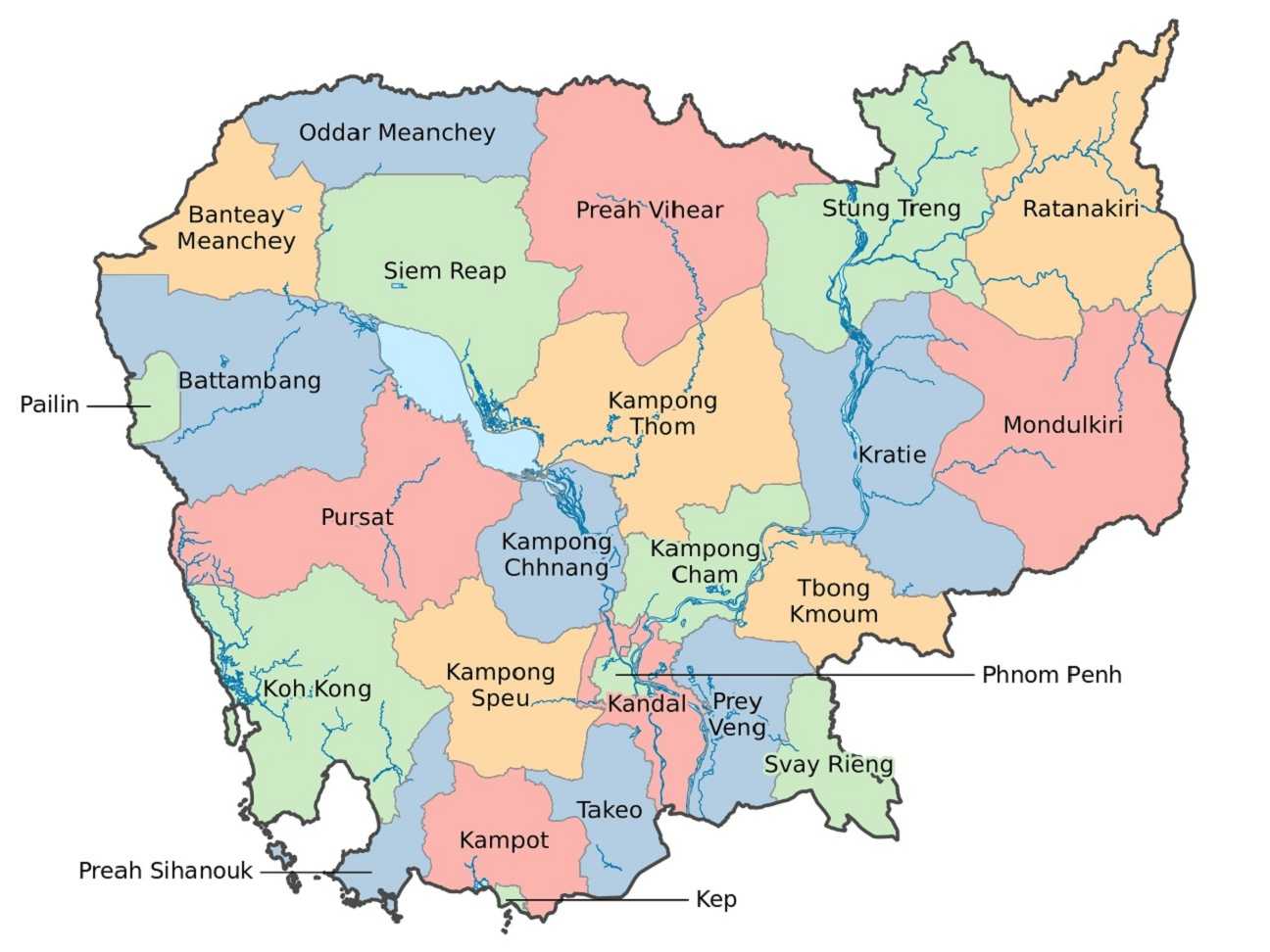

Coffee was first introduced to Cambodia by the French during the colonial era and was once a traditional source of livelihood for rural communities in mountainous regions. Today, the crop is grown in four provinces, Pailin, Kampong Cham, Mondulkiri and Ratanakkiri, competing for space with other cash crops such as rubber, cassava and cashews.

The massive growth of the global coffee industry, as well as a flourishing local coffee shop culture, would appear to offer an opportunity for local coffee growers to expand production. Yet Cambodia exported just $75,000 in coffee products last year, compared to more than $8 million in imports, Ministry of Commerce data shows.

Samban said a flood of cheaper, higher-quality imports is drowning out local products, making it difficult for local farmers to turn a profit.

He said the Ministry of Agriculture was not currently supporting coffee cultivation as it has put a priority on crops that require less time to farm, yield high quantities of fruit and have potential for market growth.

Coffee, he explained, requires from four to six years to mature and requires a lot of water, while pepper takes just two to three years to yield its first harvest and produces high quantities with a high market value.

“Pepper, compared to coffee, takes a shorter time to grow, produces large quantities and has a stable price in the market, which ensures farmers can get the profit,” he said.

The shrinking market for locally produced coffee has not discouraged MK Mondulkiri Company, which has found a niche supplying organic Cambodian coffee to the local and international market.

Orn Chanthy, the company’s CEO, said the competition in the coffee retail market was fierce, but many consumers recognise that cheap products are often of inferior quality.

“It is hard to compete on price as coffee can be imported cheaply, though without any assurance of quality,” she said. “There is a lot of fake coffee in the market and some coffee [deceptively] uses the name of our coffee-growing region.”

Chanthy said exports of MK Mondulkiri coffee increased last year, with shipments going to European and Asian buyers, though she declined to provide figures.

Khun Sreyneth, manager of Founan Café Coffee Roasters in Phnom Penh, said there was a growing local market for coffee, but it would be a challenge for a Cambodian producer to eke out a sizable share.

“If we look at the market, there is potential for [a Cambodian brand], but it is hard to carve out a share as there are a lot of international players here, including [famous] Italian brands,” she said.

Sreyneth said it was difficult to build confidence in Cambodian coffee, especially with so many low-quality brands falsely advertising their coffee as originating in Mondulkiri or Ratanakkiri provinces, which undermines confidence in the genuine item.

“There is a lot of coffee importing from Vietnam, but claiming to be from a Cambodian coffee-producing region,” she said. “This makes it difficult for [genuine Cambodian brands] to build consumer confidence.”

Cheng Sokhorng