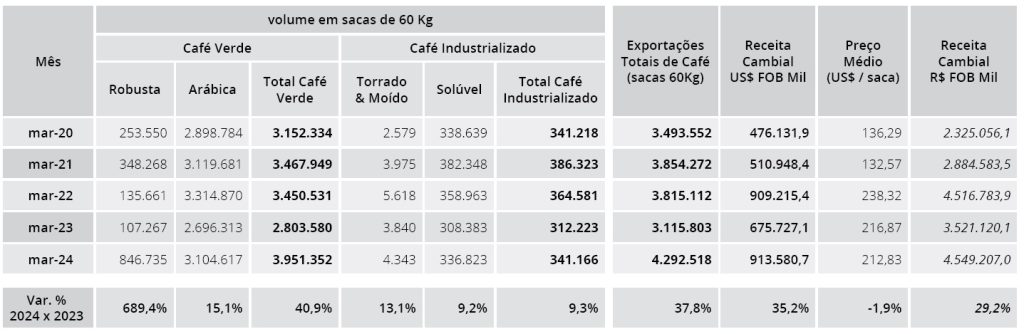

MILAN – Brazil ‘s exports set another record in March: according to data released by Cecafé late yesterday afternoon (April 9th), Brazil exported 4,292,518 bags of all forms of coffee last month, a 37.8% increase over March 2023. Green coffee exports rose to 3,951,352 bags: 40.9% more than a year ago.

Arabica volumes amounted to 3,104,617 bags, up 15.1% on-year, but slightly below those of two years and three years ago.

Robusta shipments, on the other hand, reached a record 846,735 bags, up almost eight-fold (+689.4%) compared to last year.

Sales abroad of processed coffee (mostly soluble) also recovered (+9.3%), totalling 341,166 bags.

Sales abroad of processed coffee (mostly soluble) also recovered (+9.3%), totalling 341,166 bags.

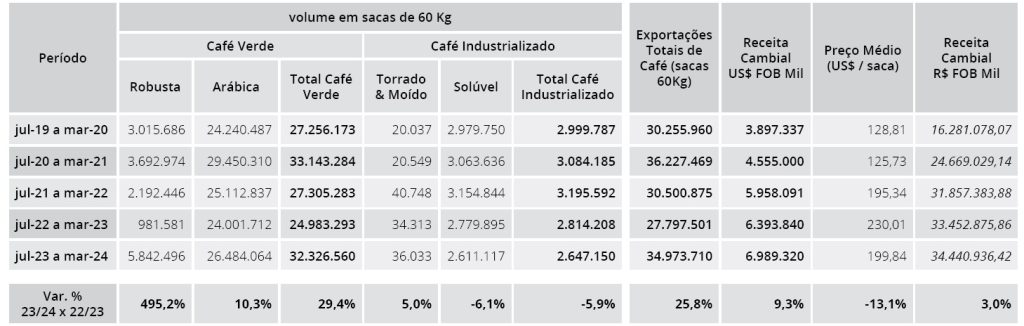

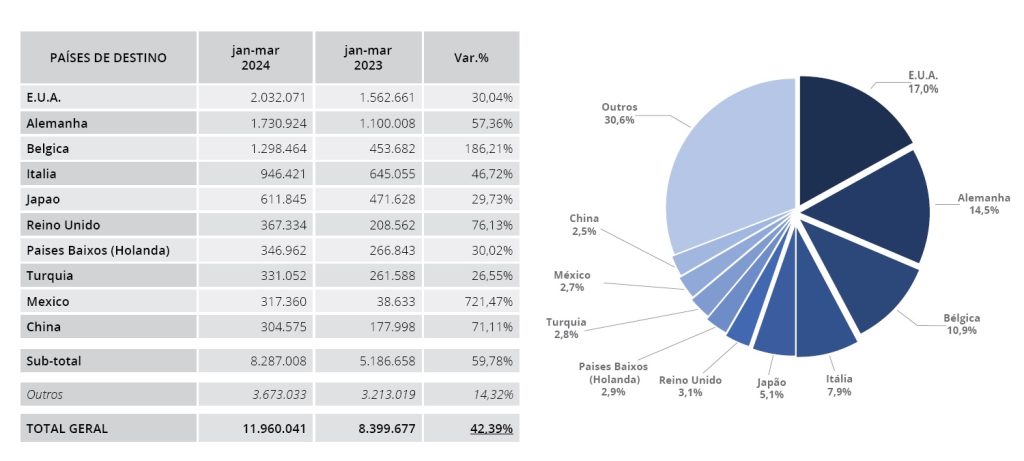

In the first quarter of 2024, exports of coffee in all forms totalled 11,960,041 bags: up 42.4% compared to the same period in 2023.

Exports of green coffee reached 11,071,458 bags (+48.2%), of which 9,199,061 bags (+27.8%) of Arabica and 1,872,397 bags (+591.9%) of Robusta.

A slight decrease (-4.6%) was recorded for processed coffee, whose exports fell to 888,583 bags.

A slight decrease (-4.6%) was recorded for processed coffee, whose exports fell to 888,583 bags.

In the first 9 months of current crop year (July-March), exports of all forms of coffee grew by just over a quarter (+25.8%), to 34,973,710 bags. Despite a significant increase, the figure remains below an all-time high of 36,227,469 bags recorded in the same period in 2020/21.

Green coffee volumes amounted to 32,326,560 bags (+29.4%), of which 26,484,064 bags (+10.3%) were Arabica and 5,842,496 bags (+495.2%) Robusta. Exports of processed coffee amounted to 2,647,150 bags (-5.9%).

Green coffee volumes amounted to 32,326,560 bags (+29.4%), of which 26,484,064 bags (+10.3%) were Arabica and 5,842,496 bags (+495.2%) Robusta. Exports of processed coffee amounted to 2,647,150 bags (-5.9%).

Going back to the first three months of this year, there is a positive trend for all markets. Of particular note were the exceptional increases in exports to Belgium (+186.21%) and Mexico (+721.47%).

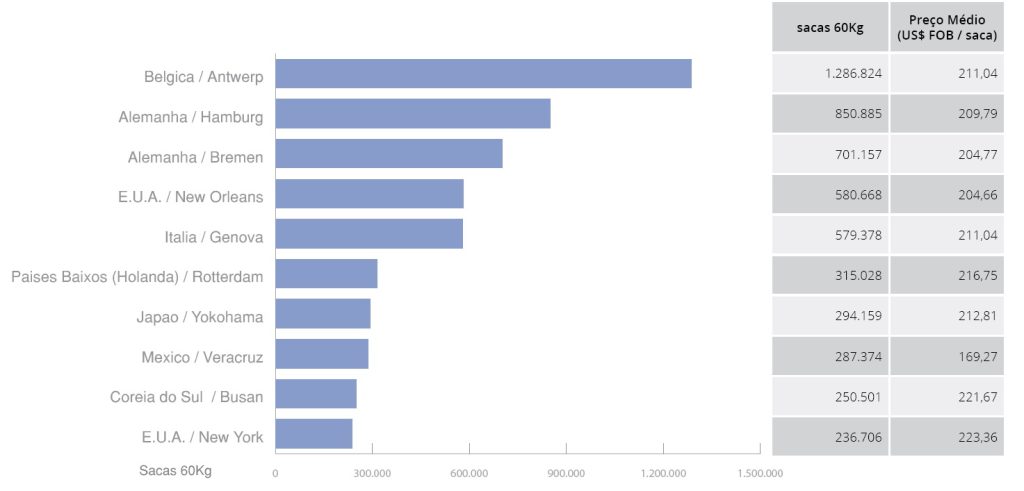

Booming exports to Belgium boosted shipments to the port of Antwerp, which has become the largest destination port for Brazilian coffees, with a volume of over 1.2 million bags shipped in the first quarter, ousting the German ports of Hamburg and Bremen.

Booming exports to Belgium boosted shipments to the port of Antwerp, which has become the largest destination port for Brazilian coffees, with a volume of over 1.2 million bags shipped in the first quarter, ousting the German ports of Hamburg and Bremen.

“Brazil has been able to meet international demand, overcoming difficulties caused by climatic issues in Indonesia and Vietnam,” Cecafe’s president, Marcio Ferreira, said in a statement.

“Brazil has been able to meet international demand, overcoming difficulties caused by climatic issues in Indonesia and Vietnam,” Cecafe’s president, Marcio Ferreira, said in a statement.

Taking into account information from the National Coffee Association’s (NCA) annual convention in the United States, Ferreira said that the drop in production in Vietnam was not as significant as expected.

“We discovered, during our participation in the NCA Convention, that there was, in fact, a very large retention last year, possibly waiting for better prices. With the rise in the market, volumes shipped from Vietnam in the first quarter were very significant, rising by more than 40% compared to the same period of the previous year”, he explains.

“Indonesia, also from what we found in the NCA Convention – adds Ferreira –, suffered more from the impact of El Niño on its production. In addition to this, the increase in domestic consumption of the drink in the country also helps to reduce availability for shipments”.

In the domestic scenario, the president of Cecafé notes that, as a result of the higher prices of canephoras, a gradual reduction in the participation of conilon in industrial blends is already being observed, with the percentage approaching that observed in the years prior to the shortage of arabica, after the 2021 frost.

“The reduction of Robusta in blends has also been possible due to the significant recovery in Arabica crops in the last two years. And the start of the harvest of an expected good Arabica crop in 2024/25, starting in May, should further favor the increase of this species in the national blend”, he projects.