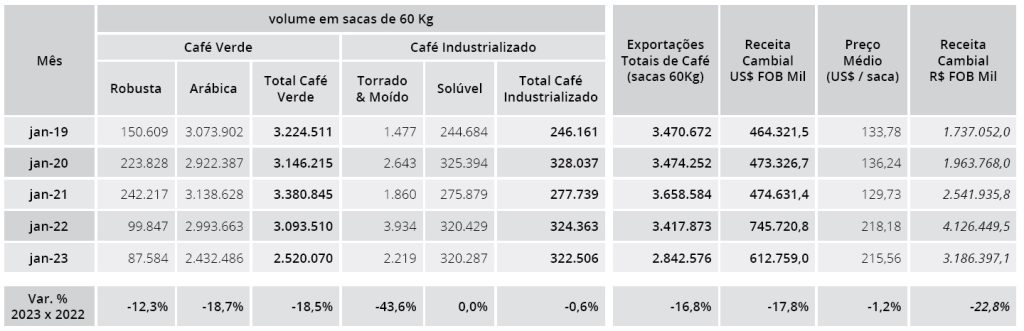

MILAN – Brazil’s coffee exports were down in January due to lower prices despite a higher crop in 2022. According to Cecafé, the world’s largest producer and exporters shipped a total of 2,842,576 bags of all forms of coffee, a 16.8% decrease in comparison to January 2022.

It is interesting to note that the fall in earnings was even more accentuated (-17.8%), reflecting a lower (but still historically high) average price per bag.

Green coffee exports amounted to 2,520,070 bags (-18.5%), of which 2,432,486 were Arabicas (-18.7%) and 87,584 bags Robustas (-12.3%). Shipments of processed coffee (mostly soluble) were flat (-0.6%) at 322,506 bags.

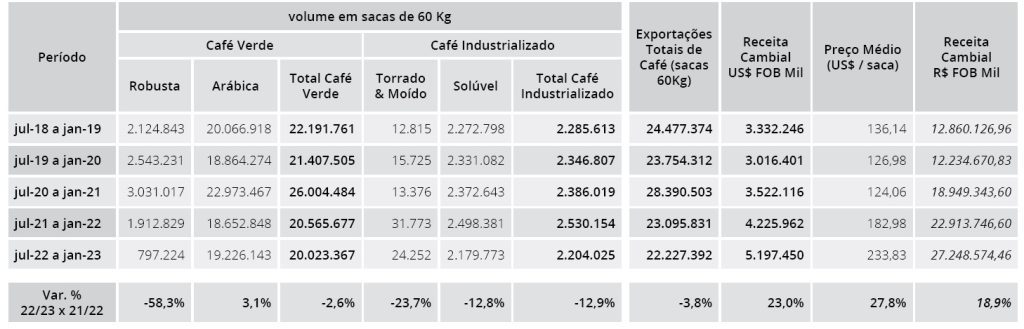

Export for the first seven months of the current crop year were down by 3.8% to 22,227,392 bags. Green coffee exports nosedived to their lowest levels in years totalling 20,023,367 bags, or a 2.6% decrease year-on-year.

Export for the first seven months of the current crop year were down by 3.8% to 22,227,392 bags. Green coffee exports nosedived to their lowest levels in years totalling 20,023,367 bags, or a 2.6% decrease year-on-year.

A slight increase (+3.1%) in Arabica volumes was offset by the continuing fall of Robusta exports, that dipped to a new low of 797,224 bags, down 58.3% from the same period of 2021/22. Sales of processed coffee dropped by 12.9% to 2,204,025 bags.

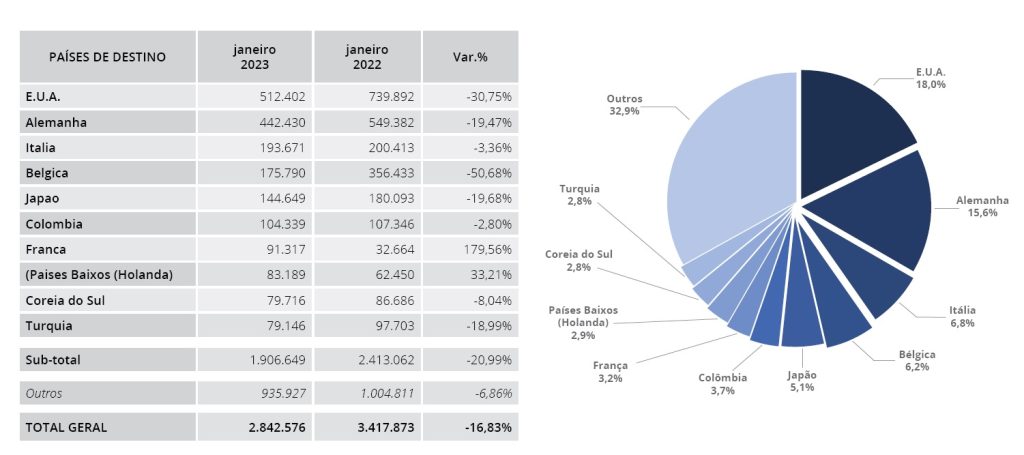

Shipments to almost all the main destinations recorded a decrease in January. Exports to USA and Germany, Brazil’s main markets, were down by almost 31% and 19.5% respectively.

Shipments to almost all the main destinations recorded a decrease in January. Exports to USA and Germany, Brazil’s main markets, were down by almost 31% and 19.5% respectively.

Exports to Italy were slightly lower (-3.4%). Volumes shipped to Belgium and Japan also fell sharply. On the other hand, sales to France rose by almost 180%.

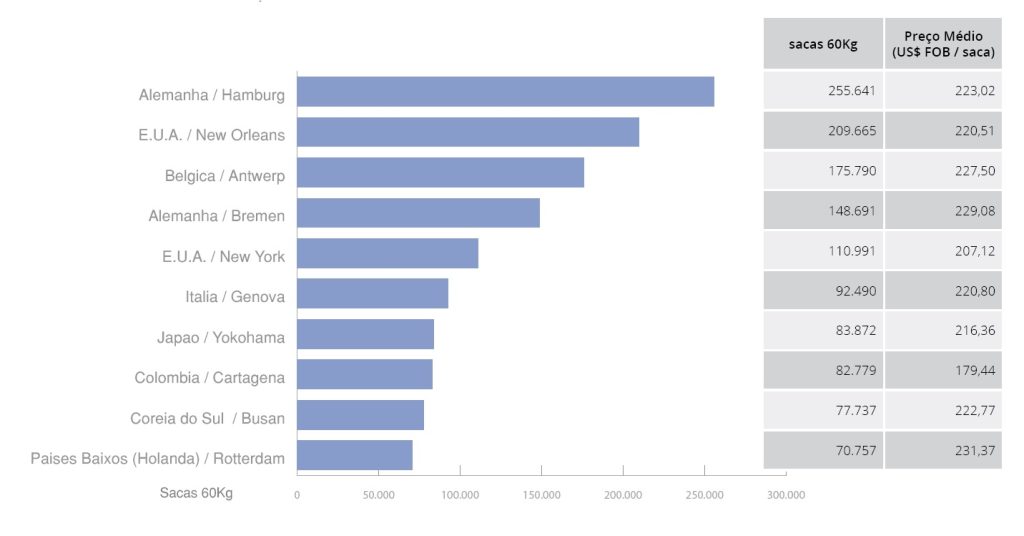

New Orleans surpassed Antwerp and Bremen to become the second port of destination behind Hamburg.

New Orleans surpassed Antwerp and Bremen to become the second port of destination behind Hamburg.

“We are in the off-season, after two smaller harvests, impacted by strong weather adversities in recent years. There is also some resistance from producers to sell their stock of the 2022 harvest on the current price bases, which have dropped significantly since October, facts that justify the decrease observed in January”, said in a note the president of Cecafé, Márcio Ferreira.

“We are in the off-season, after two smaller harvests, impacted by strong weather adversities in recent years. There is also some resistance from producers to sell their stock of the 2022 harvest on the current price bases, which have dropped significantly since October, facts that justify the decrease observed in January”, said in a note the president of Cecafé, Márcio Ferreira.

According to Cecafé, there was also an impact from a sharp drop in international prices, with minimums in January, which were not replicated in the Brazilian physical market.

“Importers have preferred to postpone new purchases or opted for occasional coverage in the spot market abroad, leaving, only as a last resort, new acquisitions in view of these more expensive differentials”, said the executive.

However, he considers this a “natural behavior in the off-season, especially when you come from two consecutive years of smaller harvests”.

Another factor cited in the decrease in shipments is the greater demand from national industries, mainly for Robustas.